Qualified Dividends And Capital Gain Tax Worksheet 2023 Capital Gains and Qualified Dividend Rates Taxable Income Threshold 0 Married Filing Jointly and Surviving Spouse 0 to 89 250 Head of Household

The tax rate computed on your Form 1040 must consider any tax favored items such as A qualified dividend will be one that falls under capital gains tax rates and is then taxed at a lower rate than income taxes rates for those

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet

https://www.pdffiller.com/preview/391/725/391725062/large.png

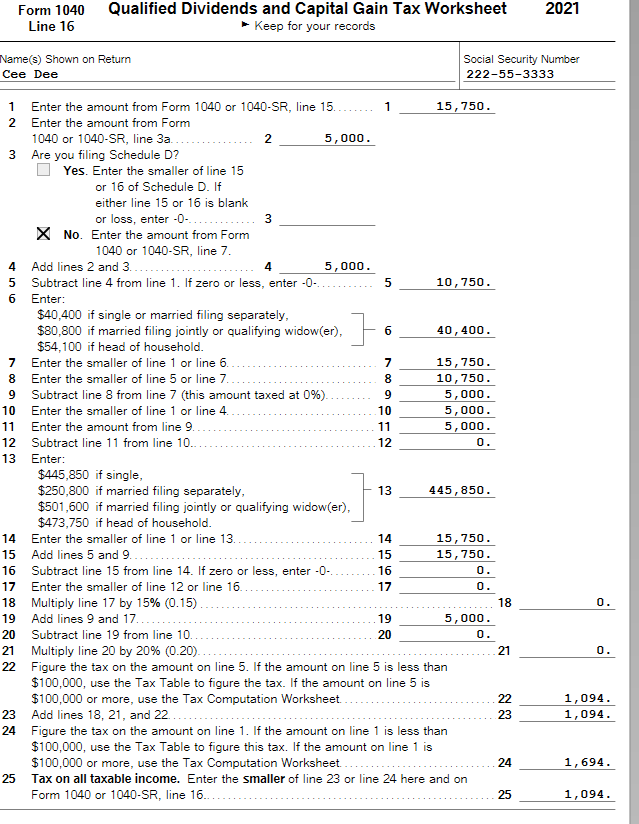

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 No Complete the rest of Form 1040 1040 SR or

Templates are pre-designed documents or files that can be used for various functions. They can save effort and time by providing a ready-made format and layout for developing different type of content. Templates can be used for individual or expert tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends Form - Fill Out and Sign Printable PDF Template | signNow

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign Printable Template Online

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

Qualified dividends and capital gain tax worksheet | Chegg.com

SOLUTION: Acc 330 qualified dividends and capital gain tax worksheet alexa thomas - Studypool

IN C++ Please Create a Function to Certify the | Chegg.com

https://www.irs.gov/pub/irs-news/fs-04-11.pdf

The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Qualified_Dividends_and_Capital_Gains_Tax_Worksheet_line_16_fillable.pdf

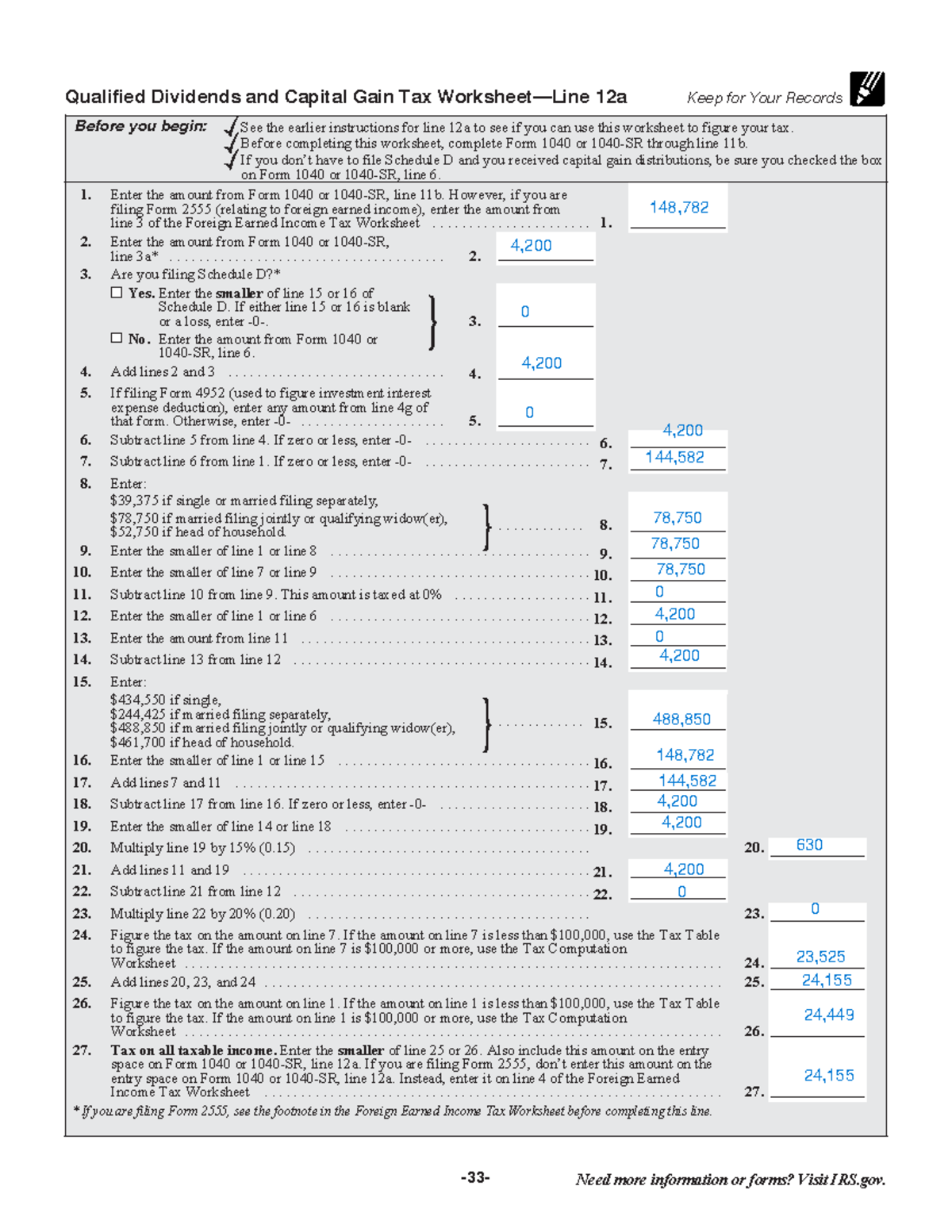

Enter the amount from Form 1040 or 1040 SR line 15 However if you are filing 1 Form 2555 relating to foreign earned income enter the amount from

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.taxact.com/support/1112/2022/schedule-d-viewing-tax-worksheet

Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet

https://www.marottaonmoney.com/how-your-tax-is-calculated-qualified-dividends-and-capital-gains-worksheet/

Lines 1 5 of this worksheet calculate your total qualified income line 4 and your total ordinary income line 5 so they can be taxed at

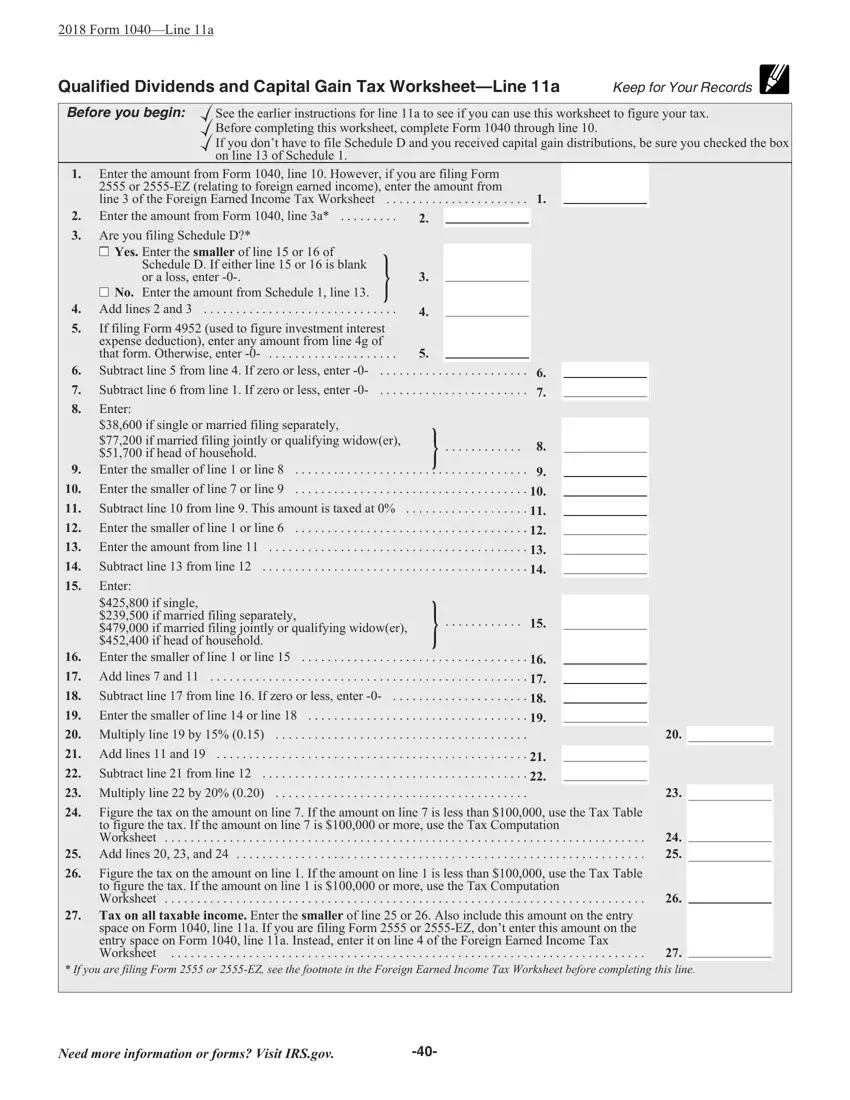

Qualified dividends and capital gain tax 12a keep for your records before you begin 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Qualified Dividends and Capital Gain Tax Worksheet Line 11aSee the earlier instructions for line 11a to see if you can use this worksheet to figure your tax

This flowchart is designed to quickly determine the tax on capital gains and dividends based on the taxpayer s taxable income It is for a