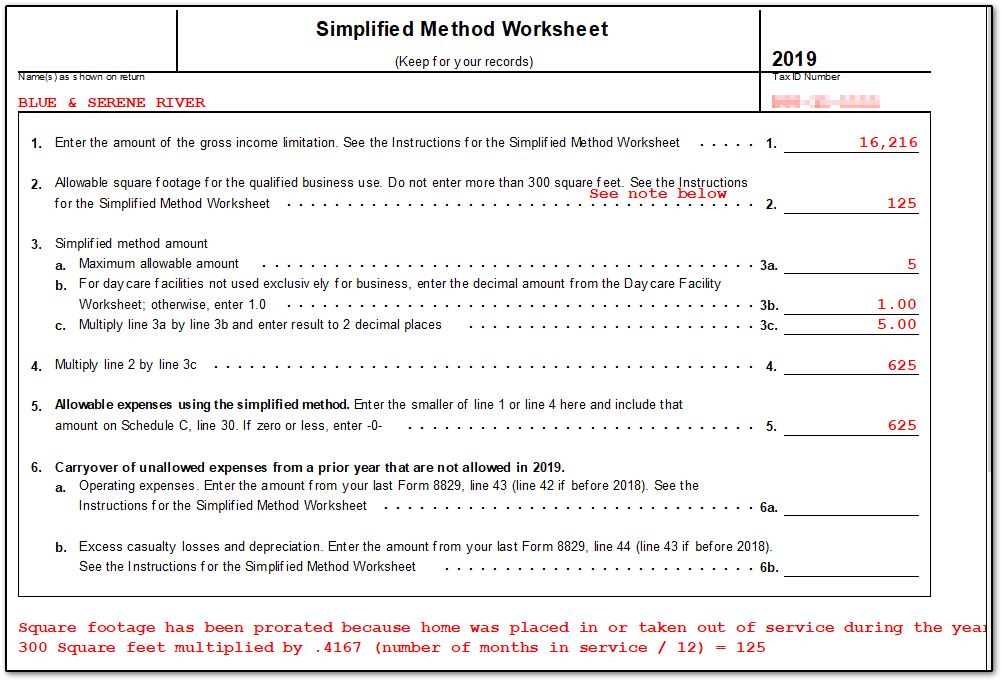

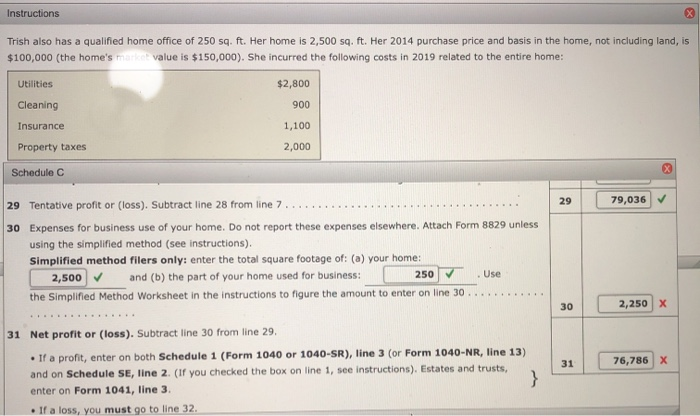

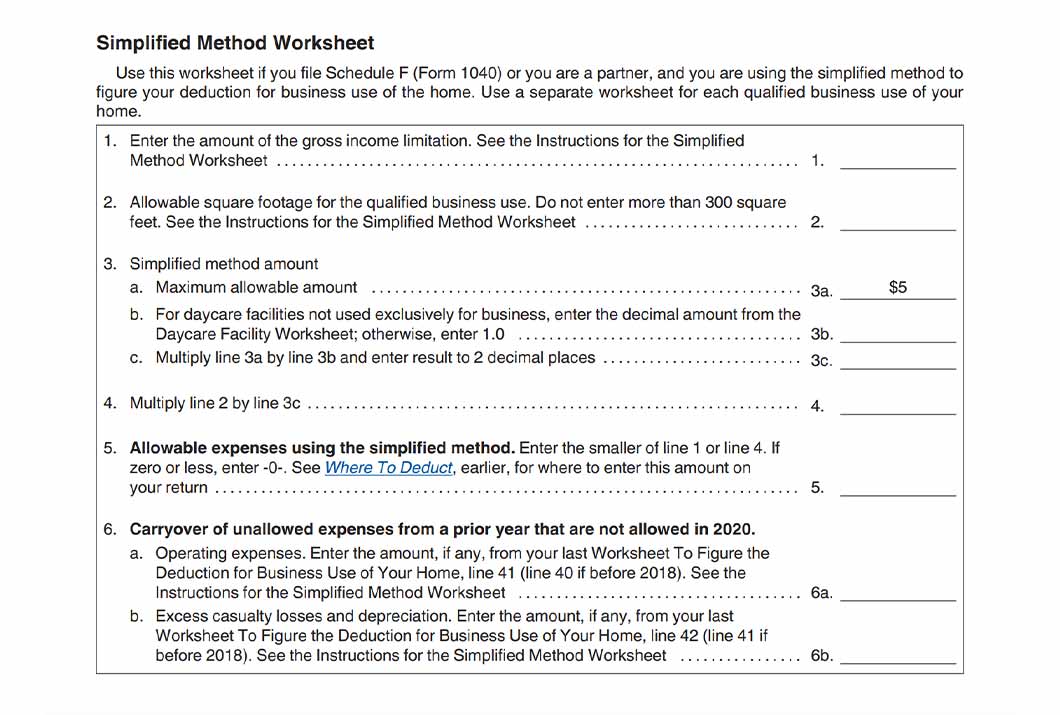

Simplified Method Worksheet Home Office The simplified method allows a standard deduction of 5 per square foot of home used for business with a maximum of 300 square feet Allowable home related

Using this optional method you simply deduct 5 for every square foot of your home office But the deduction is capped at 1 500 per year So it can only be Simplified Home Office Deduction Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable home related itemized

Simplified Method Worksheet Home Office

Simplified Method Worksheet Home Office

Simplified Method Worksheet Home Office

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%205.jpg

Simplified method Under the simplified safe harbor method the deduction is simply 5 00 for each square foot of the home office up to a maximum of 300

Pre-crafted templates provide a time-saving solution for developing a diverse variety of documents and files. These pre-designed formats and designs can be used for various personal and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content production procedure.

Simplified Method Worksheet Home Office

Simplified Method Worksheet 2018 - Fill Out and Sign Printable PDF Template | signNow

Simplified method worksheet 2018: Fill out & sign online | DocHub

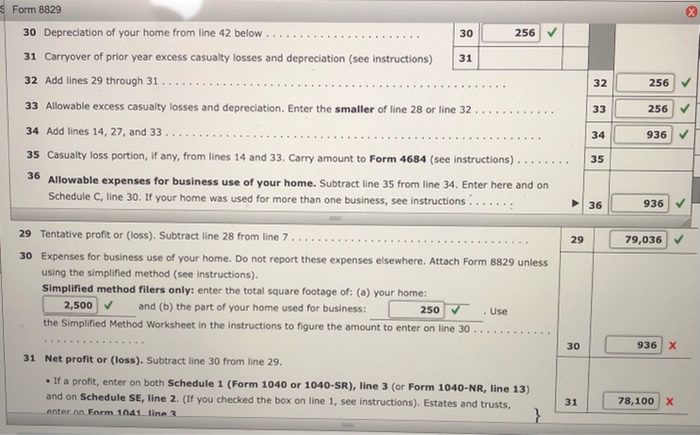

Solved What is the Simplified Method Worksheet in the | Chegg.com

Solved What is the Simplified Method Worksheet in the | Chegg.com

Home Office Tax Deduction: What to Know | Fast Capital 360®

Simplified Home Office Deduction Explained: Should I Use It?

https://www.irs.gov/businesses/small-businesses-self-employed/faqs-simplified-method-for-home-office-deduction

A No You cannot use the simplified method for a taxable year and deduct actual expenses related to the qualified business use of the home The

https://www.keepertax.com/posts/should-i-use-the-simplified-home-office-deduction

The standard rate used for the simplified method You get 5 for every square foot of your home office up to 1 500 That means that if your

https://support.taxslayerpro.com/hc/en-us/articles/360009297393-Simplified-Option-for-Home-Office-Deduction

You may use the simplified method when you file your tax return The rate is 5 per square foot of the part of your home used for business

https://kb.drakesoftware.com/Site/Browse/12513/8829-Simplified-Method

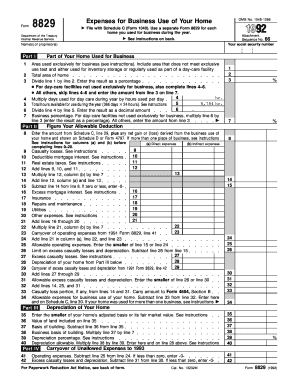

To elect the simplified method open the 8829 screen and select the applicable form or schedule in the For drop list Enter a Multi Form code if applicable

https://www.taxslayerpro.com/blog/post/many-home-based-businesses-can-use-simplified-method-for-claiming-home-office-deduction

The maximum value of the home office deduction using the simplified method is 1 500 per year This is based on a rate of 5 per square foot for

To use the simplified method just calculate the portion of your home that is exclusively used for business and multiply it by 5 When should I The maximum deduction that can be claimed using this method is 1 500 However you can t claim more than your gross income of your business that is

Use this worksheet to compute the amount of expenses the taxpayer may deduct for a qualified business use of a home if electing to use the simplified method for