S Corp Shareholder Basis Worksheet Excel Please see the last page of this article for a sample of a Shareholder s Basis Worksheet Suspended Losses Normally a shareholder that has basis in the company

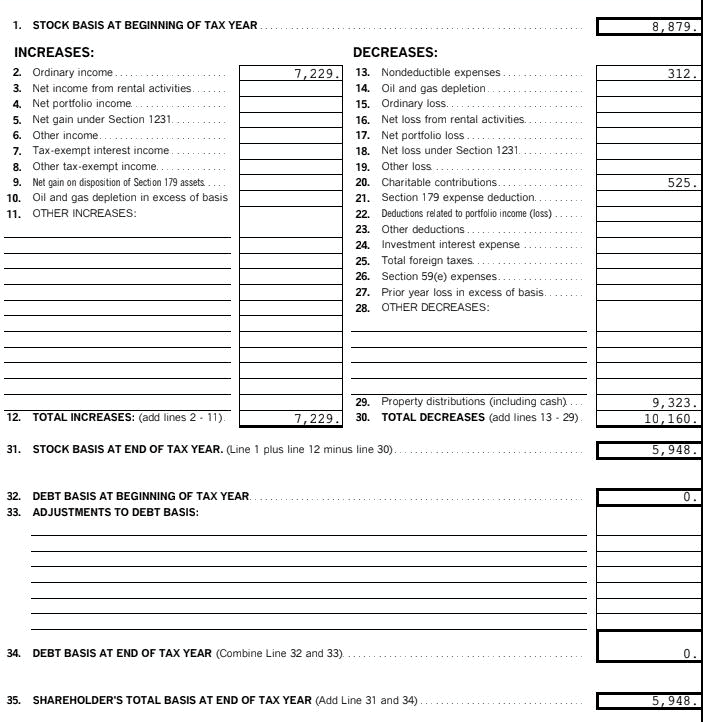

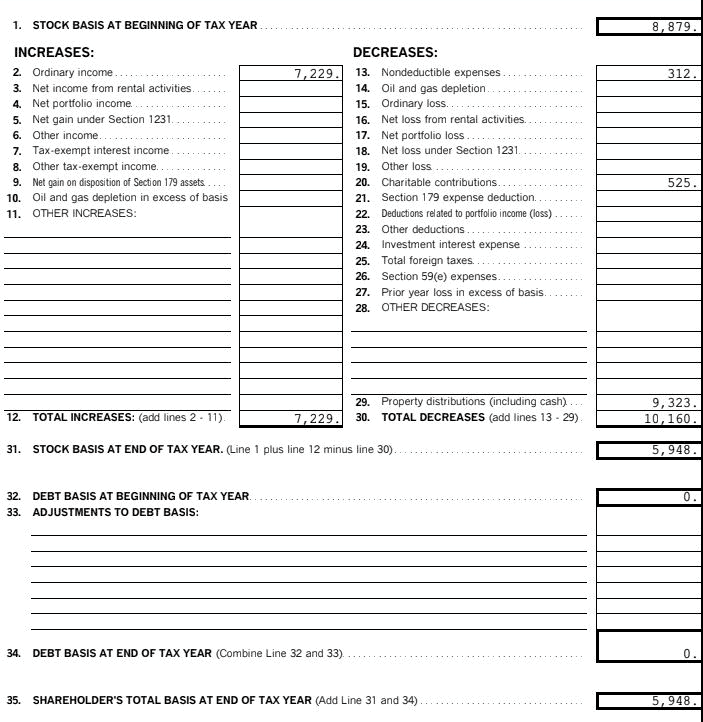

In computing stock basis the shareholder starts with their initial capital contribution to the S corporation or the initial cost of the stock they purchased This tax worksheet calculates an S Corporation shareholder s basis in stock and debt for transactions that occur during the year Footnotes See IRC Secs 49

S Corp Shareholder Basis Worksheet Excel

S Corp Shareholder Basis Worksheet Excel

S Corp Shareholder Basis Worksheet Excel

https://www.tldraccounting.com/wp-content/uploads/2020/12/Stock-Basis-Example_TLDR-Accounting.png

Use screen Basis Wks to calculate a shareholder s new basis after increases and or decreases are made to basis during the current year The basis of S

Pre-crafted templates provide a time-saving solution for creating a diverse series of documents and files. These pre-designed formats and layouts can be made use of for different individual and expert projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the material creation procedure.

S Corp Shareholder Basis Worksheet Excel

LB&I Process Unit Knowledge Base – S Corporations

S Corporation Shareholder Basis Losses Claimed in Excess of Basis

Calculating Basis in Debt

IRS Expands Cases Where S Shareholder Must Attach Basis Computation and Adds Check Box to Schedule E — Current Federal Tax Developments

When, why and how … Basis reporting by partners, members and S Corp. shareholders

Partnership Basis Calculation Worksheet Excel 2020-2023 - Fill and Sign Printable Template Online

https://www.upcounsel.com/s-corp-basis-worksheet

An S corp basis worksheet is used to compute a shareholder s basis in an S corporation Shareholders who have ownership in an S corporation must make a point to

https://www.dochub.com/fillable-form/114191-s-corp-shareholder-basis-worksheet-excel

An S corp basis worksheet is used to compute a shareholders basis in an S corporation Shareholders who have ownership in an S corporation must make a point to

https://www.pdffiller.com/456348215--s-corp-shareholder-basis-worksheet-excel-

An S corp basis worksheet is used to compute a shareholder s basis in an S corporation Shareholders who have ownership in an S corporation must make a point to

https://irp.cdn-website.com/8c5b6e72/files/uploaded/1041420-Shareholder_Basis_in_SCorp_Worksheet.pdf

The worksheet contains the nondeductible expense line in two places Use the first line if the taxpayer has not made an election under Reg 1 1367 1 f Use

https://www.signnow.com/fill-and-sign-pdf-form/231256-s-corp-shareholder-basis-worksheet-excel

Shareholder Basis Worksheet Template Excel Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor

Basis Worksheet to the Return Page 11 To compute basis you need to know 1 The shareholder s initial cost of the stock and additional paid in capital 2 This program discusses in a practical way how an S corporation shareholder calculates their stock and loan basis on Form 7203

Under the normal computation rules basis is computed by taking beginning basis and adding the items of income reducing that by nondividend