Sale Of Home Worksheet Most taxpayers can qualify for a 250 000 exclusion of gain on the sale of their home if they have lived in the home for at least two years out of the five

A loss on the sale of the home cannot be deducted from income It is a personal loss See IRS Pub 523 DETERMINING ADJUSTED BASIS AND GAIN OR LOSS ON SALE Go to the Income Sch D 4797 4684 Gains and Losses 10988 B 1099 S 2439 worksheet Select Section 13 Sale of Your Home Calculate the return

Sale Of Home Worksheet

Sale Of Home Worksheet

Sale Of Home Worksheet

https://www.rocketlawyer.com/binaries/content/gallery/responsive/thumbnails/us/drafts/sample-home-sale-worksheet-template.png

If your home was your residence for at least 24 of the months you owned the home during the 5 years leading up to the date of sale you meet the residence

Pre-crafted templates provide a time-saving solution for producing a varied variety of documents and files. These pre-designed formats and layouts can be used for various individual and expert jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the material creation procedure.

Sale Of Home Worksheet

Publication 523, Selling Your Home; Chapter 2 - Rules for Sales in 2001, Excluding the Gain

Adjusted Basis Of Home Sold Worksheet - Fill and Sign Printable Template Online

Sale of Primary Residence Calculator - Fact Professional Accounting

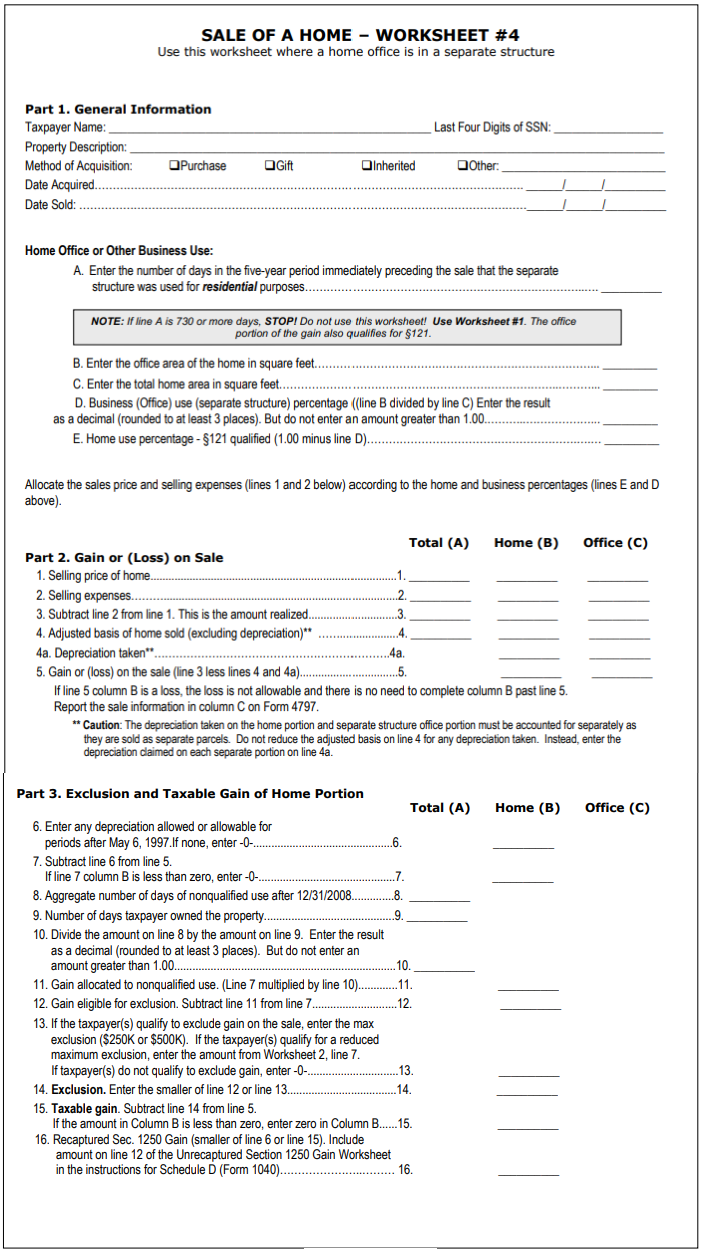

Sale of a Home – IRS Worksheet #4 | TaxBuzz

Understanding the Tax Consequences of Selling One's Personal Home: Part I

IRS Pub 523 | PDF

https://www.irs.gov/pub/irs-pdf/p523.pdf

This publication also has worksheets for calculations relating to the sale of your home It will show you how to 1 Determine if you have a

https://cotaxaide.org/tools/Home%20Sale%20Worksheet.html

Date sold Enter this before answering questions below Date obtained How did you obtain

https://support.taxslayer.com/hc/en-us/articles/360015899431-What-is-the-Sale-of-Main-Home-Worksheet-

Complete the information required and the program will calculate the taxable portion for you If the sale is not for your main home report it as follows

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

The proceeds from selling your home the amount of money you realized from the sale less selling expenses such as brokerage commissions inspection costs

https://www.rocketlawyer.com/real-estate/home-ownership/buy-or-sell-property/document/home-sale-worksheet

A Home Sale Worksheet can help you compare real estate agents sort out closing costs track the status of the buyer s loan or any other factor you may be

The personal part of the sale flows to the Sale of Home Worksheet To view the Sale of Home Worksheet Go to the list of Government forms and open Worksheets Please use this worksheet to give us your property purchase improvements and sale information for preparation of your tax returns The goal here is to

Sale of Home Partial Exclusion Worksheet See Sale of Principal Residence page 6 20 TheTaxBook 1040 Edition Deluxe Edition Use this worksheet only if no