Ngpf Activity Bank Taxes Answer Key Pdf All income earners except for purely compensation income earners are mandated to issue a receipt or invoice for every sale of services or products The BIR even require all businesses to

Feb 23 2025 0183 32 This article aims to provide a comprehensive overview of the legal requirements for issuing official receipts the penalties for non compliance and the practical ramifications for Jun 16 2025 0183 32 Statutory requirement Section 237 of the National Internal Revenue Code NIRC obliges every person subject to an internal revenue tax to issue a receipt or sales commercial

Ngpf Activity Bank Taxes Answer Key Pdf

Ngpf Activity Bank Taxes Answer Key Pdf

Ngpf Activity Bank Taxes Answer Key Pdf

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/70909e827fc3470244b50151b8ba74ee/thumb_1200_1553.png

Full text of circulars orders and other issuances of the Supreme Court of the Philippines Featured on the World Wide by The Law Firm of Chan Robles amp Associates Philippines

Pre-crafted templates offer a time-saving solution for developing a diverse range of documents and files. These pre-designed formats and layouts can be utilized for various personal and professional projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the content creation process.

Ngpf Activity Bank Taxes Answer Key Pdf

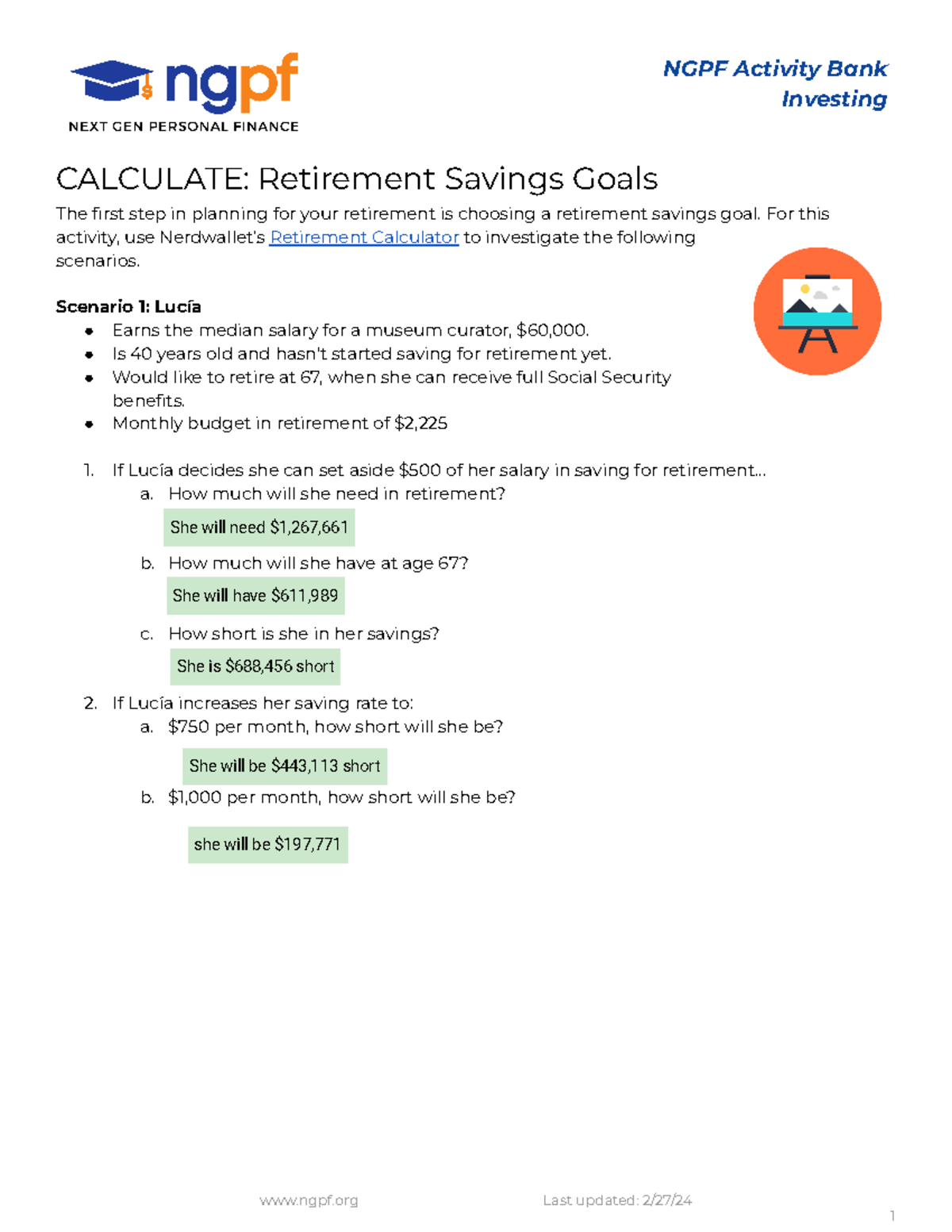

Jonathan 5099913 Copy Of Calculate Retirement Savings Goals NGPF

How To Find NGPF Answer Keys Worksheets Library

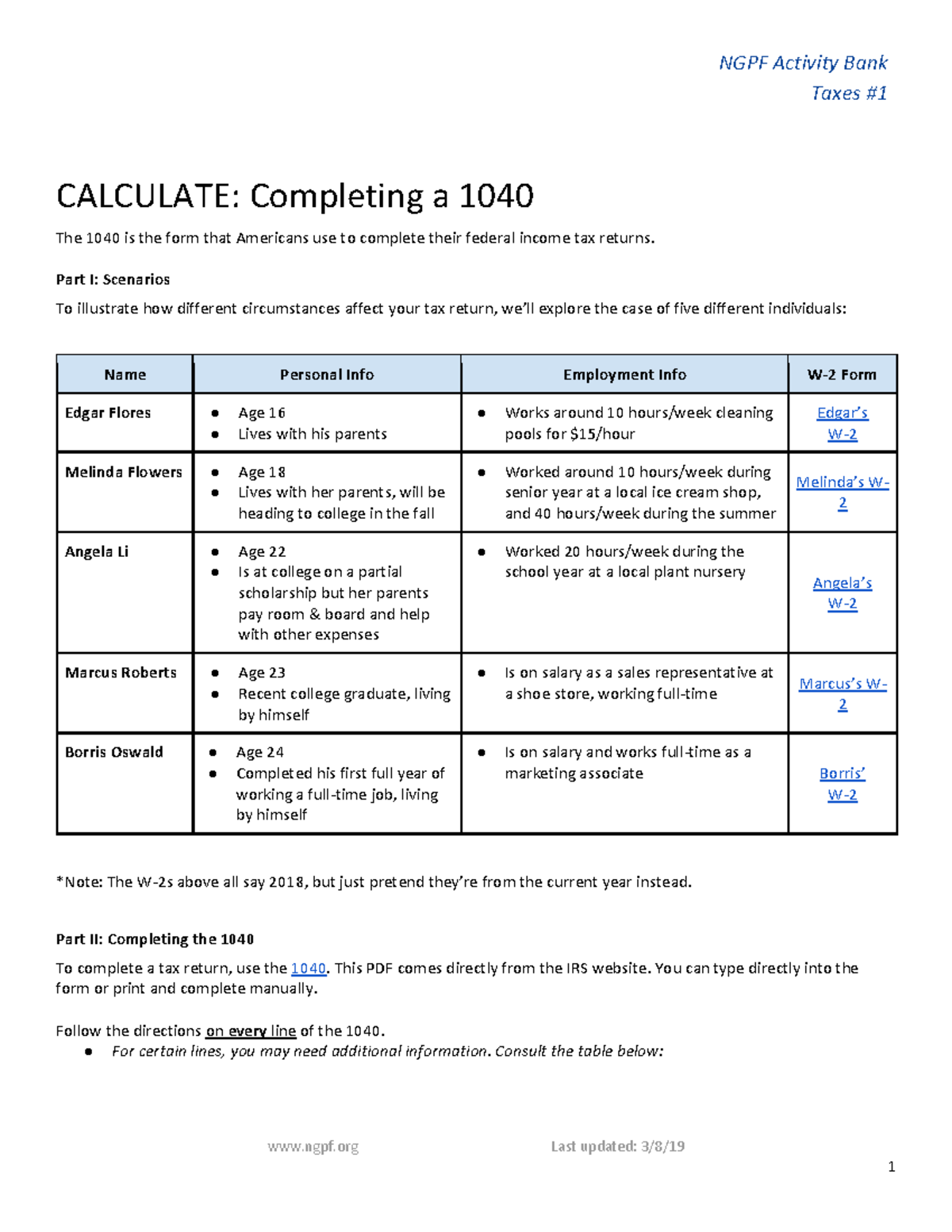

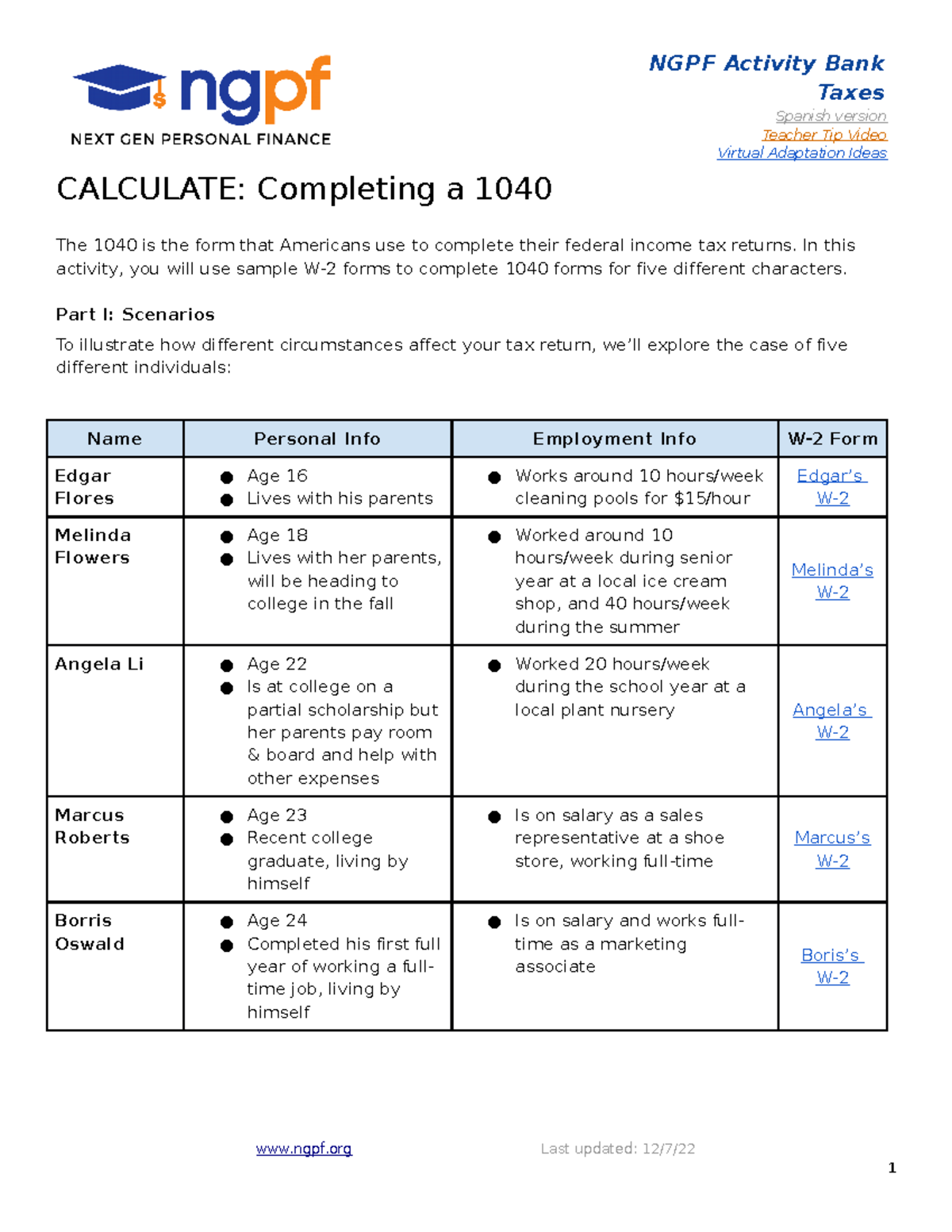

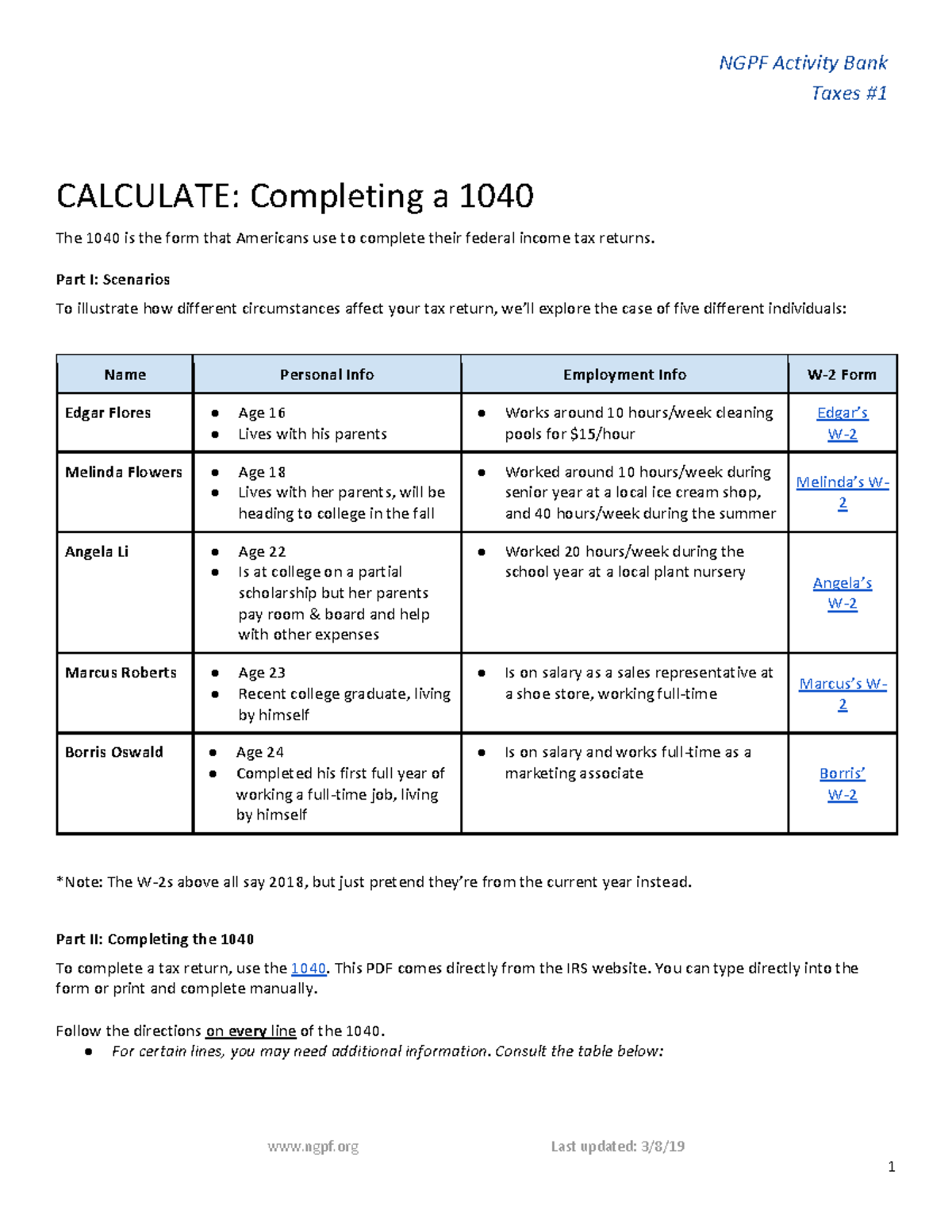

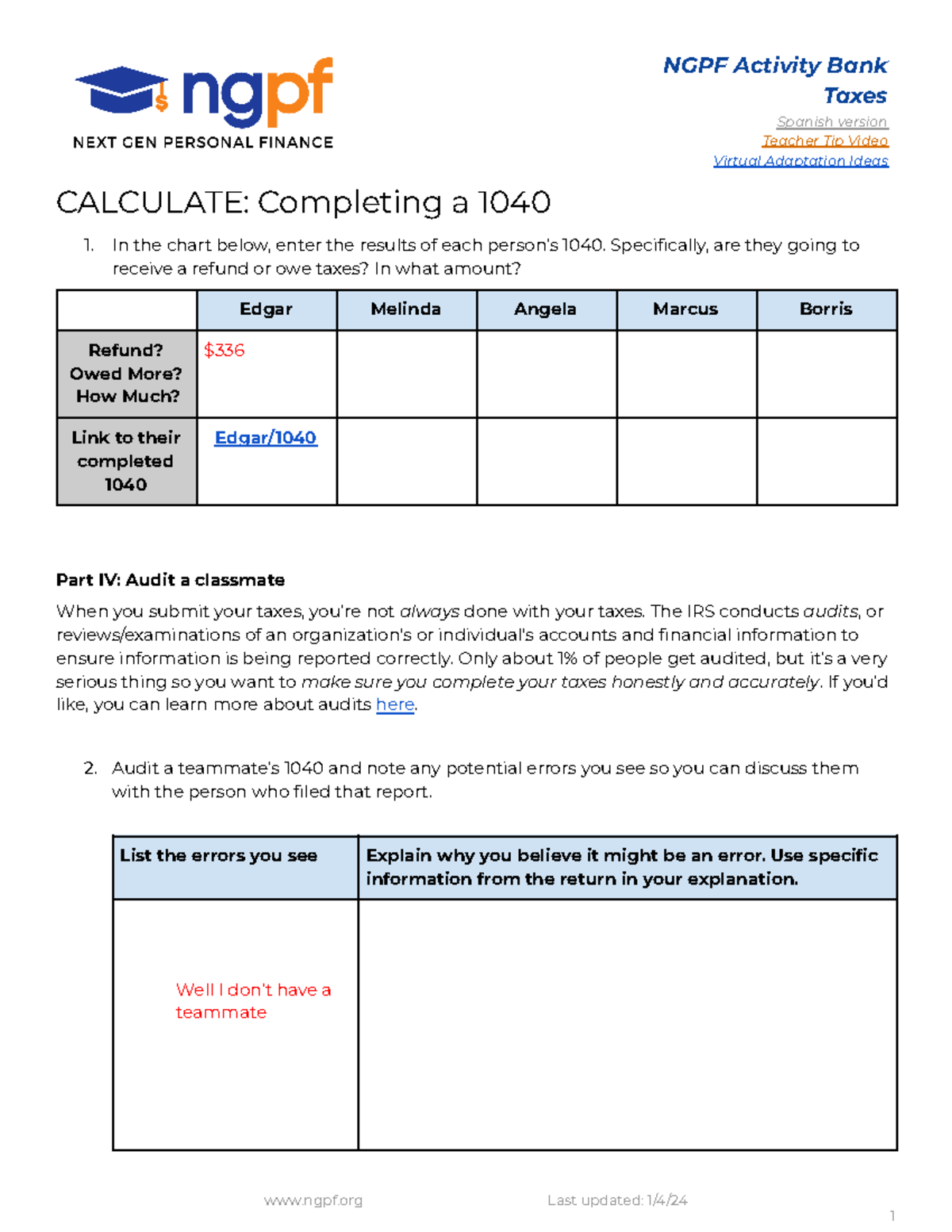

Calculate Completing A 1040 NGPF Activity Bank Taxes Spanish Version

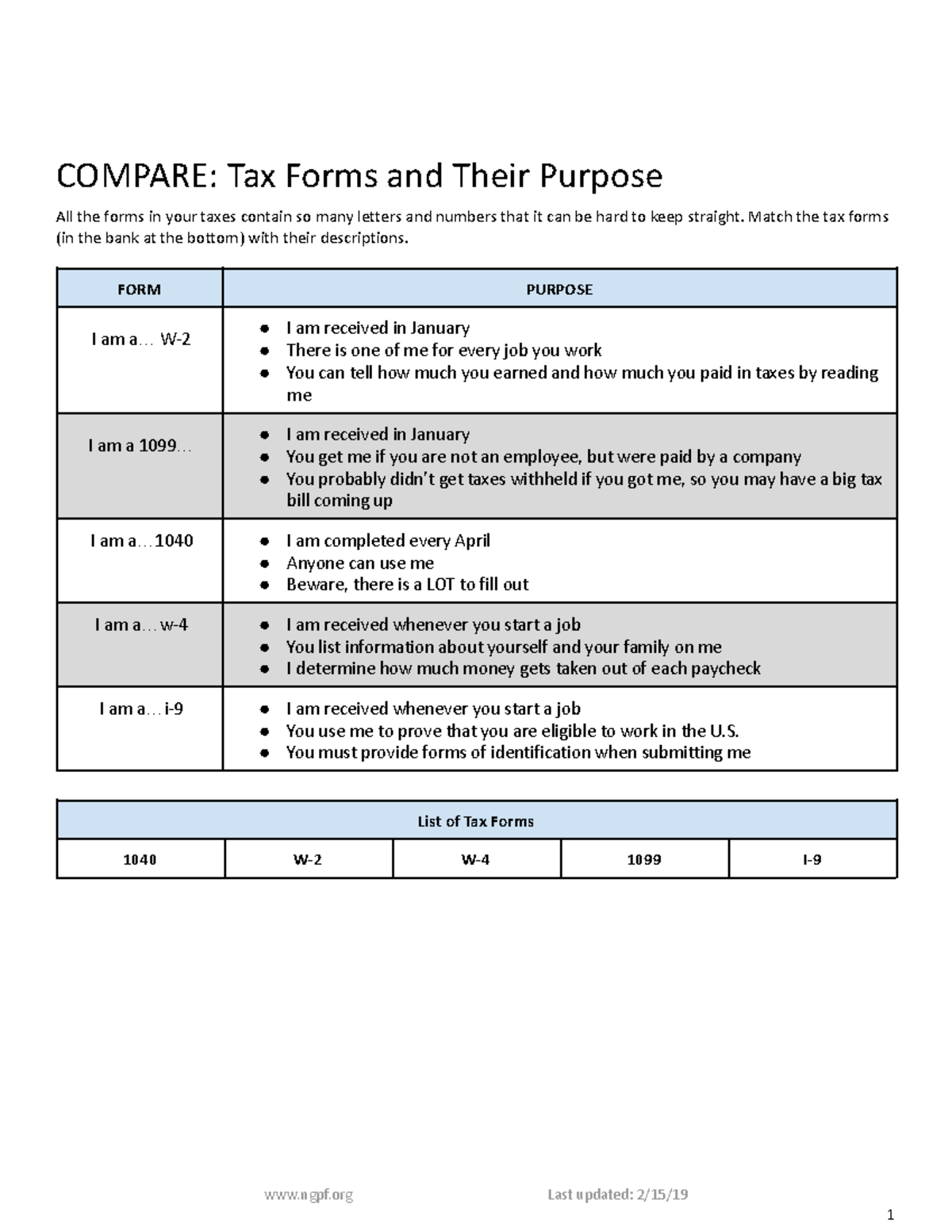

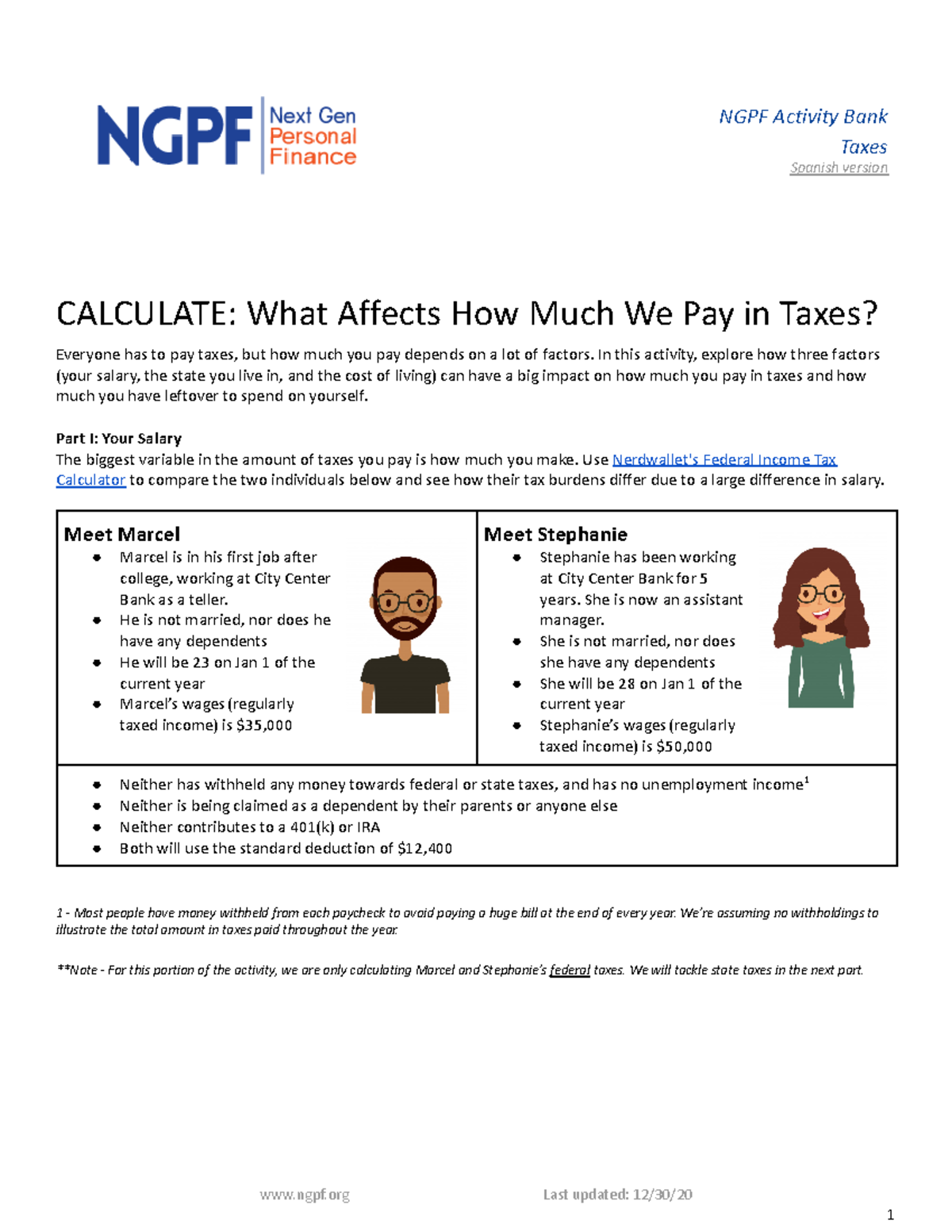

Tax Forms And Their Purpose COMPARE Tax Forms And Their Purpose All

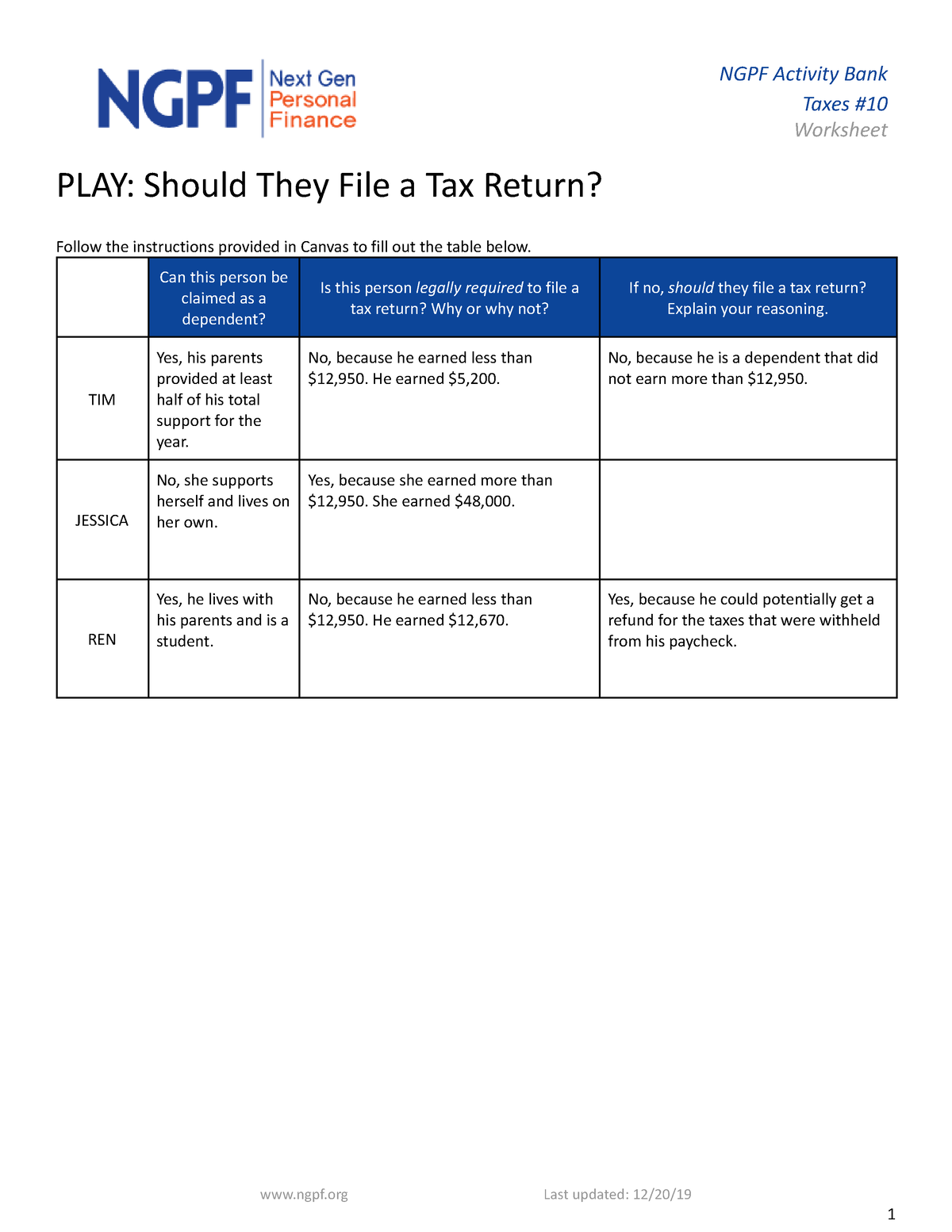

Updated PLAY Student Worksheet Should They File A Tax Return NGPF

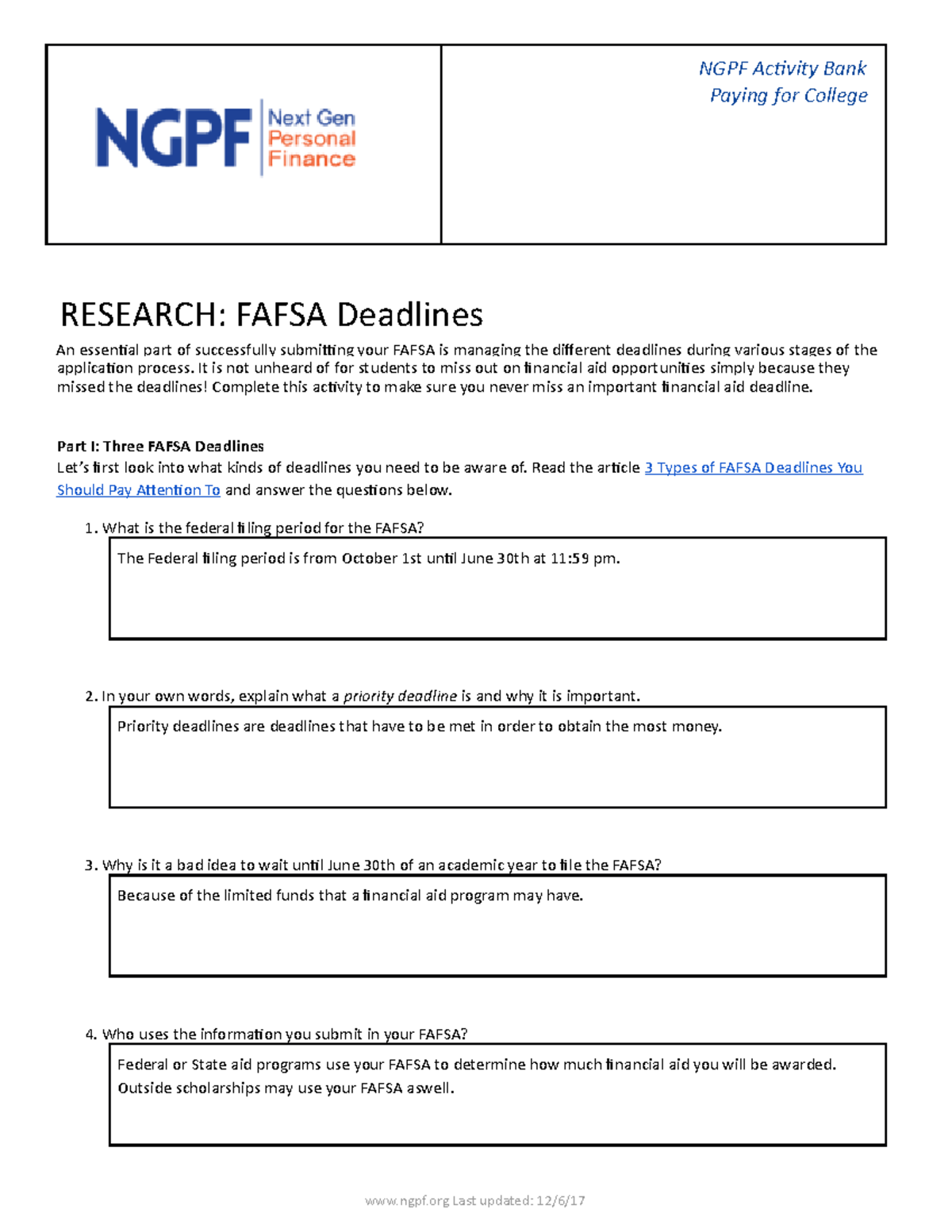

Module Three Lesson One Activity NGPF Activity Bank Paying For

https://taxcalculatorphilippines.net › bir-ruling-on

Master the maze of BIR regulations on issuing official receipts and avoid penalties with our essential guide

https://taxacctgcenter.ph › bir-official-receipts

As a rule under Section 237 of the Tax Code as amended by Republic Act No 11976 or Ease of Paying Taxes Act taxpayers engaged in trade or business are required to issue official

https://businessregistrationphilippines.com › sales

Aug 18 2025 0183 32 Businesses must legally issue and record certain documents such as sales invoices and official receipts However the rules on when to issue each have changed under

https://ifinancesense.com › taxes › bir-ruling-on

Oct 22 2024 0183 32 Adhering to the BIR s receipt format requirements ensures that your issuance of official receipts is compliant with regulations Remember different types of receipts like VAT

https://elibrary.judiciary.gov.ph › thebookshelf › showdocs

That Sales Invoices are demanded as evidence of delivery agreement to sell or transfer of goods and services and Official Receipt as evidence of payment In fine both Sales Invoices and

[desc-11] [desc-12]

[desc-13]