Simplified Method Worksheet Schedule C The simplified method doesn t change the criteria for who may claim a home office deduction Follow these steps to select the simplified method Go to Screen 29

Edit sign and share 8829 simplified method worksheet online No need to install software just go to DocHub and sign up instantly and for free The deduction will calculate on the Simplified Home Office Worksheet in forms view in the 8829 folder between Schedule A and business schedule Sch C or Sch

Simplified Method Worksheet Schedule C

Simplified Method Worksheet Schedule C

Simplified Method Worksheet Schedule C

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%205.jpg

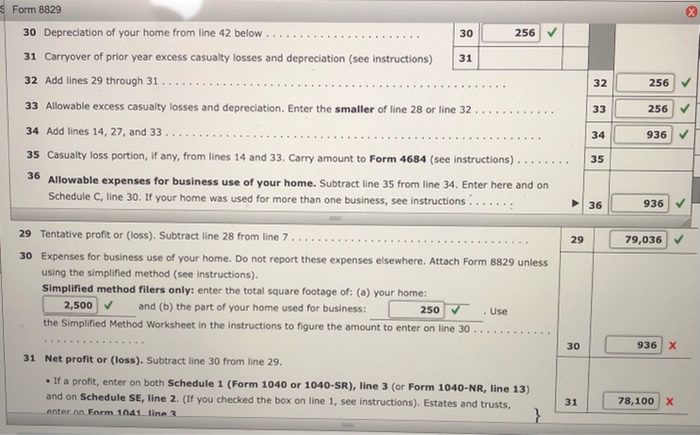

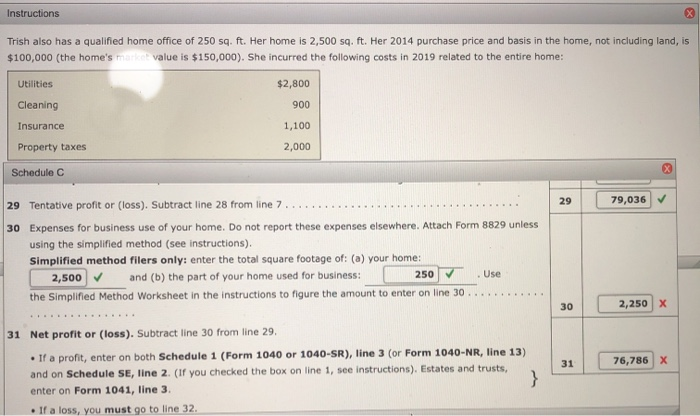

Simplified method filers enter the square footage of the home and the square footage of the part of the home used for business on Line 30 of Schedule C Then

Pre-crafted templates provide a time-saving option for developing a diverse series of files and files. These pre-designed formats and layouts can be made use of for numerous individual and professional projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, enhancing the content development process.

Simplified Method Worksheet Schedule C

8829 - Simplified Method (ScheduleC, ScheduleF)

Solved What is the Simplified Method Worksheet in the | Chegg.com

Solved What is the Simplified Method Worksheet in the | Chegg.com

Simplified home office tax deduction pays off for some small businesses - Don't Mess With Taxes

Form 1040 Schedule C Generator - ThePayStubs

Simplified Method Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

https://www.irs.gov/pub/irs-pdf/i1040sc.pdf

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor

https://kb.drakesoftware.com/Site/Browse/12513/8829-Simplified-Method

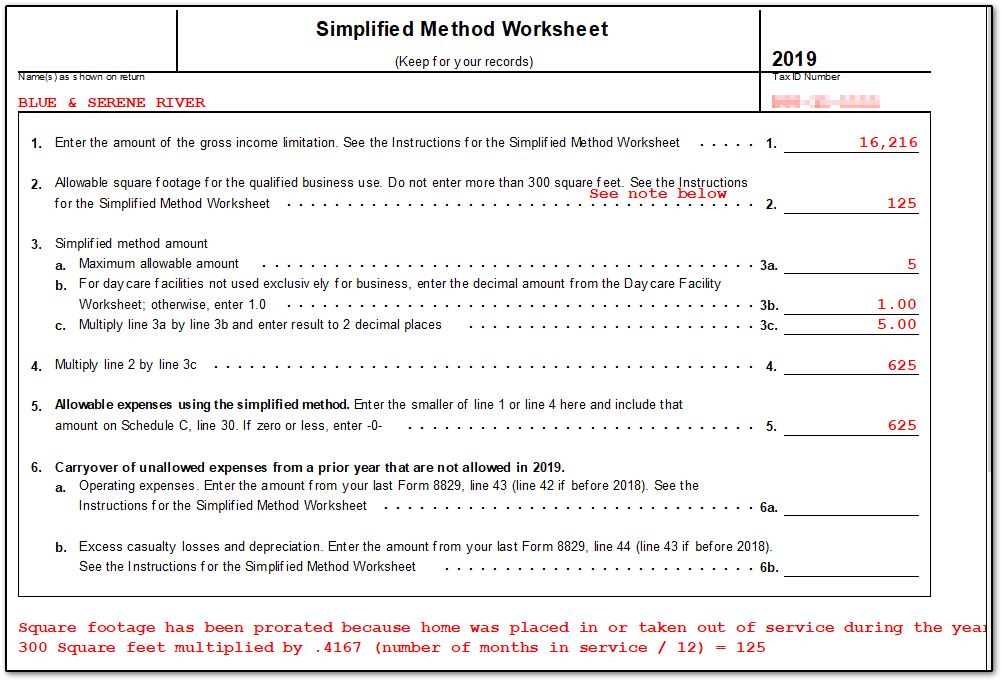

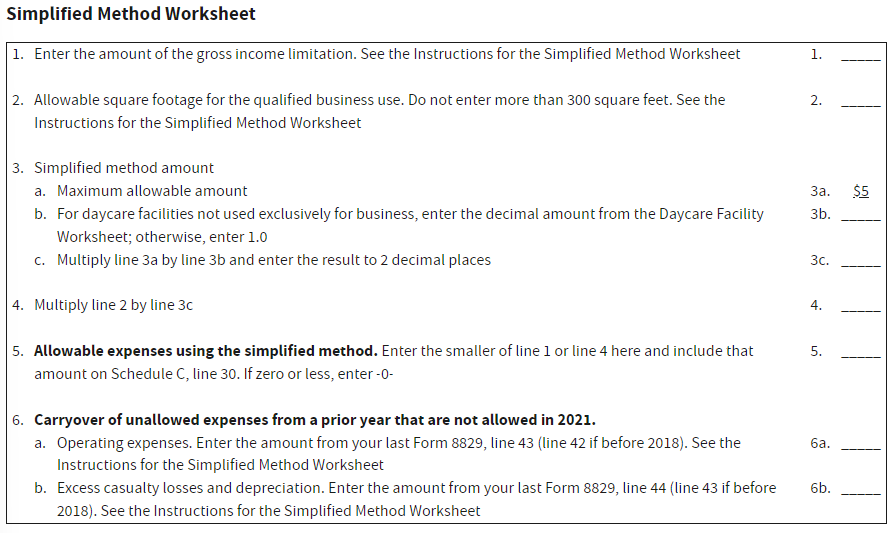

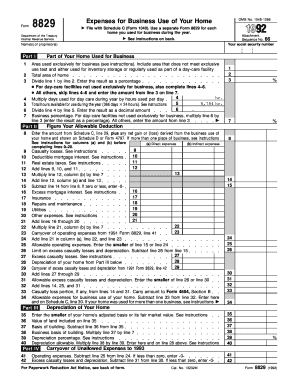

The calculation is shown on the Simplified Method Worksheet Form 8829 Simplified in view mode schedule and the calculation displays on the worksheet Form

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2021Forms/2020_Schedule_C_Simplified_Method_Worksheet.pdf

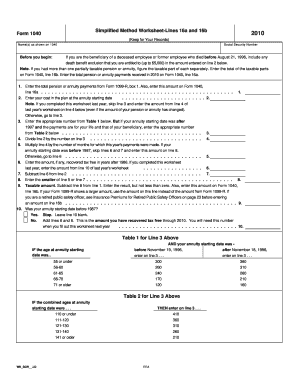

Use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing to use the simplified method for

https://support.taxslayerpro.com/hc/en-us/articles/360009297393-Simplified-Option-for-Home-Office-Deduction

Income Business Income Loss Create Edit Schedule C Form 8829 Business Use of Home Simplified Method Worksheet To select the

https://answerconnect.cch.com/topic/b23b572e7c601000bf0b90b11c18cbab06/home-office-deduction-calculating-the-deduction

There are two methods for calculating the home office deduction the actual expenses method and the simplified method Under both methods the home office

In this segment we ll provide an overview of Form 1040 Schedule C Profit or Loss from Business and discuss how to calculate gross profit and gross income You must use the General Rule explained in IRS Publication 939 to calculate the taxable part of Box 1 on your 1099 R if no taxable amount

To use the simplified method calculate the percentage of your home that is used exclusively as office space and multiply it by 5 Who