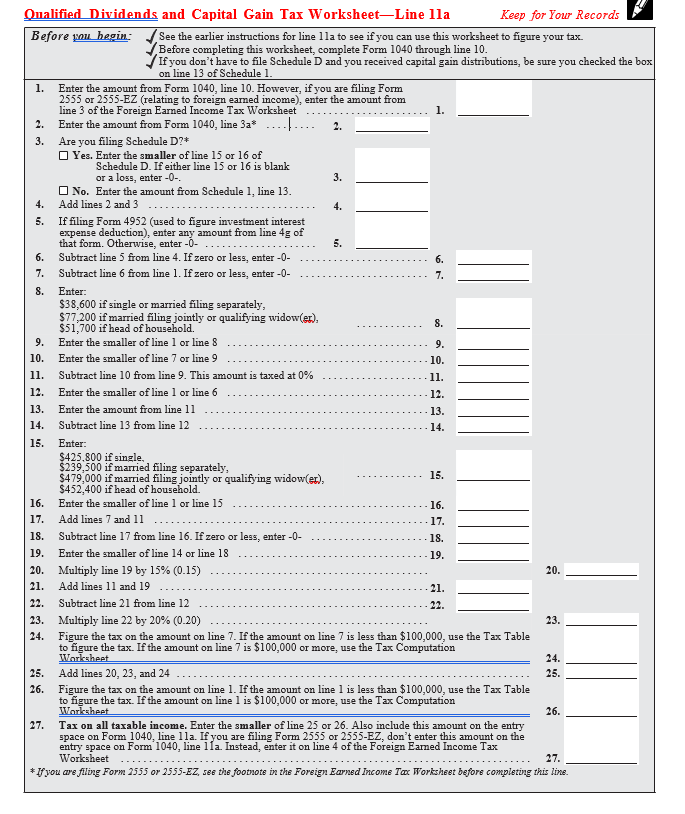

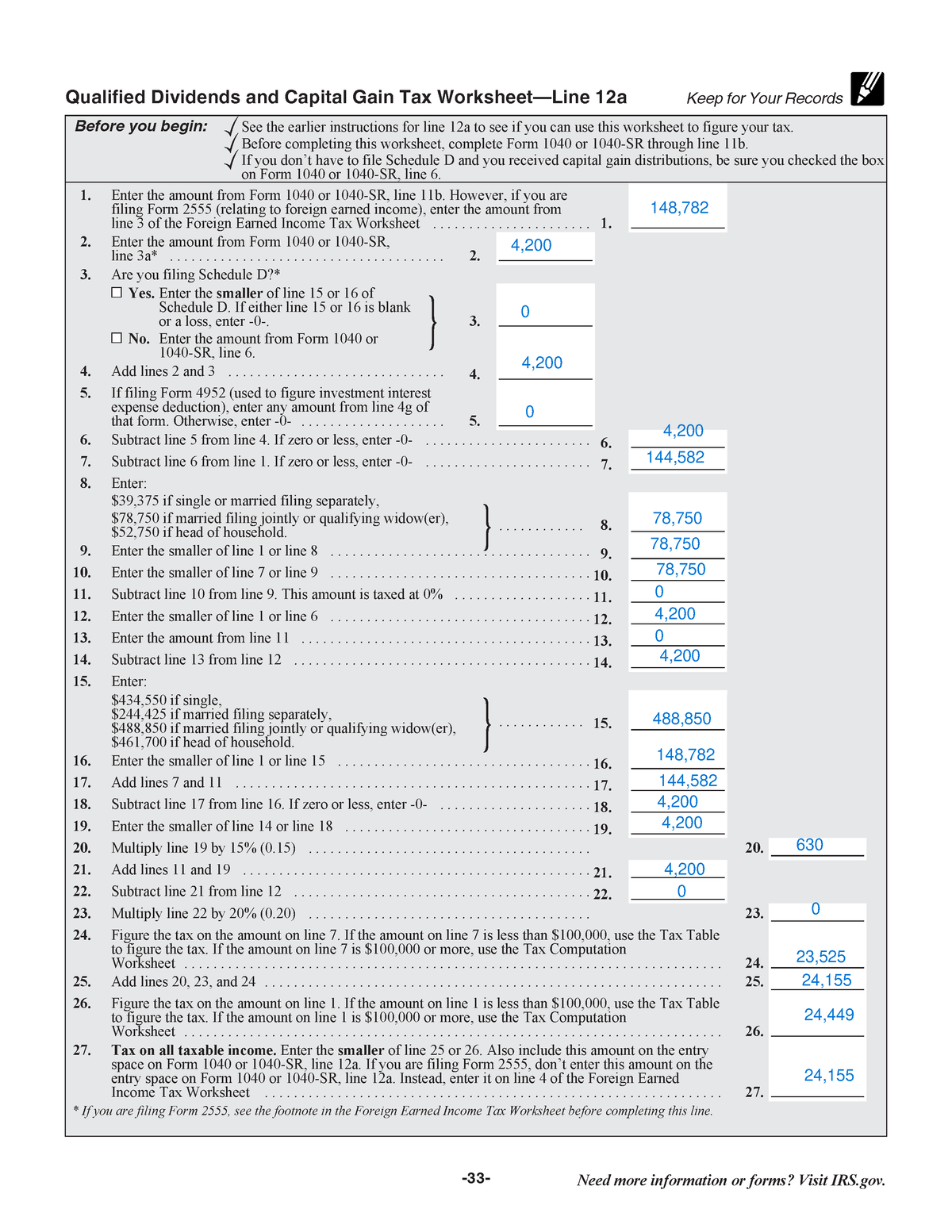

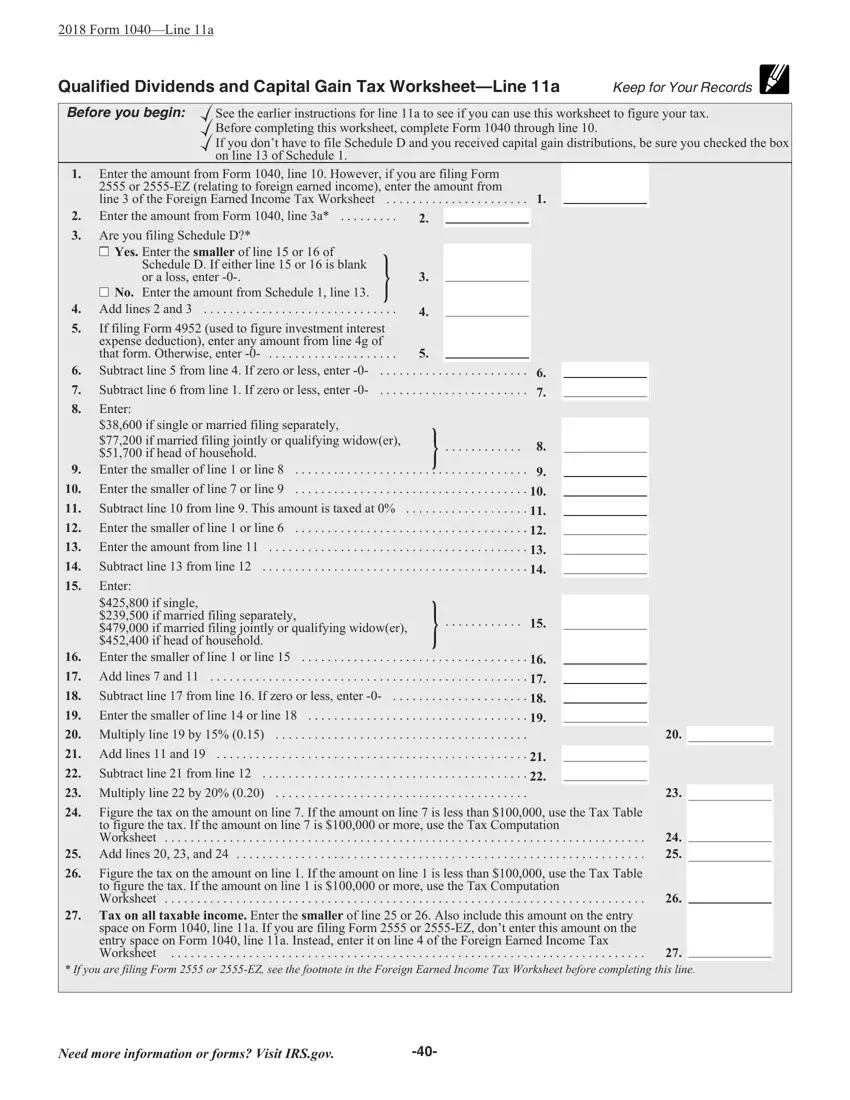

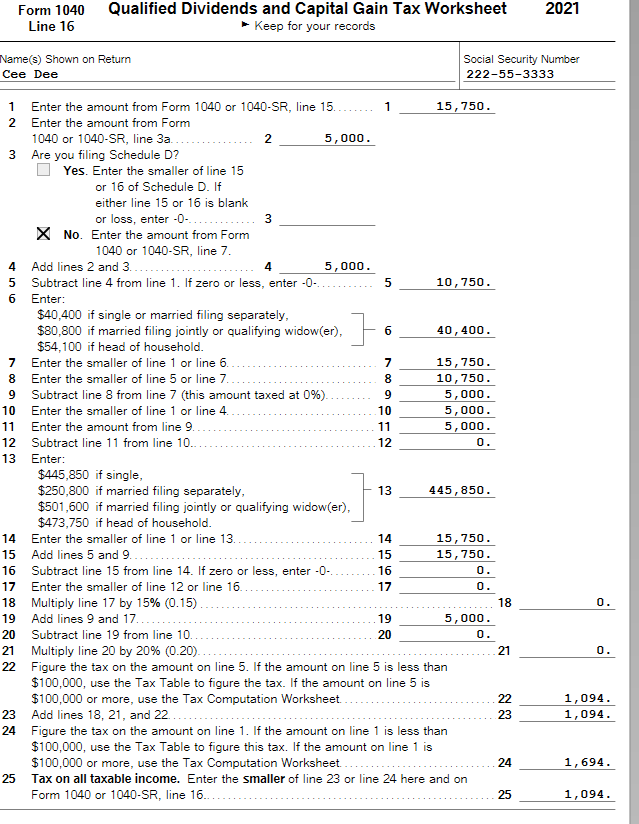

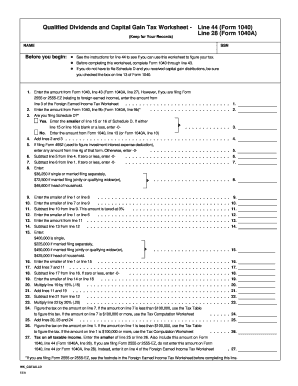

Qualified Dividends And Capital Gains Worksheet Line 16 The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate

Instead 1040 Line 16 Tax asks you to see instructions In those instructions there is a 25 line worksheet called the Qualified Dividends Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040 SR line 16 Don t complete lines 21

Qualified Dividends And Capital Gains Worksheet Line 16

Qualified Dividends And Capital Gains Worksheet Line 16

Qualified Dividends And Capital Gains Worksheet Line 16

http://www.marottaonmoney.com/wp-content/uploads/2017/05/line44.jpg

The Qualified Dividends Tax Worksheet is a tax form used to calculate the 15 excise tax on qualified dividends paid by regular C corporations If you wish to

Templates are pre-designed documents or files that can be utilized for various functions. They can save time and effort by providing a ready-made format and layout for creating various sort of material. Templates can be used for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Qualified Dividends And Capital Gains Worksheet Line 16

IN C++ PLEASW Create a Function for Calculating the | Chegg.com

Qualified Dividends and Capital Gains Worksheet - Page 33 of 108 Fileid: - Studocu

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

SOLUTION: Acc 330 qualified dividends and capital gain tax worksheet alexa thomas - Studypool

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet.pdf - 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line | Course Hero

Create a Function for calculating the Tax Due for | Chegg.com

https://www.irs.gov/pub/irs-prior/i1040sd--2022.pdf

Enter on Schedule D line 13 the to tal capital gain distributions paid to you during the year regardless of how long you held your investment This amount

https://apps.irs.gov/app/vita/content/globalmedia/capital_gain_tax_worksheet_1040i.pdf

Qualified Dividends and Capital Gain Tax Worksheet Line 11a Keep for Your Records See the Subtract line 17 from line 16 If zero or less enter 0

https://support.cch.com/kb/solution.aspx/000059538

According to the IRS Form 1040 instructions for line 16 Schedule D Tax Worksheet If you have to file Schedule D and line 18 or 19 of Schedule D is more

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

Qualified Dividends and Capital Gain Tax Worksheet line 16 This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits

https://support.taxslayer.com/hc/en-us/articles/360015899391-Why-doesn-t-the-tax-on-my-return-line-16-match-the-Tax-Table-

When you have qualified dividends or capital gains you do not use the tax table Instead you will need to use the Capital Gains Worksheet to figure your tax

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Within the pages of Qualified Dividends And Capital Gains Worksheet Line 16 an enthralling opus penned by a very acclaimed wordsmith readers attempt an

Qualified Dividends and Capital Gain Tax Worksheet Line 16 Is Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2019 How To Calculate Capital