Self Employment Tax And Deduction Worksheet Line 6 Your self 173 employment tax deduction on line 27 of Form 1040 is 9 504 See the filled 173 in por 173 tions of both Schedule SE Form 1040 Self 173 Employment Income and Form 1040 later You figure your self 173 employed rate and max 173 imum deduction for employer contributions you

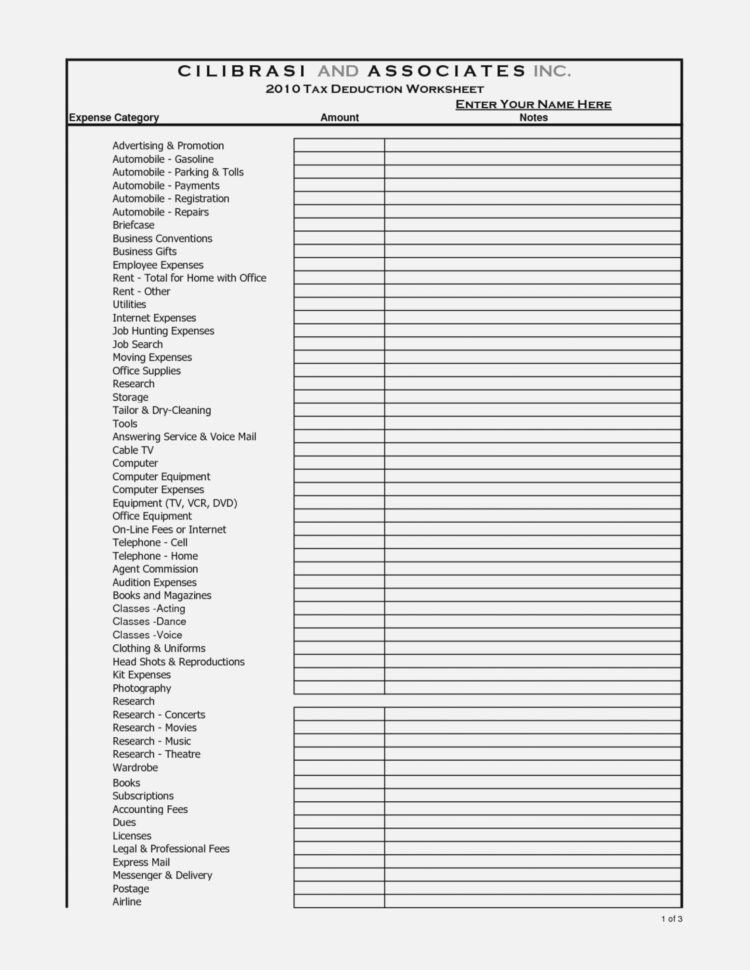

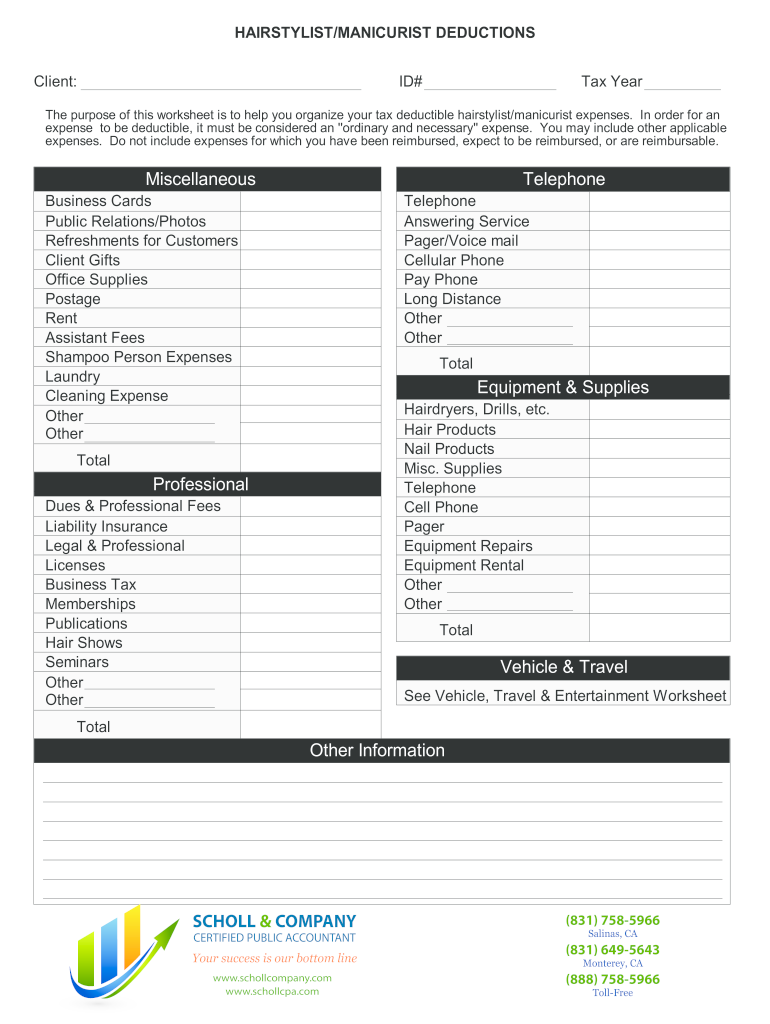

Feb 26 2024 0183 32 Self employed individuals you should complete the 2024 Self Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Tax Worksheet to figure the amount of self employment taxes to subtract when figuring your expected AGI Jan 24 2023 0183 32 Want a handy worksheet to help you organize your self employment tax deductions Here s several I found on the Internet De More Tax Service Deductions Worksheet PDF

Self Employment Tax And Deduction Worksheet Line 6

Self Employment Tax And Deduction Worksheet Line 6

Self Employment Tax And Deduction Worksheet Line 6

https://briefencounters.ca/wp-content/uploads/2018/11/2017-self-employment-tax-and-deduction-worksheet-also-internal-revenue-bulletin-2017-26-of-2017-self-employment-tax-and-deduction-worksheet-745x1024.gif

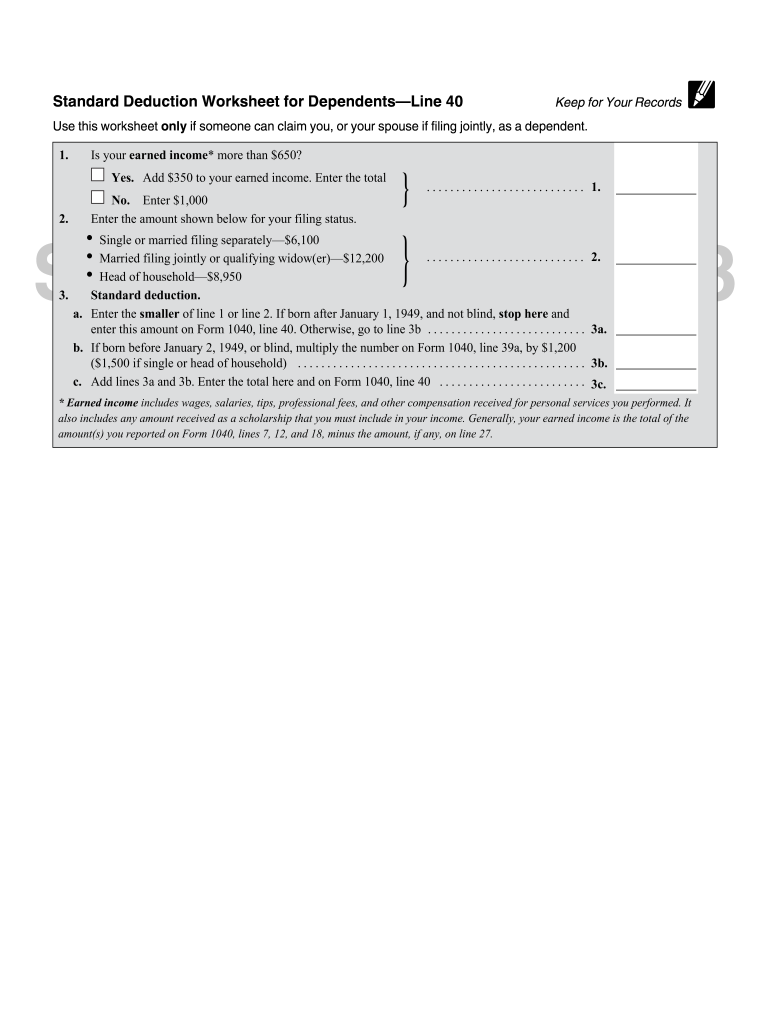

Step 6 Multiply Line 5 by 5 for your self employment tax deduction Click the quot Back quot button on your browser to return to the Self Employment Tax Deduction Worksheet

Pre-crafted templates offer a time-saving option for developing a diverse series of files and files. These pre-designed formats and layouts can be made use of for different personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material development process.

Self Employment Tax And Deduction Worksheet Line 6

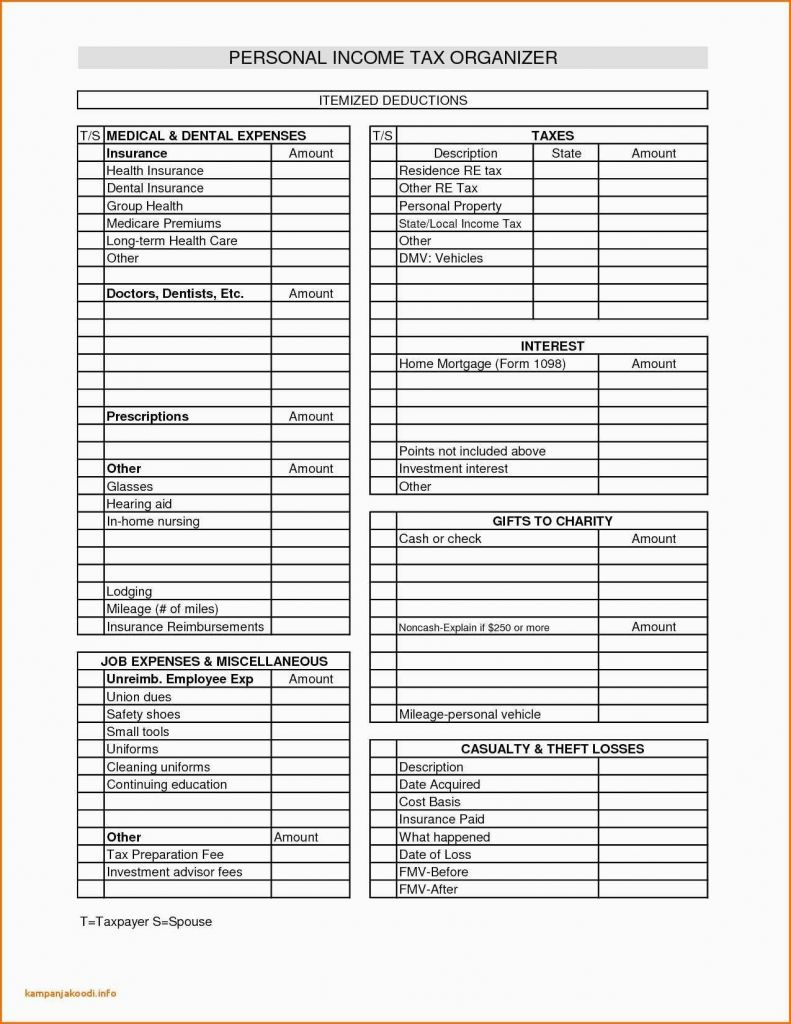

Itemized Deductions Worksheet Db excel

2016 Self Employment Tax And Deduction Worksheet Db excel

Instructions For Self Employment Tax And Deduction Worksheet

8 Tax Itemized Deduction Worksheet Worksheeto

10 2014 Itemized Deductions Worksheet Worksheeto

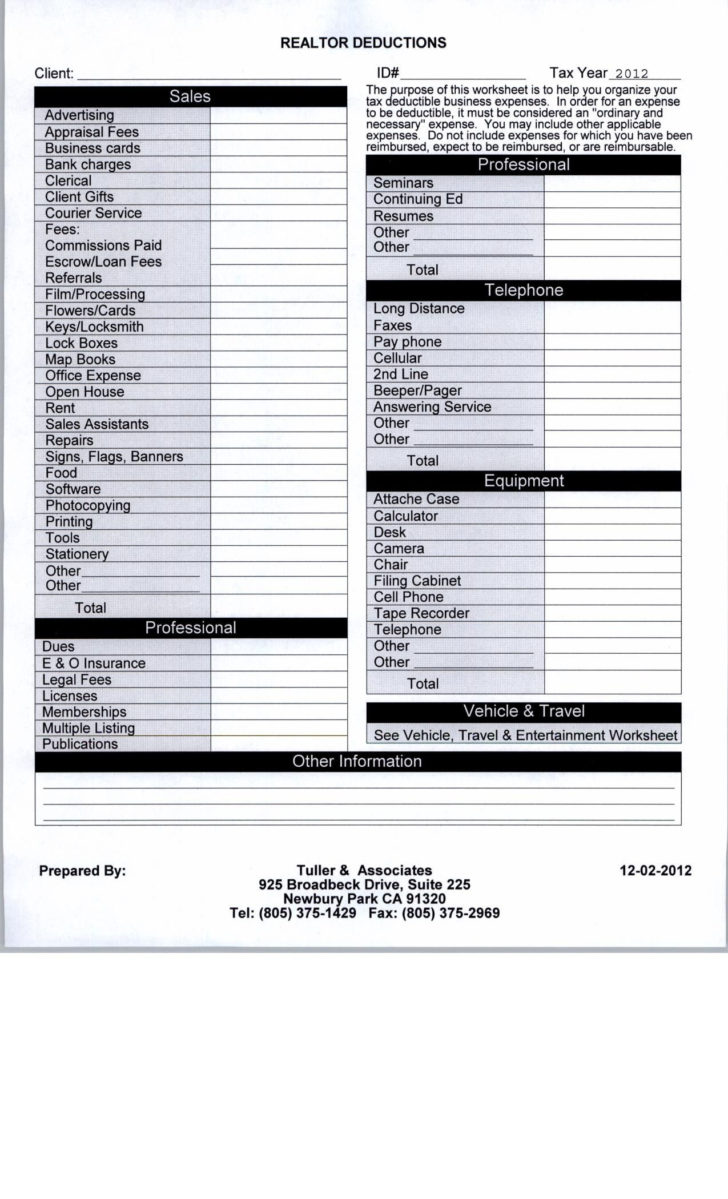

39 Realtor Tax Deduction Worksheet Worksheet Master

https://www.irs.gov › instructions

Use Schedule SE Form 1040 to figure the tax due on net earnings from self employment The Social Security Administration SSA uses the information from Schedule SE to figure your benefits under the social security program This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits

https://www.reddit.com › tax › comments › help

Dec 27 2023 0183 32 On the 2024 Self Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Tax Worksheet line 6 it asks for quot expected wages subject to social security tax quot Do I use the taxable wages from my wife s paycheck plus my expected net income

https://www.reddit.com › tax › comments

Jan 13 2020 0183 32 In the 2019 Self Employment Tax and Deduction Worksheet line 6 refers to quot your expected wages quot These refer to any W2 wages I earned in 2019 NOT my side hustle earnings quot expected income subject to self employment tax quot Line 1

https://www.reddit.com › personalfinance › comments ›

Jun 21 2014 0183 32 Line 6 Enter your expected wages if subject to social security tax or the 6 2 portion of tier 1 railroad retirement tax is used if the Taxpayer has income from wages in addition to income and profits from self employment

https://www.bench.co › blog › tax-tips › schedule-se

If you re self employed you have to pay self employment tax to the IRS And to do that you need to file Schedule SE How exactly does the IRS classify quot self employment quot income

Dec 18 2024 0183 32 Master the Schedule SE tax form and maximize your self employment tax savings Explore step by step instructions and valuable insights for self employed individuals Table and Worksheets for the Self Employed As discussed in chapters 2 and 4 if you are self employed you must use the following rate table or rate worksheet and deduction worksheet to figure your deduction for contributions you made for yourself to a SEP IRA or qualified plan

Feb 21 2024 0183 32 Since many taxpayers report self employment income within their own personal tax return the IRS applies this 7 65 deduction automatically to net self employed earnings before determining your