Recovery Rebate Credit Worksheet 2020 The Recovery Rebate Credit Worksheet can help determine if you are eligible for the credit

Go to the Credits Recovery Rebate Credit worksheet In Line 12 Suppress the Recovery Rebate Credit worksheet select the checkbox Calculate The maximum 2020 Additional Recovery Rebate credit is 600 for each eligible individual and each qualifying child Each maximum credit amount is reduced but

Recovery Rebate Credit Worksheet 2020

Recovery Rebate Credit Worksheet 2020

https://support.taxslayer.com/hc/article_attachments/4415858470797

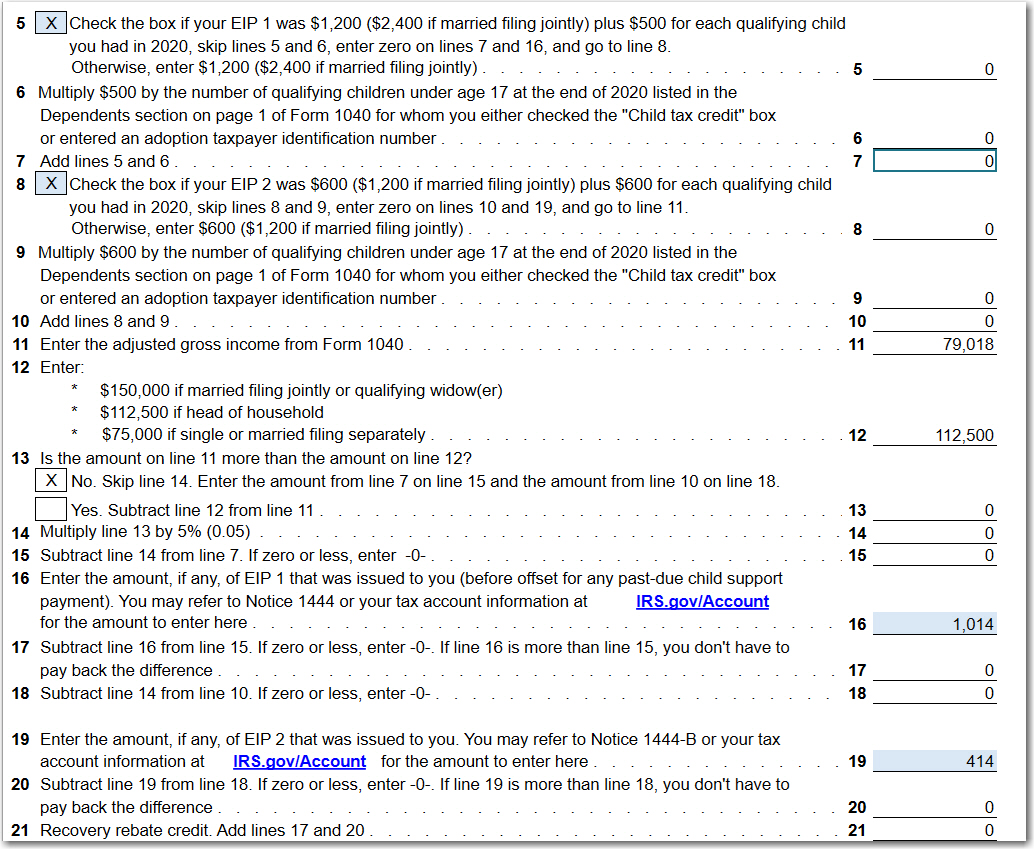

The 2020 tax return instructions include a worksheet you can use to figure the amount of any Recovery Rebate Credit for which you are eligible The worksheet

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve time and effort by supplying a ready-made format and layout for creating various kinds of content. Templates can be used for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Recovery Rebate Credit Worksheet 2020

How to use the recovery rebate credit worksheet TY2020

IT'S NOT TOO LATE: Claim a 'Recovery Rebate Credit' to get your stimulus checks | cbs19.tv

What Happens If I Make a Mistake when Claiming My Remaining Child Tax Credit (CTC) or Stimulus Check (Recovery Rebate Credit) in Your 2021 Tax Return Filed in 2022 | $aving to Invest

How to claim the stimulus money on your tax return | wfmynews2.com

What is a Recovery Rebate Credit? Here's what to do if you haven't received your second stimulus payment from the IRS - ABC11 Raleigh-Durham

Here's what to do if you haven't received a previous stimulus check | American Samoa | Samoa News

https://www.irs.gov/newsroom/recovery-rebate-credit

Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how

https://www.finance.gov.mp/division-forms/revenue-taxation/2020/2020-recovery-rebate-credit-wksht.pdf

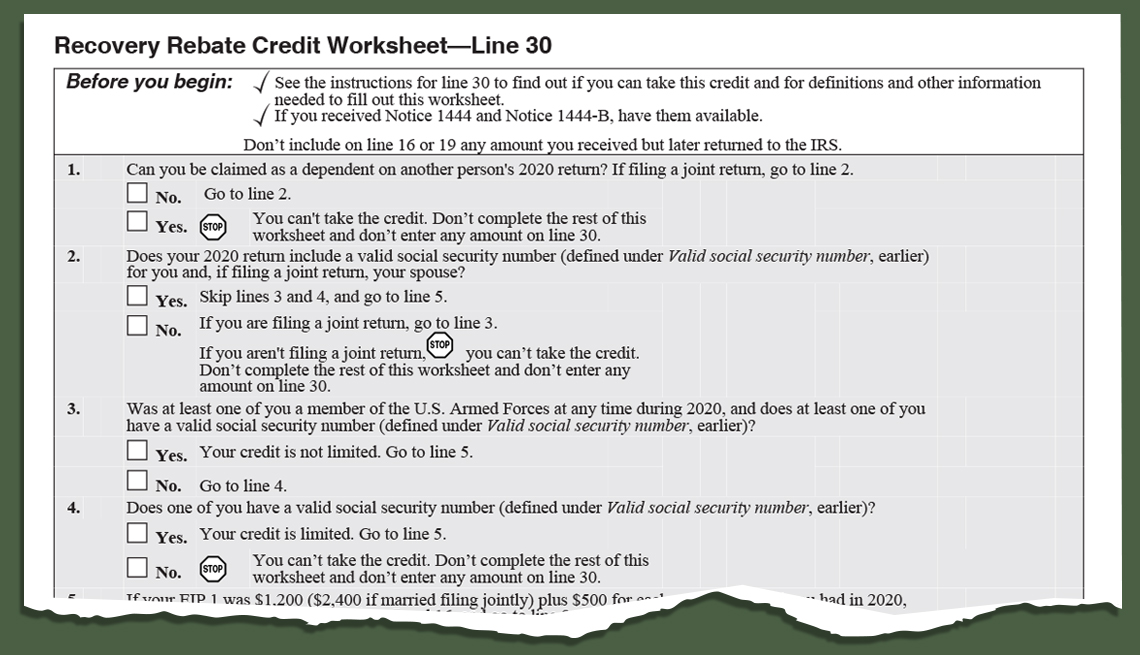

If you aren t filing a joint return STOP you can t take the credit Don t complete the rest of this worksheet and don t enter any amount on line 30 3

https://www.taxact.com/support/25636/2020/recovery-rebate-credit

The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments issued in 2020 You will

https://turbotax.intuit.com/tax-tips/tax-relief/what-is-the-recovery-rebate-credit-and-am-i-eligible/L3pAVU4it

In particular look for the 2020 Recovery Rebate Credit Worksheet Line 30 to calculate your potential credit amount

https://support.taxslayer.com/hc/en-us/articles/360059853171--Recovery-Rebate-Credit-Worksheet-Explained

The Recovery Rebate Credit worksheet is populated based on your answers the filing status dependents on the return and social security numbers

Calculate the Recovery Rebate Worksheet Choose Setup then select 1040 Individual Select Other Return Options Go to the Return Presentation tab Select You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments

All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly