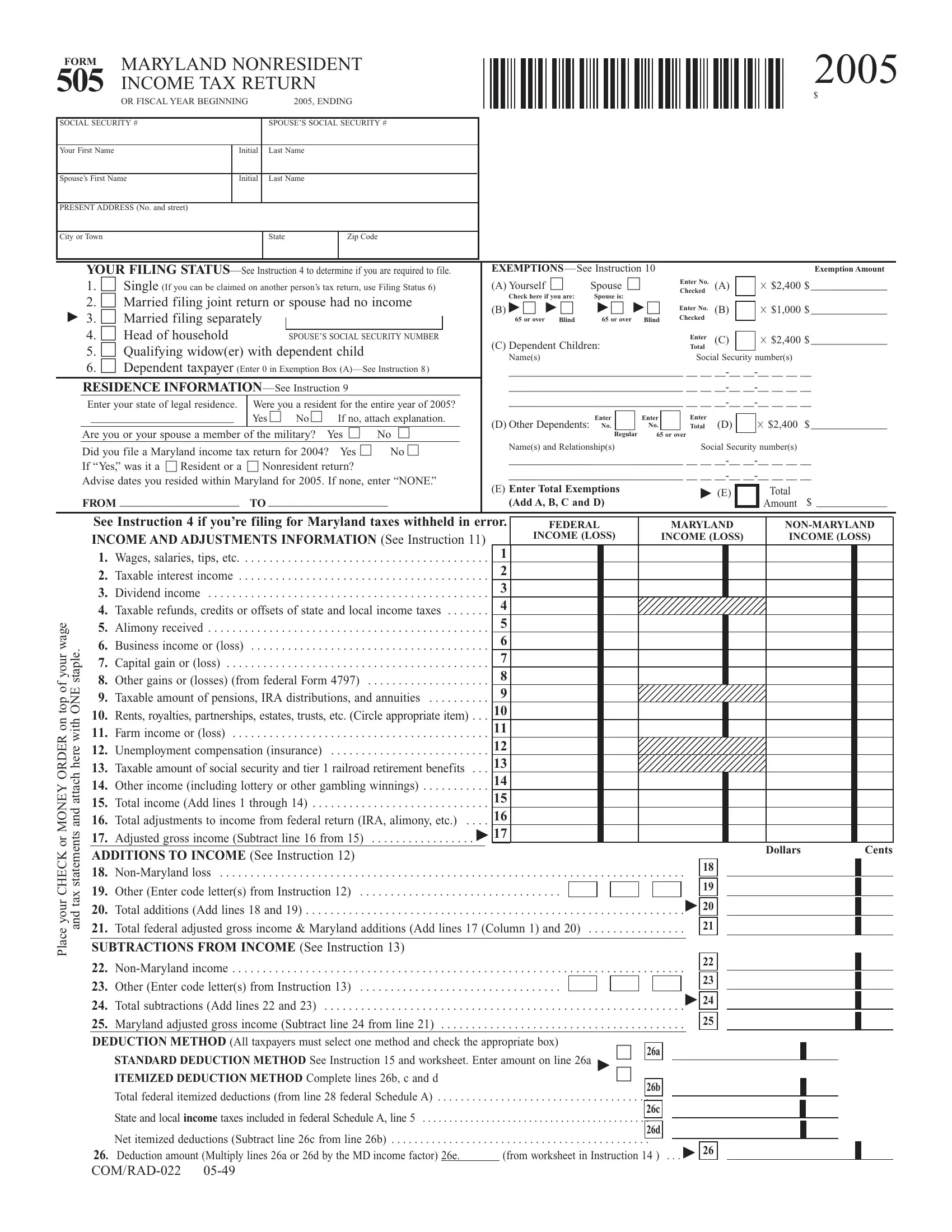

Maryland Itemized Deduction Worksheet ITEMIZED DEDUCTION METHOD complete lines 17a and b on Maryland Form 502 See Instruction 16 to see if you will use the ITEMIZED DEDUCTION METHOD USE

The worksheets on page 2 further adjust your withholding allowances based on itemized deductions certain credits adjustments to income or two earner multiple Complete the Personal Exemption Worksheet on page 2 to further adjust your NOTE Standard deduction allowance is 15 of Maryland adjusted gross income

Maryland Itemized Deduction Worksheet

Maryland Itemized Deduction Worksheet

Maryland Itemized Deduction Worksheet

https://formspal.com/pdf-forms/other/maryland-form-505/maryland-form-505-preview.webp

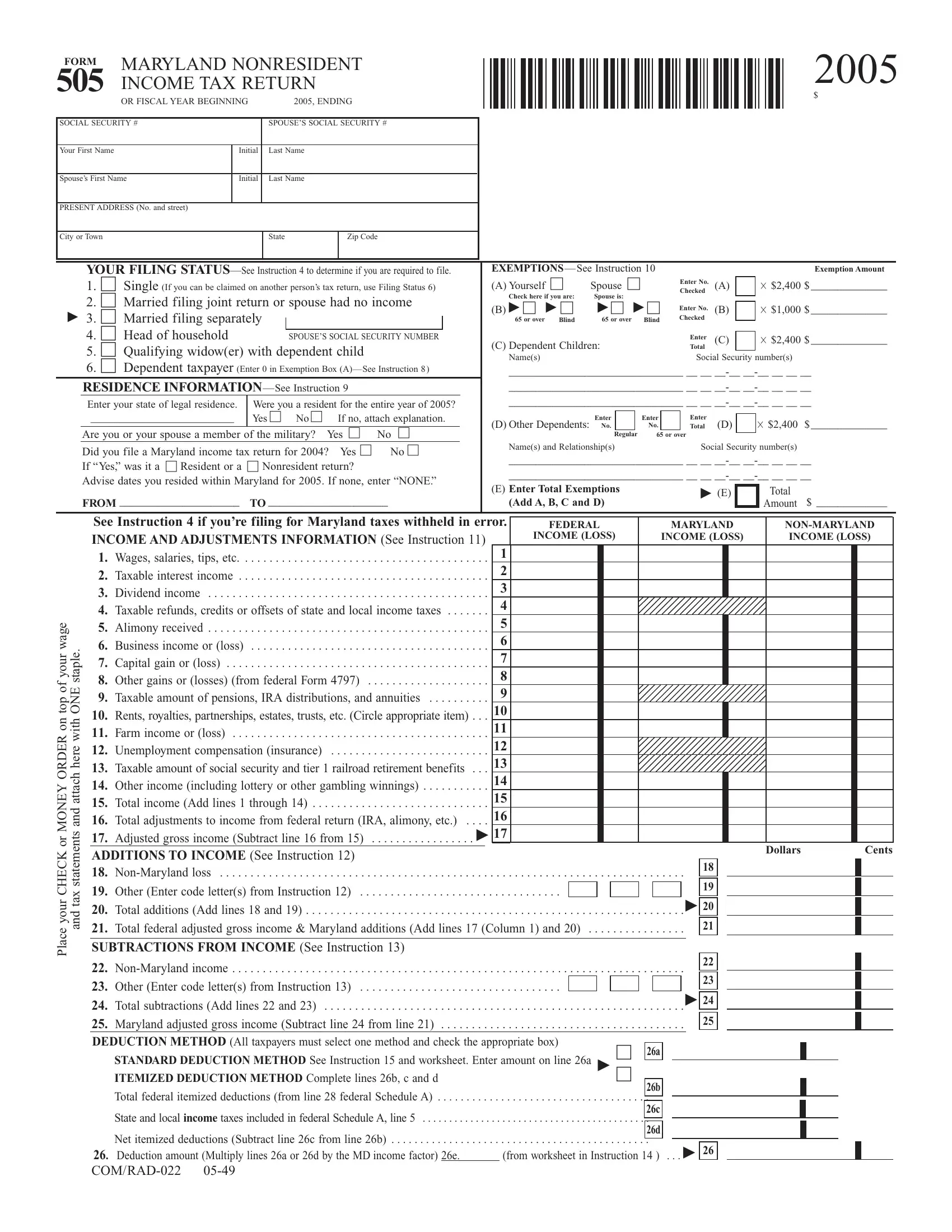

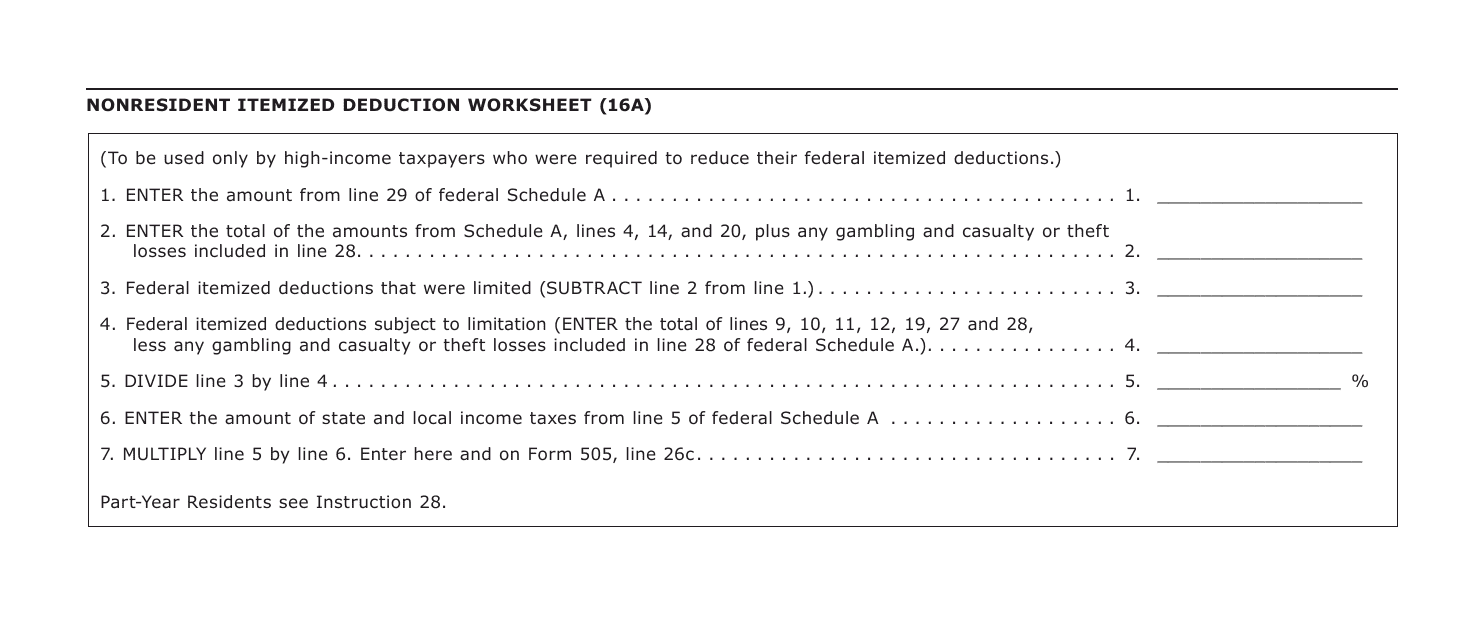

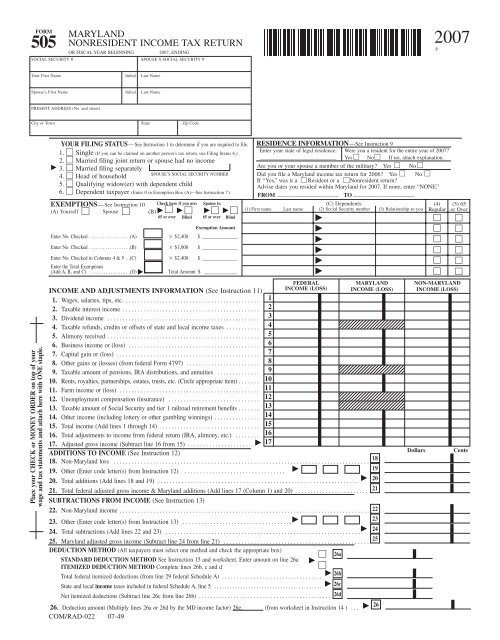

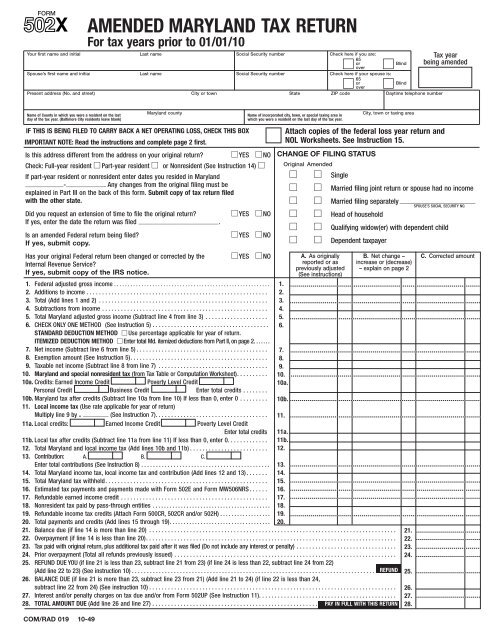

State and local taxes included in federal Schedule A line 5 or from worksheet on page 7 Net itemized deductions Subtract

Pre-crafted templates provide a time-saving solution for developing a diverse series of documents and files. These pre-designed formats and layouts can be utilized for various personal and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the content development procedure.

Maryland Itemized Deduction Worksheet

Form 16A - Fill Out, Sign Online and Download Printable PDF, Maryland | Templateroller

maryland nonresident income tax return - the Comptroller of Maryland

2018 Maryland Tax Course

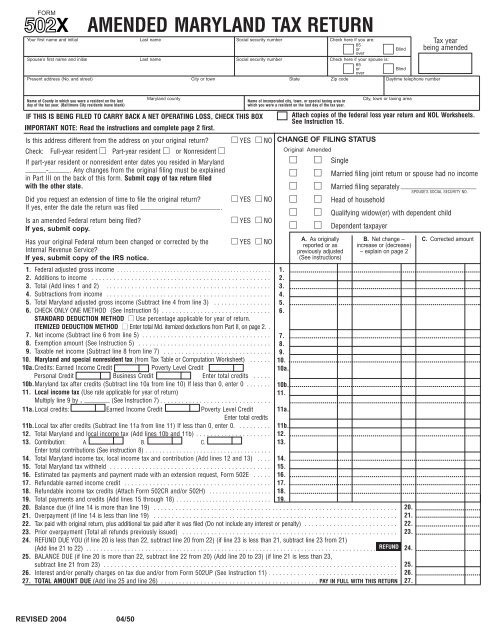

AMENDED MARYLAND TAX RETURN - the Comptroller of Maryland

INSTRUCTIONS & WORKSHEET FOR COMPLETING WITHHOLDING FORMS FOR MARYLAND STATE EMPLOYEES

2018 Maryland Tax Course

https://www.marylandtaxes.gov/forms/13_forms/Itemize_Ded_Nonresident.pdf

PART I To be completed by all taxpayers who itemize deductions and who had federal Adjusted Gross Income of 178 150 or more 89 075 if Married Filing

https://answerconnect.cch.com/document/jmd0109013e2c843b4355/state/explanations/maryland/itemized-deductions

Only an individual who itemizes deductions on the federal tax return may elect to itemize deductions on a Maryland income tax return

https://www.msatp.org/maryland-salt-cap/

Directly from the MarylandTaxes website here are instructions for FORM 502 itemized deduction calculation So the 3 800 is the net Maryland itemized

https://www.irs.gov/pub/irs-prior/i1040sca--2022.pdf

Instead of using this worksheet you can find your deduction by using the Sales Tax Deduction Maryland Massachusetts Michigan New Jersey or Rhode Island

https://www1.goramblers.org/textbooks/files?trackid=koK:6427&Academia=maryland_itemized_deduction_worksheet.pdf

An alternate way to get ideas is always to check another Maryland Itemized Deduction Worksheet This method for see exactly what may be included and adopt

Maryland offers tax deductions and credits to reduce your tax liability including a standard deduction itemized deduction the earned income tax credit child For details see the instructions for Form 760 PY Virginia Itemized Deductions If you itemize your deductions on your federal income tax return you must also

In some situations it makes sense to itemize vs take the standard deduction on Form 1040 Itemizing your tax deductions makes sense if you Have itemized