Publication 575 Worksheet A Simplified Method The document explains the tax treatment of distributions from pensions and annuities and describes how to report the income on your federal income tax return

If Form 1099 R does not show the taxable amount in Box 2a you may need to use the General Rule explained in Publication 575 and Publication Publication 575 Pension and Annuity Income describes the Simplified Method and includes the worksheet at the end of the publication Publication 575 to

Publication 575 Worksheet A Simplified Method

Publication 575 Worksheet A Simplified Method

x-raw-image:///8ca1ec91a26b7b2800328ed8bcc88b496868524cc66bd51b4940da69ac579195

Webpublication 575 worksheet a simplified method publication 575 pdf marriage allowance form pdf irs publication 575 for 2022 transferring tax allowance to

Templates are pre-designed documents or files that can be utilized for various functions. They can save time and effort by providing a ready-made format and layout for developing various sort of material. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Publication 575 Worksheet A Simplified Method

Publication 575 (2022), Pension and Annuity Income | Internal Revenue Service

Publication 575: Pension and Annuity Income; Publications

ACC180 - Simplified Method Worksheet- Winston.pdf - Simplified Method Worksheet 1 Before you begin: If you are the beneficiary of a deceased employee or former | Course Hero

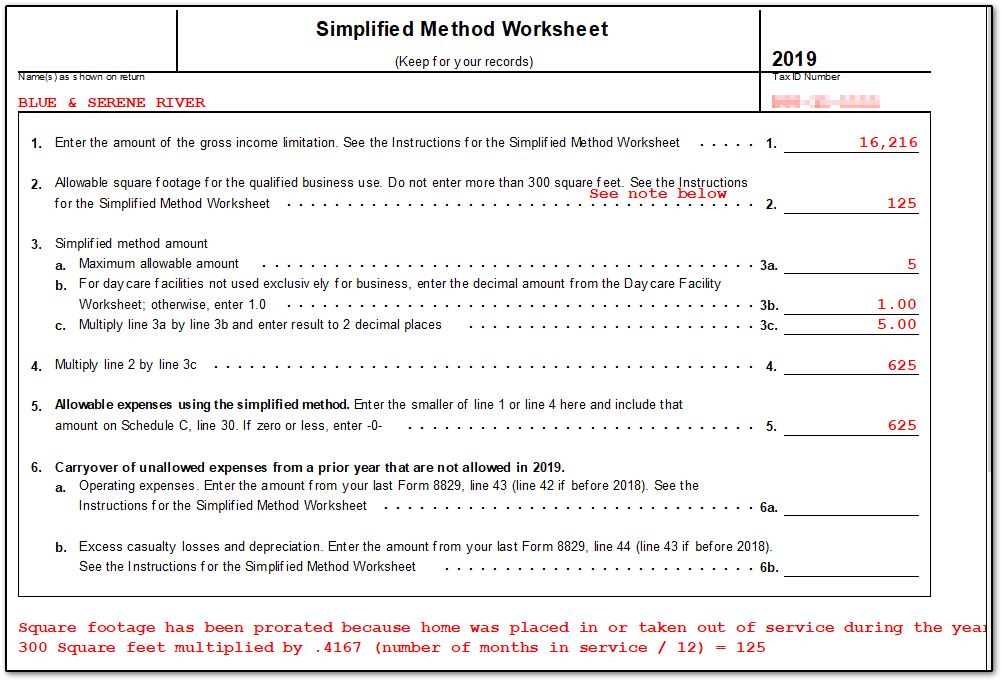

8829 - Simplified Method (ScheduleC, ScheduleF)

Retirement plans, pensions, and annuities |

Simplified method worksheet: Fill out & sign online | DocHub

https://www.irs.gov/publications/p575

However this publication 575 covers the tax treatment of the non social security equivalent benefit portion of tier 1 railroad retirement benefits tier 2

https://www.freetaxusa.com/taxes2019/formdownload?form=f_simplified_pension_wksht.pdf

Simplified Method Worksheet A Keep for Your Records 1 Enter the total pension or annuity payments received this year Also add this amount to the total

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

See Publication 575 for the definition of guaranteed payment You must use the Simplified Method if your annuity starting date was after November 18 1996

https://www.taxact.com/support/1368/2022/simplified-method-for-pensions-and-annuities

See IRS Publication 575 Pension and Annuity Income for the definition of guaranteed payments The Simplified Method Worksheet helps you figure the taxable

https://www.investopedia.com/terms/i/irs-pub-575.asp

IRS Publication 575 explains how to treat pensions and annuities according to the IRS This publication covers distributions from pensions and annuities and

For more information see Lump Sum Distributions and Tax on Early Distributions in Pub 575 Worksheet A Simplified Method for Bill Smith See the instructions simplified method it s based on the age you started receiving the annuity It s figured from this table and the worksheet in Pub 575 Use Table 1 for

Simplified Method Safe Harbor Calculation This letter provides a summary of the information found in IRS Publication 575 Pension and Annuity Income