S Corp Basis Calculation Worksheet An S corp basis worksheet is used to compute a shareholders basis in an S corporation Shareholders who have ownership in an S corporation must make a point to

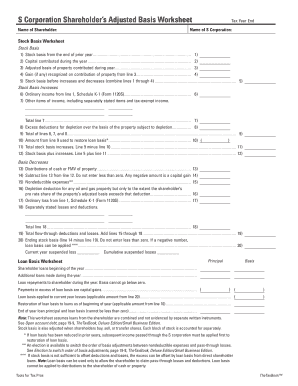

This tax worksheet calculates an S Corporation shareholder s basis in stock and debt for transactions that occur during the year Starting in tax year 2018 the IRS requires a basis computation to be attached to individual returns where the taxpayer is a shareholder in an s corporation

S Corp Basis Calculation Worksheet

S Corp Basis Calculation Worksheet

x-raw-image:///85c402415501ac05b5b2917ba77518f41397d57a57348829af765f11be5d3328

You are correct The IRS does not track your basis in your S corporation investment but you need to do so as you

Pre-crafted templates offer a time-saving solution for producing a varied series of files and files. These pre-designed formats and designs can be used for numerous personal and professional projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content production procedure.

S Corp Basis Calculation Worksheet

S Corporation Shareholder Basis Losses Claimed in Excess of Basis

Calculating Basis in Debt

LB&I Process Unit Knowledge Base – S Corporations

When, why and how … Basis reporting by partners, members and S Corp. shareholders

Calculating Basis in Debt

Partnership Basis Calculation Worksheet Excel 2020-2023 - Fill and Sign Printable Template Online

https://www.irs.gov/businesses/small-businesses-self-employed/s-corporation-stock-and-debt-basis

S Corporation shareholders are required to compute both stock and debt basis The amount of a shareholder s stock and debt basis in the S corporation is very

https://www.aicpa-cima.com/resources/download/s-corporation-shareholder-basis-schedule

Calculate an S corporation s shareholder s basis using this customizable template and keep track of your client s ownership in their S corporation stock

https://irp.cdn-website.com/8c5b6e72/files/uploaded/1041420-Shareholder_Basis_in_SCorp_Worksheet.pdf

Payments made on reduced basis loans result in taxable income See worksheet below Enter the full loan repayment amount in the Loan Face Amount column

https://kb.drakesoftware.com/Site/Browse/10919/1120S-Shareholders-Adjusted-Basis-Worksheet-Basis-Wks

Use screen Basis Wks to calculate a shareholder s new basis after increases and or decreases are made to basis during the current year The basis of S

https://irp-cdn.multiscreensite.com/f58c8f33/files/uploaded/S-Corp_Shareholder_Basis.pdf

The basis for each shareholder is calculated annually and must be tracked from day 1 of ownership Importance of Basis It is important to calculate the basis

Under the normal computation rules basis is computed by taking beginning basis and adding the items of income reducing that by nondividend To enter S Corporation basis limitation In line 1 Subject this entity to the basis limitation calculation select the check box to activate the basis

Https www surgentcpe cpe courses calculating s corporation stock basis Overview This