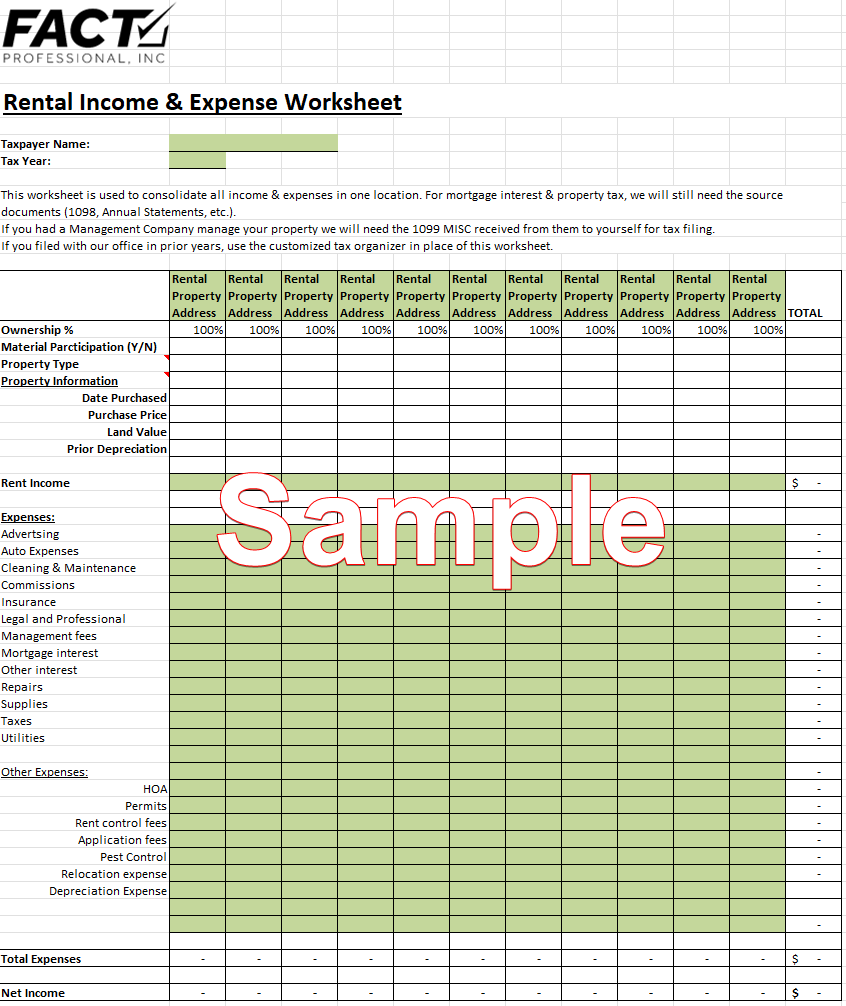

Schedule E Rental Income Calculation Worksheet Based on the usage of the property ies complete your rental analysis using Schedule E Lease Agreement or alternate or Form 8825 as required by your investor For Schedule E Traditional Method complete rows 15 18 amp 22

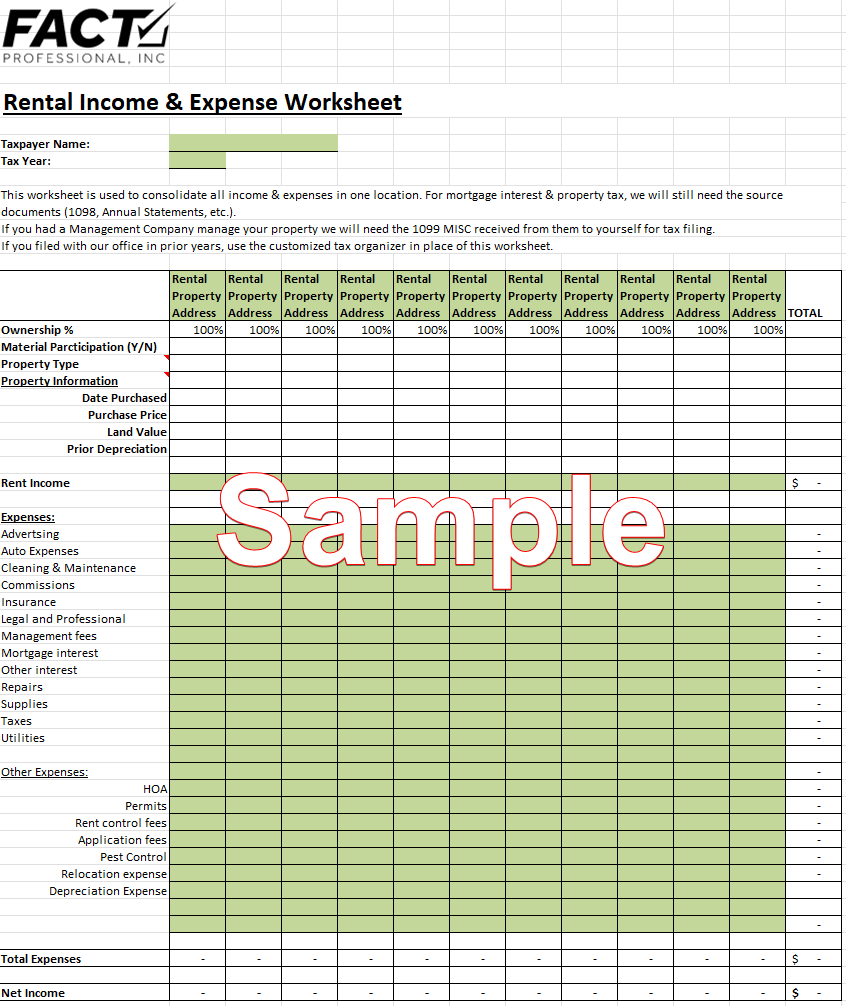

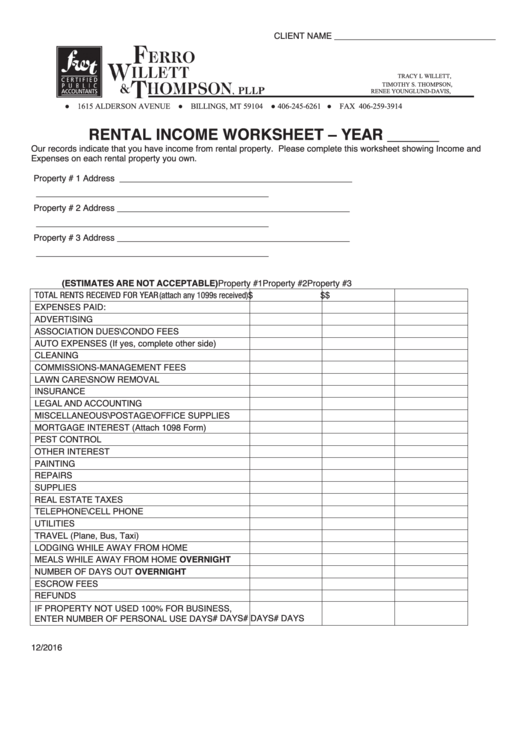

I certify that I have listed all income all expenses and I have documentation to prove the figures entered on this worksheet for preparation of my income tax return Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines

Schedule E Rental Income Calculation Worksheet

Schedule E Rental Income Calculation Worksheet

Schedule E Rental Income Calculation Worksheet

https://factprofessional.com/wp-content/uploads/2022/08/image.png

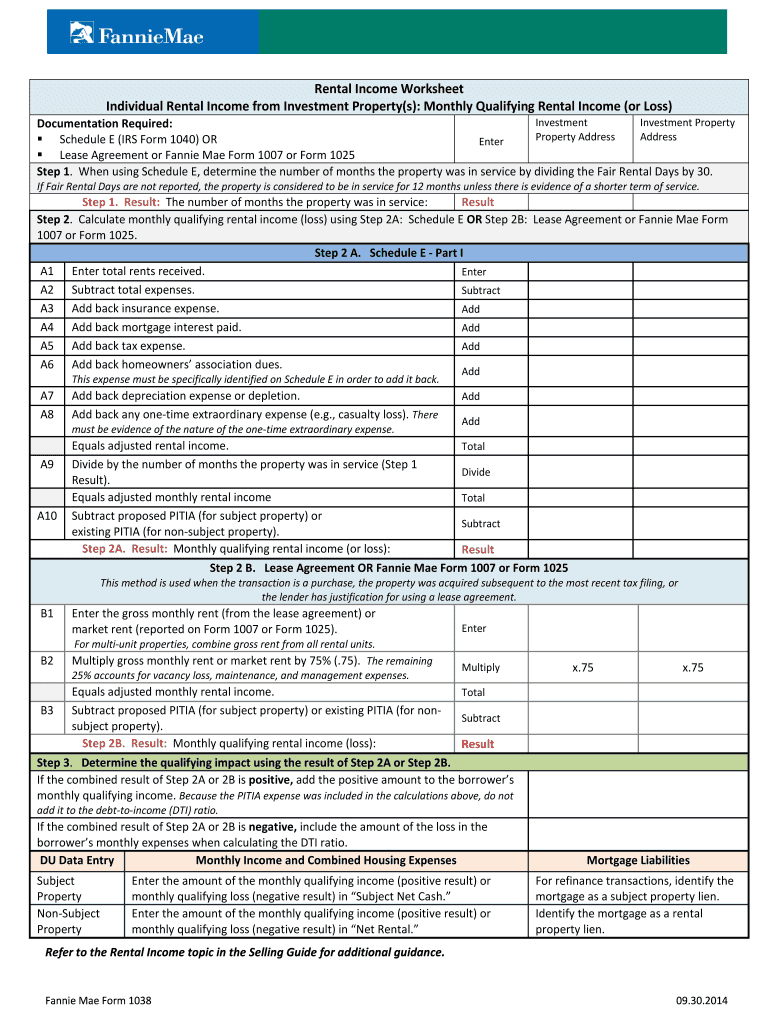

Fannie Mae Rental Guide Calculator 1038 Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 Individual Rental Income from Investment Property s up to 4 properties

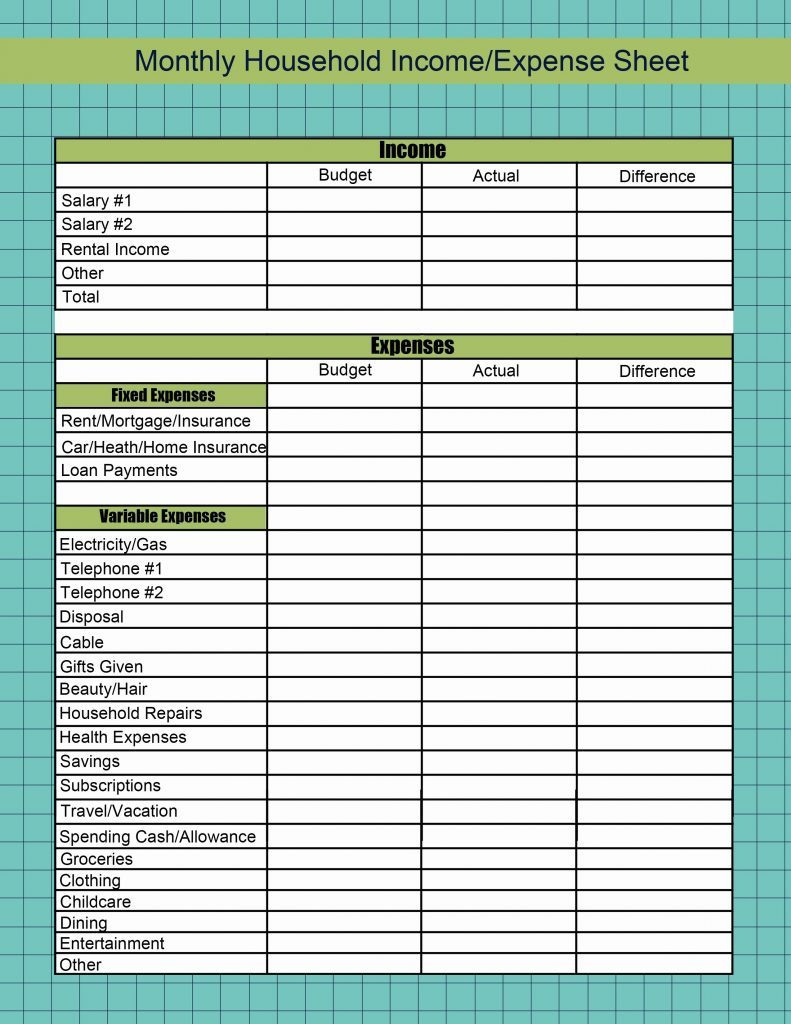

Pre-crafted templates use a time-saving service for producing a varied range of documents and files. These pre-designed formats and designs can be utilized for numerous personal and expert projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material creation process.

Schedule E Rental Income Calculation Worksheet

Fannie Mae Rental Income Calc Worksheet

Schedule E Rental Income Worksheet

Fannie Mae Rental Income Calc Worksheet

Schedule E Rental Income Worksheet

Business Income Calculation Worksheets

Schedule E Worksheet 2023

https://www.essent.us//income-analysis-tools

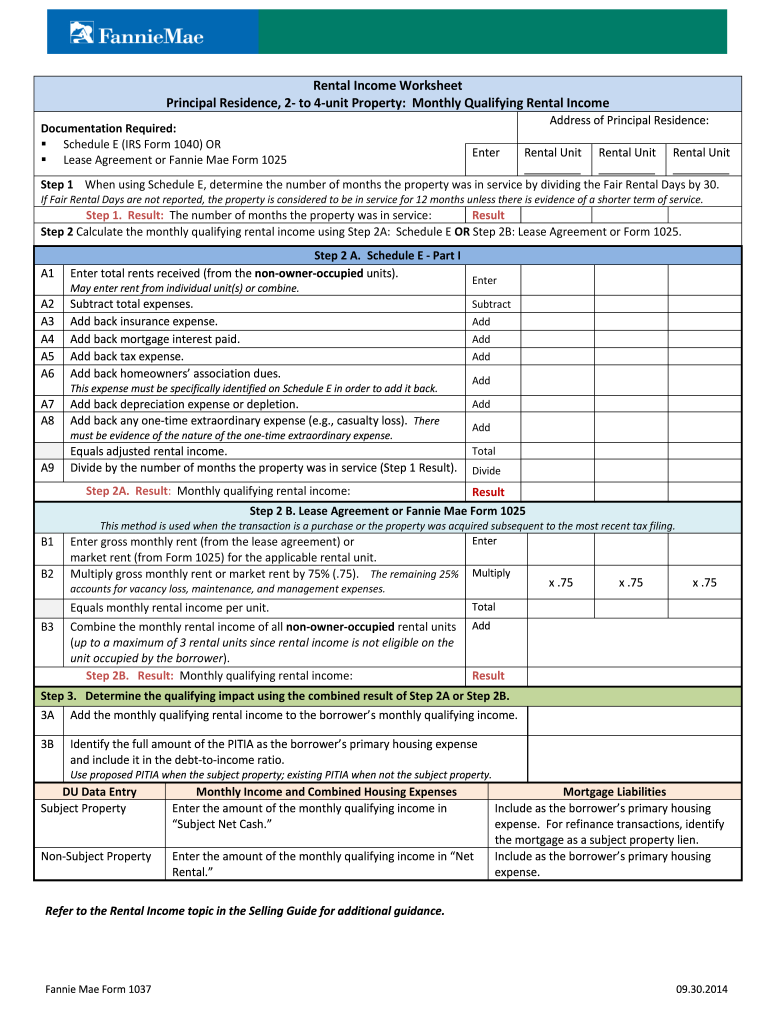

Rental Property Primary Schedule E Determine the average monthly income loss for a 2 4 unit owner occupied property

https://content.enactmi.com/documents/calculators/

Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 2 A Schedule E Part I

https://www.irs.gov/instructions/i1040se

Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in REMICs You can attach your own schedule s to report income or loss from any of

https://content.enactmi.com/documents/calculators/

Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines

https://www-stage.essent.us/sites/default/files/

For a 2 4 unit primary residence the FULL amount of the mortgage payment MUST be included in the borrower s monthly housing obligation when calculating the debt to income ratios

This form is a tool to help the Seller calculate the net rental income from Schedule E the Seller s calculations must be based on the requirements and guidance for the determination of stable monthly income in Guide Chapter 5306 Assume 12 months of rental income expenses for each tax year unless other documentation i e HUD 1 proving date of property acquisition has been provided If the Average Monthly figure is Income Positive include it in the borrower s monthly qualifying income

Assume 12 months of rental income expenses for each tax year unless other documentation i e Closing Disclosure proving date of property acquisition has been provided If the average monthly figure is positive include it in the borrower s monthly qualifying income