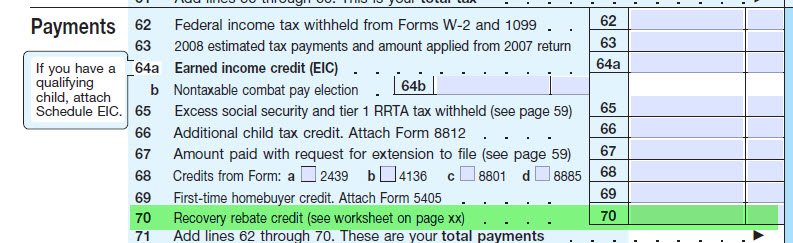

Recovery Rebate Worksheet 2021 The Recovery Rebate Credit is a new line item on the 2020 Tax Return and is in the same place on the 2021 Return listed on line 30 on the 2021 1040 form

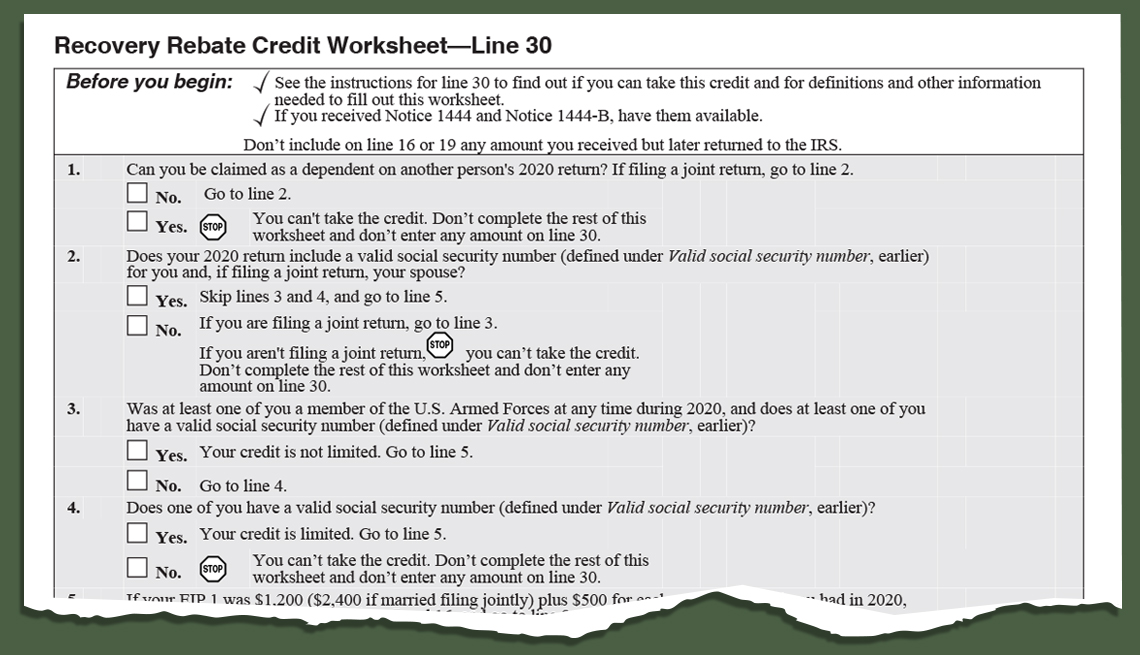

See the instructions for line 30 to find out if you can take this credit and for definitions and other information needed to fill out this worksheet The Recovery Rebate Credit Worksheet can help determine if you are eligible for the credit 09 March 2021 Visit Our Partners London and

Recovery Rebate Worksheet 2021

Recovery Rebate Worksheet 2021

https://support.taxslayer.com/hc/article_attachments/4415858470797

Calculate the Recovery Rebate Worksheet Choose Setup then select 1040 Individual Select Other Return Options Go to the Return Presentation tab Select

Pre-crafted templates use a time-saving service for producing a varied series of files and files. These pre-designed formats and layouts can be made use of for different individual and professional projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the content development procedure.

Recovery Rebate Worksheet 2021

What Happens If I Make a Mistake when Claiming My Remaining Child Tax Credit (CTC) or Stimulus Check (Recovery Rebate Credit) in Your 2021 Tax Return Filed in 2022 | $aving to Invest

How to use the recovery rebate credit worksheet TY2020

Recovery Rebate Credit Worksheet | Tax Guru - Ker$tetter Letter

Ready-To-Use Recovery Rebate Credit 2021 Worksheet - MSOfficeGeek

IT'S NOT TOO LATE: Claim a 'Recovery Rebate Credit' to get your stimulus checks | cbs19.tv

Recovery Rebate Credit Worksheet | Tax Guru - Ker$tetter Letter

https://www.irs.gov/newsroom/recovery-rebate-credit

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your

https://support.taxslayer.com/hc/en-us/articles/360059853171--Recovery-Rebate-Credit-Worksheet-Explained

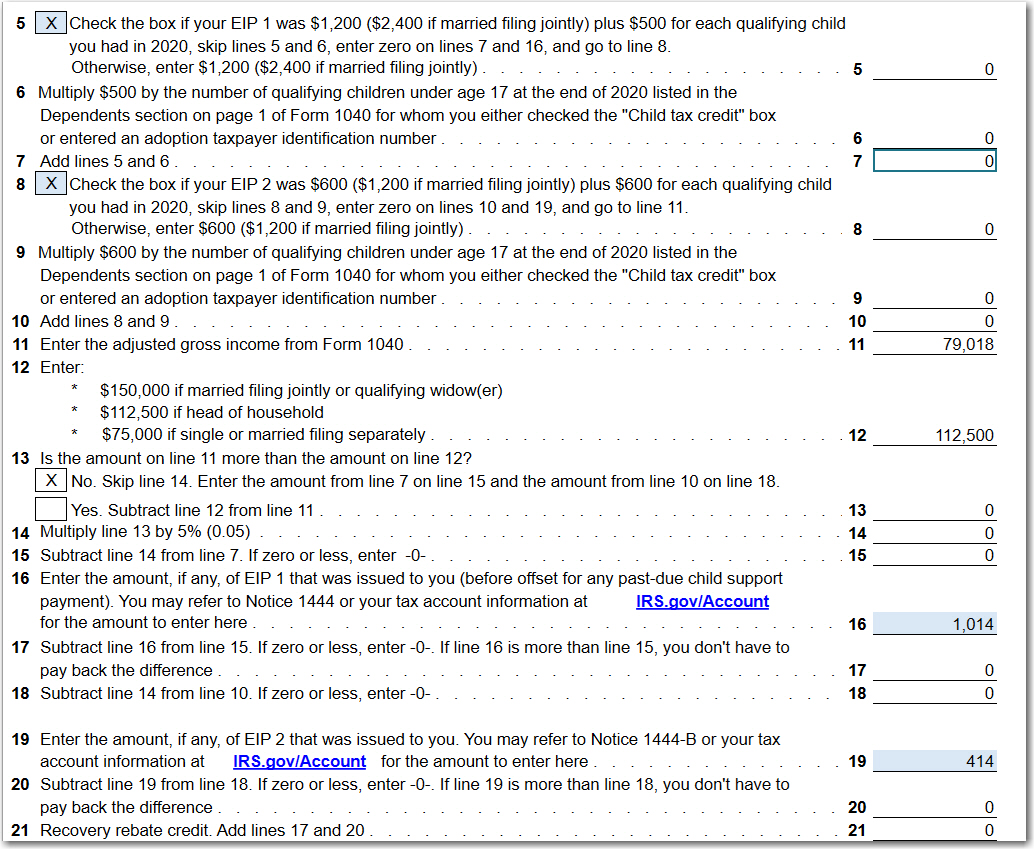

The Recovery Rebate Credit worksheet is populated based on your answers the filing status dependents on the return and social security numbers

https://www.1040.com/tax-guide/coronavirus-pandemic-news-and-resources/recovery-rebate-credit/

The Recovery Rebate Credit as part of the CARES Act makes it possible for any eligible individual who did not receive an Economic Impact Payment or EIP

https://www.youtube.com/watch?v=7wrwVp_hFG8

Recovery Rebate Credit 2021 2021 Tax Law Changes Part 1A Recovery Rebate Credit

https://support.cch.com/kb/solution/000119351/how-do-i-enter-the-recovery-rebate-credit-for-line-30-of-a-1040-return-using-worksheet-view

Go to the Credits Recovery Rebate Credit worksheet In Lines 1 11 Recovery Rebate Credit enter all applicable information Calculate the

Due to COVID 19 most eligible taxpayers received a third economic impact payment between March and December 2021 To ensure that all eligible taxpayers The recovery rebate credit is considered a refundable credit meaning it can reduce the amount of taxes you owe or generate a refund to you One

2021 and EIP3 starting in March of 2021 What is the Have these notices available when you complete the Recovery Rebate Credit Worksheet