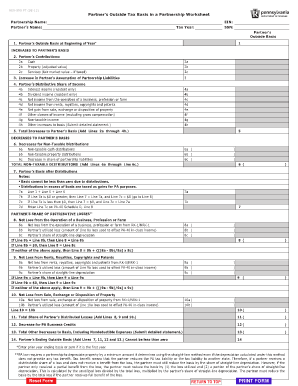

Partner S Outside Basis Worksheet Use the Basis Wks screen Partner s Adjusted Basis Worksheet to calculate a partner s new basis after increases and or decreases are made to basis during the

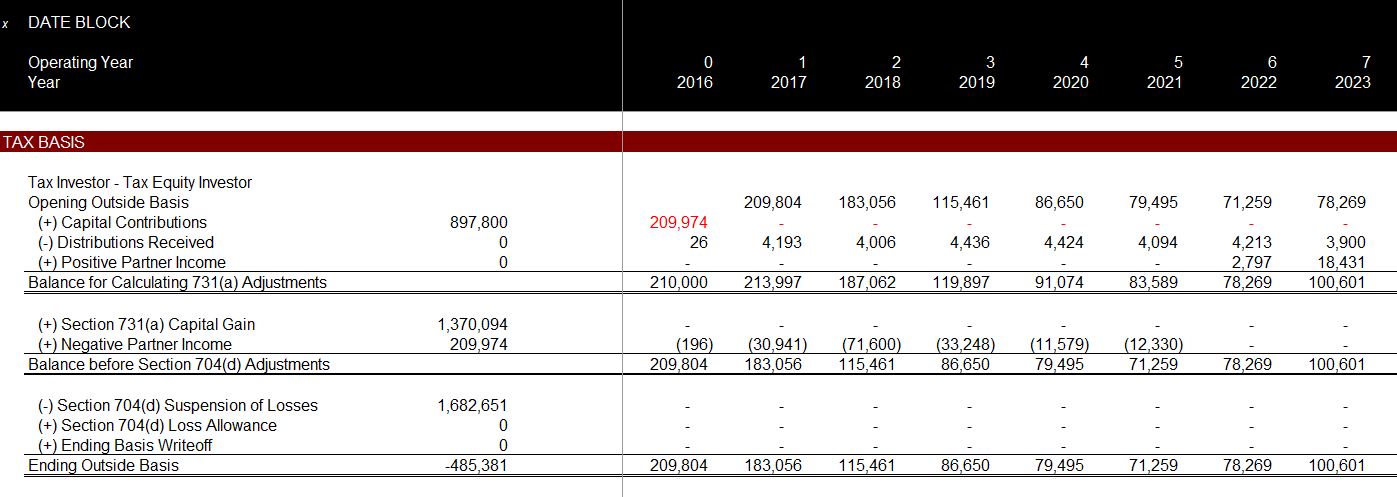

A partner s outside basis can generally be computed as the partner s capital account plus the partner s share of liabilities Some examples of the effect on the Outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or

Partner S Outside Basis Worksheet

Partner S Outside Basis Worksheet

Partner S Outside Basis Worksheet

https://edbodmer.com/wp-content/uploads/2019/07/Outside-Basis.jpg

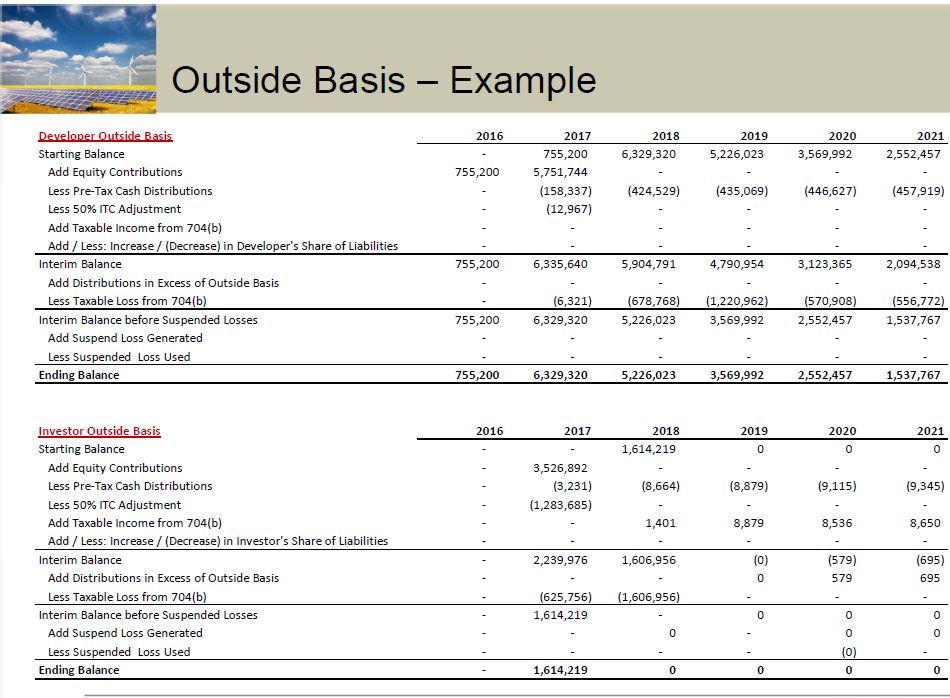

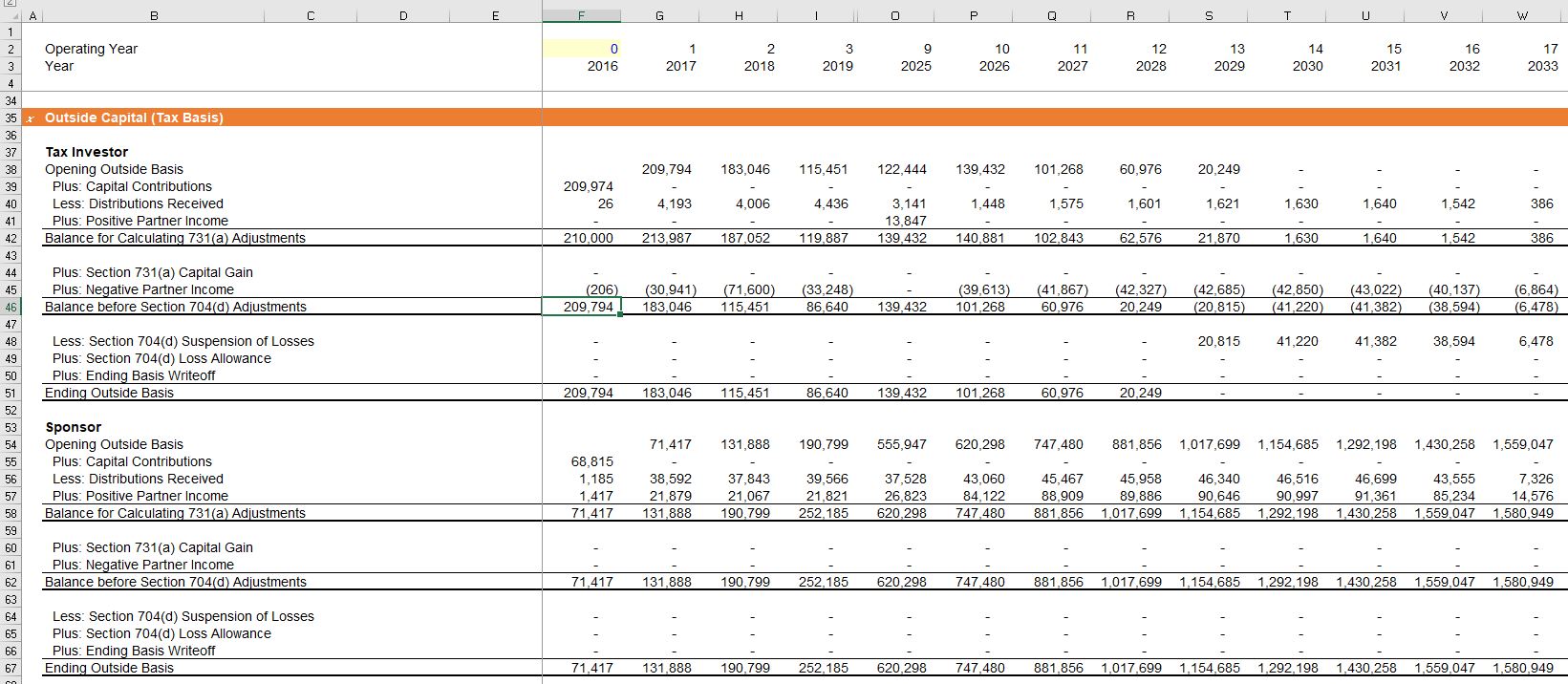

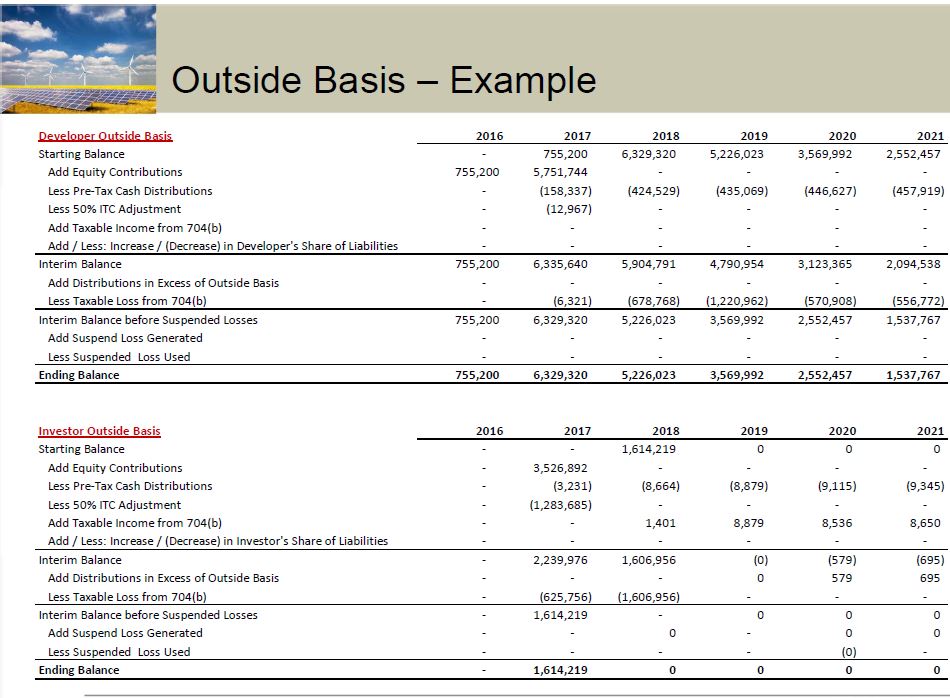

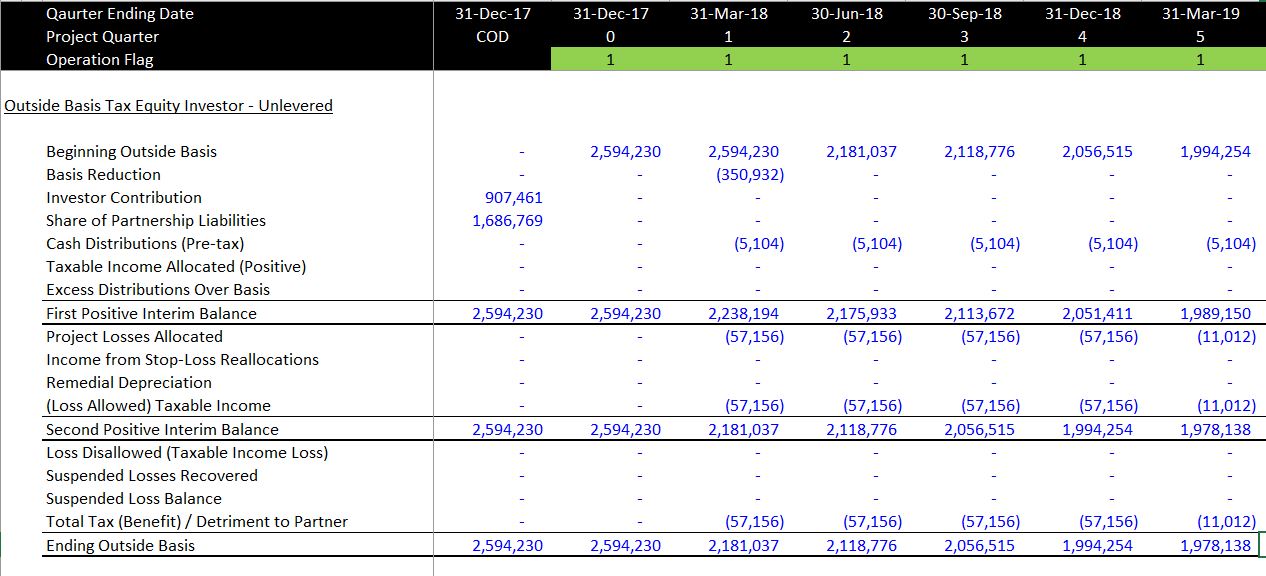

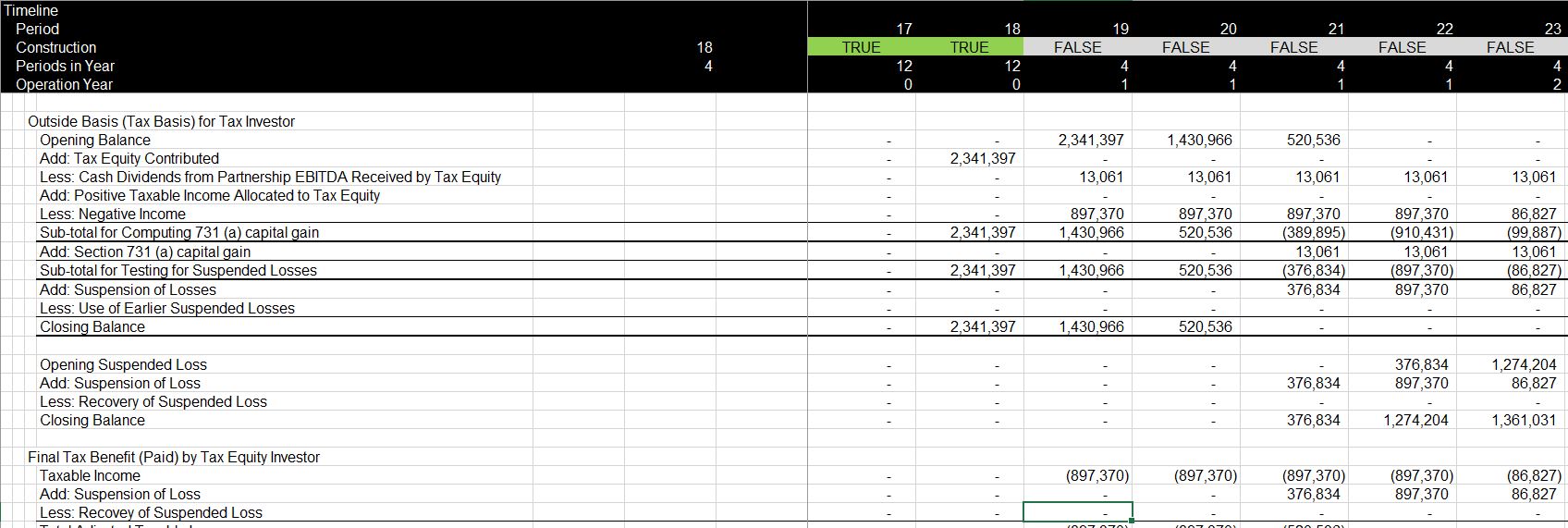

The outside basis is essentially the allocated net assets of the partnership to one of the partners with the important constraint that the tax basis cannot be

Pre-crafted templates offer a time-saving service for producing a diverse range of files and files. These pre-designed formats and designs can be made use of for various personal and professional jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material creation procedure.

Partner S Outside Basis Worksheet

TAX5015 - Partners Adjusted Basis Worksheet.pdf - Partners Adjusted Basis Worksheet Outside Basis Tax Year End / / Name of Partner: TIN: Name of | Course Hero

How to Calculate Outside Basis of a Partner - YouTube

Advantages of an Optional Partnership Basis Adjustment

Partner's Outside Basis Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Outside Basis (Tax Basis) – Edward Bodmer – Project and Corporate Finance

Advantages of an Optional Partnership Basis Adjustment

https://www.thomsonreuters.com/content/helpandsupp/en-us/help/checkpoint-tools/1065-returns/partners_outside_basis_calculation.html

This template calculates each partner s outside basis in the partnership which equals the partner s tax basis capital account plus his share of partnership

https://www.revenue.pa.gov/FormsandPublications/FormsforBusinesses/Partnerships-S-Corps-LLCs/Documents/rev-999.pdf

INCREASES TO PARTNER S BASIS 2 Partner s Contributions 2a Cash 2a 2b Property adjusted value 2b 2c Services fair market value if taxed

https://partners-outside-basis-worksheet.pdffiller.com/

The purpose of a partners outside basis worksheet is to track each partner s basis in the partnership at the end of the partnership s tax year This worksheet

https://cs.thomsonreuters.com/ua/toolbox/cs_us_en/Calculator_screen_overviews/cshw_partners_outside_basis_screen.htm

This tax worksheet calculates for carryforward purposes a partner s outside basis in a partnership interest Outside basis refers to basis each partner

https://www.youtube.com/watch?v=b-6bG-K9vSE

Outside basis refers to a partner s tax basis in their partnership interest Outside basis

Inside basis focuses on individual assets while outside basis has to do with each partner s interest in the partnership For example Partner A contributes Under this method the partner s tax basis capital account is calculated by starting with cash plus the tax basis of assets contributed less any liabilities

Each partner owns a share of the partnership s inside basis for all of its assets and all partners should maintain a record of their