Nonrefundable Portion Of Employee Retention Credit From Worksheet 1 The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to

Worksheet 1 13 56 Worksheet 1 Non Refundable Employee Retention 1 See More DLA The term nonrefundable is a misnomer if the taxpayer did not claim the ERC and instead paid the employer s share of the Social Security tax

Nonrefundable Portion Of Employee Retention Credit From Worksheet 1

Nonrefundable Portion Of Employee Retention Credit From Worksheet 1

Nonrefundable Portion Of Employee Retention Credit From Worksheet 1

https://blog.taxbandits.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-13-at-1.21.23-PM-1024x307.png

Employers that also paid qualified wages for the employee retention credit will no longer calculate the refundable and nonrefundable portions of

Pre-crafted templates offer a time-saving solution for producing a varied series of documents and files. These pre-designed formats and layouts can be used for numerous individual and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content development process.

Nonrefundable Portion Of Employee Retention Credit From Worksheet 1

.jpg)

Updated Form 941 Worksheet 1, 2, 3 and 5 for 2023 | Revised 941

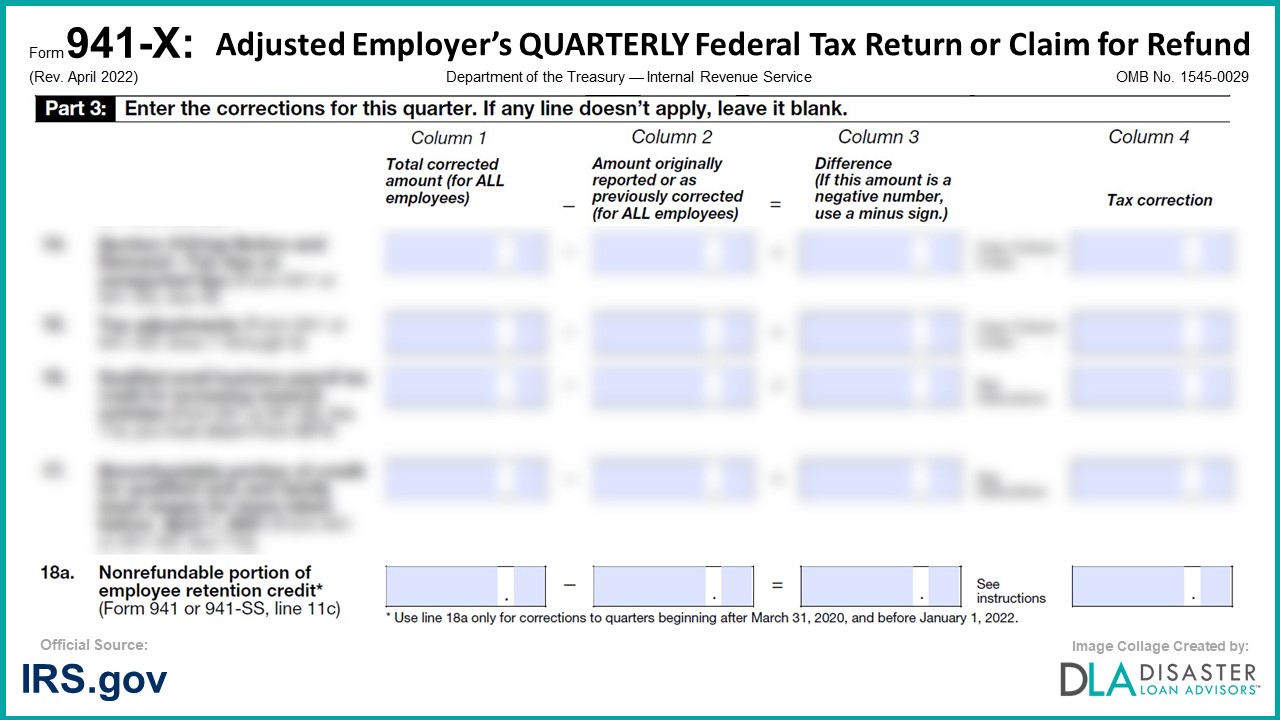

941-X: 18a. Nonrefundable Portion of Employee Retention Credit, Form Instructions | DisasterLoanAdvisors.com

Employee Retention Tax Credit

![How To Fill Out 941-X For Employee Retention Credit [Stepwise Guide] | StenTam how-to-fill-out-941-x-for-employee-retention-credit-stepwise-guide-stentam](https://images.surferseo.art/bfce0c6e-3848-46ee-8e10-d8ca5813ab5d.png)

How To Fill Out 941-X For Employee Retention Credit [Stepwise Guide] | StenTam

Employee Retention Tax Credit on 941

Taking Advantage of the Employee Retention Tax Credit (ERTC)

https://erctoday.com/non-refundable-portion-of-erc-explained/

With ERC the non refundable portion is equal to 6 4 of wages This is the employer s portion of Social Security Tax Form 941 Revision of

https://www.disasterloanadvisors.com/what-is-the-non-refundable-portion-of-employee-retention-credit/

The non refundable portion of ERC simply decreases the amount of tax payable to zero a non refundable tax credit does not result in a return

https://www.hostmerchantservices.com/articles/explanation-of-the-non-refundable-part-of-employee-retention-credit/

For the first two quarters the ERC non refundable part amounts to 6 4 of the paid wages It is equal to the eligible employer s Social Security tax portion

https://www.lendio.com/blog/nonrefundable-erc/

In IRS speak the term non refundable means that the amount cannot be used to increase a business s refund or create a refund that wasn t

https://www.irs.gov/instructions/i941x

You use Worksheet 1 to refigure the correct nonrefundable portion of the credit Nonrefundable Portion of Employee Retention Credit Use line 18a only for

If your business is eligible as a non recovery startup business the maximum credit is 21 000 per employee 7 000 per quarter for the year If your business And family leave wages from Worksheet 1 Line 11c Nonrefundable portion of employee retention credit from Worksheet 1 Line 11d Total nonrefundable

Nonrefundable portion of credit for qualified sick and family leave wages will be reported on Line 11b Businesses with less than 500 employees