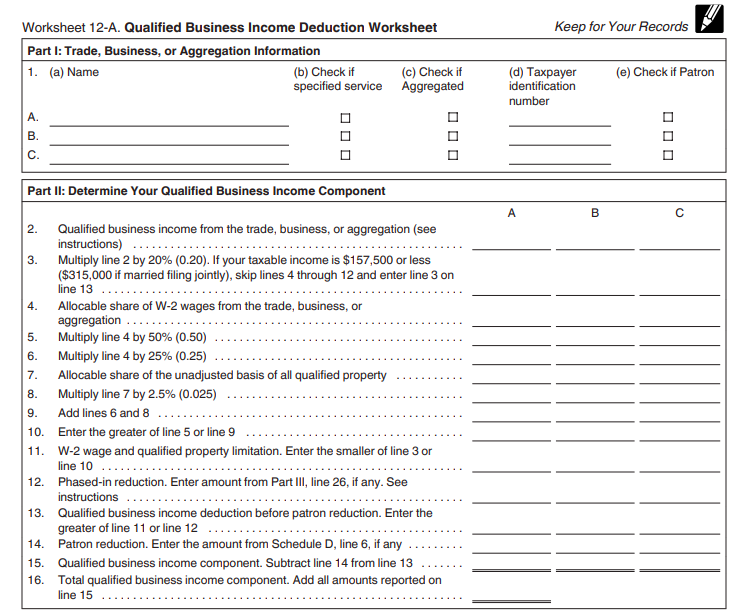

Section 199a Information Worksheet Information for computing the qualified business income deduction The Form 1040 Instructions and Publication 535 provide worksheets to

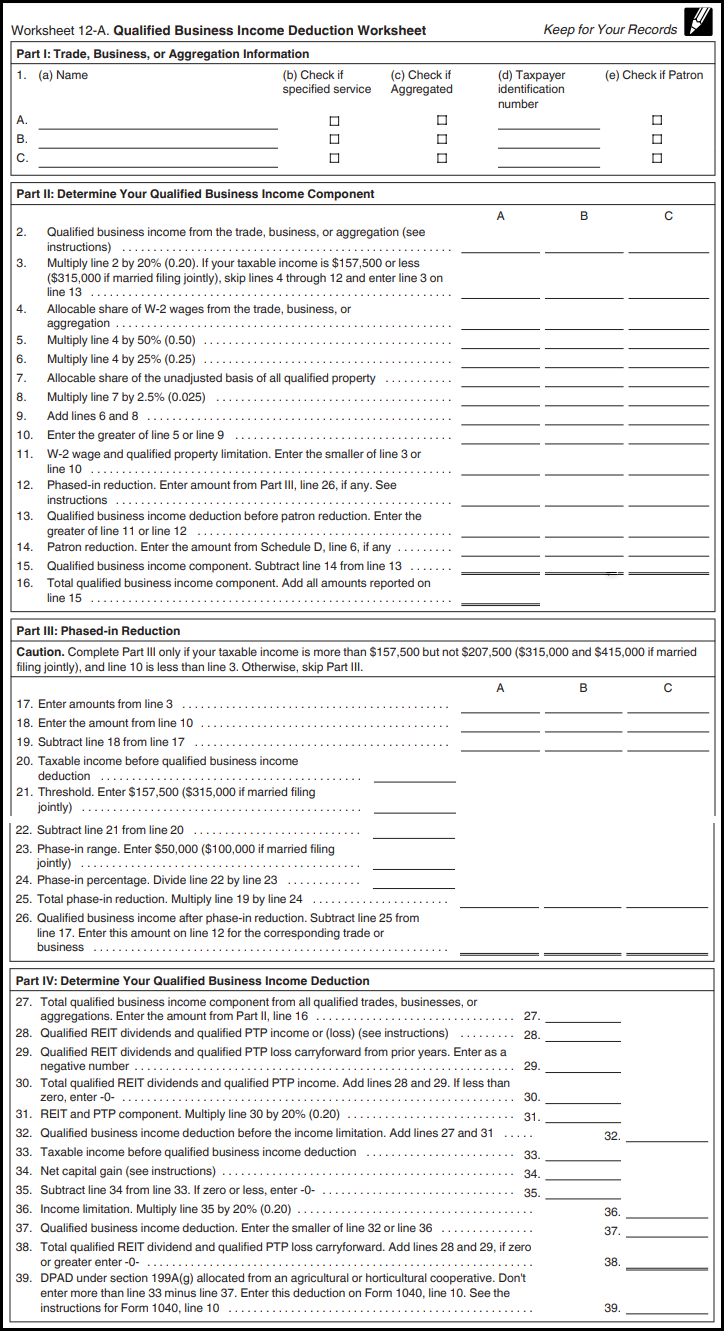

IRC Section 199A allows individuals trusts and estates with pass through business income to deduct up to 20 of their qualified business Section 199A information Generally you may be allowed a deduction of up to 20 of your net qualified business income QBI plus 20 of your qualified REIT

Section 199a Information Worksheet

Section 199a Information Worksheet

Section 199a Information Worksheet

https://digitalasset.intuit.com/IMAGE/A7aD50kda/PCG-PS-L4QuiQECJ-09.png

Code Z Section 199A information Generally you may be allowed a deduction of up to 20 of your net qualified business income QBI plus 20 of

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve time and effort by providing a ready-made format and design for developing various kinds of content. Templates can be used for individual or expert tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Section 199a Information Worksheet

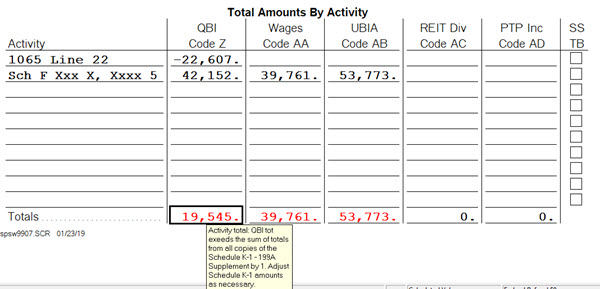

How to resolve an activity total error on the 199A Supplemental Worksheet

Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018

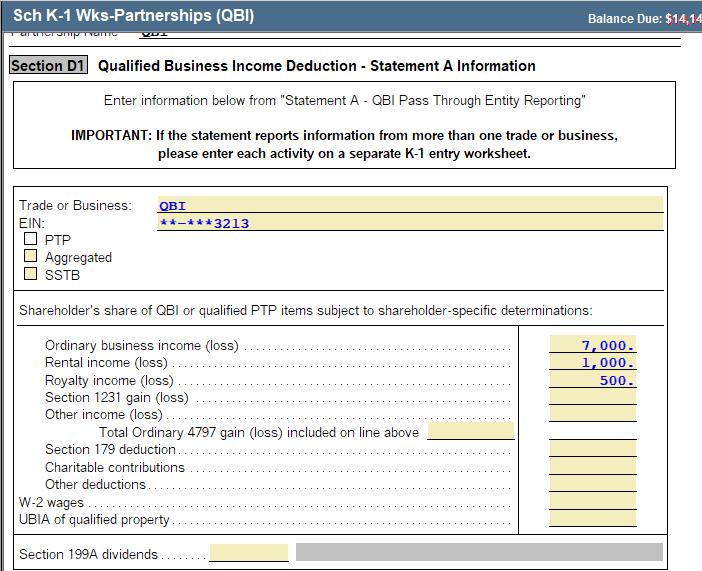

QBI Deduction - Frequently Asked Questions (K1, QBI, ScheduleC, ScheduleE, ScheduleF, W2)

Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018

Instructions for Form 8995 (2022) | Internal Revenue Service

Solved: K-1 Schedule: Need Help re: entering QBI data for Box 14-I

https://support.cch.com/kb/solution/000094988/

This video shows how to prepare the Qualified Business Income Deduction or QBID Section 199A worksheets in a 1040 return using interview

https://www.irs.gov/pub/irs-pdf/f8995a.pdf

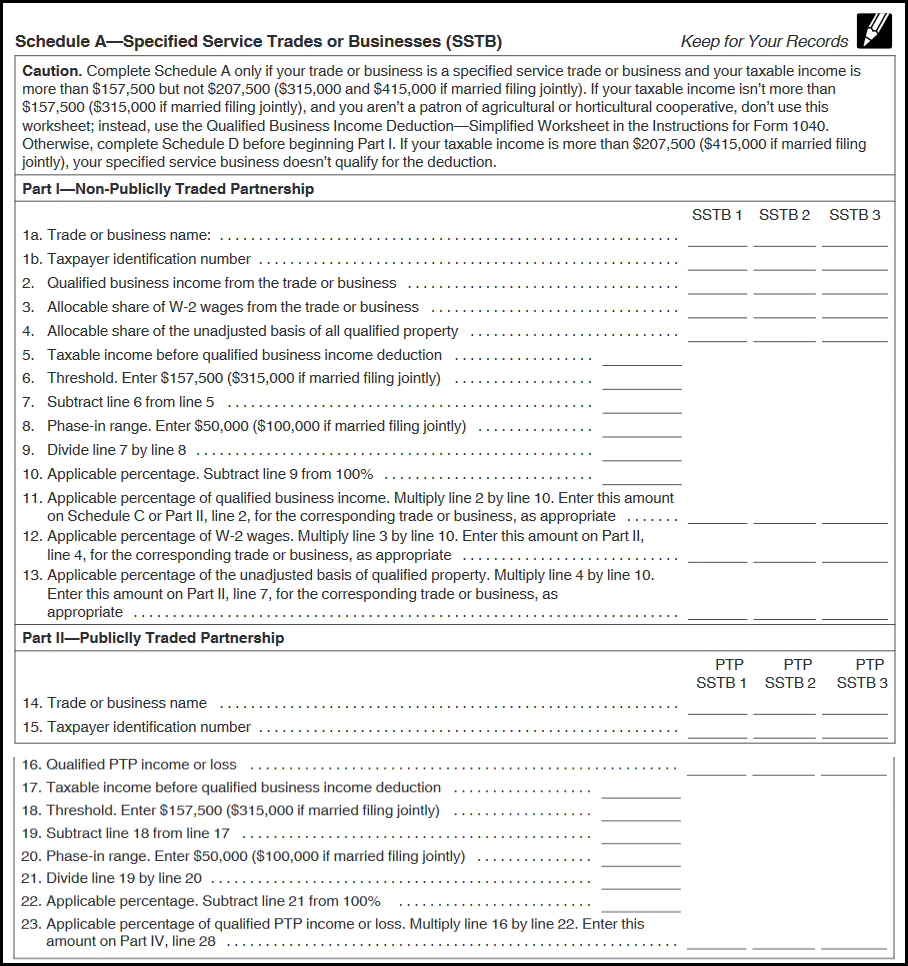

Complete Schedules A B and or C Form 8995 A as applicable before starting Part I Attach additional worksheets when needed See instructions 1 a Trade

https://cs.thomsonreuters.com/ua/ut/cs_us_en/utwapp/kb/1065-qualified-business-income-deduction-calculations-and-troubleshooting.htm

Partnership s Section 199A Information Worksheet This worksheet lists each activity s qualified business income Section 1231 gain loss Section 179

https://proconnect.intuit.com/support/en-us/help-article/business-tax-credits-deductions/enter-calculate-qualified-business-income-section/L4QuiQECJ_US_en_US

Scroll down to Section D2 Qualified Business Income Deduction Info A QBI worksheet will automatically generate but if you are aggregating this

https://cs.thomsonreuters.com/ua/ut/cs_us_en/cus/shr/qbi_overview.htm

The Section 199A Information Worksheet includes columns for multiple activities You may mark more than one unit of Screen QBI in the Income Deductions folder

Line 20Z Section 199 Information Amounts reported in Box 20 Code Z Section 199A income This is the Qualified Business Income QBI File name 2022 sec 199a flowchart pdf Download 945 6 KB Download the information on your browser mostly in the form of cookies This

Part I Trade Business or Aggregation Information 1 a Name b DPAD under section 199A g allocated from an agricultural or horticultural cooperative