Partner S Adjusted Basis Worksheet How do you use the Partner s Adjusted Basis Worksheet when preparing taxes for an LLC 745

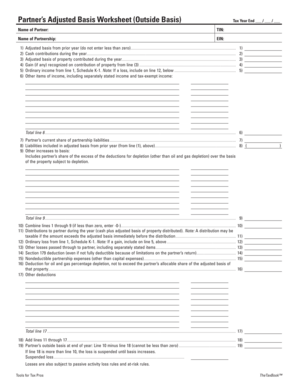

Here is the Worksheet for Adjusting the Basis of a Partner s Interest in the Partnership For S corporations see S Corporation Stock and Debt Note This worksheet reflects the partner s amount at risk which is used to determine the amount of loss if any that can be deducted in the current year

Partner S Adjusted Basis Worksheet

Partner S Adjusted Basis Worksheet

Partner S Adjusted Basis Worksheet

https://i.ytimg.com/vi/U9yPJoA67vk/maxresdefault.jpg

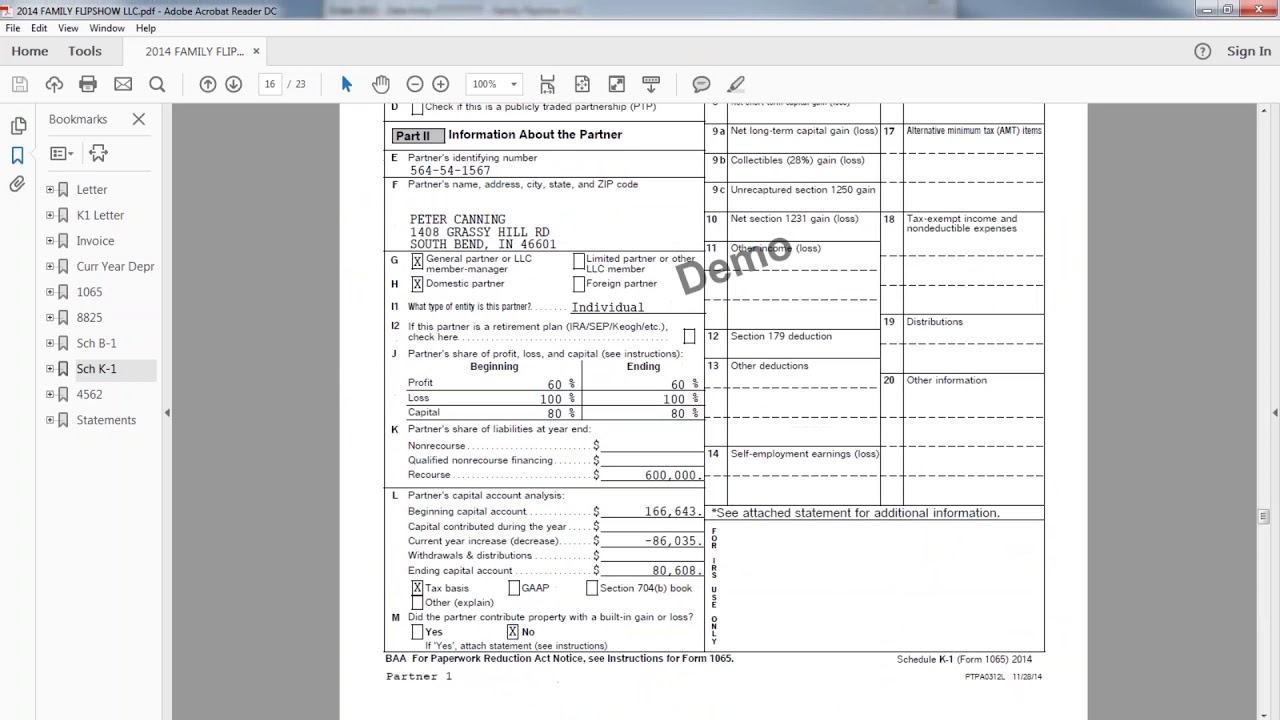

Go to the Partners Partner Basis worksheet Select Section 1 Partner Basis Options In Line 1 Produce Partner Basis Worksheet in K 1 copy select the

Templates are pre-designed documents or files that can be used for various functions. They can conserve time and effort by supplying a ready-made format and layout for creating various type of content. Templates can be used for personal or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Partner S Adjusted Basis Worksheet

How do you use the Partner's Adjusted Basis Worksheet when preparing taxes for an LLC? - YouTube

When, why and how … Basis reporting by partners, members and S Corp. shareholders

1040 - Basis Worksheets (K1)

1065 - Partners Adjusted Basis Worksheet (Basis Wks)

S Corporation Shareholder Basis Losses Claimed in Excess of Basis

Partners Adjusted Basis Worksheet | PDF | Public Finance | Economy Of The United States

https://kb.drakesoftware.com/Site/Browse/10920/1065-Partners-Adjusted-Basis-Worksheet-Basis-Wks

Use the Basis Wks screen Partner s Adjusted Basis Worksheet to calculate a partner s new basis after increases and or decreases are made to basis during the

https://support.taxslayerpro.com/hc/en-us/articles/360009292813-Form-1065-Partner-s-Adjusted-Basis-Worksheet

At the Adjusted Basis Worksheet menu the user will be able to enter based on the accounting records of the partnership any of the above

https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

Use the Worksheet for Adjusting the Basis of a Partner s Interest in the Partnership to figure the basis of your interest in the partnership For partnership

https://www.irs.gov/pub/irs-utl/partners-outside-basis.pdf

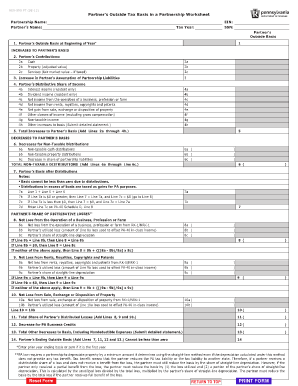

A partner s outside basis in his partnership interest can be estimated by adding his tax basis capital account his share of liabilities and

https://www.taxact.com/support/21547/2020/worksheet-for-tracking-the-basis-of-a-partner-s-interest-in-the-partnership

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest To help you track basis there is a

a General ruleThe adjusted basis of a partner s interest in a partnership shall except as provided in subsection b be the basis of such interest Partners Adjusted Basis Worksheet Outside Basis Tax Year End Name of Partner TIN Name of Partnership EIN 1 Adjusted basis from prior

Partner s Basis The partner s adjusted basis is used to determine the amount of loss deductible by the partner A partner cannot deduct a loss in excess of his