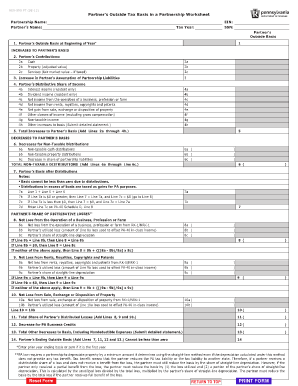

Partner S Basis Worksheet There are two methods to select the Partner Basis Worksheet to print in the client and government copies of the return globally for all Partnership returns

Here s a worksheet that will help you track the basis of a partner s interest in the partnership Follow these steps to navigate the worksheet and make Partner s Basis after Distributions Notes Basis cannot be less than zero due to distributions Distributions in excess of basis are taxed as gains for PA

Partner S Basis Worksheet

https://imgv2-1-f.scribdassets.com/img/document/351222315/original/536d1dbc16/1692917300?v=1

How do you use the Partner s Adjusted Basis Worksheet when preparing taxes for an LLC

Templates are pre-designed files or files that can be utilized for different purposes. They can save effort and time by supplying a ready-made format and layout for developing various sort of content. Templates can be utilized for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Partner S Basis Worksheet

IRS Partners Adjusted Basis Worksheet 2019-2023 - Fill and Sign Printable Template Online

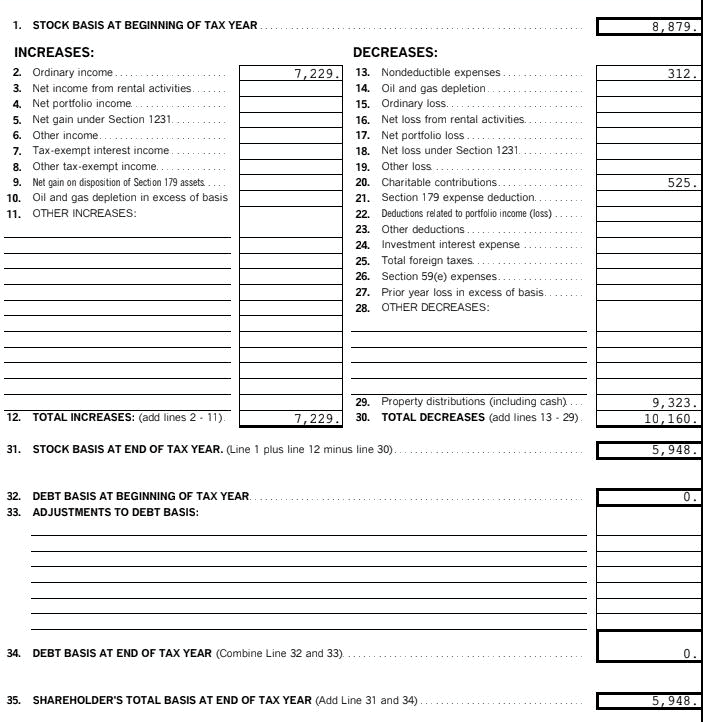

What Is the Basis for My S-Corporation? | TL;DR: Accounting

S Corporation Shareholder Basis Losses Claimed in Excess of Basis

Calculating Basis in a Partnership Interest - YouTube

GIT-9P Income From Partnerships

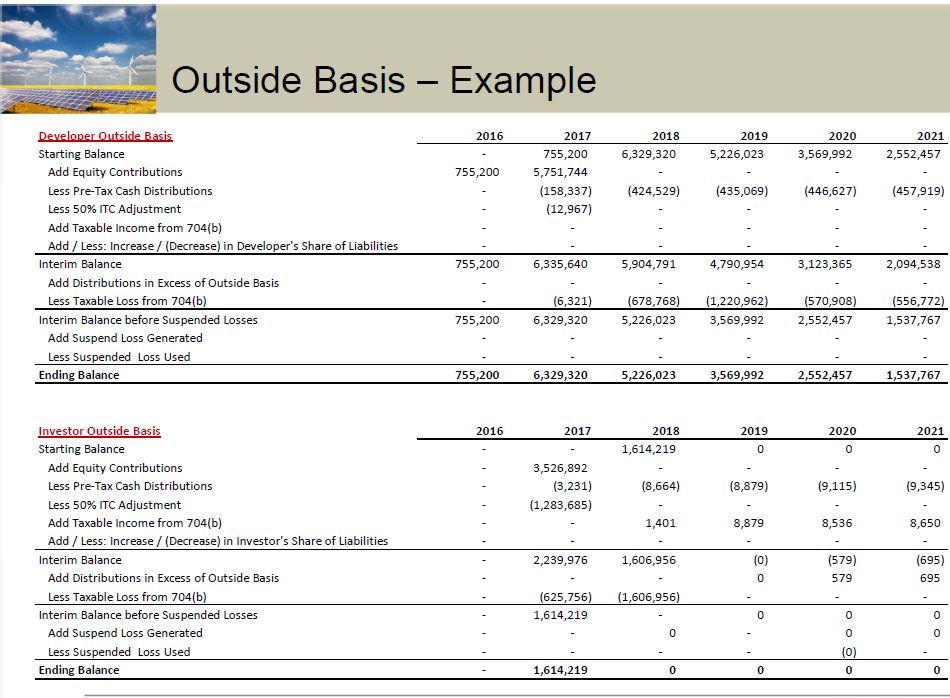

Outside Basis (Tax Basis) – Edward Bodmer – Project and Corporate Finance

https://kb.drakesoftware.com/Site/Browse/10920/1065-Partners-Adjusted-Basis-Worksheet-Basis-Wks

A partner s adjusted outside basis refers to the partner s investment in a partnership The basis is determined without considering any amount shown in the

https://www.irs.gov/pub/irs-utl/partners-outside-basis.pdf

Audit Tool Partner s Basis Computation Spreadsheet Issue Snapshot Determining Basis in a Partnership Interest Outside Basis Back

https://support.taxslayerpro.com/hc/en-us/articles/360009292813-Form-1065-Partner-s-Adjusted-Basis-Worksheet

A taxpayer s basis in a partnership consists of the net cash that the partner has contributed to the partnership entity plus the adjusted basis

https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

That decrease your basis Use the Worksheet for Adjusting the Basis of a Partner s Interest in the Partnership to figure the basis of your interest in the

https://support.cch.com/kb/solution.aspx/sw18712

Go to the Partners Partner Basis worksheet Select Section 1 Partner Basis Options In Line 1 Produce Partner Basis Worksheet in K 1 copy select the

A partner s distributive share of the adjusted basis of a partnership s property donation to charity Here is the Worksheet for Adjusting the Edit sign and share partnership basis worksheet excel online No need to install software just go to DocHub and sign up instantly and for free

They share all profits and losses in the ratios of the beginning capital balances shown above 16 Partners Basis 6 Worksheet 2 A B C D