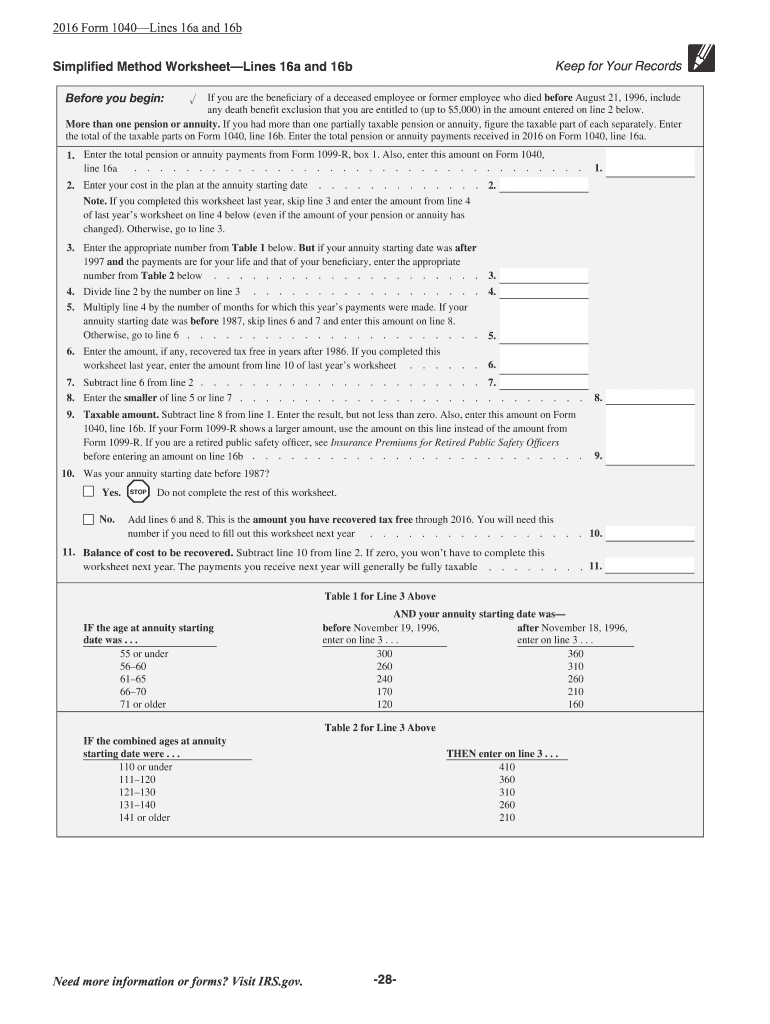

Simplified Method Worksheet 2021 The Simplified Method Worksheet helps you figure the taxable and tax free parts of your annuity payments each year Determining the taxable portion of an

The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section You need The simplified method allows you to figure the tax free part of each annuity payment If you made some after tax contributions divide your cost by the total

Simplified Method Worksheet 2021

Simplified Method Worksheet 2021

Simplified Method Worksheet 2021

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%203.jpg

Here is a link to the Simplified Method Worksheet for pensions and annuities from the IRS

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by providing a ready-made format and design for producing various kinds of content. Templates can be utilized for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Simplified Method Worksheet 2021

2017-2023 Form IRS 1040 Lines 16a and 16bFill Online, Printable, Fillable, Blank - pdfFiller

2017-2023 Form IRS 1040 Lines 16a and 16bFill Online, Printable, Fillable, Blank - pdfFiller

Simplified method worksheet 2018: Fill out & sign online | DocHub

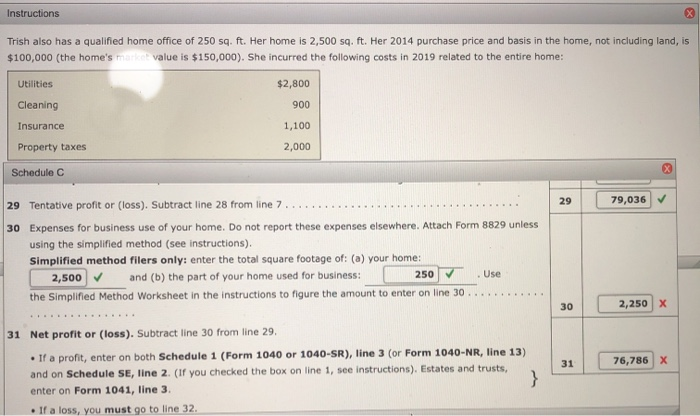

Simplified home office tax deduction pays off for some small businesses - Don't Mess With Taxes

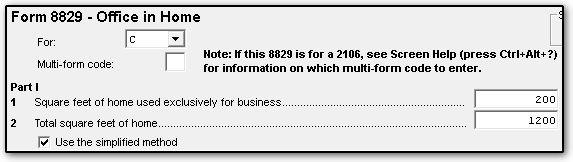

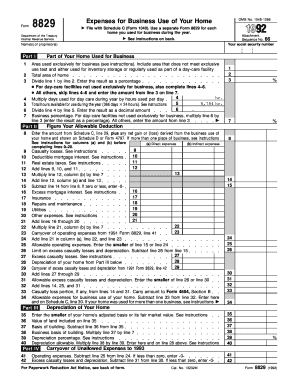

8829 - Simplified Method (ScheduleC, ScheduleF)

Solved What is the Simplified Method Worksheet in the | Chegg.com

https://www.irs.gov/taxtopics/tc411

Under the Simplified Method you figure the taxable and tax free parts of your annuity payments by completing the Simplified Method Worksheet in

https://www.freetaxusa.com/taxes2021/formdownload?sid=5&form=f_simplified_pension_wksht.pdf

Enter the total pension or annuity payments received in 2021 on Form 1040 or 1040 SR line 5a 1 1 2 2 Note If you completed this worksheet last year

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

The Simplified Method Worksheet can be found in Form 1040 1040 SR Instructions if Simplified Method Worksheet This is a guide on entering the Simplified

https://www.cchwebsites.com/content/taxguide/tools/pension_m.php

If you re receiving a pension that was entirely paid for by your employer the entire amount of your payments will be taxed and you don t need this tool But

https://www.ctcresources.com/uploads/3/1/6/2/31622795/using_the_simplified_method_to_determine_taxable_amount-82021.pdf

In the Calculate Taxable Amount screen click to open Simplified Method Worksheet 5 Click Con nue to access the Worksheet 6 Complete the worksheet onscreen

Simplified Method Note If Form 1099 R does show a taxable amount the taxpayer may be able to report a lower taxable amount by using the For years after January 2 2013 taxpayers may elect to use a simplified method instead of actual expenses when figuring the deduction for business use of

2021 uploaded Adv 7 1099 R Simplified Method 2021 uploaded Adv 7 1099 R Simplified Method 12 02 2021 03 50 2021 uploaded Adv 7 1099 R Simplified Method