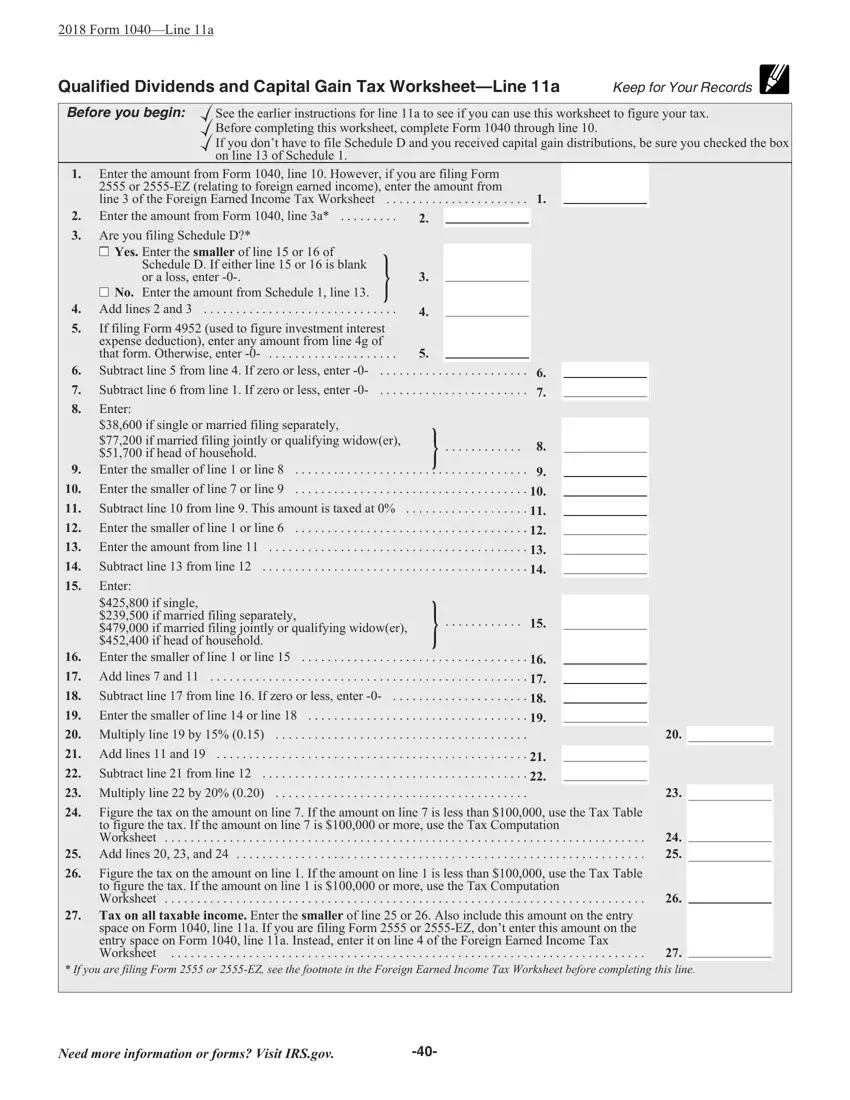

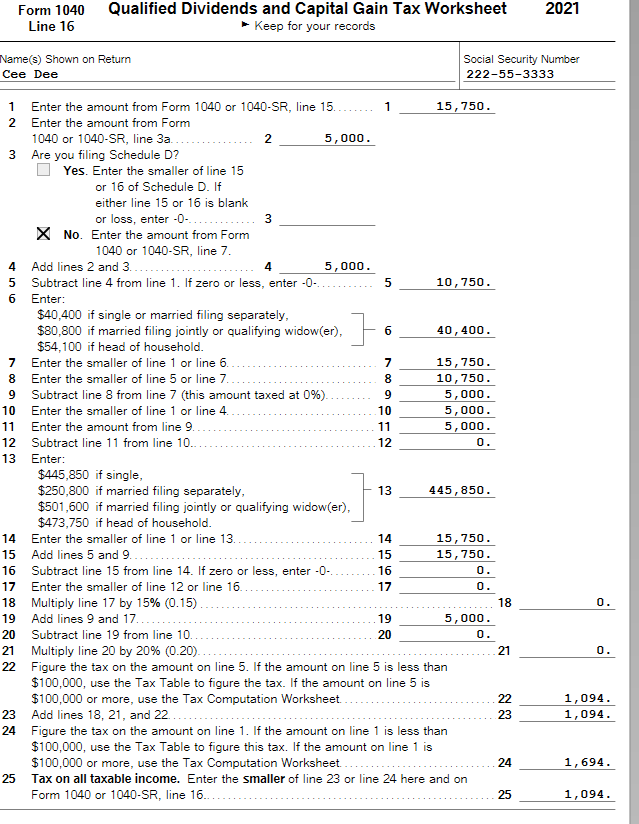

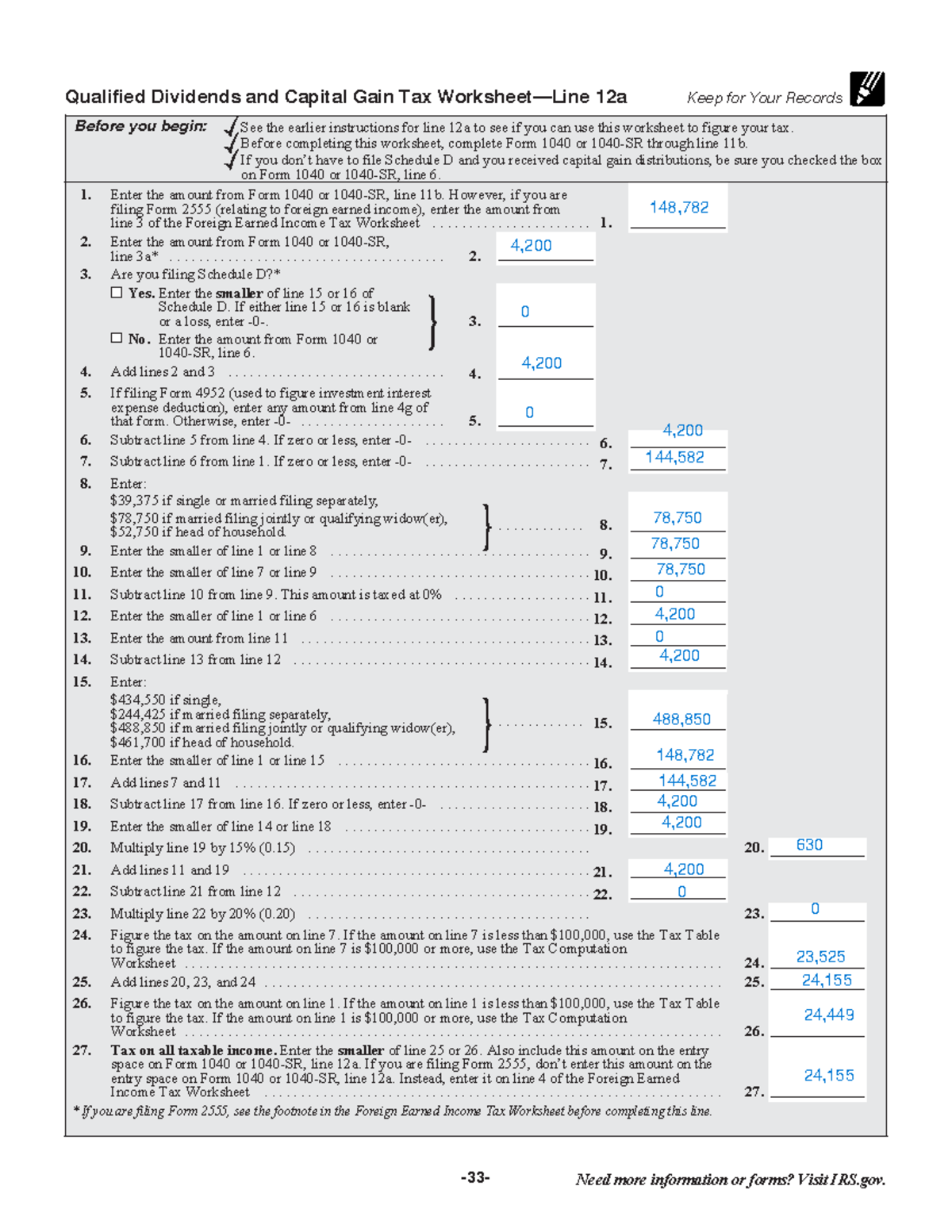

Qualified Dividend And Capital Gain Worksheet 2022 Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the

The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete

Qualified Dividend And Capital Gain Worksheet 2022

Qualified Dividend And Capital Gain Worksheet 2022

Qualified Dividend And Capital Gain Worksheet 2022

https://www.pdffiller.com/preview/391/725/391725062/large.png

Use the qualified dividends and capital gain tax worksheet 2022 pdf 2015 template to simplify high volume document management Get Form Show details

Pre-crafted templates use a time-saving solution for creating a varied range of files and files. These pre-designed formats and designs can be utilized for various individual and expert projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the content creation process.

Qualified Dividend And Capital Gain Worksheet 2022

Qualified Dividends And Capital Gain Tax Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

IN C++ Please Create a Function to Certify the | Chegg.com

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

Qualified dividends and capital gain tax worksheet | Chegg.com

Easy Calculator for 2022 Qualified Dividends and Capital Gain - Etsy Hong Kong

Irs 1040 qualified dividends and capital gain tax worksheet

https://www.irs.gov/pub/irs-dft/i1040sd--dft.pdf

Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Qualified_Dividends_and_Capital_Gains_Tax_Worksheet_line_16_fillable.pdf

Enter 8 41 675 if single or married filing separately 83 350 if married filing jointly or Qualifying surviving spouse 6 55 800 if

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.taxact.com/support/1111/2022/qualified-dividends-and-capital-gain-tax

If the tax was calculated on either of these worksheets you should see Tax computed on Qualified Dividend Capital Gain WS as one of the items listed Go to

https://www.youtube.com/watch?v=gqRKwn4ef74

The tax rate computed on your Form 1040 must consider any tax favored items such as

Deductions Worksheet Itemized Deductions Medical and dental expenses Enter capital gains and qualified dividends For this purpose taxable income is worksheet is Single head of household or qualifying surviving spouse and you have Married filing jointly and you have 0 1 2 3 0 1

The worksheet is for taxpayers who solely have dividend income or whose only capital gains are capital gain distributions from mutual funds