Qualified Business Income Deduction Worksheet This video shows how to prepare the Qualified Business Income Deduction or QBID Section 199A worksheets in a 1040 return using interview

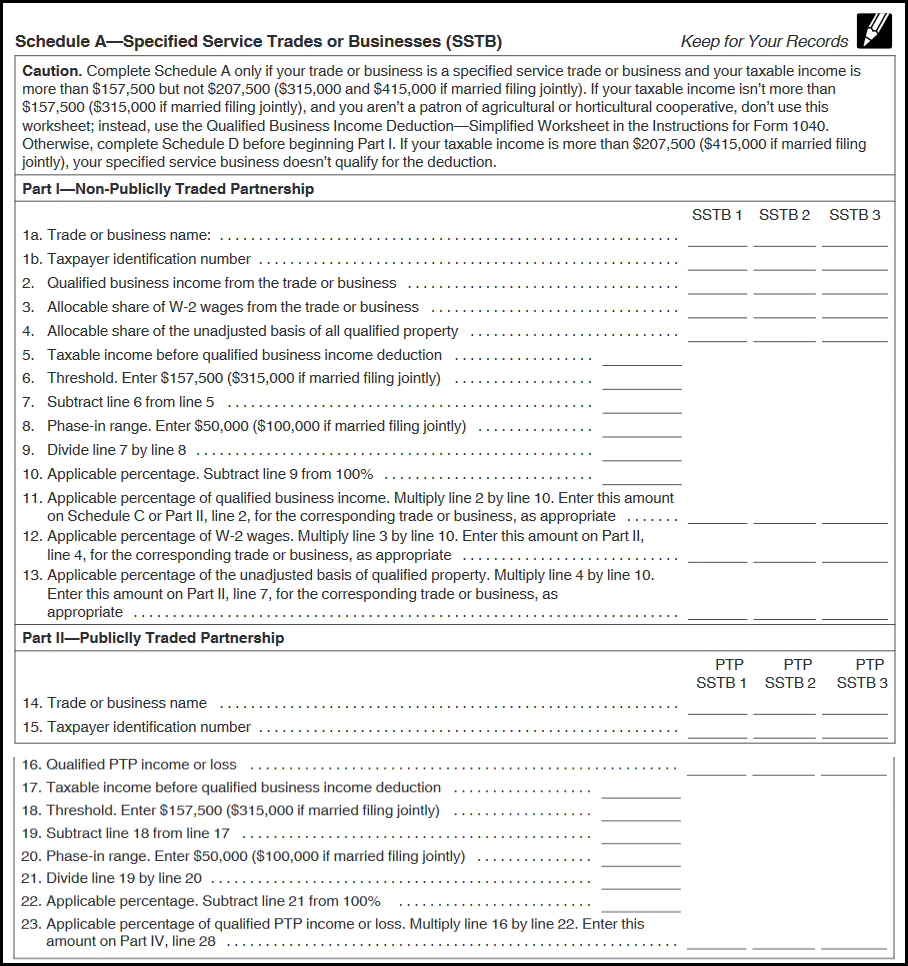

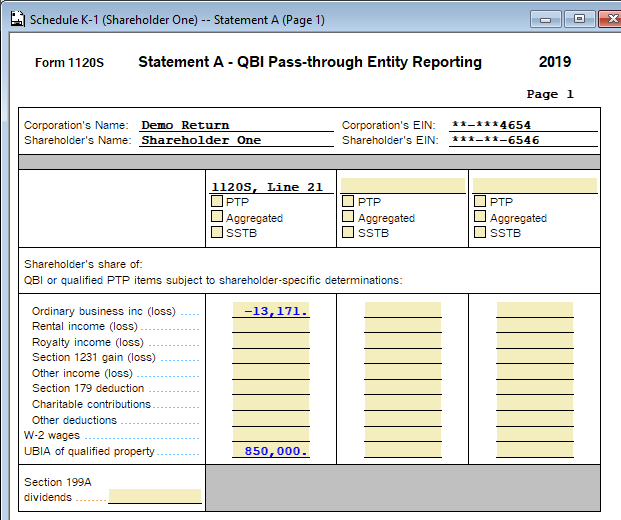

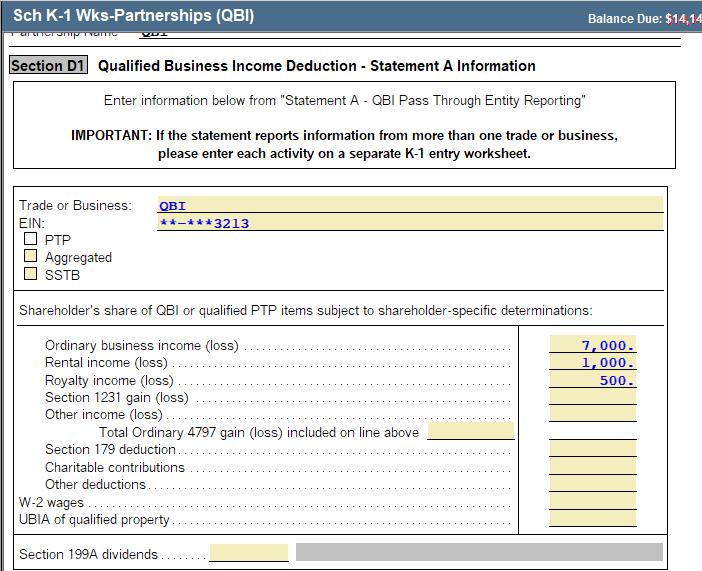

This worksheet lists each activity s qualified business income Section 1231 gain loss Section 179 deduction W 2 Wages other income and deductions and 1040 Deductions 8995 8995 A Qualified Business Income Section 199A 1 General 2 Total Overrides and Other Information

Qualified Business Income Deduction Worksheet

Qualified Business Income Deduction Worksheet

Qualified Business Income Deduction Worksheet

https://i.ytimg.com/vi/l7ePFEMNpGc/maxresdefault.jpg

Qualified Business Income Deduction to figure your QBI deduction Qualified Business Income Deduction to figure your QBI deduction IRS

Pre-crafted templates offer a time-saving service for developing a diverse range of files and files. These pre-designed formats and layouts can be made use of for numerous individual and professional projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content production procedure.

Qualified Business Income Deduction Worksheet

Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018

How to Claim The Qualifying Business Income (QBI) Deduction - Tax Professionals Member Article By Jim McClaflin, EA, NTPI Fellow, CTRC

Section 199A Deduction (QBI) and Retirement Accounts | White Coat Investor

Qualified business income deduction simplified worksheet instructions

How to enter and calculate the qualified business income deduction, section 199A, in ProSeries

How to use the new Qualified Business Income Deduction Worksheet for 2018 - YouTube

https://www.irs.gov/pub/irs-pdf/f8995a.pdf

Complete Schedules A B and or C Form 8995 A as applicable before starting Part I Attach additional worksheets when needed See instructions 1 a Trade

https://www.castroandco.com/documents/Comprehensive_QBI_Worksheet.pdf

Part II Determine Your Qualified Business Income Component A B C 2 Qualified business income from the trade business or aggregation see

https://proconnect.intuit.com/support/en-us/help-article/business-tax-credits-deductions/enter-calculate-qualified-business-income-section/L4QuiQECJ_US_en_US

There are two ways to calculate the QBI deduction Using the simplified worksheet or the complex worksheet

https://support.taxslayerpro.com/hc/en-us/articles/360021251353-Qualified-Business-Income-Deduction-Overview

income known as the Qualified Business Income Deduction QBID also called the Section 199A Deduction In 2018 QBID was calculated on

https://turbotax.intuit.com/tax-tips/irs-tax-forms/what-is-form-8995/L7dqp7NMg

The Qualified Business Income Deduction also know as the Section 199A deduction allows owners of pass through businesses to deduct up to

IA 8995C Composite Return Qualified Business Income Deduction Worksheet 41 166 Breadcrumb Home Forms Form IA8995C 41166 pdf Tax Type Individual Income What happens to the QBI deduction for a qualified business when qualified business income is between the thresholds worksheet lines 9 10 11 as

The worksheet provides a reasonable method to track and compute previously disallowed losses or deductions to be included in qualified business income deduction