Sale Of Main Home Worksheet Go to the Income Sch D 4797 4684 Gains and Losses 10988 B 1099 S 2439 worksheet Select Section 13 Sale of Your Home

If this property was mixed use primary residence and rental please list the dates it was your primary residence Property Sale Worksheet is accurate and VERIFICATION OF RESIDENCY CAPITAL GAIN OR LOSS WORKSHEET 383 a Capital gains other than gain excluded from the sale of a principal residence that is

Sale Of Main Home Worksheet

Sale Of Main Home Worksheet

Sale Of Main Home Worksheet

https://www.unclefed.com/IRS-Forms/2001/HTML/graphics/15044w23.gif

WORKSHEET Sale and or Purchase of Main Home Sale of Main Home Main Home the home you live in most of the time can be a house houseboat mobile home

Templates are pre-designed documents or files that can be utilized for various functions. They can conserve time and effort by offering a ready-made format and layout for producing different type of material. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Sale Of Main Home Worksheet

Pro- Excluding Sale of Main Home (Form 1099-S) – Support

Sale of Primary Residence – How to Enter into ProSeries

IRS Pub 523 | PDF

Sale Of Home Worksheet Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Home Sale WKS what is it used for

Reduced Sec 121 Exclusion Worksheet | Tax Guru - Ker$tetter Letter

https://www.irs.gov/pub/irs-pdf/p523.pdf

This publication also has worksheets for calculations relating to the sale of your home It will show you how to 1 Determine if you have a

https://support.taxslayer.com/hc/en-us/articles/360015899431-What-is-the-Sale-of-Main-Home-Worksheet-

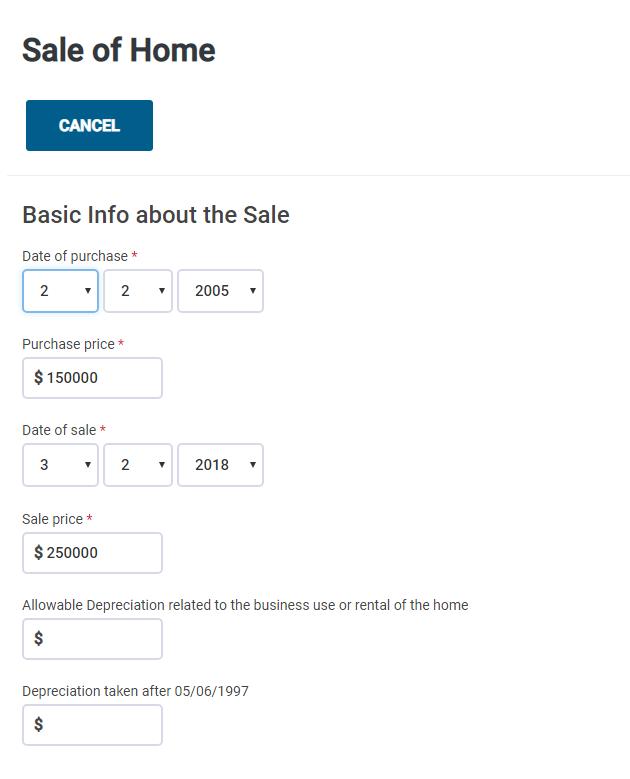

Complete the information required and the program will calculate the taxable portion for you If the sale is not for your main home report it as follows

https://cotaxaide.org/tools/Home%20Sale%20Worksheet.html

Enter this before answering questions below Was there any time when this home was not used as the main home for either taxpayer or spouse Yes

https://support.taxslayerpro.com/hc/en-us/articles/360009170414-Desktop-Excluding-the-Sale-of-Main-Home-Form-1099-S-

To access the Sale of Main Home Worksheet in the individual tax return in TaxSlayer Pro from the Main Menu of the tax return Form 1040 select

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

How to Calculate Gain The proceeds from selling your home the amount of money you realized from the sale less selling expenses such as brokerage commissions

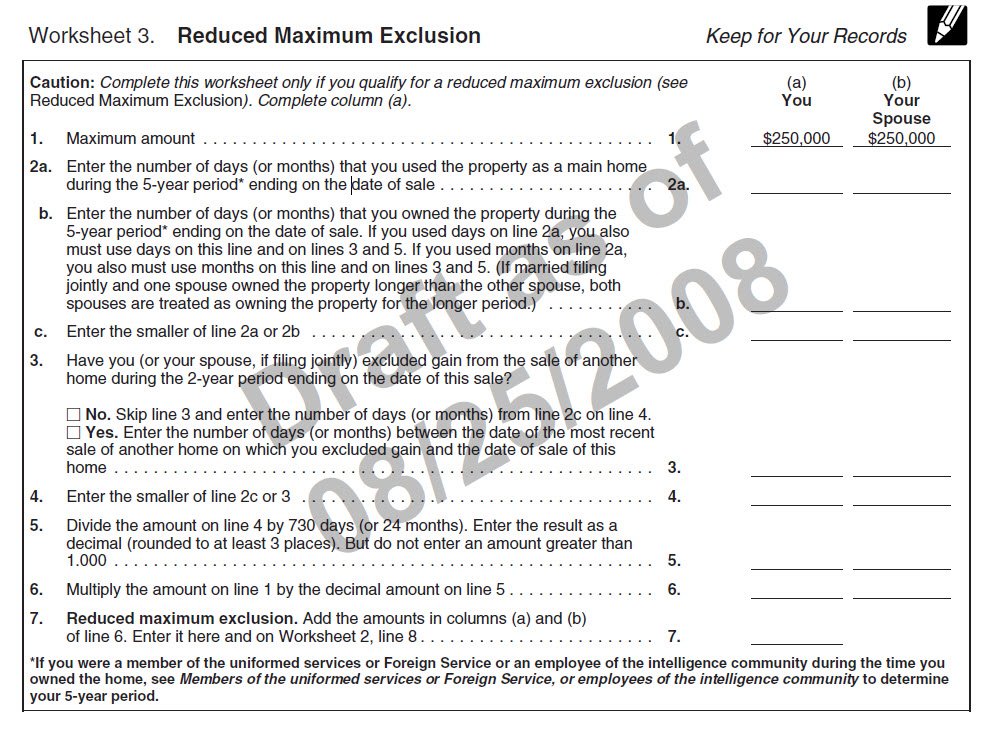

Taxpayers who are married filing jointly may qualify for a double exclusion of 500 000 But what if you can t meet the two year requirement The tax laws do See Sale of Principal Residence page 6 20 TheTaxBook 1040 Edition Deluxe Edition Use this worksheet only if no automatic disqualifications apply and take

Per IRS Instructions for Schedule D pages 2 and 3 Sale of Your Home You may not need to report the sale or exchange of your main home