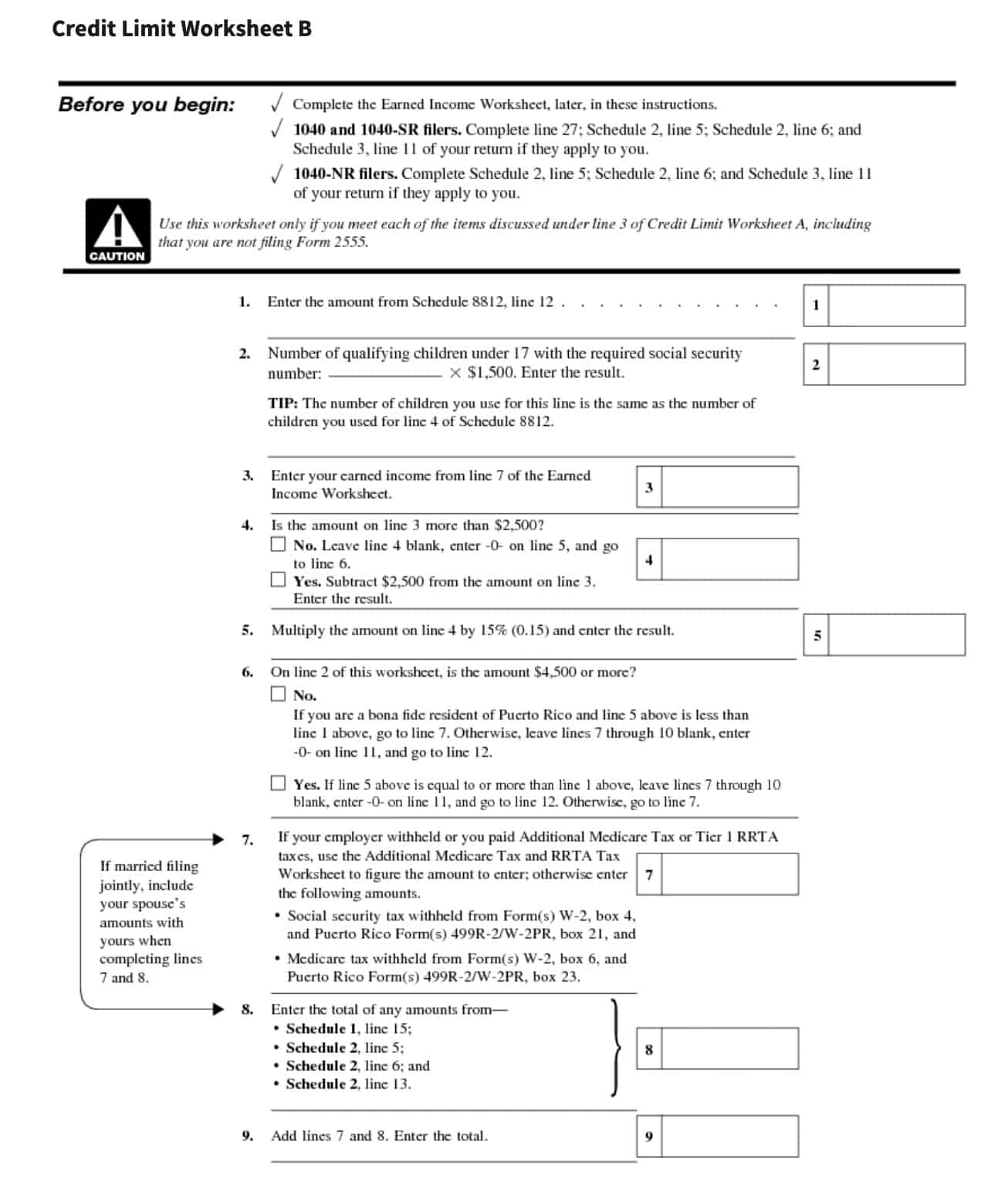

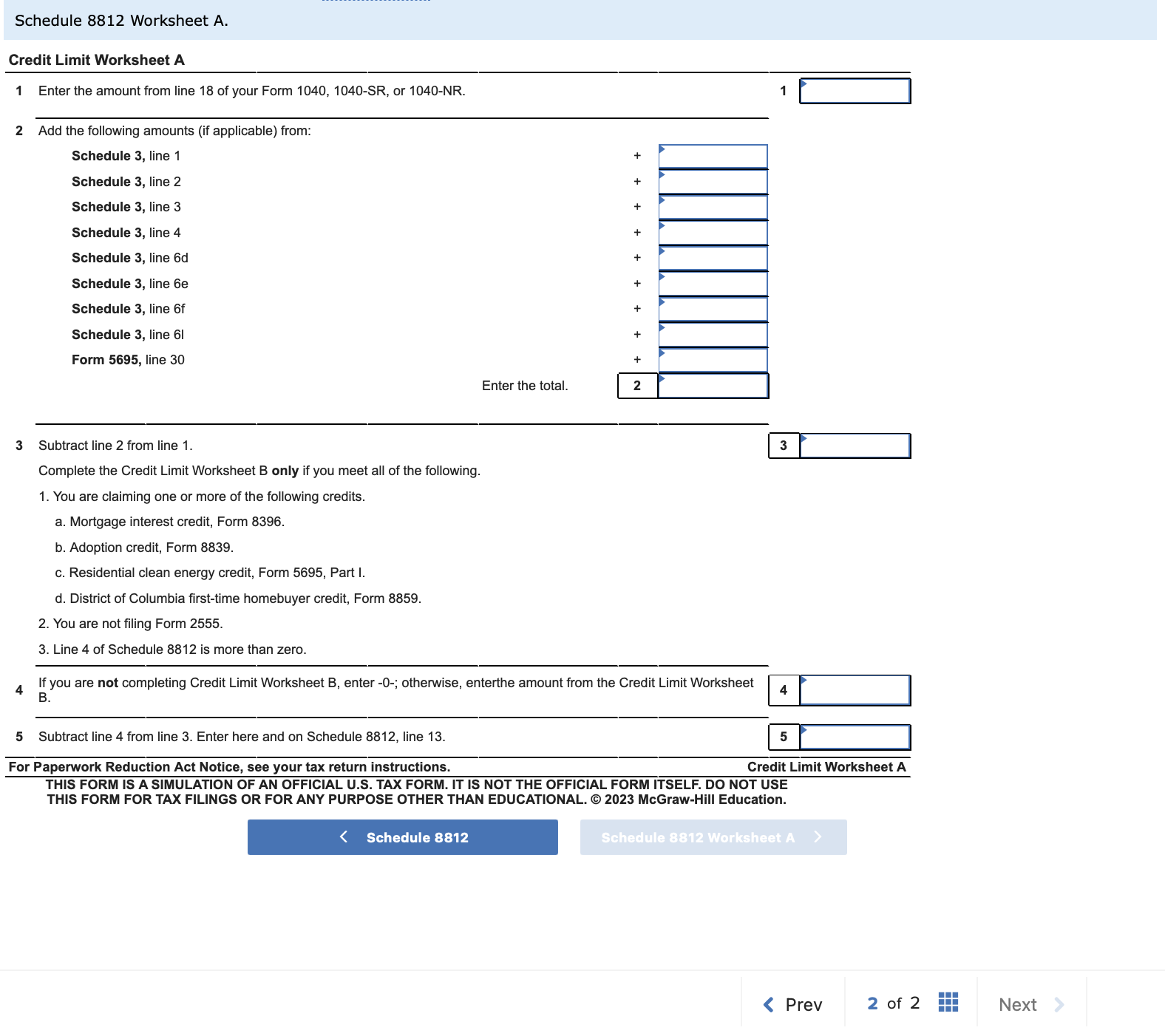

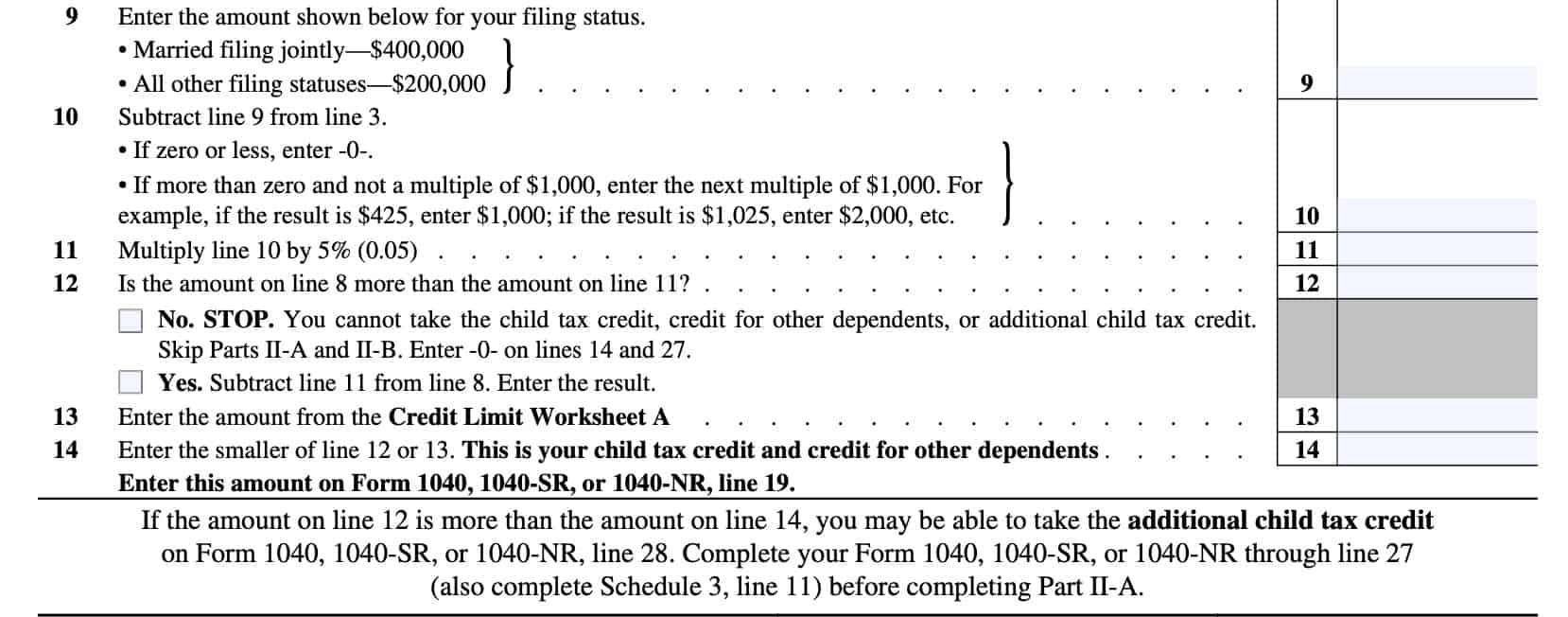

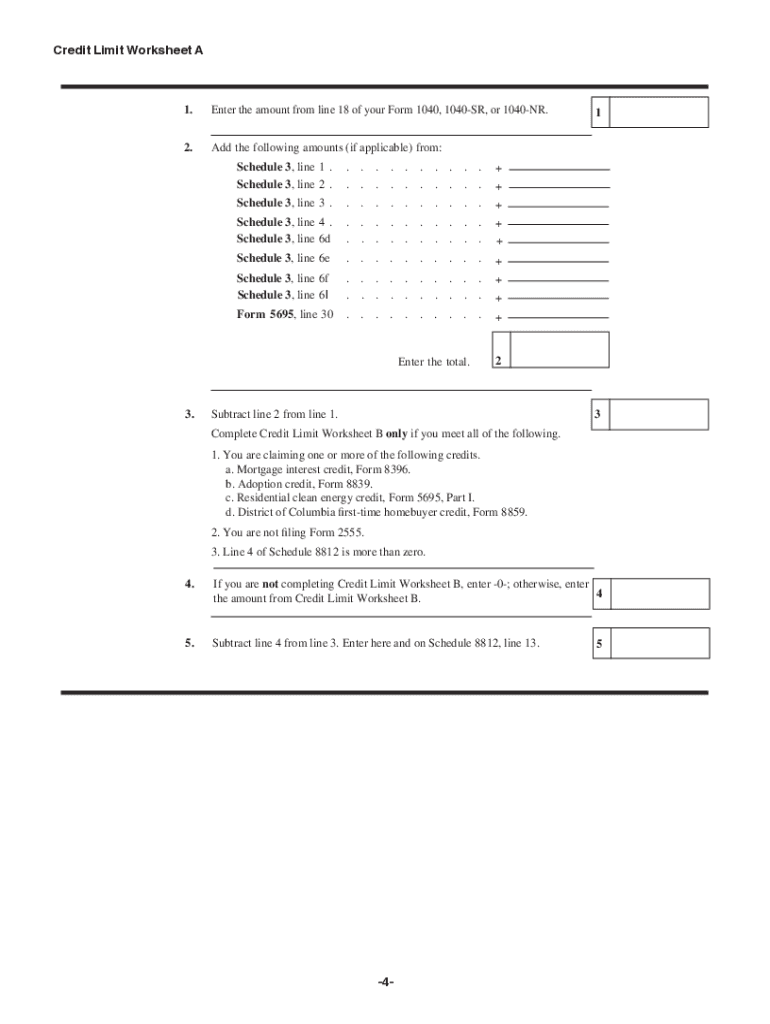

Schedule 8812 Credit Limit Worksheet A Limits on the CTC and ODC The maximum credit amount of your CTC and ODC may be

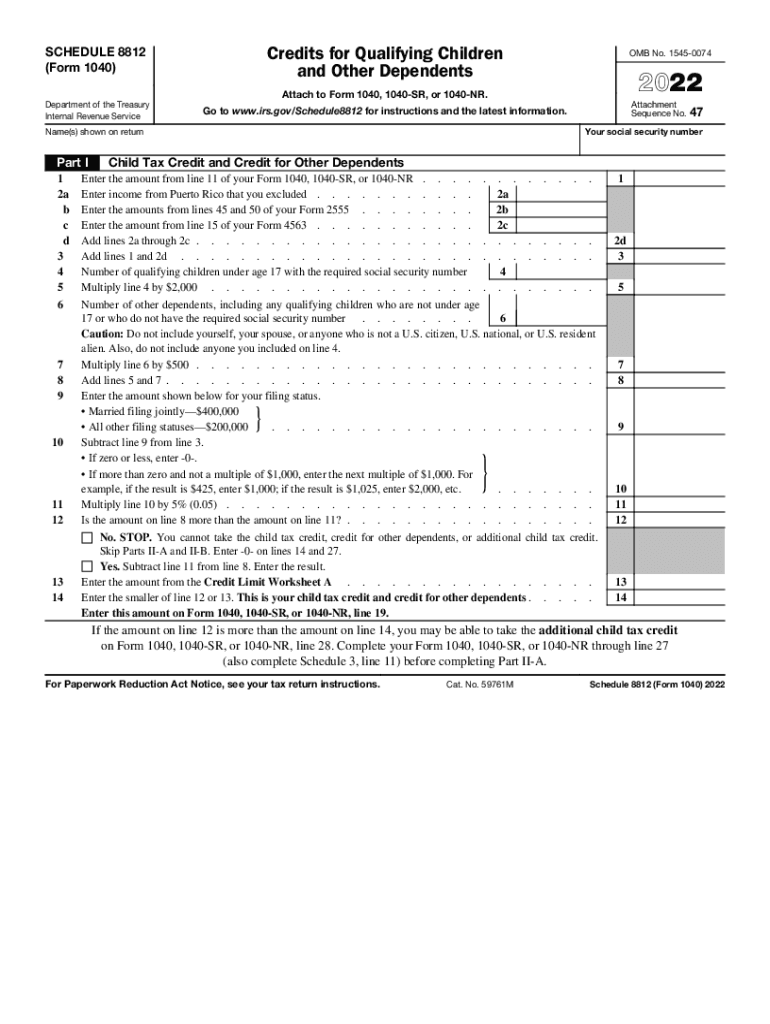

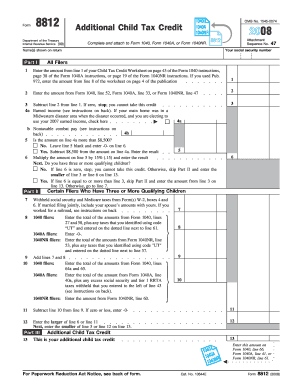

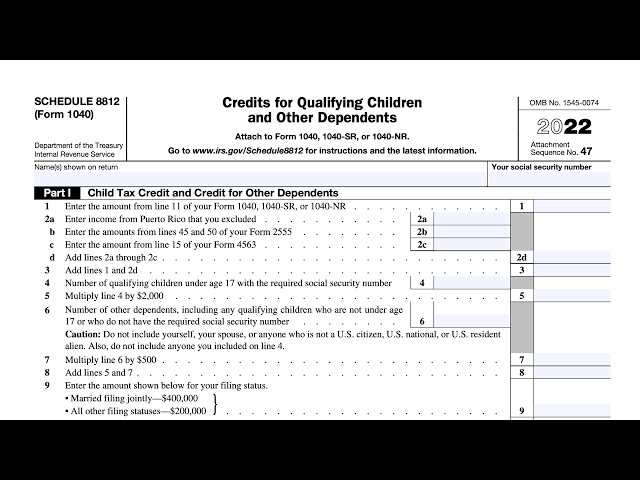

Use Schedule 8812 to determine the Child Tax Credit CTC Credit Limit Worksheet A found in the Schedule 8812 instructions booklet page 4 Schedule 8812 Child Tax Credit is generated if a child thats being claimed under the Child Tax Credit has an ITIN instead of a Social Security number

Schedule 8812 Credit Limit Worksheet A

Schedule 8812 Credit Limit Worksheet A

Schedule 8812 Credit Limit Worksheet A

https://www.irs.gov/pub/xml_bc/59790p02.gif

You will need your completed 2022 federal Schedule 8812 Credits for Qualifying Children and Other Dependents to complete this worksheet 1 Enter the amount

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save time and effort by offering a ready-made format and design for producing different sort of content. Templates can be used for personal or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Schedule 8812 Credit Limit Worksheet A

Downloadable worksheets: Fill out & sign online | DocHub

About Schedule 8812 (Form 1040), Additional Child TaxAbout Schedule 8812 ( Form 1040), Additional Child Tax2020 Instructions for Schedule 8812 (2020)Internal2020 Instructions for Schedule 8812 (2020)Internal: Fill out & sign online | DocHub

Schedule 8812 Instructions - Credits for Qualifying Dependents

Subtract line 4 from line 3. Enter here and on | Chegg.com

Schedule 8812 Instructions - Credits for Qualifying Dependents

Schedule 8812 Form - Fill Out and Sign Printable PDF Template | signNow

https://www.irs.gov/instructions/i1040s8

Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC

https://www.youtube.com/watch?v=ZcDTEYW08mI

credit limit worksheet A located in the Schedule 8812 instructions In this walkthrough we

https://www.communitytax.com/tax-form/schedule-8812/

The Schedule 8812 Form is found on Form 1040 and it s used to calculate the alternative refundable credit known as the additional child tax credit For

https://www.youtube.com/watch?v=5TvSonZQBEo

credit schedule Schedule 8812 on the Form 1040 I discuss the 3600 and Credit Limit

https://www.hrblock.com/tax-center/filing/credits/child-tax-credit/

The maximum refundable portion of the credit is limited to 1 500 per qualifying child

19 Child tax credit or credit for other dependents from Schedule 8812 19 20 SUBTRACT LINE 2 FROM LINE 1 600 COMPLETE THE CREDIT LIMIT WORKSHEET B ONLY IF Your Child Tax Credit Worksheet use Form 8812 to see if you can take the additional child tax credit Effect of Credit on Welfare Benefits Any refund you

Use Parts II IV of Schedule 8812 to figure the additional child tax credit The additional child tax credit may give you a refund even if you do not owe any tax