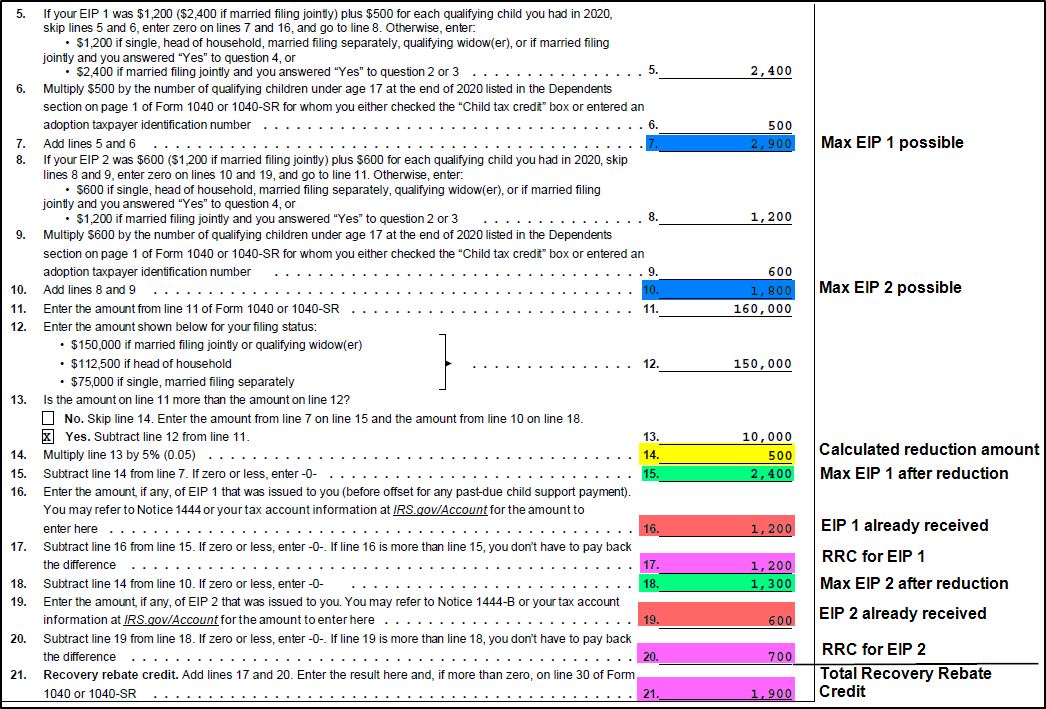

Recovery Rebate Credit Worksheet The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment also known as an EIP or stimulus

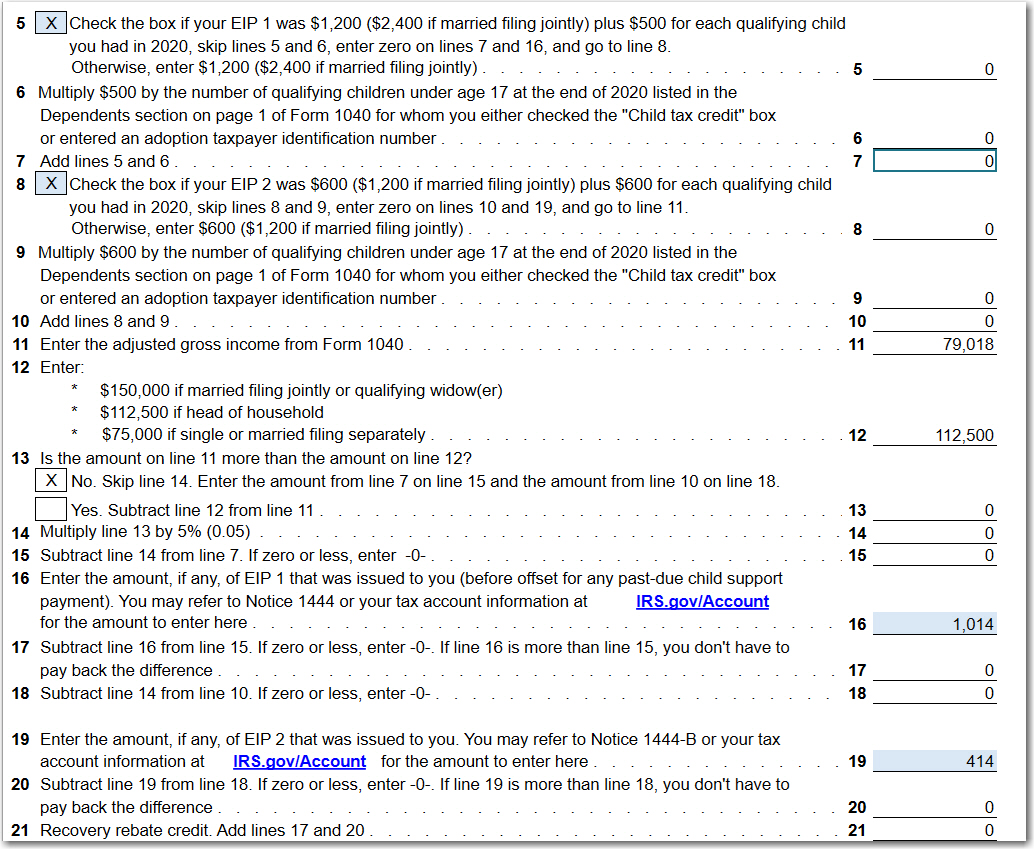

By default the worksheet and credit will always calculate Critical diagnostics will print when a recovery rebate credit is calculated but no EIP is entered Recovery Rebate Credit 2021 2021 Tax Law Changes Part 1A Recovery Rebate Credit

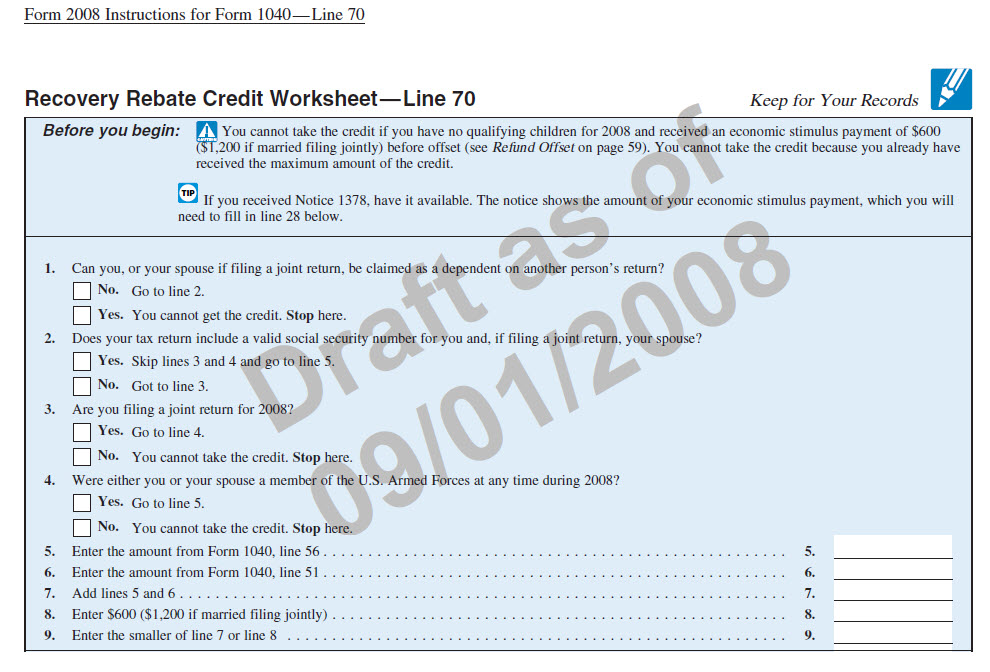

Recovery Rebate Credit Worksheet

Recovery Rebate Credit Worksheet

https://support.taxslayer.com/hc/article_attachments/4415858470797

The 2020 Recovery Rebate Credit Worksheet is a form you have to add to the 2020 1040CM document The blank contains specifications on your financial situation

Pre-crafted templates use a time-saving option for producing a varied variety of documents and files. These pre-designed formats and designs can be made use of for numerous personal and professional jobs, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the material production process.

Recovery Rebate Credit Worksheet

1040 - Recovery Rebate Credit (Drake20)

IT'S NOT TOO LATE: Claim a 'Recovery Rebate Credit' to get your stimulus checks | cbs19.tv

How to claim the stimulus money on your tax return | wfmynews2.com

How to Claim Missing Stimulus Money on Your 2020 Tax Return

Recovery Rebate Credit Worksheet | Tax Guru - Ker$tetter Letter

What Happens If I Make a Mistake when Claiming My Remaining Child Tax Credit (CTC) or Stimulus Check (Recovery Rebate Credit) in Your 2021 Tax Return Filed in 2022 | $aving to Invest

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e-calculating-the-2021-recovery-rebate-credit

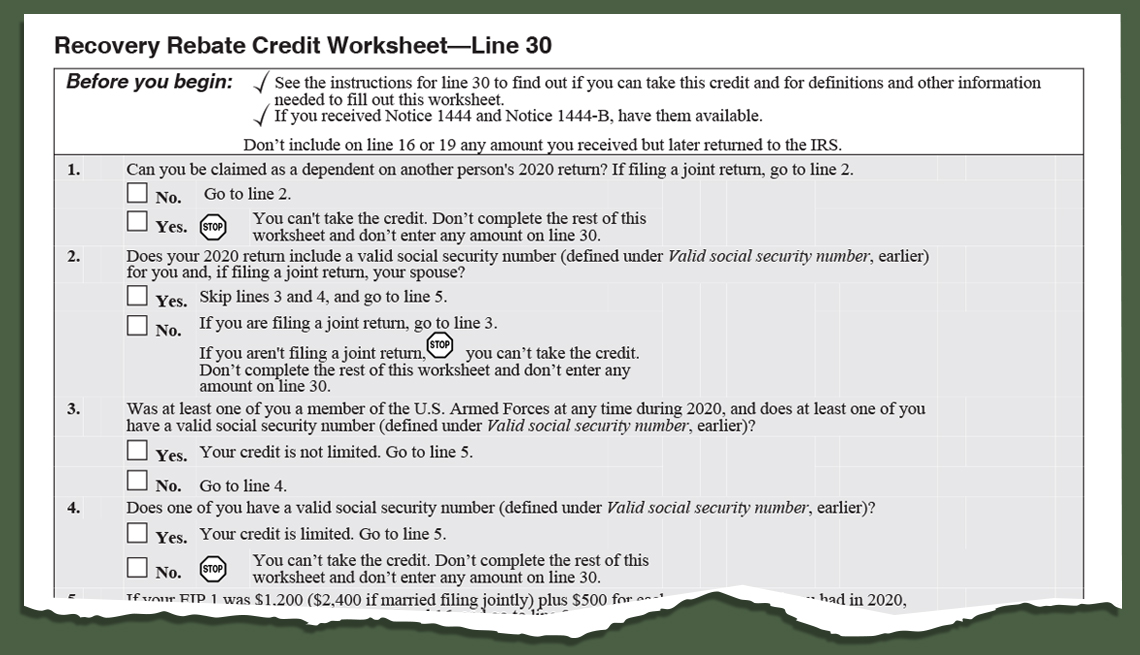

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit

https://support.taxslayer.com/hc/en-us/articles/360059853171--Recovery-Rebate-Credit-Worksheet-Explained

The Recovery Rebate Credit worksheet is populated based on your answers the filing status dependents on the return and social security numbers Questions 1

https://media.hrblock.com/media/knowledgedevelopment/itc/2021forms/recovery_rebate_worksheet_line_30.pdf

See the instructions for line 30 to find out if you can take this credit and for definitions and other information needed to fill out this worksheet

http://craig.house.gov/covid-19/utility-assistance

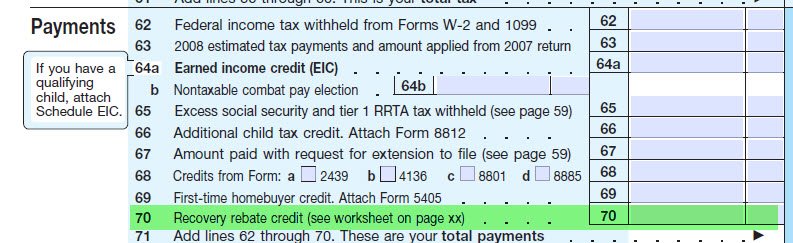

Important updates include the Recovery Rebate Credit worksheet on page 59 of the 1040 1040 SR instructions Anyone who didn t receive the full amount of both

https://support.cch.com/kb/solution/000119351/how-do-i-enter-the-recovery-rebate-credit-for-line-30-of-a-1040-return-using-worksheet-view

This video demonstrates how to enter the Recovery Rebate Credit for Form 1040 Line 30 how to view the Recovery Rebate Credit Worksheet

You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments What is the Recovery Rebate Credit The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus

The Recovery Rebate Credit is a new line item on the 2020 Tax Return and is in the same place on the 2021 Return listed on line 30 on the 2021 1040 form