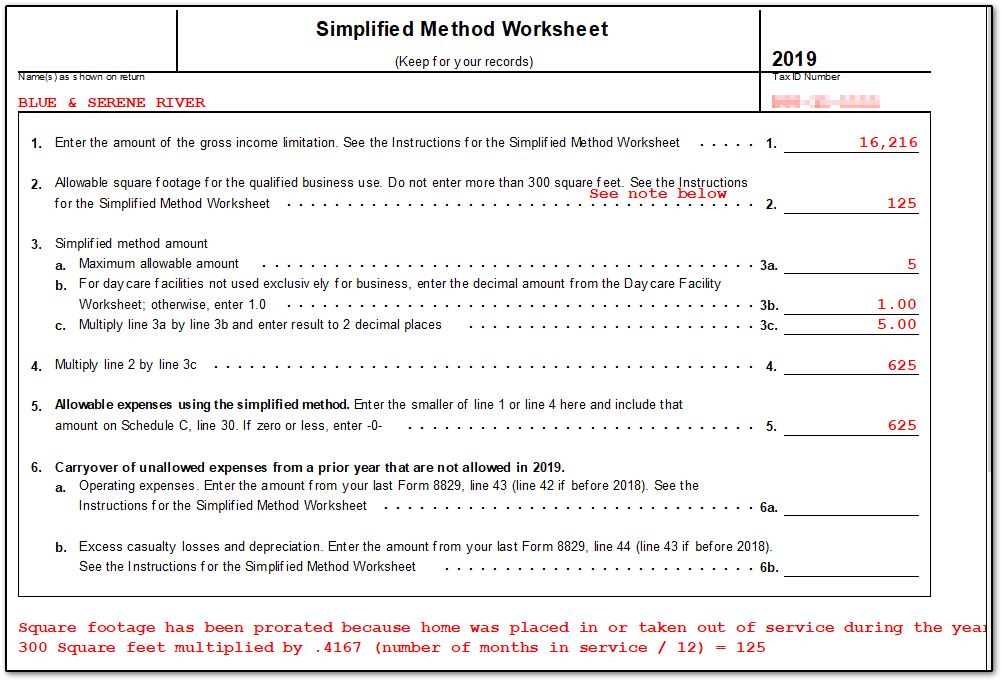

Simplified Method Worksheet Calculator The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section

The simplified method allows you to figure the tax free part of each annuity payment If you made some after tax contributions divide your cost by the total Use our online calculator to compute the tax free portion of your annuity You will find detailed information for disability and non disability retirees

Simplified Method Worksheet Calculator

Simplified Method Worksheet Calculator

Simplified Method Worksheet Calculator

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%205.jpg

Refund Calculator Stimulus Check Calculator Whitepapers Become a Simplified Method Note If Form 1099 R does show a taxable amount

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by supplying a ready-made format and design for creating different kinds of material. Templates can be used for individual or professional projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Simplified Method Worksheet Calculator

8829 Simplified Method Worksheet - Fill Out and Sign Printable PDF Template | signNow

Using Simplified Method to Calculate Retirement Taxes (2023)

8829 - Simplified Method (ScheduleC, ScheduleF)

Using Simplified Method to Calculate Retirement Taxes (2023)

Simplified Home Office Deduction Explained: Should I Use It?

Simplified Home Office Deduction Explained: Should I Use It?

https://www.irs.gov/taxtopics/tc411

Under the Simplified Method you figure the taxable and tax free parts of your annuity payments by completing the Simplified Method Worksheet in

https://apps.irs.gov/app/vita/content/globalmedia/simplified_method_worksheet_4012.pdf

If the taxable amount isn t calculated in Box 2 the Simplified Method must be used Hint If you use TaxSlayer s simplified method worksheet enter a note with

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

Should I use the Simplified Method Worksheet to figure my 1099 R s taxable amount You must use the General Rule explained in IRS Publication 939 to calculate

https://www.annuityexpertadvice.com/simplified-method-retirement-taxes/

The simplified method is a formula used to calculate the portion of your pension income subject to federal income taxes The formula considers your age the age

https://www.taxact.com/support/1368/2022/simplified-method-for-pensions-and-annuities

The Simplified Method Worksheet helps you figure the taxable and tax free parts of your annuity payments each year Determining the taxable portion of an

4 In the Calculate Taxable Amount screen click to open Simplified Method Worksheet 5 Click Con nue to access the Worksheet 6 Using assumptions described in the ANPRM noted below this calculator illustrates an annuitization approach This calculator uses a simplified computation

The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section You need