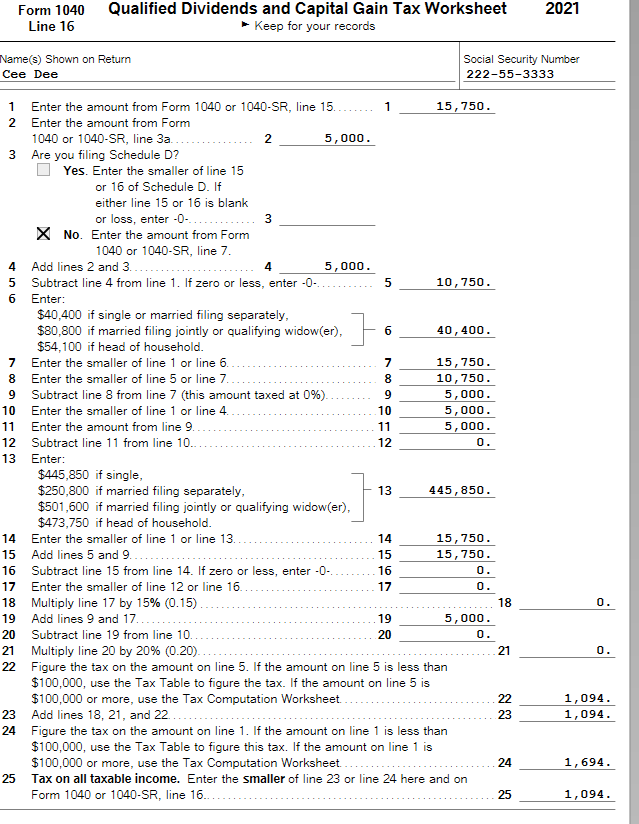

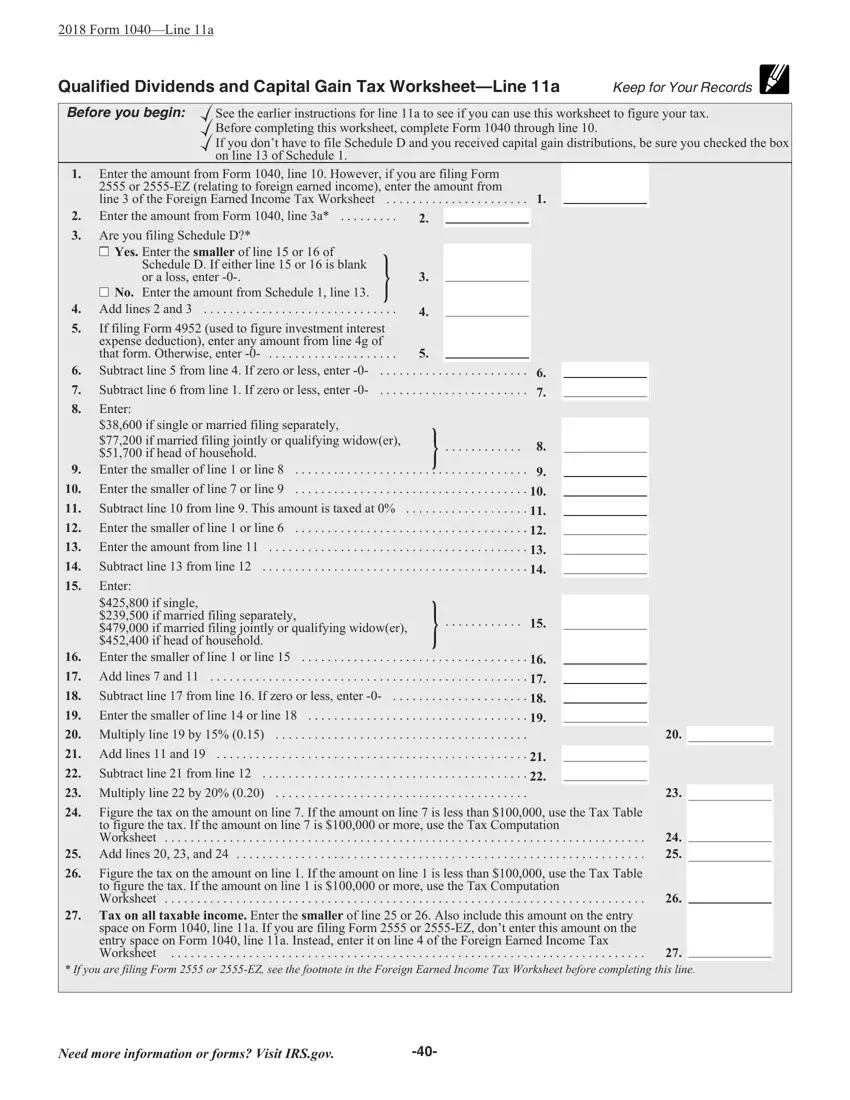

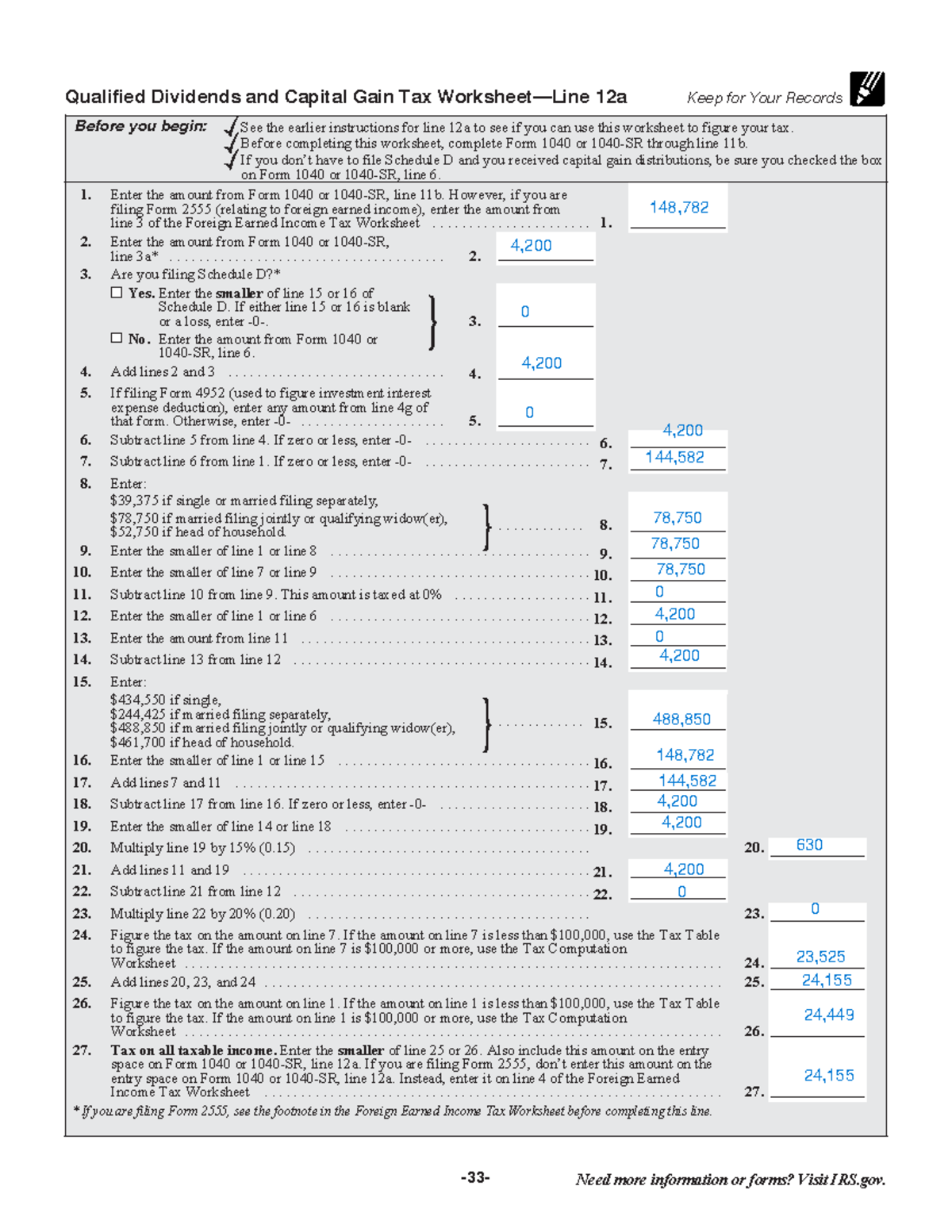

Qualified Dividends And Capital Gain Worksheet Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the

Qualified Dividends and Capital Gain Tax 1 Information reported to you on Form Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet To Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 No Complete the rest of Form 1040 1040 SR or 1040

Qualified Dividends And Capital Gain Worksheet

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/c465f676-3fbb-4148-9468-8268d83ab82c.default.PNG

The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by offering a ready-made format and design for creating different type of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Qualified Dividends And Capital Gain Worksheet

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

Qualified dividends and capital gain tax worksheet | Chegg.com

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

2015-2023 Form IRS Instruction 1040 Line 44Fill Online, Printable, Fillable, Blank - pdfFiller

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet.pdf - 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line | Course Hero

Completed Qualified Dividends and Capital Gain Worksheet.pdf - 2017 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for | Course Hero

https://www.irs.gov/pub/irs-news/fs-04-11.pdf

The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Qualified_Dividends_and_Capital_Gains_Tax_Worksheet_line_16_fillable.pdf

Enter the amount from Form 1040 or 1040 SR line 15 However if you are filing 1 Form 2555 relating to foreign earned income enter the amount from

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.youtube.com/watch?v=gqRKwn4ef74

The tax rate computed on your Form 1040 must consider any tax favored items such as

https://www.marottaonmoney.com/how-your-tax-is-calculated-qualified-dividends-and-capital-gains-worksheet/

Lines 1 5 of this worksheet calculate your total qualified income line 4 and your total ordinary income line 5 so they can be taxed at

It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations Form 1040 Instructions 2013 Edit sign and share qualified dividends and capital gain tax worksheet 2019 online No need to install software just go to DocHub and sign up instantly

But if you are filing Form 2555 you must use the Foreign Earned Income Tax Worksheet instead Say Thanks by clicking the thumb icon in a