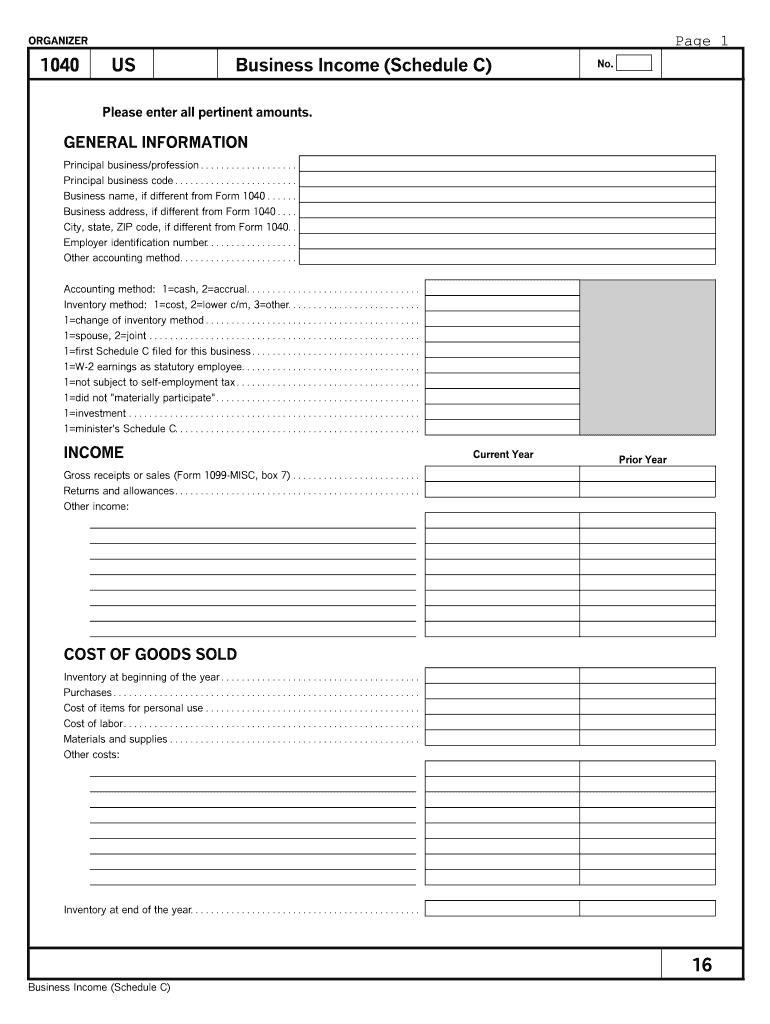

Printable Schedule C Worksheet 1 first Schedule C filed for this business NOTE If you purchased or disposed of any business assets please complete Sheet 22

Edit sign and share help with filling out schedule c online No need to install software just go to DocHub and sign up instantly and for free IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The

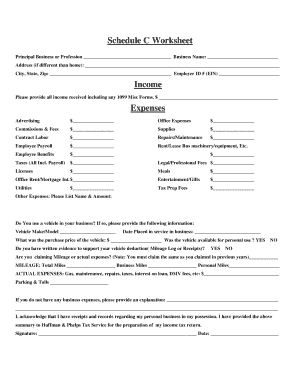

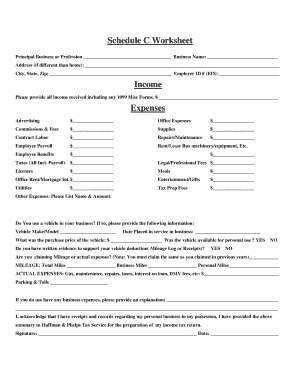

Printable Schedule C Worksheet

Printable Schedule C Worksheet

Printable Schedule C Worksheet

https://www.signnow.com/preview/238/593/238593343.png

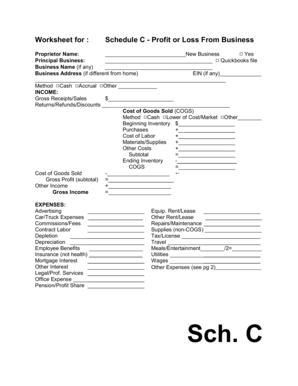

If you are the sole owner of a business or operate as an independent contractor you will need to file a Schedule C to report income or loss from your

Templates are pre-designed files or files that can be utilized for different purposes. They can conserve effort and time by supplying a ready-made format and design for developing different type of content. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Printable Schedule C Worksheet

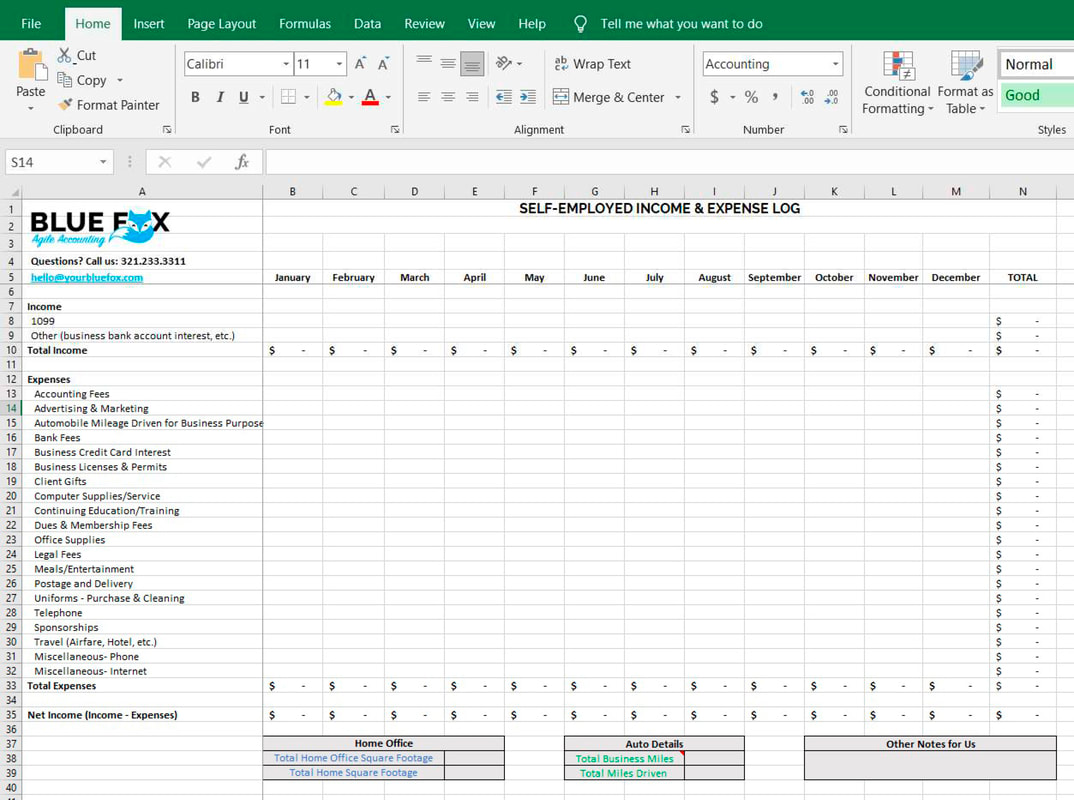

Free Download: Schedule C Excel Worksheet for Sole-Proprietors - BLUE FOX | Accounting for Nonprofits and Social Enterprises

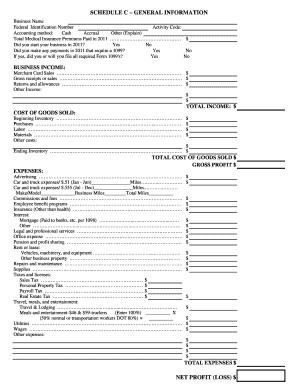

2011 Schedule C - Fill and Sign Printable Template Online

Schedule C Form 1040: Profit or Loss from Business for Sole Proprietorship | DocHub

Schedule C Worksheet - Fill and Sign Printable Template Online

Schedule C Expenses Spreadsheet | Business expense tracker, Spreadsheet template, Small business expenses

Schedule C Excel Template Awesome Schedule C Expenses Template Along with Elegant Business | Business expense, Small business expenses, Spreadsheet business

https://www.kristels.com/docs/Kristels-ScheduleC.pdf

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors Did you make payments requiring a Form 1099 Yes No If YES did you

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor

https://1040-schedule-c.pdffiller.com/

Easily complete a printable IRS 1040 Schedule C Form 2022 online Get ready for this year s Tax Season quickly and safely with pdfFiller

https://www.essent.us/sites/default/files/2023-01/2023-sole-proprietor-schedule-c-worksheet-v01.2023.pdf

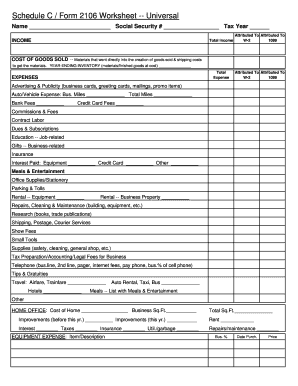

2023 ANALYSIS OF SCHEDULE C INCOME SCHEDULE ANALYSIS METHOD If claimed Business Miles can be found on either Line 44a of the Schedule C or on Line 30 of

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

If using bonus depreciation do not use Form 4562 Use Schedule C 2 on Side 2 of this schedule The maximum deduction PA income tax law permits under IRC Find the 2023 federal tax forms you need Official IRS income tax forms are printable Schedule B Schedule C Profit or Loss from Business Schedule D

If you re self employed and set up your business as a sole proprietorship you should file Schedule C with your Form 1040 to report the profit or loss for your