Qualified Dividends And Capital Gain Tax Worksheet Line 16 2020 There isn t much you should do to change the 2020 qualified dividends and capital gain tax worksheet document just adopt these measures in the next order

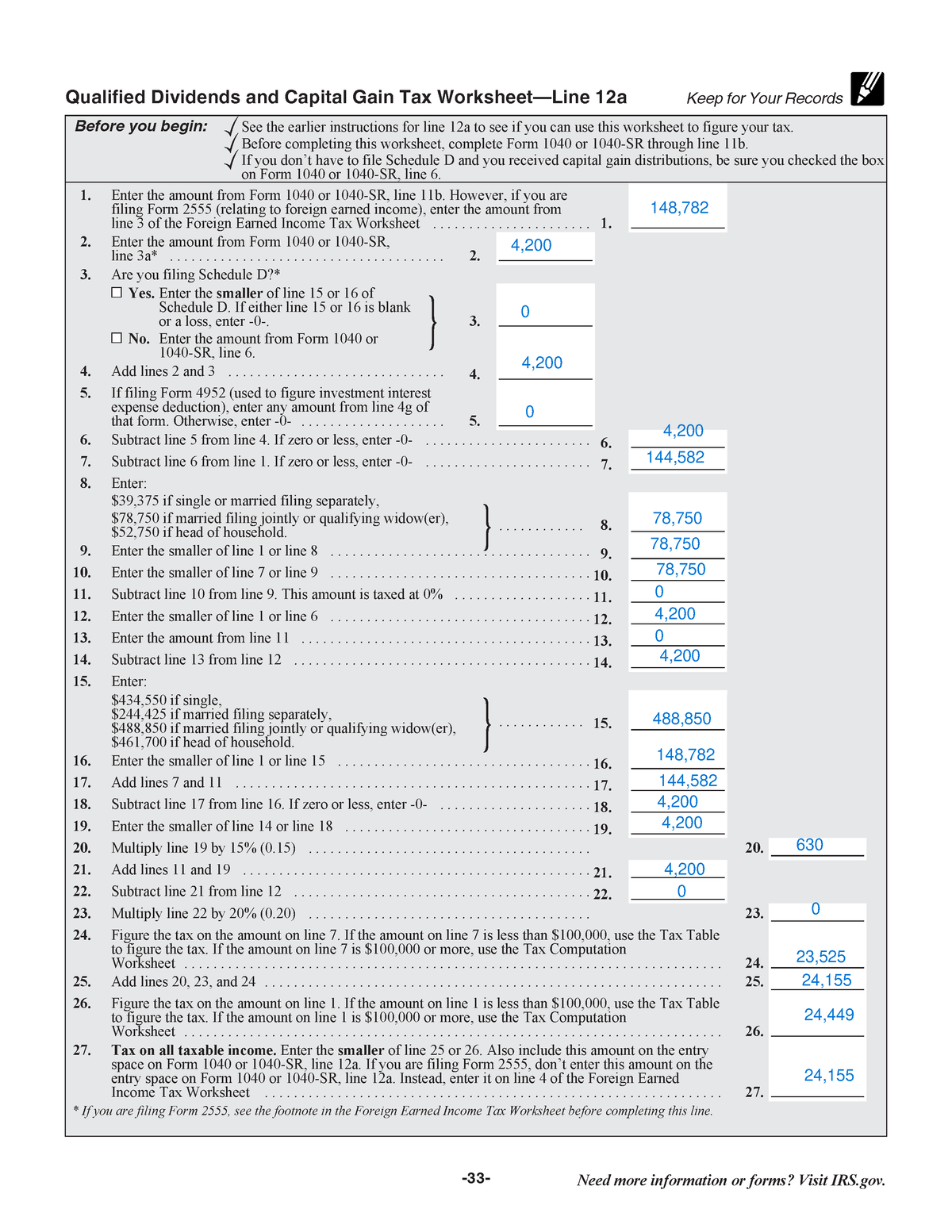

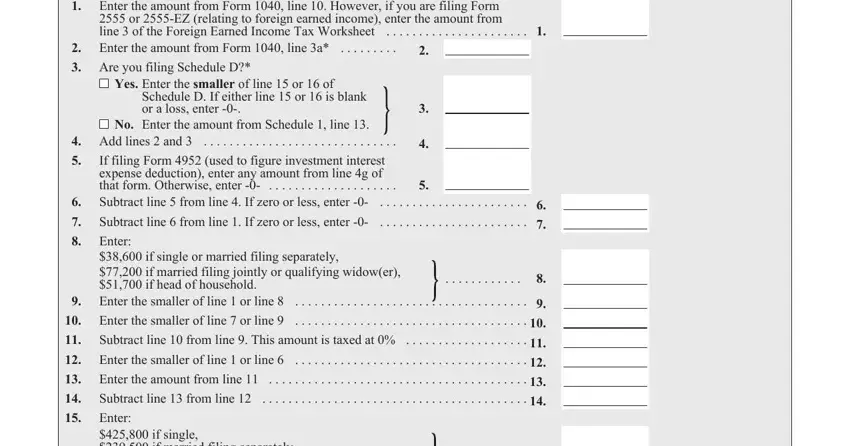

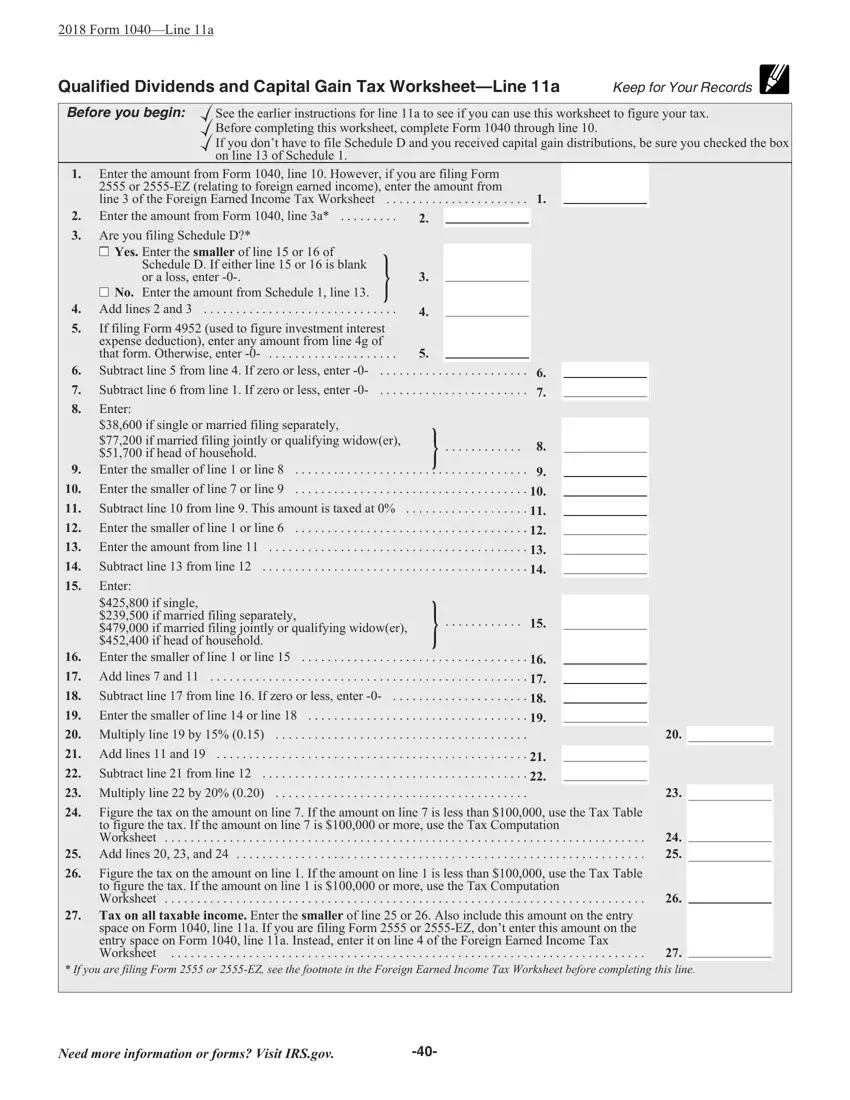

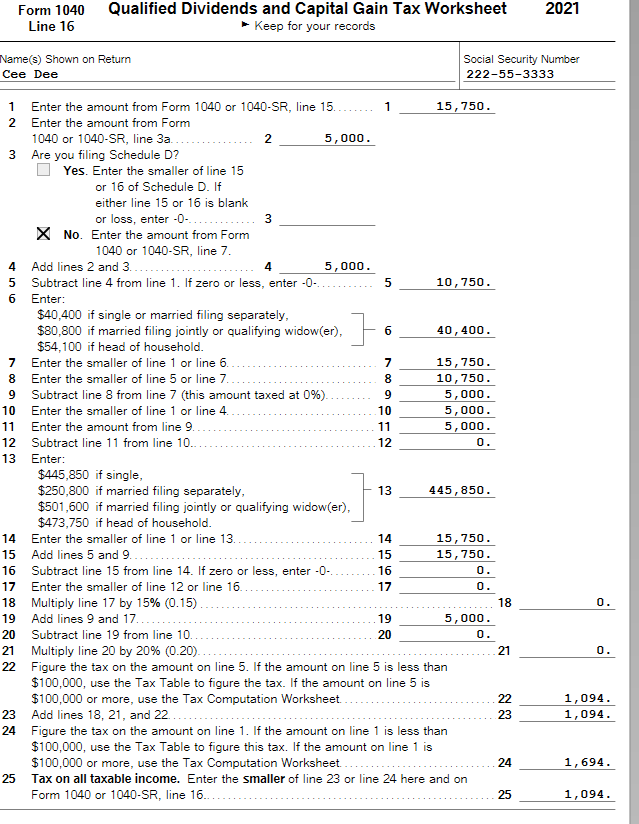

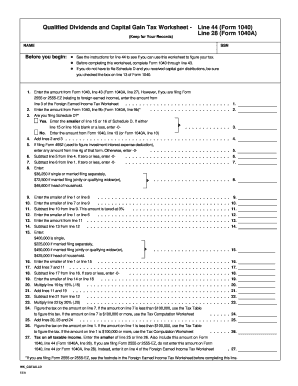

According to the IRS Form 1040 instructions for line 16 Schedule D Tax Worksheet If you have to file Schedule D and line 18 or 19 of Schedule D is more Qualified Dividends And Capital Gain Tax WebQualified Dividends and Capital Gain Tax Worksheet Line 16 1 Enter the amount from Form 1040 or 1040 SR line

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2020

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2020

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2020

https://www.pdffiller.com/preview/391/725/391725062.png

Qualified dividends and capital gain tax worksheet irs capital gains worksheet 2021 qualified dividends and capital gain tax worksheet line 16 2020 qualified

Pre-crafted templates provide a time-saving solution for developing a diverse series of documents and files. These pre-designed formats and designs can be made use of for numerous personal and expert jobs, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, streamlining the content development process.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2020

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet – Marotta On Money

SOLUTION: Acc 330 qualified dividends and capital gain tax worksheet alexa thomas - Studypool

Qualified Dividends And Capital Gain Tax Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Qualified Dividends and Capital Gains Worksheet - Page 33 of 108 Fileid: - Studocu

Qualified Dividends Tax Worksheet PDF Form - FormsPal

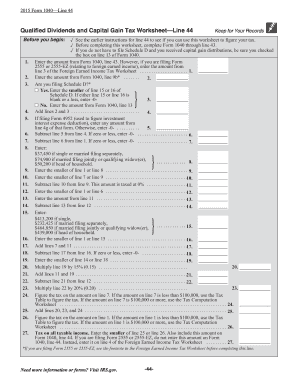

Completed Qualified Dividends and Capital Gain Worksheet.pdf - 2017 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for | Course Hero

https://apps.irs.gov/app/vita/content/globalmedia/capital_gain_tax_worksheet_1040i.pdf

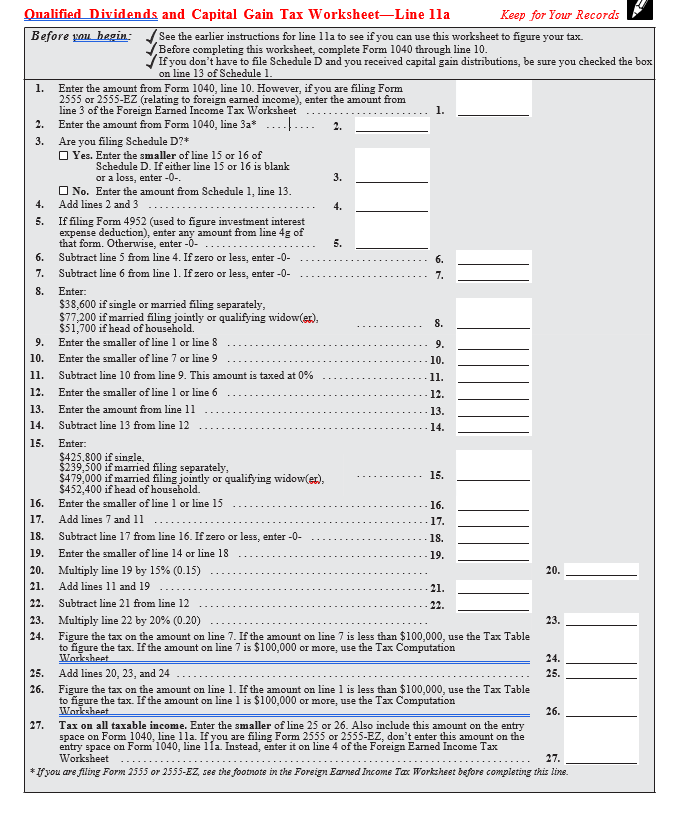

Qualified Dividends and Capital Gain Tax Worksheet Line 11a Keep for Your Records See the Subtract line 17 from line 16 If zero or less enter 0

https://www.irs.gov/pub/irs-prior/f1040sd--2020.pdf

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040 SR line 16 Don t complete lines 21 and 22 below

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.whitehouse.gov/wp-content/uploads/2022/04/2022-04-15-VPOTUS-Redacted-2021-Federal-and-State-Returns.pdf

2021 estimated tax payments and amount applied from 2020 return 27a Qualified Dividends and Capital Gain Tax Worksheet Line 16 Name s

https://qualified-dividends-tax-worksheet.pdffiller.com/

The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate

When you have qualified dividends or capital gains you do not use the tax table Instead you will need to use the Capital Gains Worksheet to figure your tax qualified dividends and capital gain tax worksheet 2020 see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute

The tax computation for Line 16 of Form 1040 can be calculated in one of four ways Qualified Dividend and Capital Gain Tax Worksheet To see this select