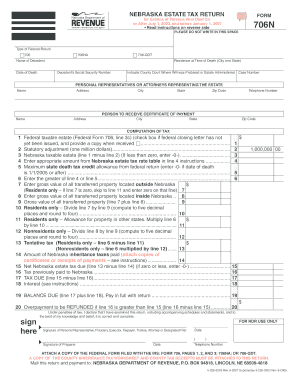

Nebraska Inheritance Tax Worksheet Form 500 An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to reach agreement with the county attorney as to

For any Inheritance Tax payments the following is needed Signed Order by judge or Signed Worksheet by County Attorney Name of the Deceased Date of Death When Nebraskans inherit land or other property they must pay inheritance taxes to the county where the property is located

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500

https://www.signnow.com/preview/242/291/242291051.png

A Nebraska state estate tax is imposed on estates for which a federal estate tax return is filed The amount of this tax is linked to the Maximum Federal Credit

Pre-crafted templates use a time-saving service for producing a diverse series of files and files. These pre-designed formats and layouts can be used for numerous individual and expert projects, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, enhancing the content development process.

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax: A Brief Overview And Tax-Planning Opportunities | McGrath North – a client driven law firm supporting business in Nebraska, the Midwest and across the country

Nebraska Probate Form 500 Inheritance Tax - Fill and Sign Printable Template Online

Nebraska inheritance tax worksheet form 500: Fill out & sign online | DocHub

Fillable Online Free Download Nebraska Inheritance Tax Form 500. Free Download nebraska inheritance tax form 500 Fax Email Print - pdfFiller

Nebraska inheritance tax worksheet form 500: Fill out & sign online | DocHub

HotDocs Market Product Detail

https://revenue.nebraska.gov/about/forms

Forms for bingo pickle card keno and raffle as well as the Nebraska Lottery Retailer application forms Corporation and S Corporation Income Tax Forms

https://inheritance-tax-worksheet-form-500.pdffiller.com/

Nebraska inheritance tax worksheet is a form used to calculate the amount of inheritance tax that must be paid on a decedent s estate in the state of Nebraska

https://www.dochub.com/fillable-form/11136-nebraska-inheritance-tax-worksheet-2021

Edit sign and share nebraska inheritance tax worksheet 2021 online No need to install software just go to DocHub and sign up instantly and for free

https://www.signnow.com/fill-and-sign-pdf-form/33061-nebraska-tax-worksheet-form

Nebraska Inheritance Tax Worksheet Form 500 Save yourself time and money using our fillable web templates Prepare and report accurate taxes with signNow

https://www.uslegalforms.com/form-library/430164-nebraska-probate-form-500-inheritance-tax

Complete Nebraska Probate Form 500 Inheritance Tax online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your

Clerk of the District Court Omaha Nebraska Tax Foreclosure Board of Mental Health Payment Information Family and Juvenile Domestic Violence Corporate income tax and engaged in business in Nebraska or having sources of income from Nebraska must file a Nebraska Corporation Income Tax Return Form

Additionally we cannot provide legal advice and do not have inheritance tax forms Please contact a private attorney for assistance with your inheritance tax