Non Cash Charitable Contributions Over 5 000 Jan 16 2025 0183 32 Form 8283 must be filed for non cash contributions exceeding 500 Contributions over 5 000 require a qualified appraisal

Nov 15 2023 0183 32 Form 8283 is used to ensure U S taxpayers are accurately valuing their noncash contributions and claiming the appropriate tax deductions Noncash contributions can include property such as artwork real estate Dec 19 2019 0183 32 Non cash charitable gifts of over 5 000 come with specific requirements from the IRS in order to claim the federal income tax charitable deduction

Non Cash Charitable Contributions Over 5 000

Non Cash Charitable Contributions Over 5 000

Non Cash Charitable Contributions Over 5 000

https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-40.jpg

Dec 4 2018 0183 32 Unique tax reporting rules apply when you make noncash charitable contributions of 5 000 or more Here are some tips to help you avoid the most common mistakes

Templates are pre-designed files or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and layout for creating different kinds of material. Templates can be used for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Non Cash Charitable Contributions Over 5 000

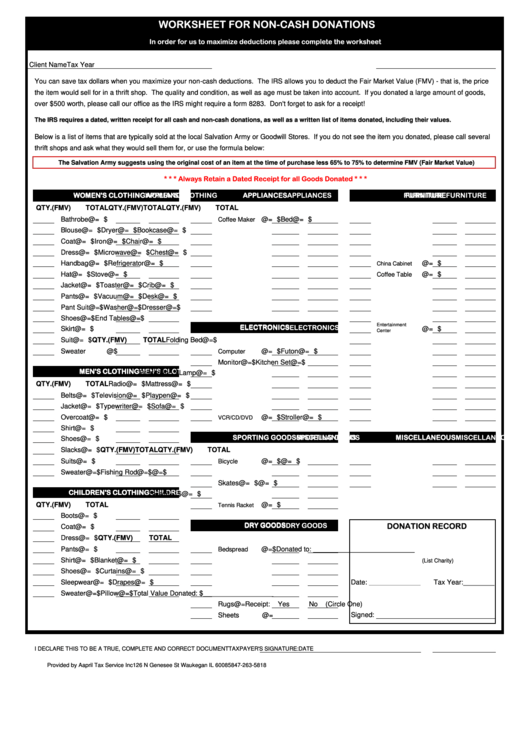

Non cash charitable contributions worksheet PDF Clothing

Donation Letter For Taxes Sample And Examples Word

20 Non Cash Charitable Contributions Worksheet Worksheets Decoomo

Irs Form Es 2024 Shay Jannelle

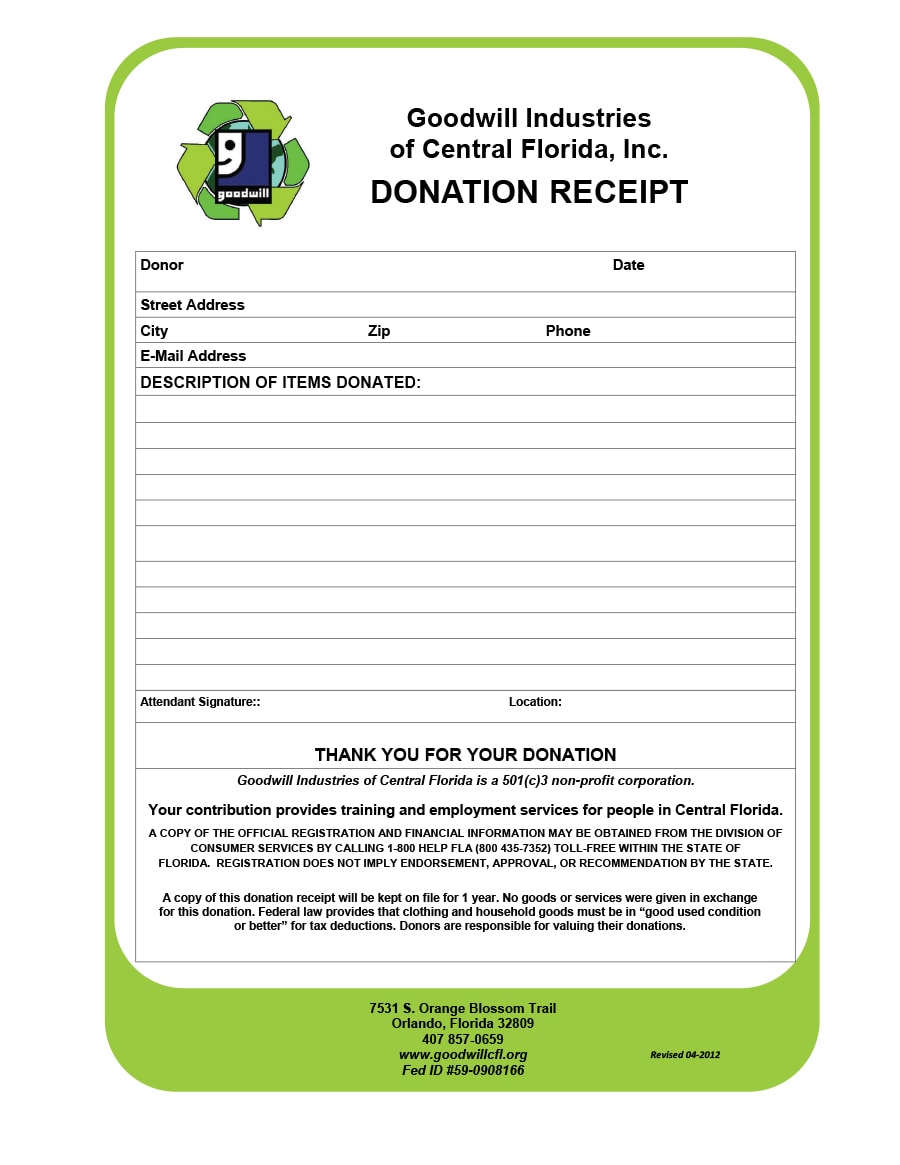

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

43 Non Cash Charitable Contributions Donations Worksheet Worksheet Works

https://www.forvismazars.us › forsights › a

While monetary contributions do have toilsome substantiation requirements non cash contributions especially those in excess of 5 000 have particularly onerous requirements and have been subject to consistent scrutiny by the IRS

https://www.irs.gov › publications

You must complete Section B of Form 8283 for each item or group of similar non cash items for which you claim a deduction of over 5 000 except as provided in Deductions Over 5 000 later The organization that received the

https://accountants.intuit.com › community › proseries

Feb 4 2023 0183 32 Seems clear if you claim over 5000 you must have appraisal You must fill out one or more Forms 8283 Noncash Charitable Contributions and attach them to your return if your

https://ttlc.intuit.com › › discussion

Jun 1 2019 0183 32 The 5000 limit applies to donations of an individual item or group of similar items Clothes and household goods would be considered similar items The best way to claim this

https://www.connerash.com › cmss_files

Generally except for gifts of publicly traded securities if the claimed deduction for an item or a group of similar items of donated property is more than 5000 you must get a qualified

Charitable donations of noncash property including virtual currency can present a unique tax advantaged way for donors to give to charity Strict substantiation and documentation If you claim a deduction of over 5 000 for a noncash charitable contribution of one item or a group of similar items you must have the acknowledgment and the written records described

If you claim a deduction of more than 500 000 for a donation of property you must attach a qualified appraisal of the property to your return This does not apply to contributions of cash