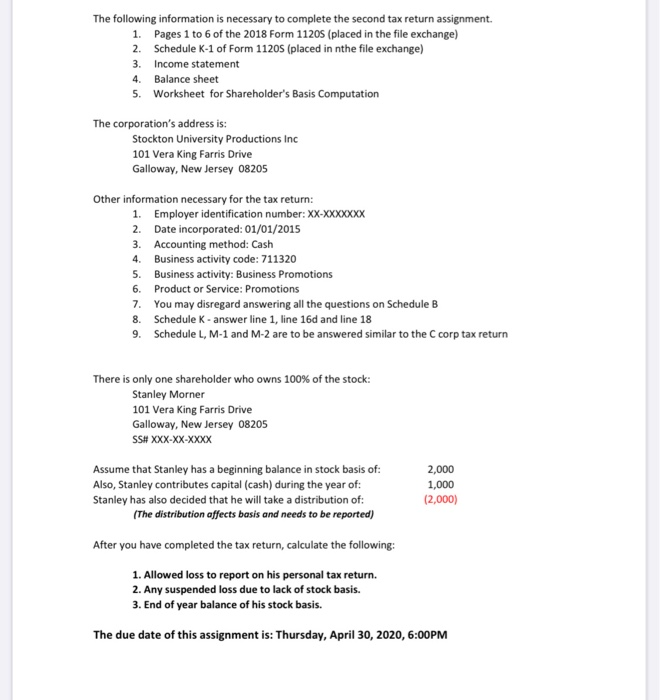

S Corp Basis Worksheet Excel Add lines 35 through 46 for each column Enter the total loss in column c on line 11 and enter the total loss in column d on line 30 Form 7203 Rev 12 2022 7203 Form Rev December 2022 Department of the Treasury Internal Revenue Service S Corporation Shareholder Stock and

General Definition If you have ownership in an S corporation it is important to have a general understanding of basis This number called basis increases and decreases with the activity of the company The IRS defines it as the amount of one s investment in the business for tax purposes May 1 2016 0183 32 The analysis also showcases the advantage the S corporation form possesses with respect to the 0 9 additional Medicare tax Implementing this case offers educators an opportunity to invite local tax practitioners into the classroom to discuss their own Excel projects and the importance of Excel skills in tax practice

S Corp Basis Worksheet Excel

S Corp Basis Worksheet Excel

S Corp Basis Worksheet Excel

https://michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg

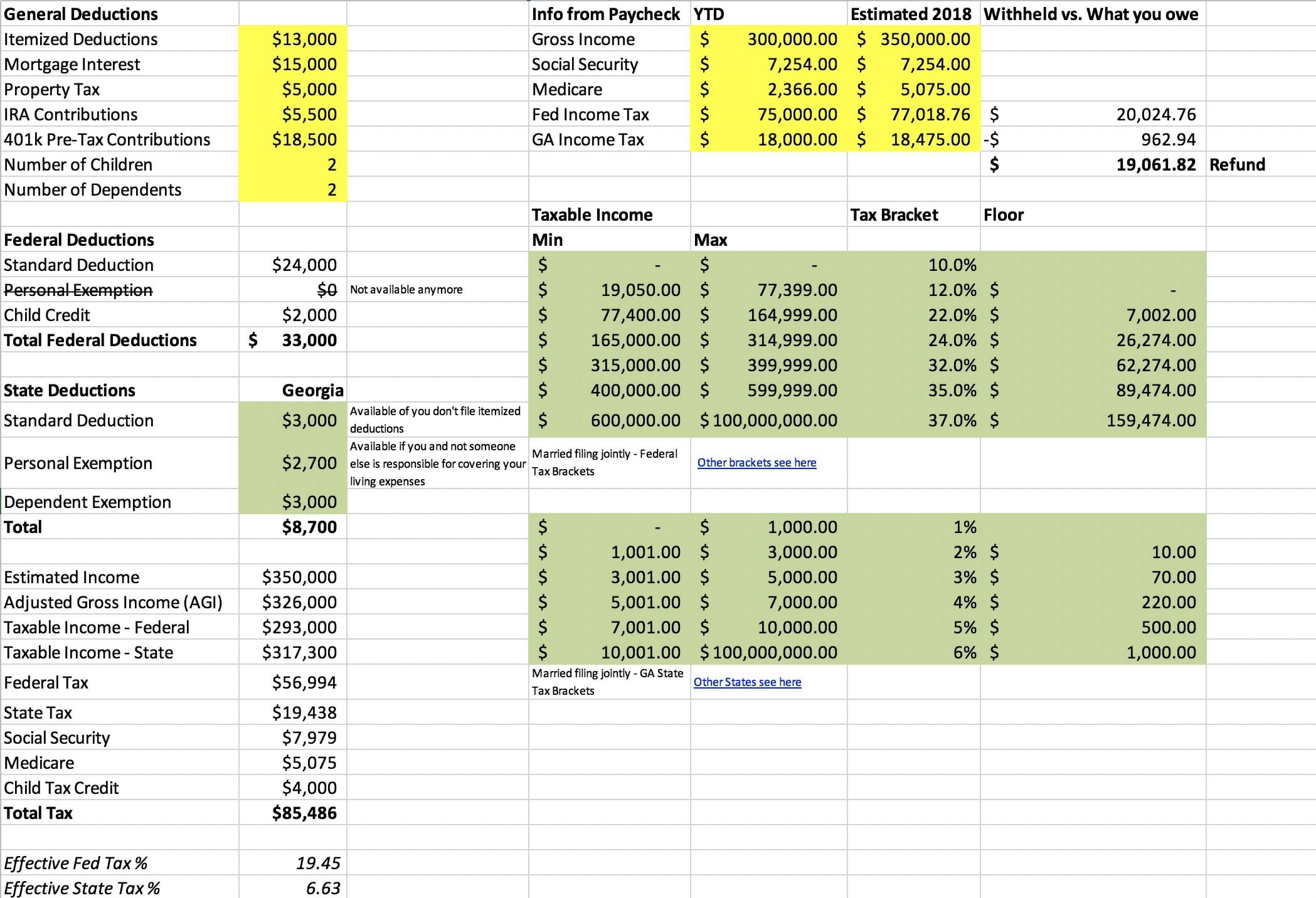

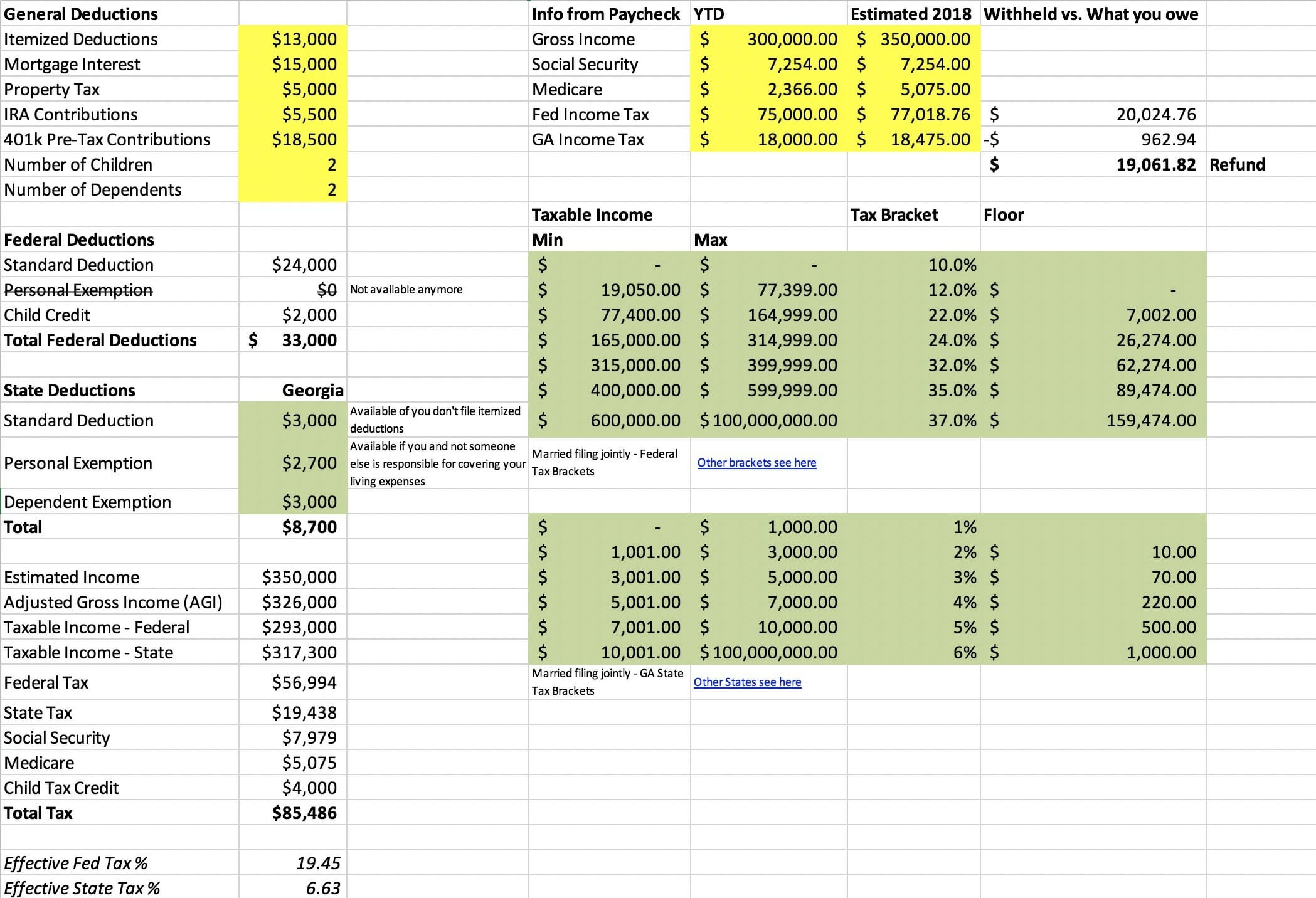

A free excel based template to track S Corporation shareholder basis S Corporation Basis In 2018 the IRS expanded adjusted basis tracking responsibilities requiring shareholders to attach their adjusted cost basis figures to their timely filed tax returns

Pre-crafted templates use a time-saving solution for developing a varied series of files and files. These pre-designed formats and designs can be made use of for numerous individual and expert jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the content development process.

S Corp Basis Worksheet Excel

Guide To Calculating S Corporation Stock Basis And Creating And

Data Center Cost Model Spreadsheet Pertaining To Food Cost Analysis

Shareholder Basis Worksheet Excel Escolagersonalvesgui

Asset Spreadsheet Template For Asset Tracking Spreadsheet Invoice

S Corp Basis Worksheet Studying Worksheets

S Corp Basis Explained YouTube

https://www.upcounsel.com/s-corp-basis-worksheet

Jul 14 2020 0183 32 An S corp basis worksheet is used to compute a shareholder s basis in an S corporation Shareholders who have ownership in an S corporation must make a point to have a general understanding of basis The amount that the property s owner has invested into the property is considered the basis

https://www.irs.gov/businesses/small-businesses

S Corporation shareholders are required to compute both stock and debt basis The amount of a shareholder s stock and debt basis in the S corporation is very important Unlike a C corporation each year a shareholder s stock and or debt basis of an S corporation increases or decreases based upon the S corporation s operations

https://cs.thomsonreuters.com/ua/toolbox/cs_us_en/

This tax worksheet calculates an S Corporation shareholder s basis in stock and debt for transactions that occur during the year Footnotes See IRC Secs 49 b 50 a 50 c 2 and 1371 c basis restoration due to credit recapture

https://www.irs.gov/forms-pubs/about-form-7203

Dec 29 2023 0183 32 S corporation shareholders use Form 7203 to figure the potential limitations of their share of the S corporation s deductions credits and other items that can be deducted on their individual returns

https://irp.cdn-website.com/8c5b6e72/files/

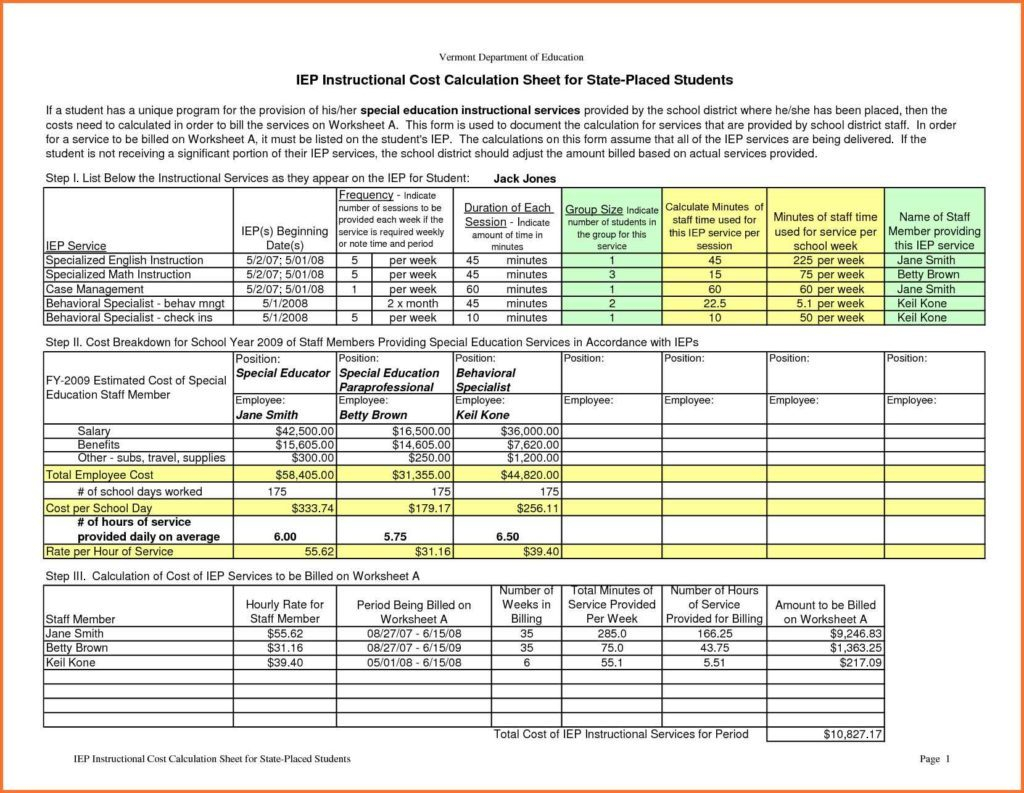

Loan Basis Immediately Before the Repayment Loan Face Amount Immediately Before the Repayment Divide 1 by 2 Enter Repayment Amount Multiply Line 4 by 3 Enter on Loan Repayment Line Loan Basis Column Subtract Line 5 from 4 Taxable Portion Enter on proper form Sch E etc as taxable income

This article refers to screen Shareholder s Adjusted Basis Worksheet in the 1120 S S corporation package The worksheet is available from screen K1E by using the Basis Wks tab at the top of the screen An S corp basis worksheet is used to compute a shareholders basis in an S corporation Shareholders who have ownership in an S corporation must make a point to have a general understanding of basis The amount that the propertys owner has invested into the property is considered the basis

Jan 11 2023 0183 32 2 ways starting an S corp can help you save money on taxes 1 It lets you write off your salary which lowers your payroll taxes Per the IRS S corp owners are required to pay themselves a reasonable salary as an employee of their company