Section 1061 Worksheet A a Computations 1 Recharacterization Amount The Recharacterization Amount is the amount that an Owner Taxpayer must treat as short term capital gain

Section 1061 changes the holding period requirement for long term capital gains attributable to an applicable partnership interest from one Section 1061 An owner taxpayer must complete Worksheet B and Tables 1 and 2 of the Owner Taxpayer Reporting of Recharacterization Amount

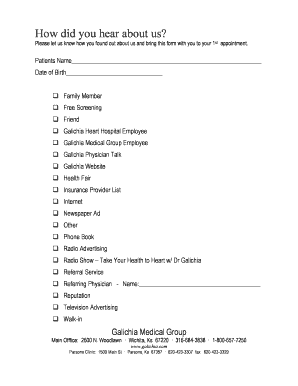

Section 1061 Worksheet A

Section 1061 Worksheet A

Section 1061 Worksheet A

https://www.pdffiller.com/preview/331/252/331252060.png

Section 1061 recharacterizes certain long term capital gains of a partner that holds one or more applicable partnership interests as short term capital gains

Pre-crafted templates provide a time-saving solution for developing a diverse series of documents and files. These pre-designed formats and designs can be made use of for numerous individual and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, streamlining the material development procedure.

Section 1061 Worksheet A

AICPA Comments on Section 1061 Reporting Guidance Frequently Asked Questions (FAQs)

If You Received Carried Interests, Profits Interest or a Promote – You Are Subject to a 3-Year Holding Rule - Aprio

ProSystem fx Tax customers: Migrating to the cloud might be your next smart move - YouTube

New Section 1061 reporting guidance for passthrough entities: PwC

If You Received Carried Interests, Profits Interest or a Promote – You Are Subject to a 3-Year Holding Rule - Aprio

New Reporting Requirements for Pass-Through Entities – KatzAbosch

https://www.irs.gov/businesses/partnerships/section-1061-reporting-guidance-faqs

For taxable years beginning after December 31 2017 section 1061 recharacterizes certain net long term capital gains of a partner that holds

https://www.pwc.com/us/en/services/tax/library/new-section-1061-reporting-guidance-for-passthrough-entities.html

The FAQs contain sample worksheets the Worksheets for passthrough entities hereinafter referred to as partnerships to attach to each

https://www.cbiz.com/insights/articles/article-details/new-section-1061-reporting-guidance-affects-private-equity-and-venture-capital

Section 1061 Worksheet A reports information pertaining to the API One Year Distributive Share Amount and API Three Year Distributive

https://taxnews.ey.com/news/2021-2043-irs-issues-faqs-for-pass-through-entities-and-owner-taxpayers-on-filing-and-reporting-carried-interests

The FAQs include worksheets and tables that pass through entities and owner taxpayers must use for years to which the final IRC Section 1061

https://us.aicpa.org/content/dam/aicpa/advocacy/tax/downloadabledocuments/56175896-aicpa-2021-section-1061-faq-comment-letter-final-12-23-21.pdf

Worksheet A Line 2 then adjusts for gains or losses not subject to section 1061 under Reg 1 1061 4 b 7 including section 1231 gains

Section 1061 a applies to a taxpayer s net long term capital gain with respect to one or more APIs held during the taxable year The Background on IRC 1061 Code Section 1061 limits the ability of investment managers that hold carried interests i e profits interests

Worksheet A Line 1 requires a partnership to report the net long term capital gain or loss from Schedule K 1 Line 9 a The letter further