Shareholder Basis Worksheet Pdf Select Do NOT attach the IRS Worksheet for Figuring a Shareholder Stock and Debt Basis even though it may be required See Screen PDF and FAQ item GG for

So if I am understanding this correctly I am filing my K 1 form 1120s electronically and hanging on to my 7203 for my records and future This article refers to screen Shareholder s Adjusted Basis Worksheet in the 1120 S S corporation package The worksheet is available from screen K1E by

Shareholder Basis Worksheet Pdf

Shareholder Basis Worksheet Pdf

Shareholder Basis Worksheet Pdf

https://www.signnow.com/preview/456/348/456348215.png

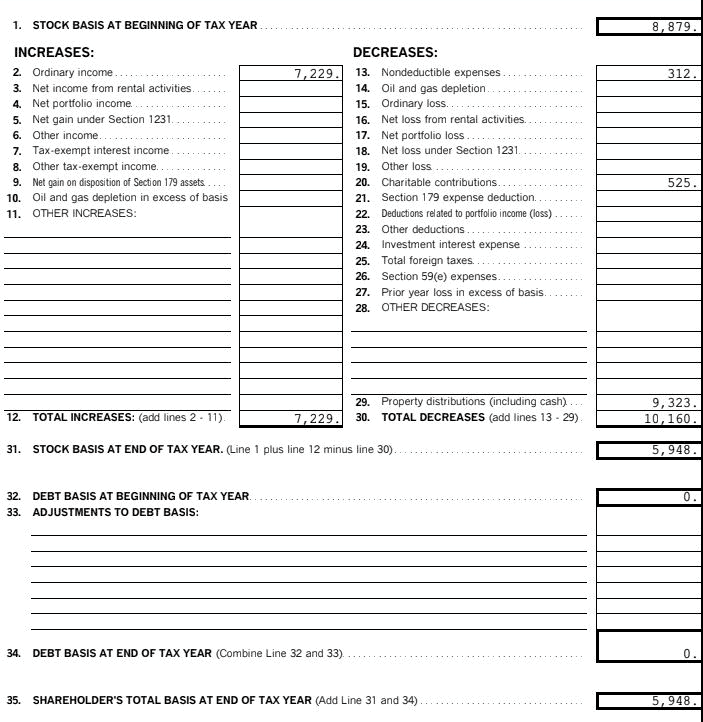

An S corp basis worksheet is used to compute a shareholder s basis in an S corporation

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and layout for producing different type of content. Templates can be utilized for personal or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Shareholder Basis Worksheet Pdf

LB&I Process Unit Knowledge Base – S Corporations

More Basis Disclosures This Year for S corporation Shareholders - Need to Complete New Form 7203 (to be Attached to 1040 Return) - Wegner CPAs

BASIS REPORTING REQUIRED FOR 2018 Draft Form Schedule E

Partnership Basis Calculation Worksheet Excel 2020-2023 - Fill and Sign Printable Template Online

IRS Expands Cases Where S Shareholder Must Attach Basis Computation and Adds Check Box to Schedule E — Current Federal Tax Developments

S-Corporation Shareholders May Need to File Form 7203

https://www.irs.gov/pub/irs-utl/2018ntf-s-corporation-shareholder-basis.pdf

Basis Worksheet to the Return Page 11 To compute basis you need to know 1 The shareholder s initial cost of the stock and additional paid in capital 2

https://irp-cdn.multiscreensite.com/f58c8f33/files/uploaded/S-Corp_Shareholder_Basis.pdf

Please see the last page of this article for a sample of a Shareholder s Basis Worksheet basis numbers that need to be tracked stock basis and debt basis

https://www.aicpa-cima.com/resources/download/s-corporation-shareholder-basis-schedule

Calculate an S corporation s shareholder s basis using this customizable template and keep track of your client s ownership in their S corporation stock

https://cs.thomsonreuters.com/ua/ut/cs_us_en/utwapp/kb/1040-us-elf-shareholders-basis-worksheets-and-net-operating-loss-worksheets.htm

There are certain worksheets calculations that the IRS will request to substantiate a calculation deduction Review Publication 536 Page 2 Tip to learn

https://www.dochub.com/fillable-form/114191-s-corp-shareholder-basis-worksheet-excel

Working on paperwork with our comprehensive and intuitive PDF editor is simple Follow the instructions below to complete S corp shareholder basis worksheet

The third example will show how the calculation will be done when there is income net Computation of shareholder basis adjusted stock basis adjusted debt Yet nestled within the musical pages of S Corp Shareholder Basis Worksheet Excel a charming perform of literary elegance that impulses with fresh feelings

While the TaxAct program does not support Form 7203 for 1040 returns we do support the ability to attach the shareholder s basis worksheet when required