Sec 1031 Exchange Worksheet Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return If you completed more than one exchange a

These instructions and the use of the enclosed worksheet help exchangers confirm that the other programs are not asking you to pay more taxes If there is a This tax worksheet examines the disposal of an asset and the acquisition of a replacement like kind asset while postponing or deferring the gain from the

Sec 1031 Exchange Worksheet

Sec 1031 Exchange Worksheet

Sec 1031 Exchange Worksheet

https://www.adventuresincre.com/wp-content/uploads/2018/01/1031.jpg

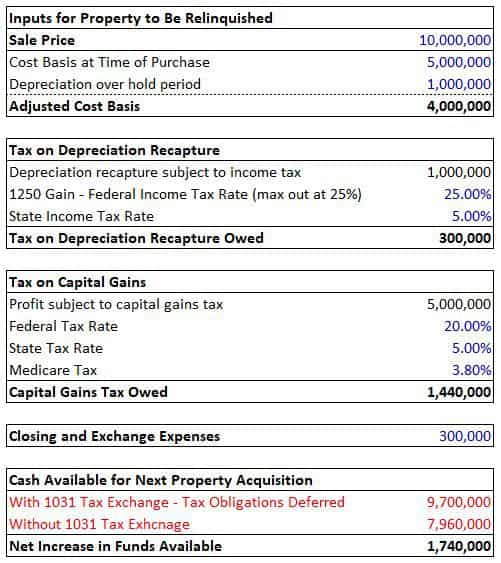

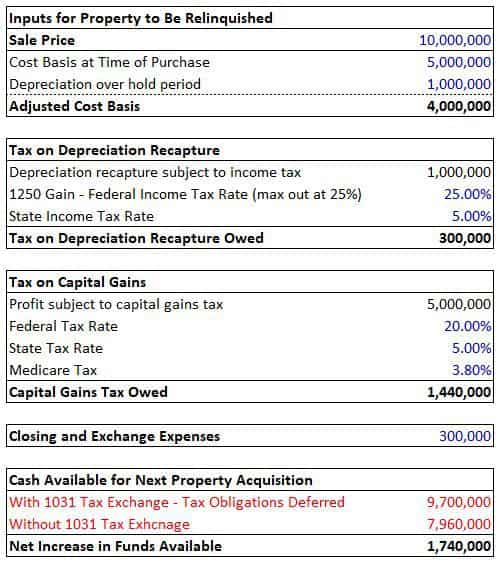

Download the free like kind exchange worksheet This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property

Templates are pre-designed documents or files that can be used for various functions. They can save effort and time by providing a ready-made format and layout for producing various kinds of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Sec 1031 Exchange Worksheet

TAXPAK™ GuideBook 2017 Reporting Your 1031 Exchange

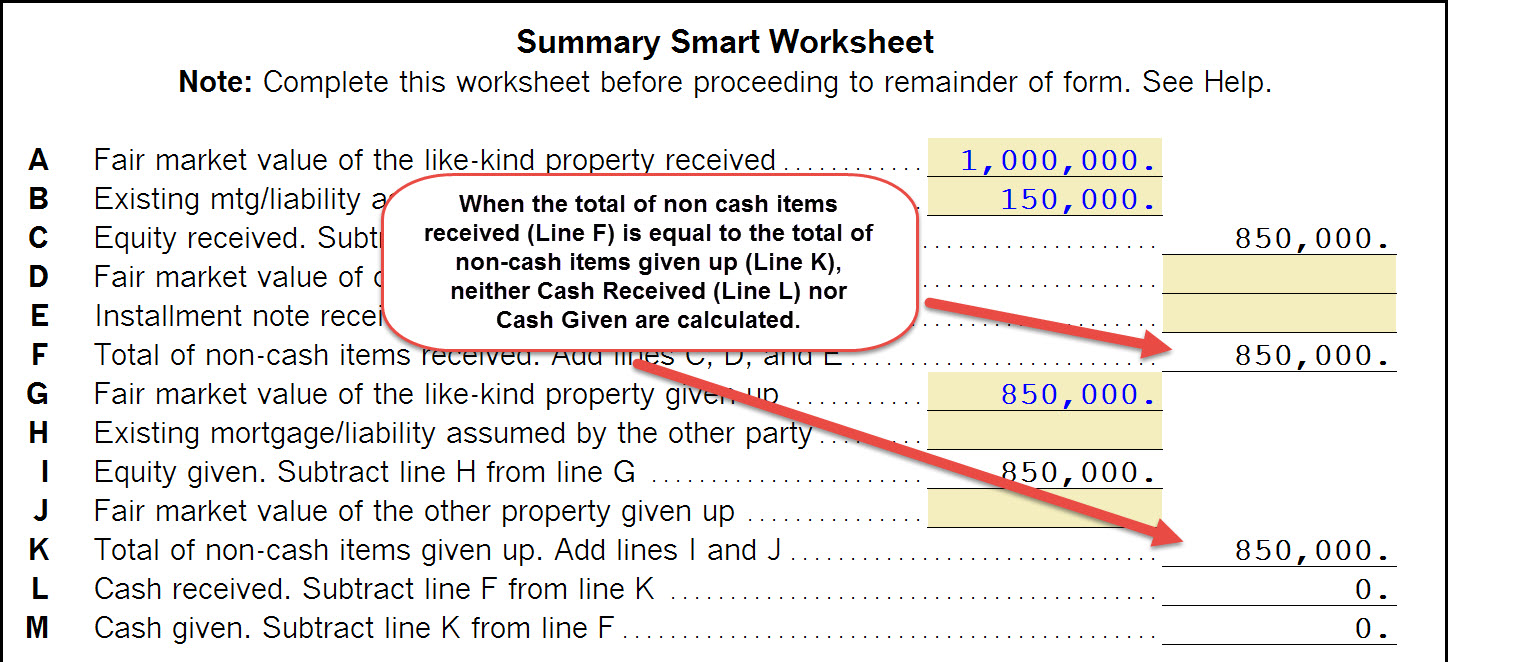

Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) - Adventures in CRE

Completing a like-kind exchange in the 1040 return

Excel 1031 Property Exchange

TAXPAK™ GuideBook 2018 Reporting Your 1031 Exchange

http://static.fmgsuite.com/media/documents/19cce23c-2bd4-4159-855b-a33f698992de.pdf

LIKE KIND EXCHANGE WORKSHEET A Realized Gain 1 FMV of all property Loss on non like kind property Section C line 2 7 Add lines 4 5 and 6 8

https://www.expert1031.com/sites/default/files/worksheets2017.pdf

Download fresh worksheets from 1031TaxPak Page 3 WorkSheet 2 Calculation of Exchange Expenses HUD 1 Line A Exchange expenses from sale of Old

https://www.irs.gov/pub/irs-pdf/f8824.pdf

Form 8824 Department of the Treasury Internal Revenue Service Like Kind Exchanges and section 1043 conflict of interest sales Attach to your tax return

http://www.1031.us/PDF/Form8824Instructions2005.pdf

The cash down payment was 370 000 and exchange expenses were 5 000 Page 4 The Worksheet is broken down into four steps as follows STEP 1 IT IS

https://www.uslegalforms.com/form-library/87804-1031-exchange-worksheet-2019-2020

Complete 1031 Exchange Worksheet 2019 2020 2023 online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your

Multiply by a capital tax rate of 15 assuming you are an individual taxpayer who held property at least 12 months We are using 15 to estimate the capital In the United States of America individuals and corporations pay U S federal income tax on Section 1031 exchange If a business sells property but uses the

The taxable amount of the transaction If there is no 1031 exchange it is the difference between the net sales price and the adjusted cost basis If a 1031