Massachusetts Agi Worksheet On Form 1 This publication covers some subjects on which a court may have made a decision more favorable to taxpayers than the interpretation by the

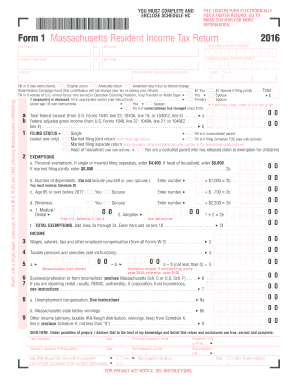

Complete the Form 1 Line 27 Massachusetts AGI Worksheet to see if you may From line 7 of Massachusetts AGI worksheet If you did not purchase any 2017 Form 1 Line 27 Massachusetts AGI Worksheet No Tax Status for Residents Enter your Filing Status from Form 1 line 1 Single Married filing joint

Massachusetts Agi Worksheet On Form 1

Massachusetts Agi Worksheet On Form 1

Massachusetts Agi Worksheet On Form 1

https://www.pdffiller.com/preview/100/98/100098917.png

Tax computation worksheet 1 If NYAGI worksheet line 5 is more than 1 077 550 page 1 of Form IT 205 and add a resident beneficiary s share to the total

Templates are pre-designed documents or files that can be utilized for numerous functions. They can save effort and time by providing a ready-made format and layout for producing different type of content. Templates can be used for personal or professional projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Massachusetts Agi Worksheet On Form 1

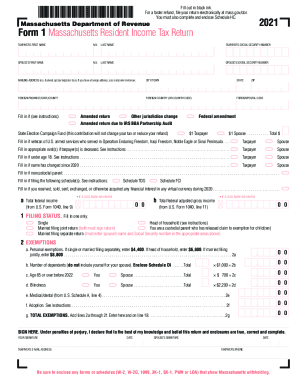

IRS Massachusetts Form 1 | pdfFiller

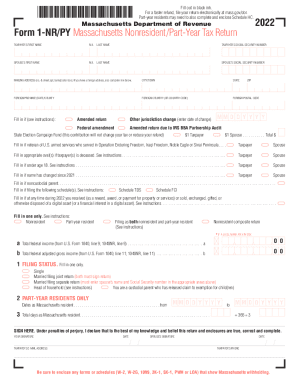

Form 1-NR/PY Instructions - Mass.Gov

Schedule C 1040 line 31 Self employed tax MAGI instructions home office

Basic Schedule D Instructions | H&R Block

Personal Income Tax for Part-Year Residents | Mass.gov

U s individual income tax return forms instructions & tax table (f1040a) (i1040a)(i1040tt) by Legibus, Inc - Issuu

https://www.mass.gov/doc/2020-form-1-instructions/download

Form 1 Line 27 Massachusetts AGI Worksheet No Tax Status Only If Single Head of Household or Married Filing Jointly 1 Enter your total 5 0 income

https://treshna-php.gymmasteronline.com/primo-explore/files?ID=wnm:6671&Academia=massachusetts-agi-worksheet-on-form-1(2).pdf

This article delves into the art of finding the perfect eBook and explores the platforms and strategies to ensure an enriching reading experience Table of

https://www.revenue.wi.gov/TaxForms2022/2022-Form1-inst.pdf

Your federal adjusted gross income for Wisconsin purposes is computed on line 3 of Form 1 See page 13 College Savings Account The

http://www.zillionforms.com/2016/I507726133.PDF

Complete the Massachusetts AGI Worksheet and the Schedule Y line 11 work sheet to see if you may qualify for this deduction See TIR 97 13 for more

https://support.cch.com/kb/Attachment.aspx?name=MA-+Income+Tax+Paid+to+Another+State.pdf&attachmentid=0684R00000Iz9wAQAR&attype=PDF&fileextension=pdf&language=en_US

Enter amount from line 7 of Massachusetts AGI Worksheet 2 Enter 8 000 if single If married filing a joint return or head of household enter the

Schedule CB Line 3 Massachusetts Income Worksheet Enter any income from a partnership trust or S corporation not reported on Form 1 or Form 1 NR PY Massachusetts AGI This deduction is reported on Schedule Y For more information go to the Massachusetts Resident Income Tax Form 1 Instructions page 21

You may also complete form TBOR 1 Dec laration of Tax Representative Modified adjusted gross income line 1 plus line 2