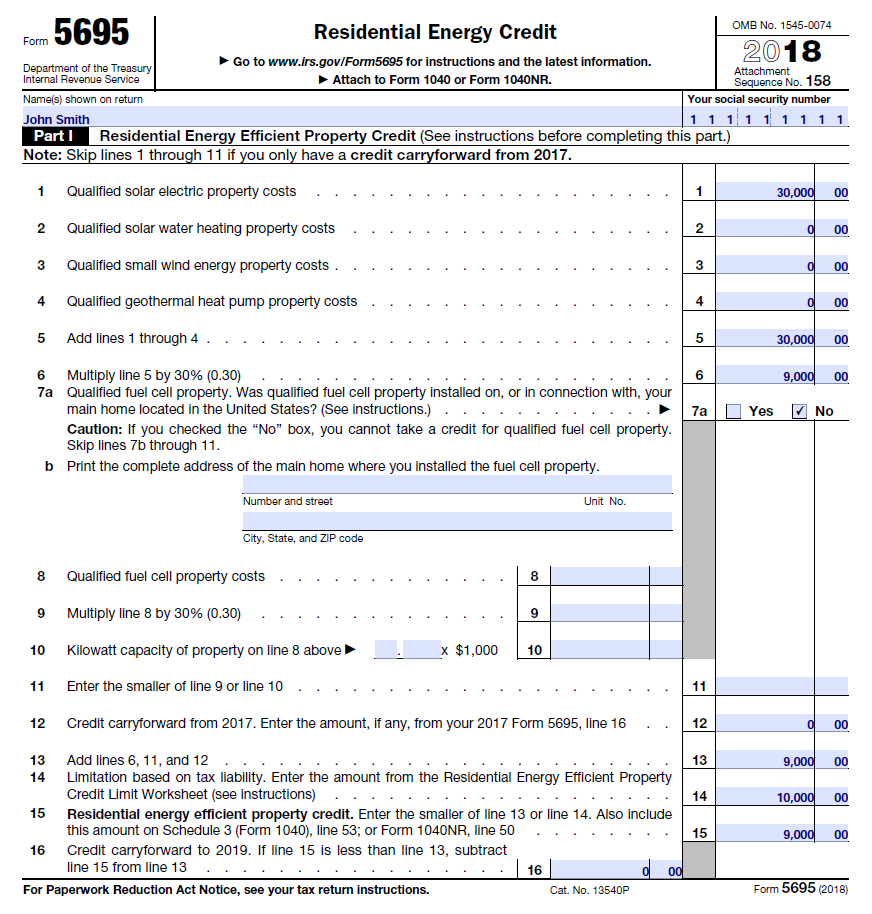

Residential Energy Efficient Property Credit Limit Worksheet 972 Residential Energy Efficient Property Credit Limit Worksheet Line 14 1 Enter the amount from Form 1040

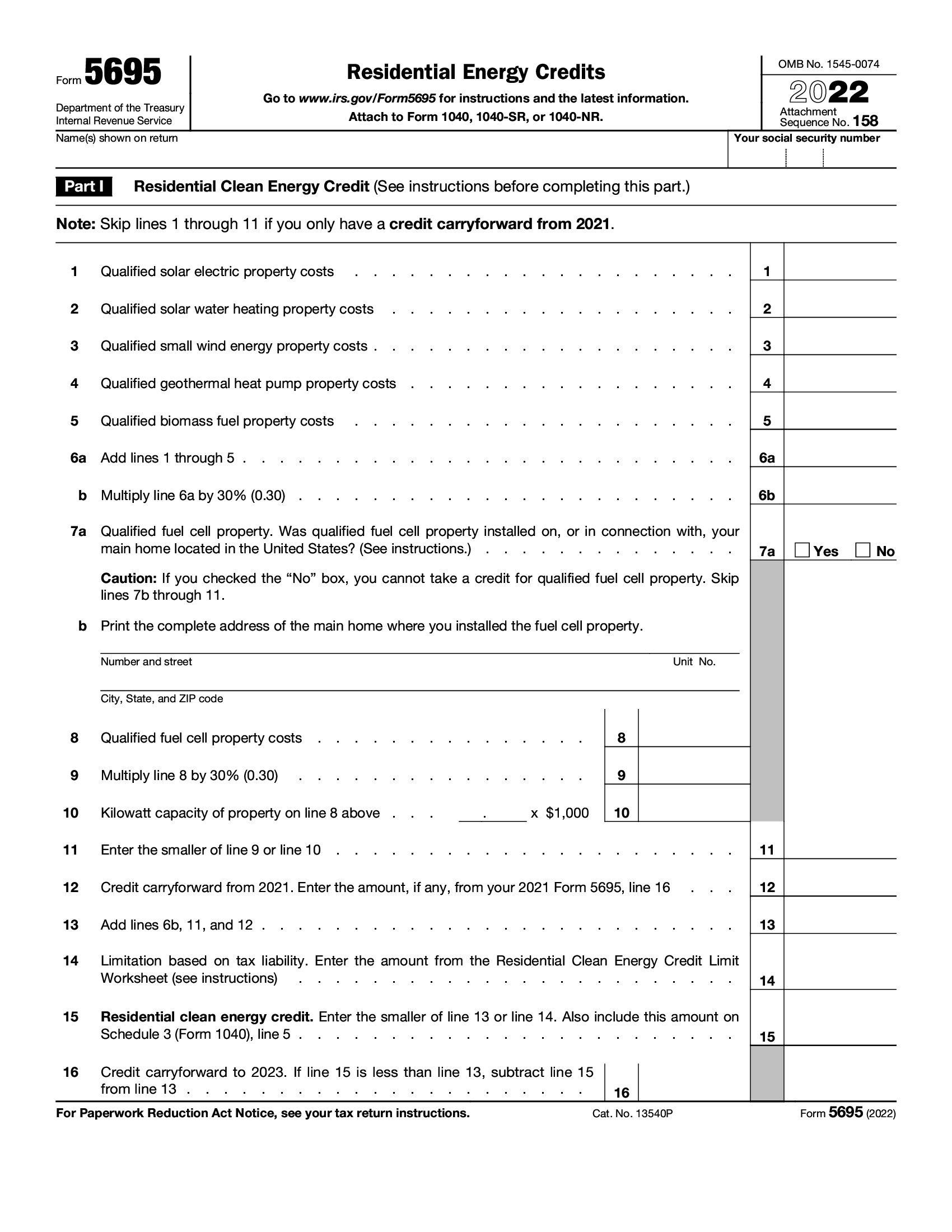

A credit limit for residential energy property costs for 2022 of 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or 15 Residential energy efficient property credit Enter the smaller of line Enter the amount from the Nonbusiness Energy Property Credit Limit Worksheet

Residential Energy Efficient Property Credit Limit Worksheet

Residential Energy Efficient Property Credit Limit Worksheet

Residential Energy Efficient Property Credit Limit Worksheet

https://amsunsolar.com/wp-content/uploads/2018/01/How-To-Fill-Out-Form-5695-Step-6.png

Regardless of which improvements you opt for there is a 500 lifetime limit for the nonbusiness energy property credit There is no limit on

Pre-crafted templates provide a time-saving option for producing a varied series of files and files. These pre-designed formats and designs can be utilized for various personal and expert tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material production procedure.

Residential Energy Efficient Property Credit Limit Worksheet

Form 5695 Instructions: Claiming the Solar Tax Credit | EnergySage

The Federal Solar Investment Tax Credit: What It Is & How to Claim It

2022 Instructions for Schedule 8812 (2022) | Internal Revenue Service

Credit Limit Worksheet a Form - Fill Out and Sign Printable PDF Template | signNow

Steps to Complete IRS Form 5695 | LoveToKnow

2022 Instructions for Schedule 8812 (2022) | Internal Revenue Service

https://www.irs.gov/pub/irs-prior/i5695--2021.pdf

Residential Energy Efficient Property Credit Limit Worksheet Line 14 1 Enter the amount from Form 1040 1040 SR or 1040 NR line 18 1

https://everlightsolar.com/instructions-for-filling-out-irs-form-5695/

Complete the worksheet on page 4 of the instructions for Form 5695 to calculate the limit on tax credits you can claim If you are claiming tax credits for

https://www.lovetoknow.com/life/work-life/irs-form-5695

Taxpayers who believe they are entitled to a residential energy tax credit must complete and file Internal Revenue Service IRS Form 5695

https://palmetto.com/learning-center/blog/how-to-fill-out-form-5695-and-claim-the-solar-tax-credit

Step 1 Calculate The Total Cost Of Your Solar Power System Step 2 Add Additional Energy Efficient Improvements Step 3 Calculate The Tax Credit Value

https://turbotax.intuit.com/tax-tips/going-green/what-is-the-irs-form-5695/L9D6ARQ0p

You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property

Credit Limit Worksheet See instructions 14 15 Residential energy efficient property credit Enter the smaller of line Credits have an annual limit See the table A More information on the energy efficient home improvement credit and residential clean energy property credit

Residential Energy Efficient Property Credit Limit Worksheet 150 for any qualified natural gas propane or oil furnace or hot water boiler Use form 5695