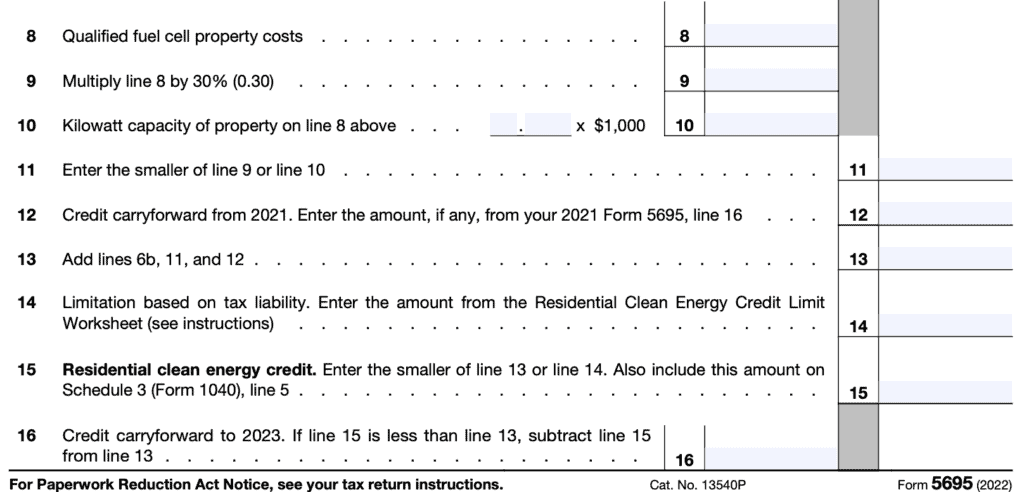

Residential Clean Energy Credit Limit Worksheet Use the information on page six of the Form 5695 instruction worksheet to calculate your credit limit then follow the directions on line 30 to transfer your

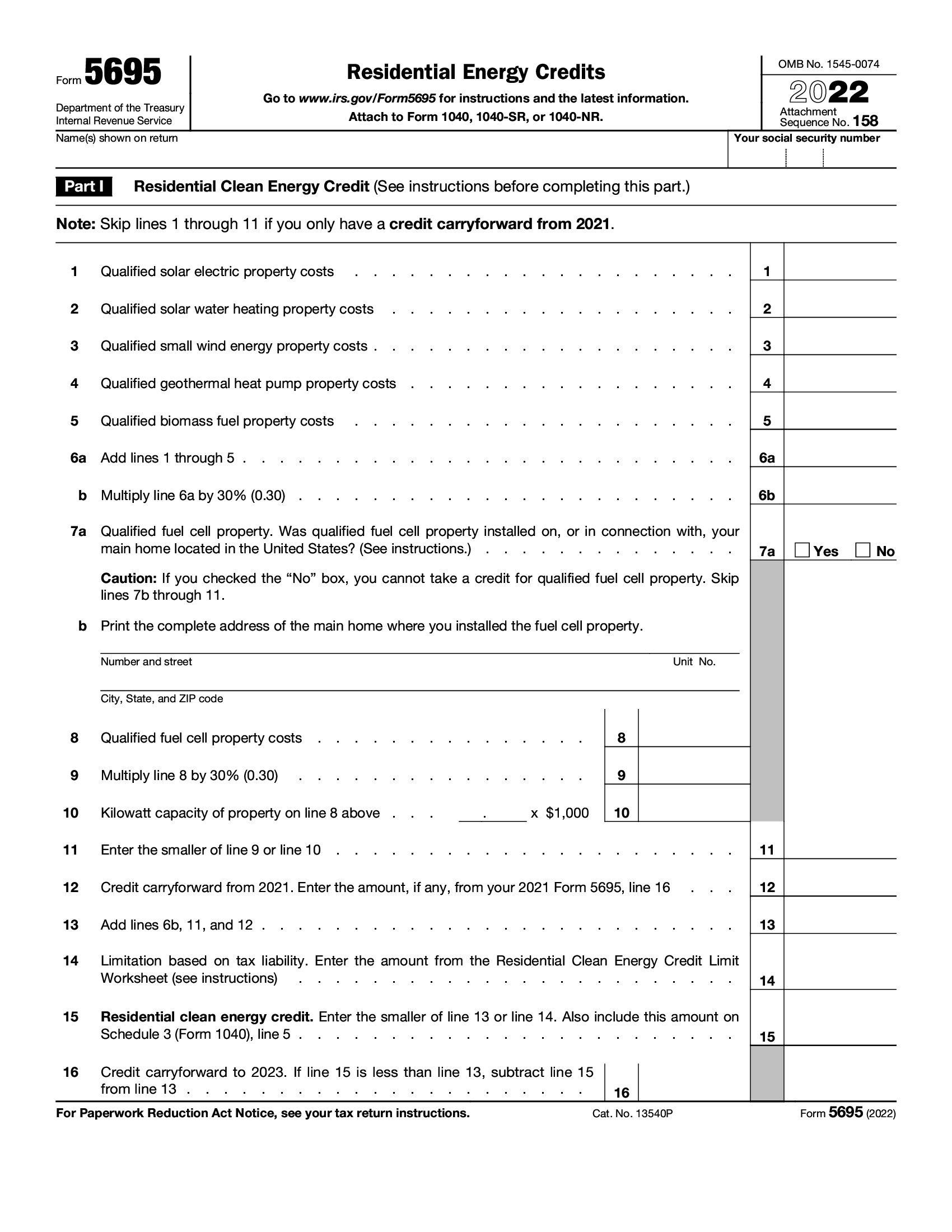

Your tax credit is up to 10 percent of these costs with a maximum total lifetime credit of 500 and a lifetime limit of 200 for the windows No there is no overall dollar limit for the Residential Clean Energy Property Credit The credit is generally limited to 30 of qualified

Residential Clean Energy Credit Limit Worksheet

Residential Clean Energy Credit Limit Worksheet

Residential Clean Energy Credit Limit Worksheet

https://www.communitytax.com/wp-content/uploads/2018/07/Form-5695-1024x840.jpg

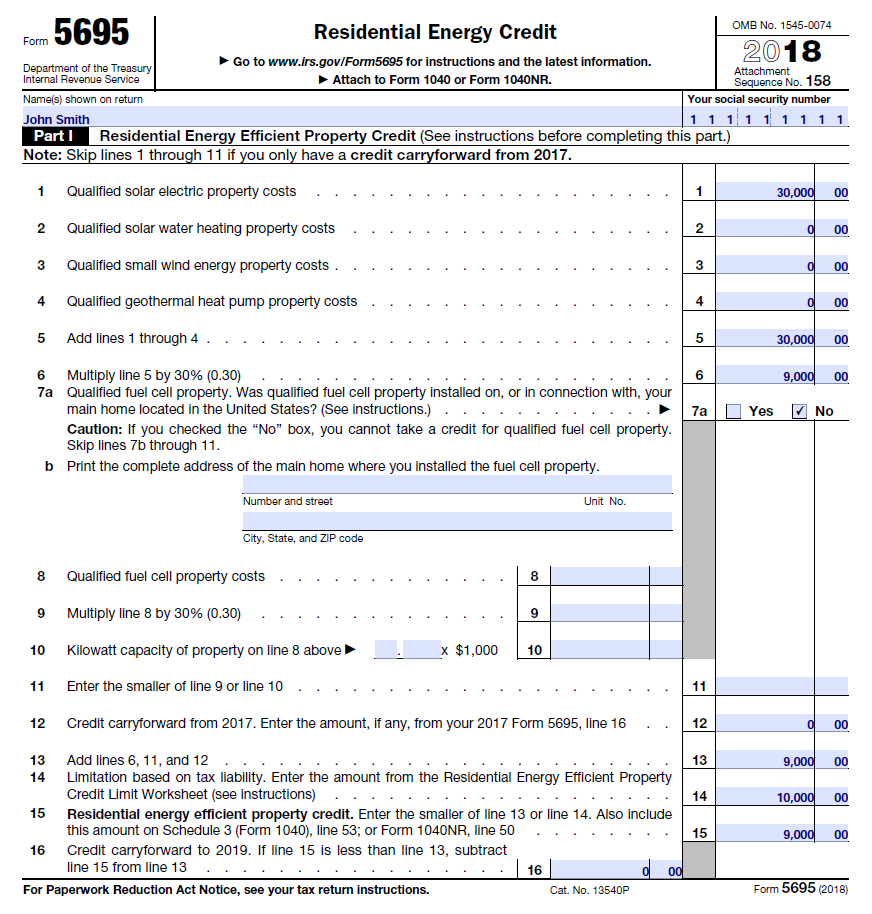

tax credit 7 500 Residential Clean Energy Credit In order to In this example your credit limit would be 10 000 Step 4 Find out

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by offering a ready-made format and layout for developing different type of material. Templates can be utilized for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Residential Clean Energy Credit Limit Worksheet

How To File The IRS Form 5695 ITC Solar Tax Credit - A.M. Sun Solar

Completed Form 5695 Residential Energy Credit | Capital City Solar

How do I claim the solar tax credit (ITC)? Form 5695 instructions

IRS Form 5695 Instructions - Residential Energy Credits

Federal Solar Tax Credit: Take 30% Off Your Solar Cost | Solar.com

2022 Instructions for Schedule 8812 (2022) | Internal Revenue Service

https://www.irs.gov/pub/irs-dft/i5695--dft.pdf

Complete the following worksheet to figure the amount to enter on line 14 Residential Clean Energy Credit Limit Worksheet Line 14 1 Enter

https://everlightsolar.com/instructions-for-filling-out-irs-form-5695/

Complete the worksheet on page 4 of the instructions for Form 5695 to calculate the limit on tax credits you can claim If you are claiming tax credits for

https://palmetto.com/learning-center/blog/how-to-fill-out-form-5695-and-claim-the-solar-tax-credit

Step 1 Calculate The Total Cost Of Your Solar Power System Step 2 Add Additional Energy Efficient Improvements Step 3 Calculate The Tax Credit Value

https://www.energy.gov/sites/default/files/2023-02/Tax%20Credit%20Table.pdf

Credits have an annual limit See the table A More information on the energy efficient home improvement credit and residential clean energy property credit

https://www.taxact.com/support/797/2022/form-5695-residential-energy-credits

A credit limit for residential energy property costs for 2022 of 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential clean energy credit and The energy efficient home tax credits for energy improvements

The credits consist of a Residential Clean Energy Credit IRC Section 25D or the Energy