Self Employed Tax Deductions Worksheet 15 Calculate the deduction using the Self Employed Health Insurance Deduction Worksheet in IRS Publication 535 16 5 Meals Deduction A meal is a tax

Self Employment Tax Deductions Worksheets PDF Schedule C self employed business expenses worksheet for single member LLC and sole List of the top self employed tax deductions Retirement self employment tax 1 Self employment tax How

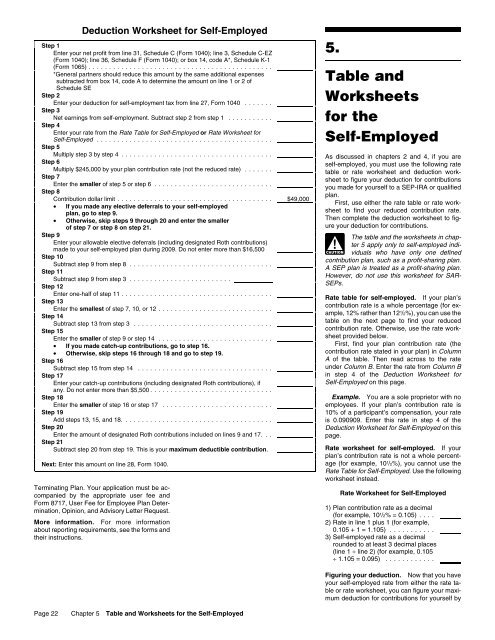

Self Employed Tax Deductions Worksheet

Self Employed Tax Deductions Worksheet

Self Employed Tax Deductions Worksheet

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Income and Expense Tracking Worksheet Download a simple printable income and expense tracking worksheet or customize and edit it using Excel or Google Sheets

Templates are pre-designed files or files that can be used for various functions. They can conserve effort and time by providing a ready-made format and design for producing different sort of content. Templates can be utilized for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Self Employed Tax Deductions Worksheet

Nurse Tax Deduction Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax worksheet realtors: Fill out & sign online | DocHub

Tax Deduction Log Printable Tax Purchase Record Tax - Etsy

Tax Deduction Worksheet | Small business tax deductions, Small business tax, Business tax deductions

Small Business Tax Spreadsheet | Business worksheet, Small business tax deductions, Small business expenses

Hair stylist tax deduction worksheet: Fill out & sign online | DocHub

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

If you are concerned with how much you ll owe don t worry The team at Bonsai organized this self employed tax deductions worksheet copy and

https://www.demoretaxservice.com/files/109128408.pdf

Tax Worksheet for Self employed Independent contractors Sole proprietors Single LLC LLCs 1099 MISC with box 7 income listed Try your best to fill this

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

If you estimated your earnings too low again complete another Form 1040 ES worksheet to recalculate your estimated taxes for the next quarter

https://portal.clientwhys.com/sites/32975rose/selfemployedand1099worksheet.pdf

Tax Worksheet for self employed independent contractors sole proprietors single member LLCs people who received a 1099 NEC or 1099 K

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

SELF EMPLOYED INDIVIDUAL DEDUCTIONS Debbie s Accounting Service 3575 income tax return is accurate and true to the best of my knowledge Signature The purpose of the Self employment Worksheet is to provide a method of computing income for individuals You cannot deduct the value of equipment such as

Small Business Self Employed 1099 Income Schedule C Worksheet Send last year s Schedule C or tax Do you have evidence to support the deduction Y N