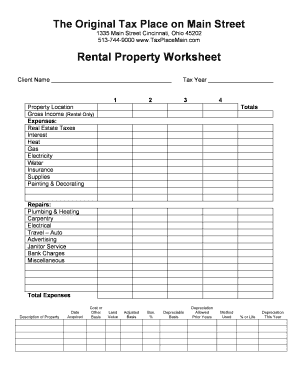

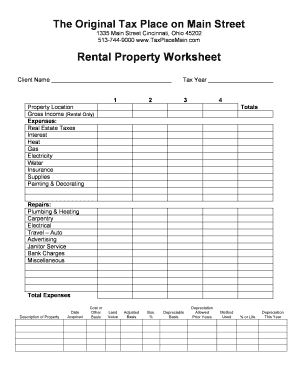

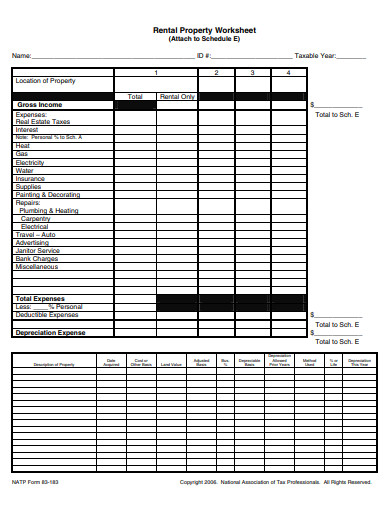

Rental Property Capital Gains Tax Worksheet Please use this worksheet to give us your rental income and expenses for preparation of your tax returns Please download open in Adobe complete and securely

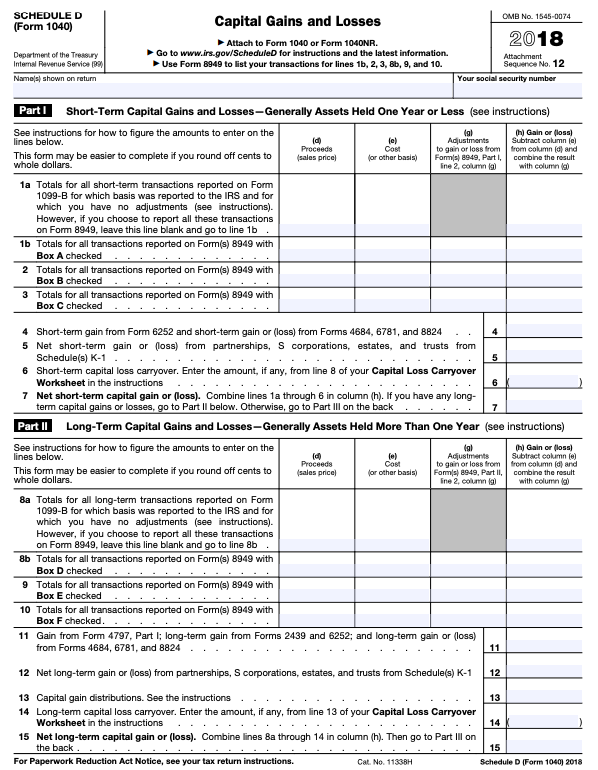

527 Residential Rental Property 530 Tax Information for Homeowners Schedule D Form 1040 Capital Gains and Losses 982 Reduction of Tax Rental Property Worksheet Several reasons it helps us create a starting point for your depreciation and capital gains calculations since some acquisition

Rental Property Capital Gains Tax Worksheet

Rental Property Capital Gains Tax Worksheet

Rental Property Capital Gains Tax Worksheet

https://www.signnow.com/preview/255/656/255656341.png

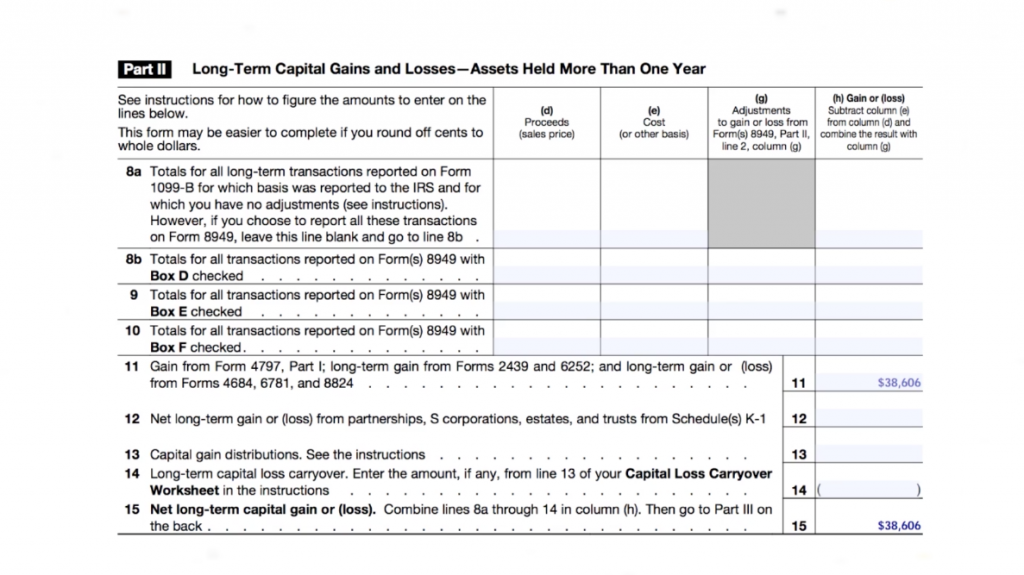

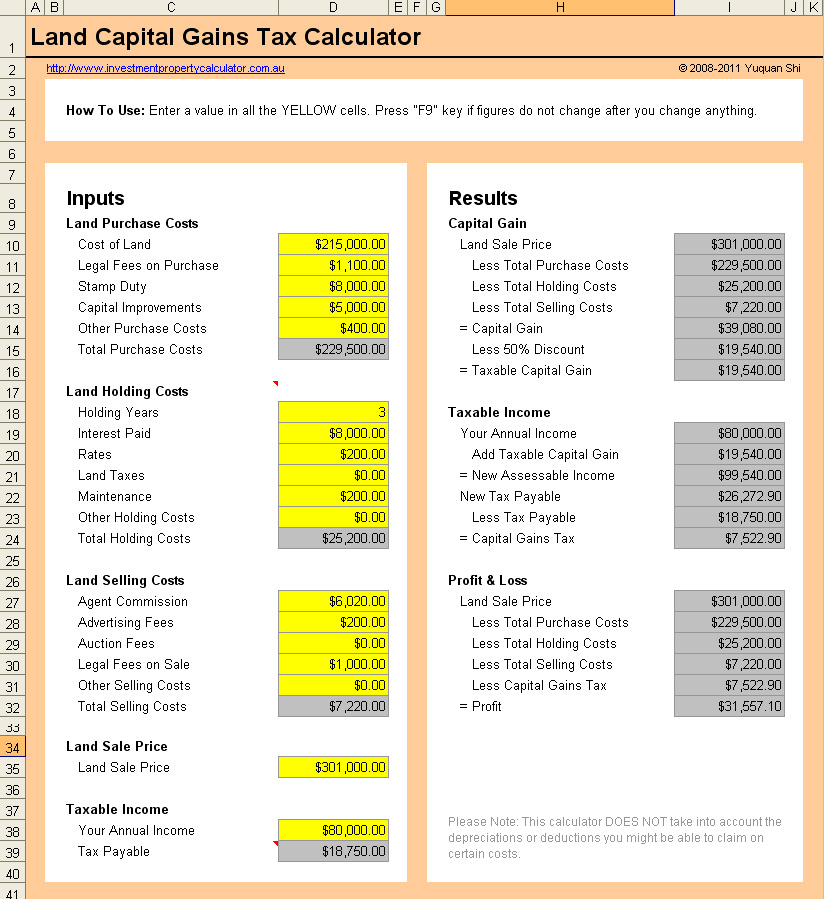

These calculations show the approximate capital gain taxes deferred by performing an IRC Section 1031 exchange with Asset Preservation

Pre-crafted templates offer a time-saving service for producing a diverse variety of documents and files. These pre-designed formats and designs can be used for various personal and professional jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the material production process.

Rental Property Capital Gains Tax Worksheet

2015-2023 Form IRS Instruction 1040 Line 44Fill Online, Printable, Fillable, Blank - pdfFiller

![2023 Rental Property Analysis Spreadsheet [Free Template] 2023-rental-property-analysis-spreadsheet-free-template](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

2023 Rental Property Analysis Spreadsheet [Free Template]

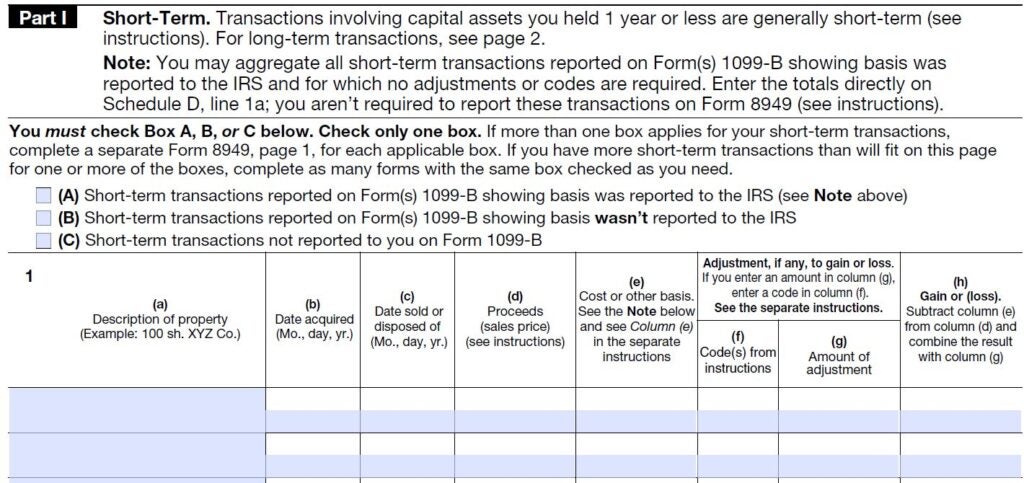

How to Report the Sale of a U.S. Rental Property - Madan CA

Capital Gains Tax Spreadsheet Shares | Capital gains tax, Capital gain, Spreadsheet template

Schedule D: How To Report Your Capital Gains (Or Losses) To The IRS | Bankrate

Quiz & Worksheet - Calculating Capital Gains | Study.com

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

Up to 250 000 in capital gains 500 000 for a married couple on the home sale is exempt from taxation if you meet the following criteria 1 You owned and

https://www.1031gateway.com/capital-gains-tax-calculator/

Use this tool to estimate capital gains taxes you may owe after selling an investment property This handy calculator helps you avoid tedious

https://irp-cdn.multiscreensite.com/0350f47b/files/uploaded/rental_property_capital_gains_tax_worksheet.pdf

Rental property capital gains tax worksheet How to avoid capital gains tax on rental property Do i pay capital gains tax on rental income How does capital

https://wcginc.com/wp-content/documents/PropertySale.pdf

Used for rental property income and expenses Currently the IRS allows up to 500 000 of capital gains to be excluded from taxation but there are ownership

https://apps.irs.gov/app/vita/content/globalmedia/capital_gain_tax_worksheet_1040i.pdf

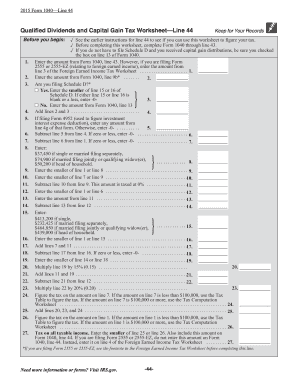

Before completing this worksheet complete Form 1040 through line 10 If you don t have to file Schedule D and you received capital gain distributions be sure

Taxes rental property investors need to pay Capital gains tax rate of 0 15 or 20 depending on filing status and taxable income The key to an accurate calculation is to keep careful receipts and tax records for your property until it s sold Capital gains on rentals are fully taxable

If you sell or dispose of any rental property asset then you would need to report that sale or disposal on your tax return If an item is