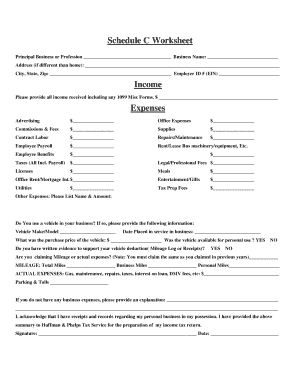

Schedule C Expenses Worksheet 2022 Sole proprietors get out your shoebox of 2022 You may also download the 2023 Schedule C Worksheet and record your 2023 income and expenses as

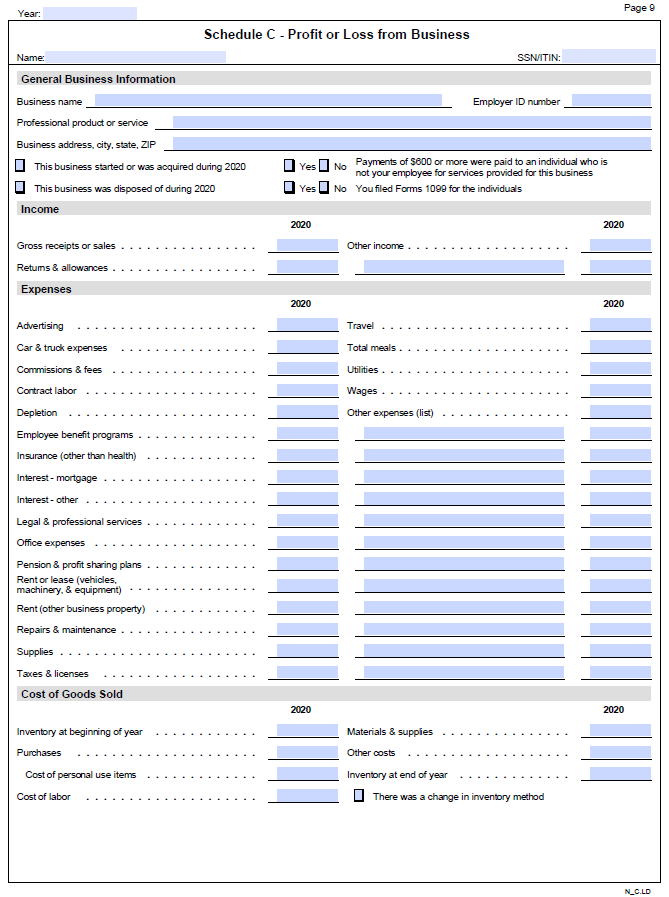

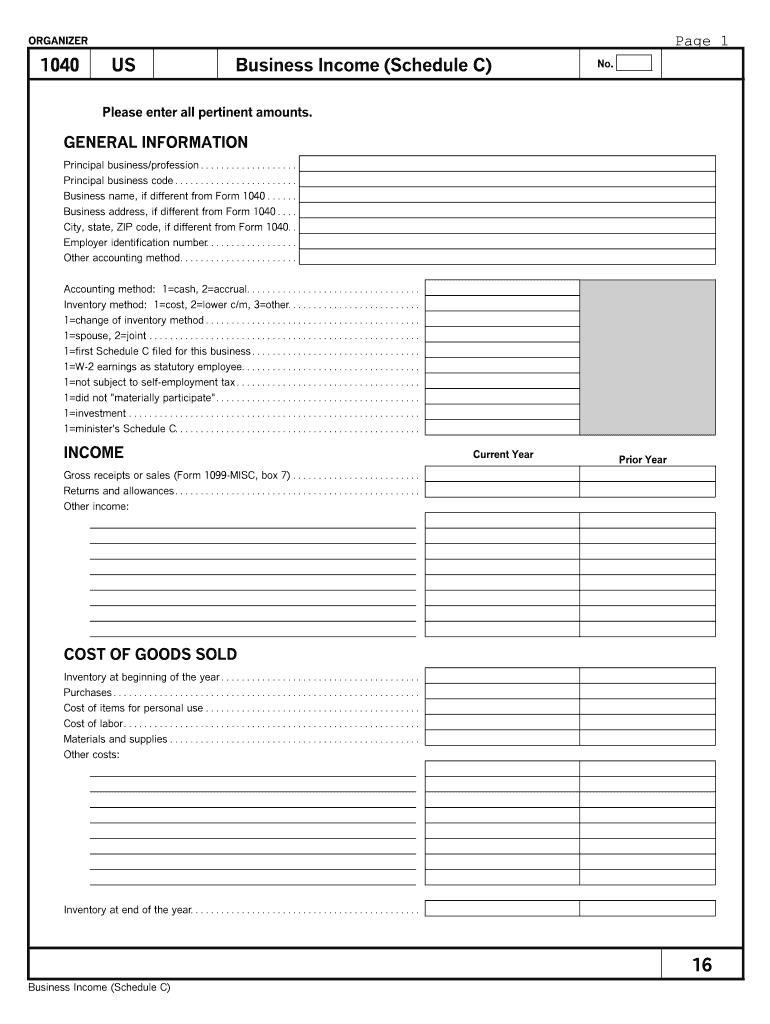

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The Schedule C is a place to report the revenue from your business as well as all the types of expenses you incurred to run your business Your business income

Schedule C Expenses Worksheet 2022

Schedule C Expenses Worksheet 2022

Schedule C Expenses Worksheet 2022

https://www.signnow.com/preview/238/593/238593343.png

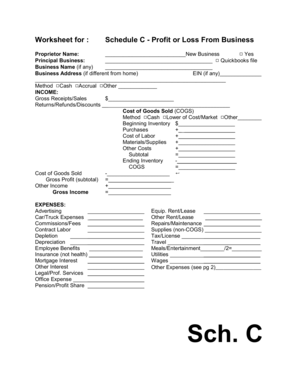

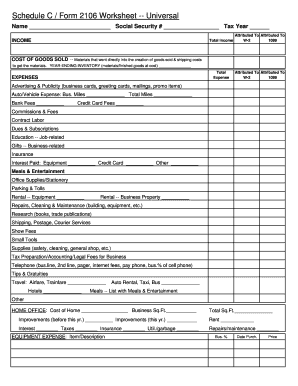

Office expense supplies Rent not home office Repairs Supplies Licenses or fees Business expenses cont Business part of

Templates are pre-designed documents or files that can be used for numerous functions. They can save time and effort by providing a ready-made format and design for developing various sort of material. Templates can be used for personal or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Schedule C Expenses Worksheet 2022

Year End Considerations for Small Business

Schedule C Small Business Organizer - Daniel Ahart Tax Service®

Schedule C Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Schedule C Worksheet Form - Fill Out and Sign Printable PDF Template | signNow

What do the Expense entries on the Schedule C mean? – Support

Writing off Business Expenses With Schedule C – Ride Free Fearless Money

https://www.irs.gov/instructions/i1040sc

This new form and its separate instructions are used to claim the IRC 179D deduction for qualifying energy efficient commercial building

https://www.kristels.com/docs/Kristels-ScheduleC.pdf

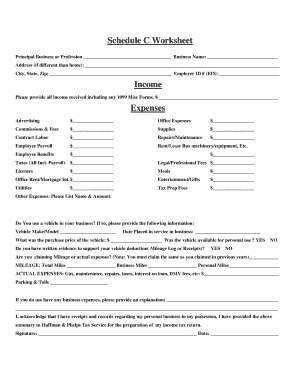

Schedule C Worksheet for Self Employed Businesses and I certify that I have listed all income all expenses and I have documentation to back up the figures

https://static.twentyoverten.com/605f3c1f00c22d3d76f6981a/whaMyF4rIBB/TY-2022-Schedule-C-Summary-Worksheet.pdf

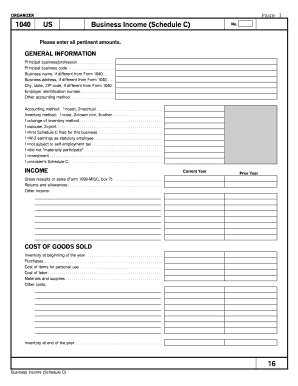

Please complete this form and include it with your other tax documents Briefly describe the nature of the business activity i e services

https://fitsmallbusiness.com/schedule-c-profit-and-loss-form-1040/

You must file a Schedule C also known as Form 1040 Profit and Loss if the primary purpose of your business is to generate revenue or profit

https://0201.nccdn.net/1_2/000/000/122/cb8/2022-schedule-c-worksheet.pdf

SCHEDULE C WORKSHEET TAX YEAR 2022 NAME PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME ACCOUNTING METHOD CASH ACCRUAL OTHER SPECIFY PART I INCOME

It includes information such as business name and address type of business income expenses cost of goods sold and any other relevant information related to Use Schedule C Form 1040 or 1040 SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor

Expenses Advertising and Promotion Selling Commissions and Fees Direct Car and Truck if you use the Actual Method see below