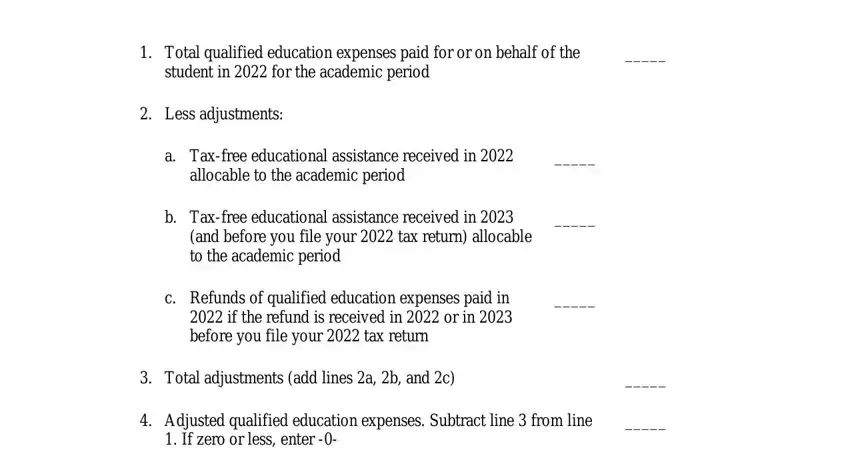

Qualified Education Expenses Worksheet Please complete one worksheet for each student There are 3 education credits the American Opportunity Credit the Lifetime Learning Credit and the Tuition

2020 Education Expense Worksheet Keep for Your Records Student name Education Qualified expenses after tax free education benefits line 21 less line 23 Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American

Qualified Education Expenses Worksheet

Qualified Education Expenses Worksheet

x-raw-image:///75db943beaa68abfe752bd0acc36f1bc2d204749c7b6d7ddc64b4faef10cc07e

Cannot be used for living expenses Qualified Expenses Available for Credit 0 Total qualified expenses that exceed grants and scholarship 23 24

Pre-crafted templates provide a time-saving solution for developing a diverse series of documents and files. These pre-designed formats and layouts can be made use of for various personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material production procedure.

Qualified Education Expenses Worksheet

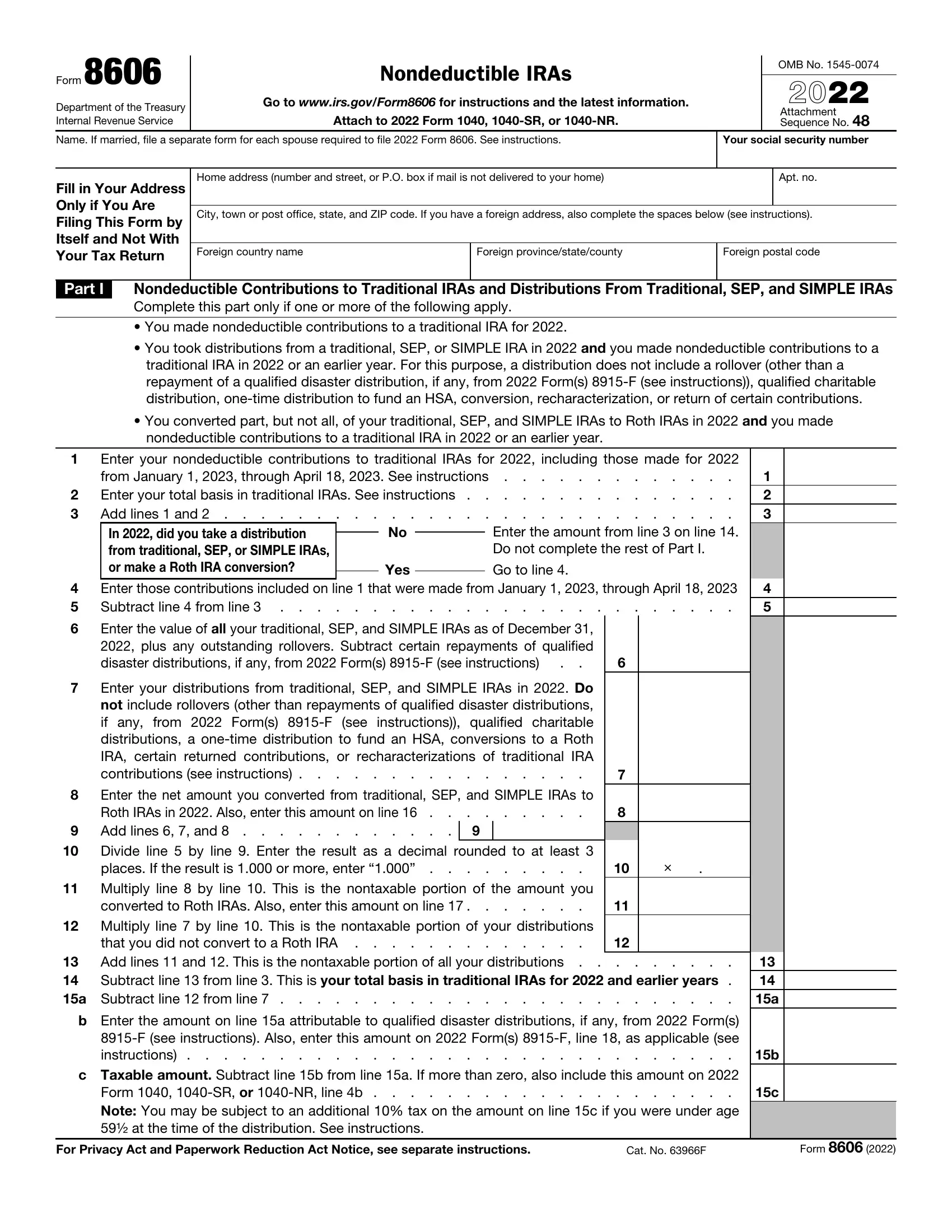

Credit Limit Worksheet A - Fill Online, Printable, Fillable, Blank | pdfFiller

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

1040 - American Opportunity and Lifetime Learning Credits (1098T)

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

Credit Limit Worksheet A - Fill Online, Printable, Fillable, Blank | pdfFiller

Solved: Adjusted Qualified Education Expenses

https://www.irs.gov/instructions/i8863

Use the Adjusted Qualified Education Expenses Worksheet next to figure each student s adjusted qualified education expenses Enter the total

https://www.taxesforexpats.com/articles/expat-tax-rules/qualified-education-expenses-same-same-but-different.html

Qualified higher education expenses include tuition and fees required for enrollment or attendance as well as books supplies and equipment

https://support.taxslayer.com/hc/en-us/articles/360015701672-How-do-I-calculate-the-amount-of-qualified-education-expenses-

In order to calculate the qualified expenses that you can claim Form 1098 T from your school is needed According to the IRS you must reduce any amount of

https://ttlc.intuit.com/community/taxes/discussion/adjusted-qualified-education-expenses/00/2006189

Are the Adjusted Qualified Education Expenses calculated by adding the total tuition and required books course material minus grants

https://portal.clientwhys.com/sites/2864andr/educationexpenseworksheet.pdf

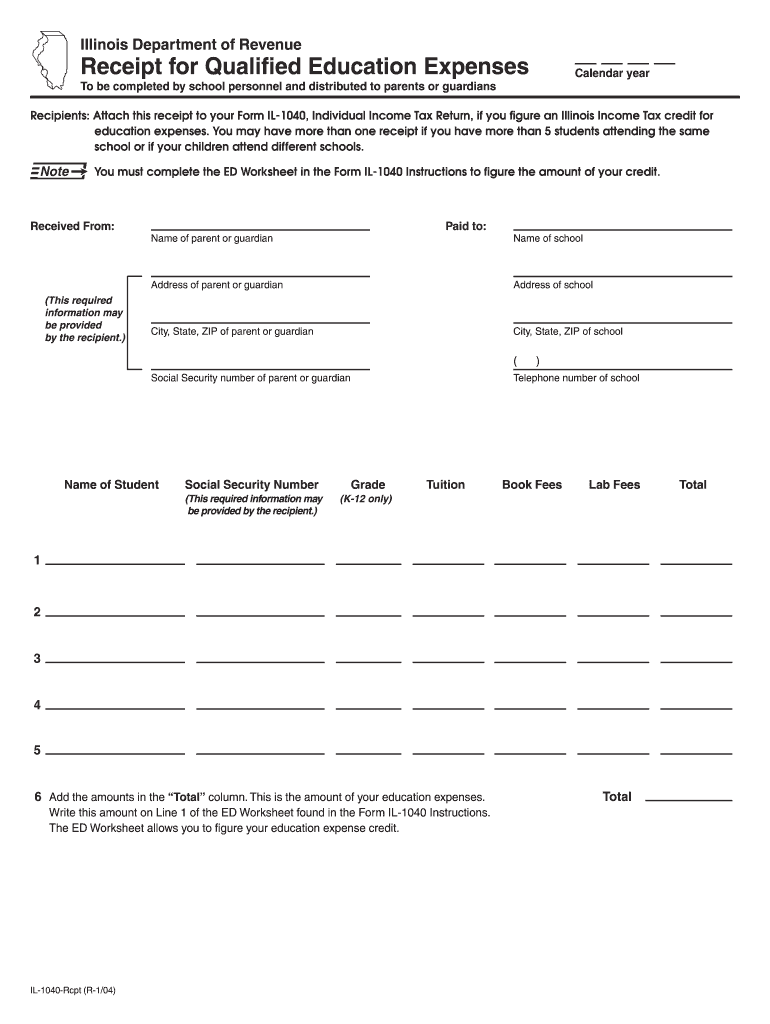

EDUCATION EXPENSE WORKSHEET Name of Student Taxpayer Spouse Dependent Status during acedemic period Full Time Part Time N A Qualifying Education

In today digital age eBooks have become a staple for both leisure and learning The convenience of accessing Adjusted Qualified Education Expenses Worksheet In today digital age eBooks have become a staple for both leisure and learning The convenience of accessing Qualified Education Expenses Worksheet and

Total qualified education expenses paid for or on behalf of the student in 2022 for the academic period Less adjustments a Tax free educational assistance