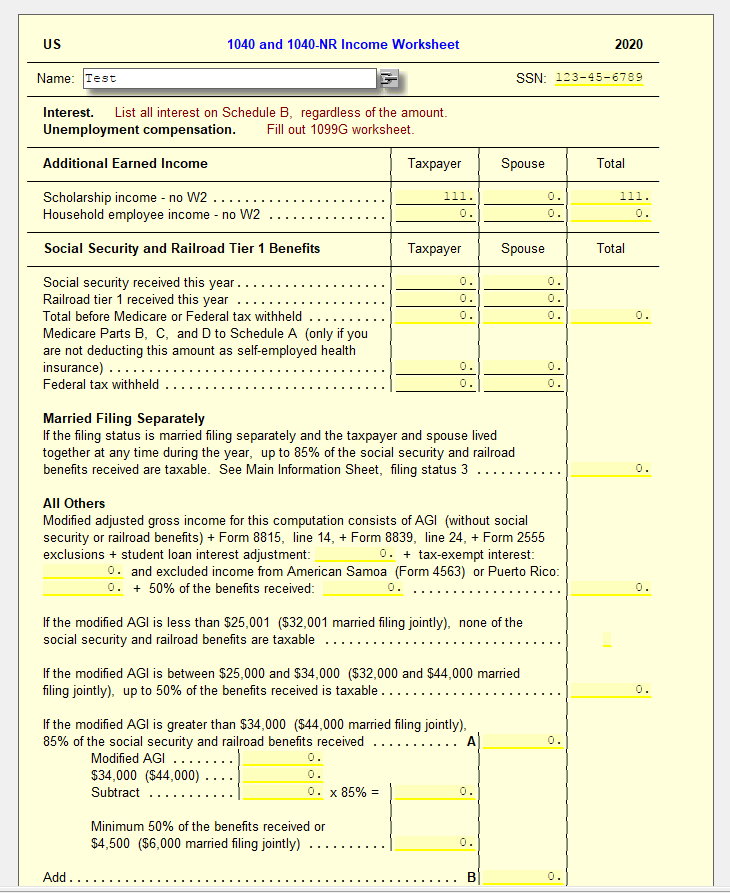

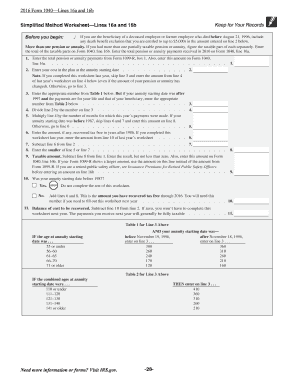

Rrb 1099 R Simplified Method Worksheet Simplified Method Go to Income Pensions IRAs 1099 R and select the Annuities tab In the Cost in plan at annuity starting date plus death benefit

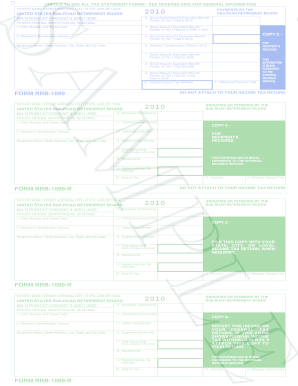

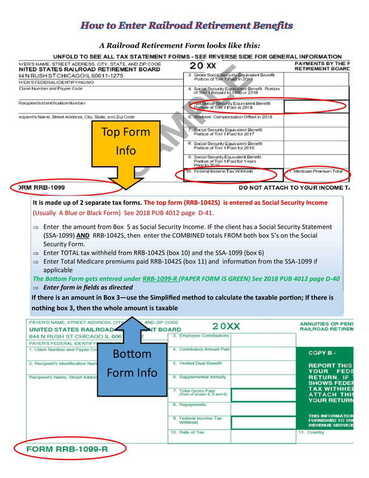

Form RRB 1099 R The Form RRB 1099 R tax statement documents the Non Social Security Equivalent Benefit NSSEB portion of tier 1 tier 2 vested dual benefit Enter all data from the form If there is amount in Box 4 the taxpayer may be eligible to use the simplified method to calculate the taxable

Rrb 1099 R Simplified Method Worksheet

Rrb 1099 R Simplified Method Worksheet

x-raw-image:///e60601e91eb1758ae5e5687c75370eae143965fd663b81d6bf646547fd4e8ca3

Federal income tax withheld enter the amount from box 9 of RRB 1099R Click Section 2 Simplified General Rule On line 1 in Rule option Select the

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve time and effort by providing a ready-made format and design for producing various sort of material. Templates can be utilized for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Rrb 1099 R Simplified Method Worksheet

Form RRB-1099-R Distributions

Form Rrb 1099 Sample - Fill Out and Sign Printable PDF Template | signNow

Form rrb 1099 r pdf: Fill out & sign online | DocHub

income

Railroad Benefits (RRB-1099) – UltimateTax Solution Center

Pub 17 Chapter 10 & 11 Pub 4012 Tab D (1040-Line 16) - ppt download

https://apps.irs.gov/app/vita/content/globalmedia/rrb_1099_r_distributions_4012.pdf

Taxable amount may have to be determined using Simplified Method Generally for a joint and survivor annuity use the combined ages to calculate the

https://support.taxslayer.com/hc/en-us/articles/360015701872-How-do-I-complete-the-Simplified-Method-Worksheet-1099-R-

Within the 1099 R entry screen Federal Section Income 1099 R RRB SSA Add or Edit a 1099 R enter your payer information and Box 1 distribution

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

To access the Simplified General Rule Worksheet from the Main Menu of the Tax Return Form 1040 select Federal Income 1099 R RRB SSA Add or Edit a 1099

https://www.ctcresources.com/uploads/3/1/6/2/31622795/using_the_simplified_method_to_determine_taxable_amount-82021.pdf

In the Calculate Taxable Amount screen click to open Simplified Method Worksheet 5 Click Con nue to access the Worksheet 6 Complete the worksheet onscreen

https://rrb.gov/sites/default/files/2018-02/QA1802.pdf

Illustrations and explanations of items found on Form RRB 1099 R can be found in IRS Publication 575 Pension and Annuity Income If the annuitant is taxed as

1099 pdf rrb 1099 r simplified method worksheet rrb 1099 online rrb 1099 r box 4 how do i get a copy of my rrb 1099 what is the difference between rrb 1099 and For any other annuity this number is the number of monthly annuity payments under the contract To access the Simplified Method Worksheet

When you enter information for Form RRB 1099 R also do the following In the 1099R screen located in the Retirement folder enter X in the Form RRB 1099 R