Small Business Tax Form For Llc A single member LLC is also required to use its name and EIN to register for excise tax activities on Form 637 pay and report excise taxes reported on Forms 720 730 2290 and 11 C and claim any refunds credits and payments on Form 8849 See employment and excise tax returns for more information

Jul 28 2023 0183 32 Guide To Small Business LLC Taxes amp LLC Tax Returns Generally limited liability company LLC taxes are reported as a sole proprietor on Form 1040 Schedule C if there is only one owner or on Form 1065 as a partnership if there are multiple owners Sole proprietors and partnerships are flow through entities so the income is taxed on the Nov 29 2023 0183 32 If you re the single member of a limited liability company LLC you ll typically file your business tax information on Schedule C and report the profit or loss from your business on Form 1040

Small Business Tax Form For Llc

Small Business Tax Form For Llc

Small Business Tax Form For Llc

https://db-excel.com/wp-content/uploads/2019/01/tax-donation-spreadsheet-with-regard-to-clothing-donation-tax-deduction-worksheet-and-collection-of-tax.png

Oct 30 2020 0183 32 A multi member LLC has to file certain tax forms with the IRS including Form 1065 U S Return of Partnership Income an informational return that must be filed annually with the IRS

Templates are pre-designed documents or files that can be used for various functions. They can save effort and time by supplying a ready-made format and design for producing different sort of content. Templates can be utilized for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Small Business Tax Form For Llc

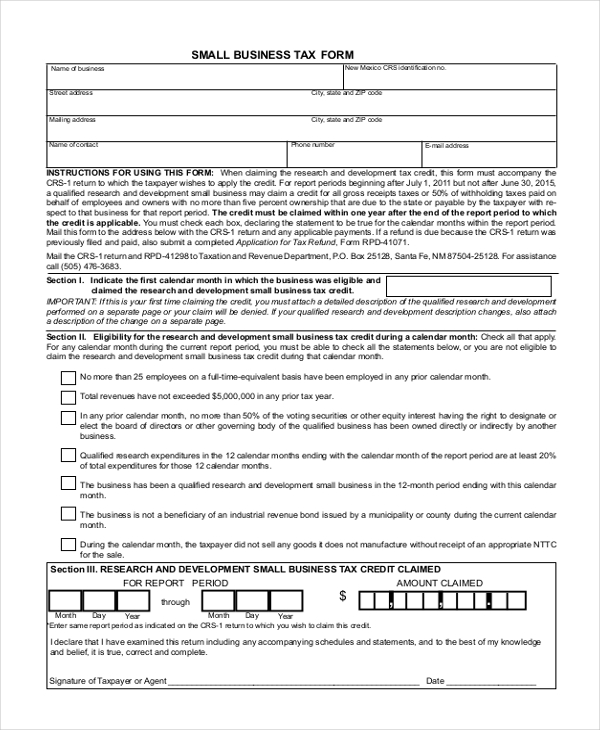

Business Tax Form Sample Business Tax Form Sample Forms

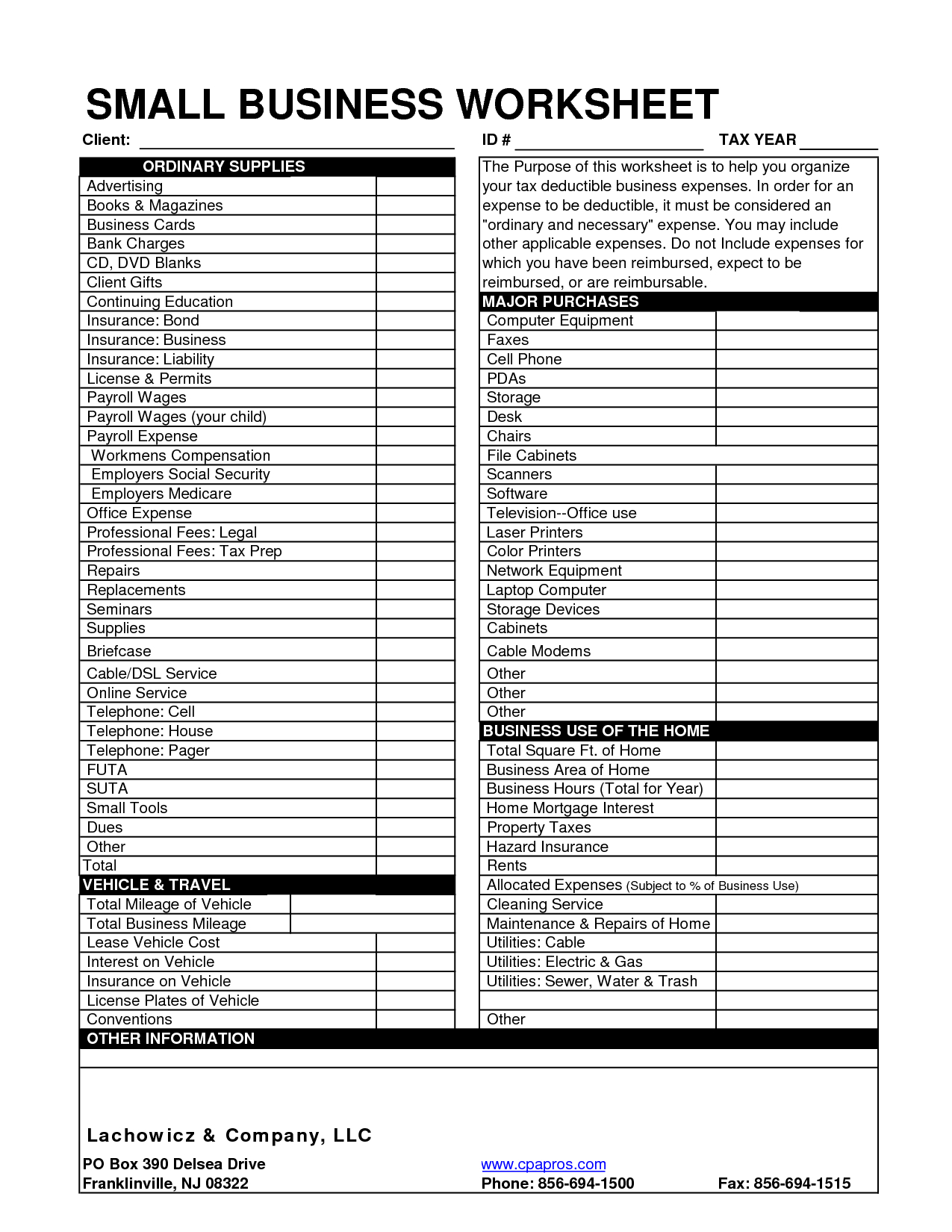

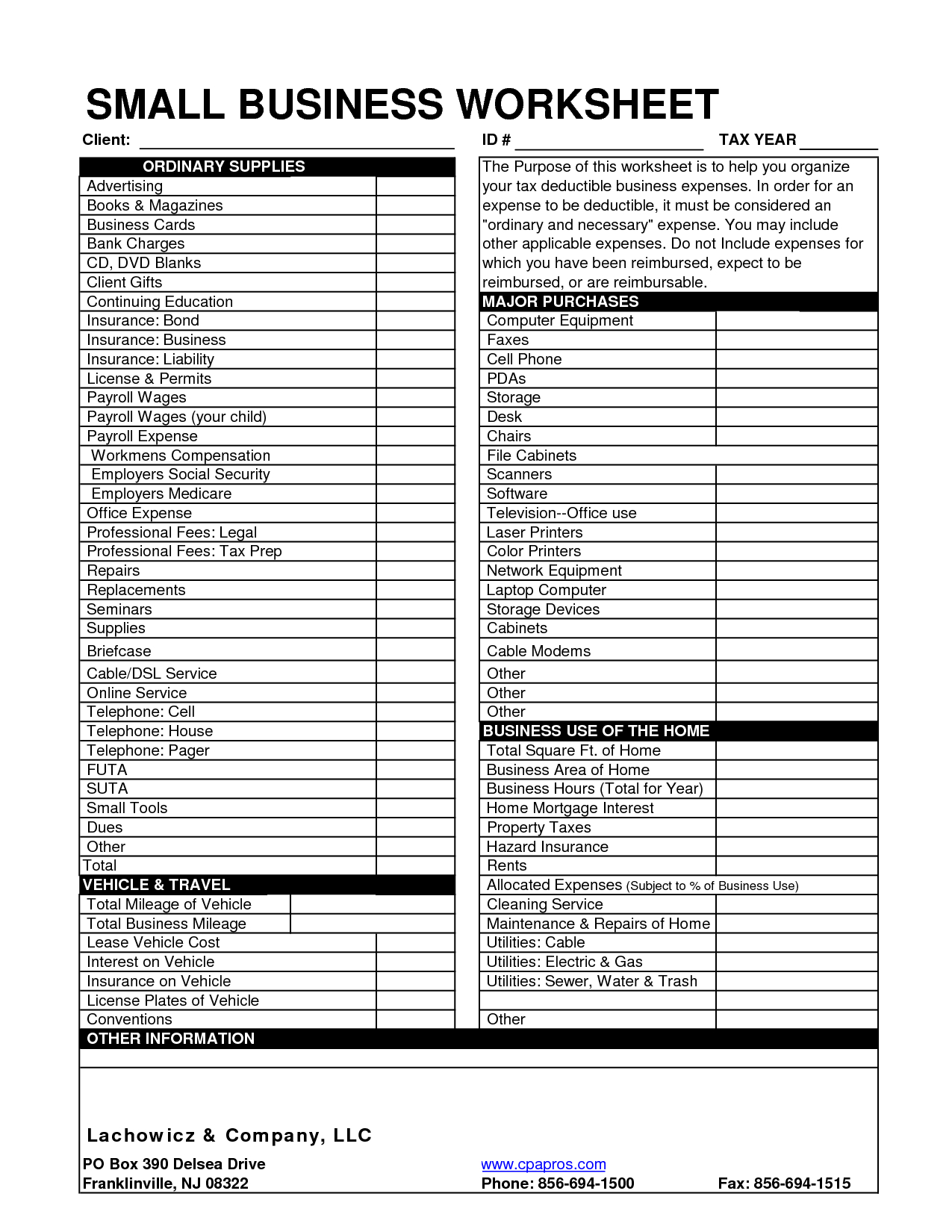

Small Business Tax Startup Business Plan Bookkeeping Business

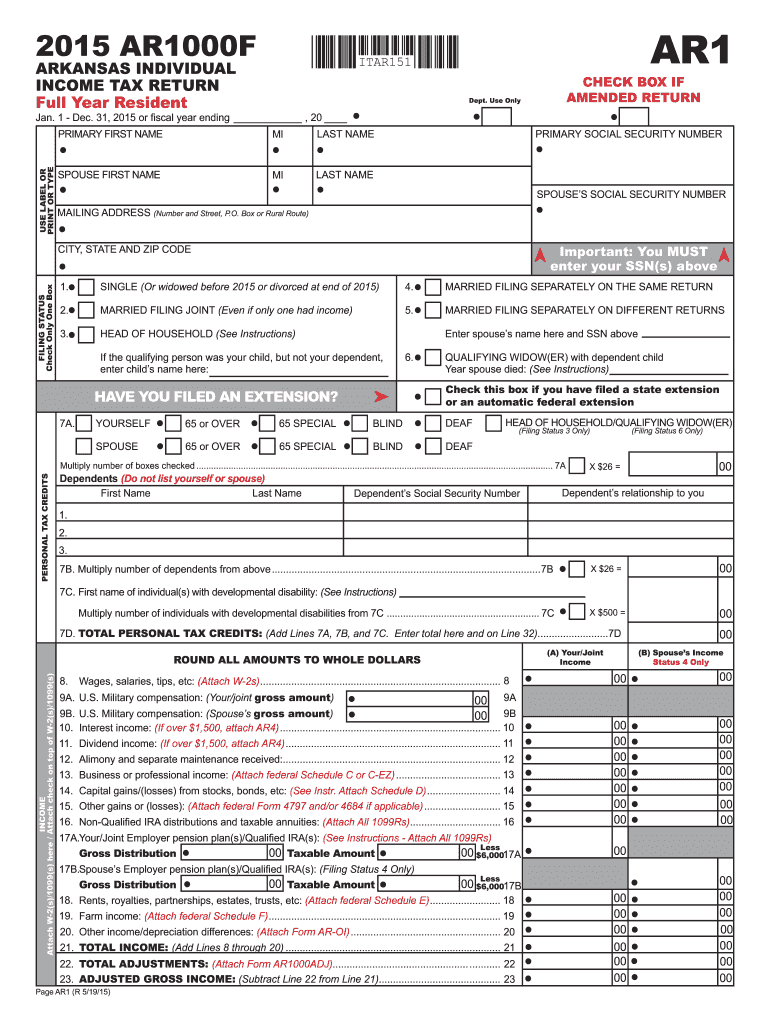

Non Fillable Tax Forms Printable Forms Free Online

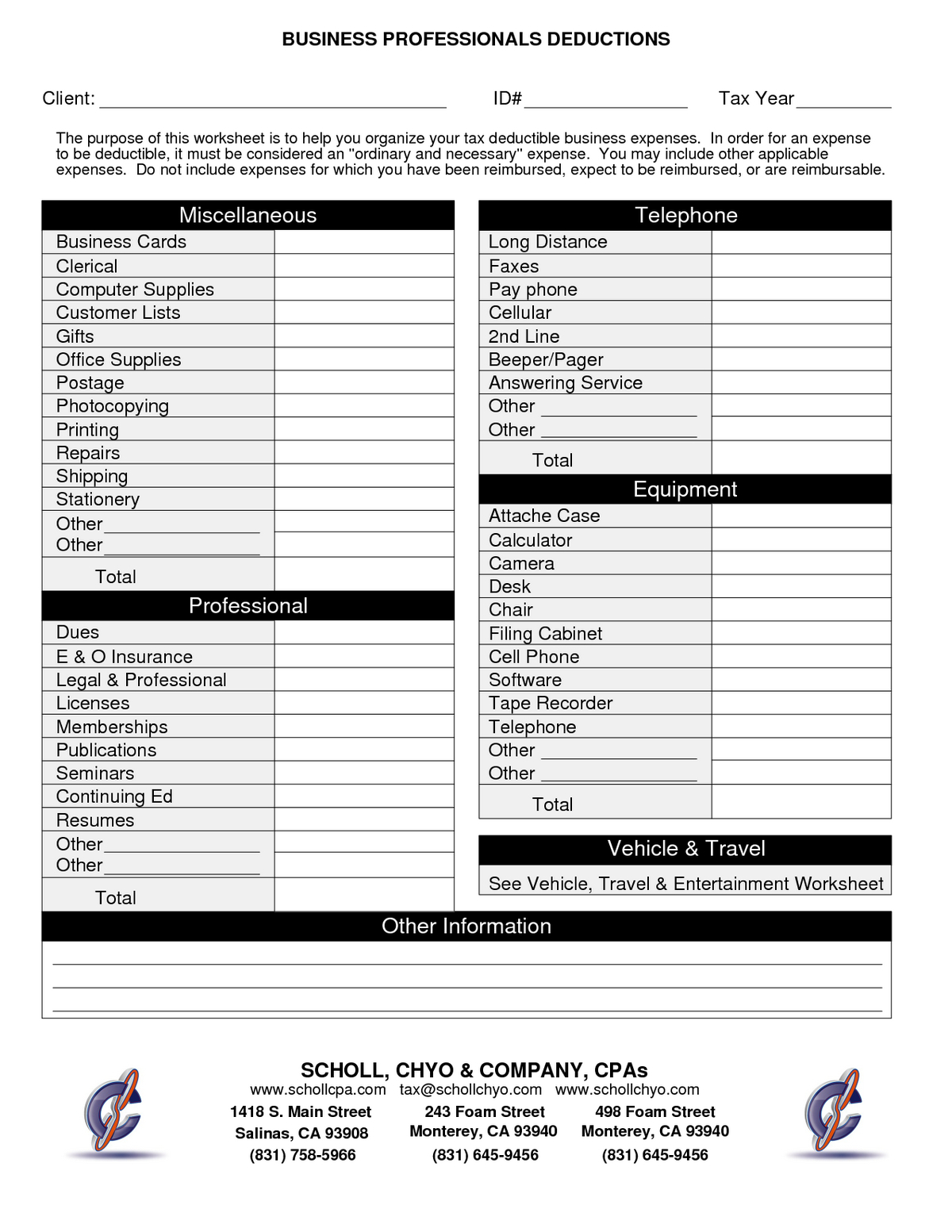

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

FREE 12 Sample Business Forms In PDF MS Word Excel

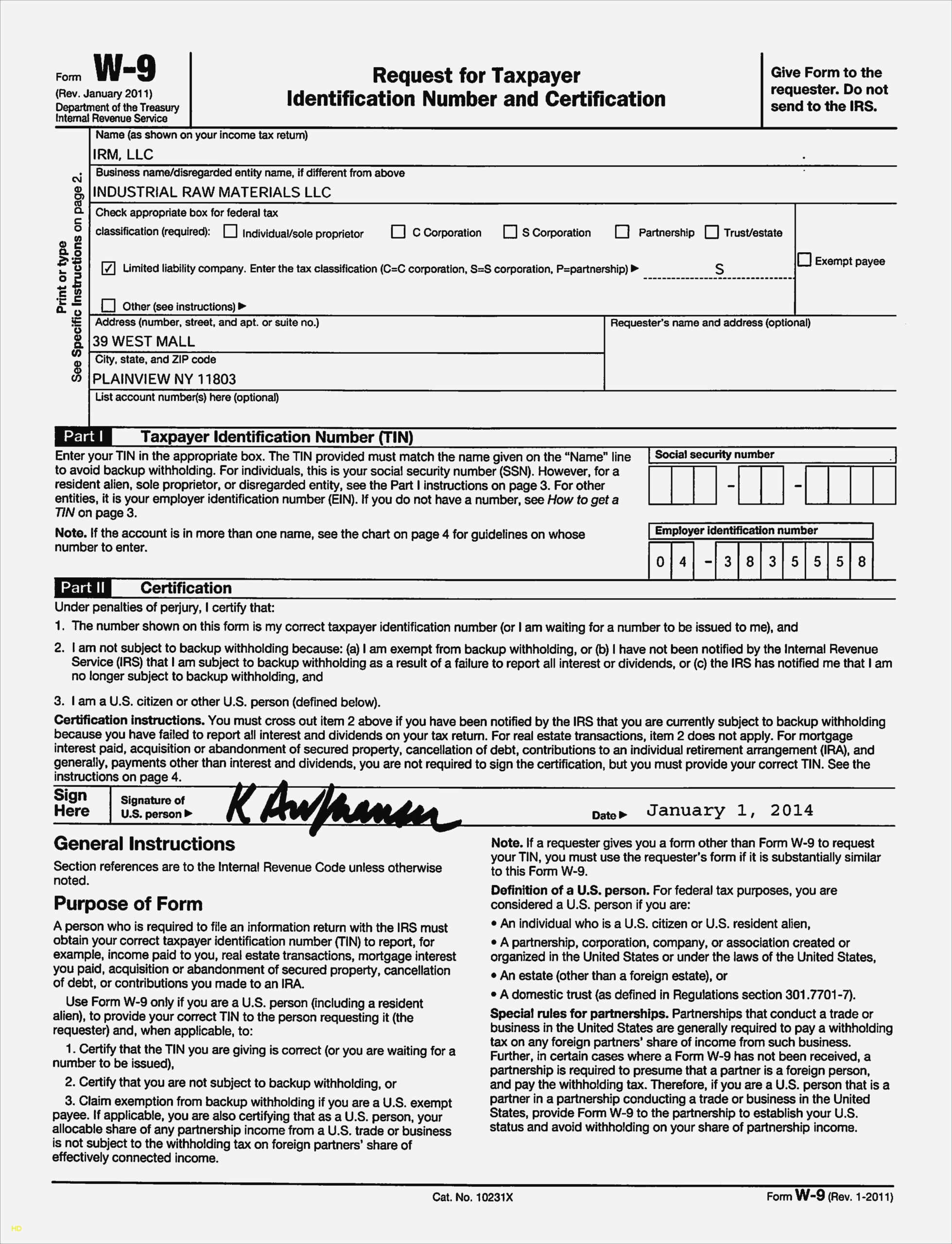

IRS Form W 9 Fillable Online

https://www.irs.gov/businesses/small-businesses

Jul 20 2023 0183 32 Small Business Forms and Publications Now you can select and download multiple small business and self employed forms and publications or you can call 800 829 3676 to order forms and publications through the mail If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you please

https://quickbooks.intuit.com/r/taxes/small-business-tax-forms

Jan 25 2024 0183 32 This streamlined guide explains the 25 most important small business tax forms By reviewing these forms and their tax dates you ll learn how to file taxes for a small business We recommend reading through the entire article to learn the ins and outs of taxes for small businesses

https://turbotax.intuit.com/tax-tips/small

Nov 29 2023 0183 32 At tax time you ll use Form 1120 Corporation Income Tax Return or 1120S if you choose to be taxed as an S corporation If you have a single member LLC you ll typically file as a sole proprietorship using Schedule C unless you choose to treat the LLC as a corporation

https://www.nerdwallet.com/article/small-business/irs-business-forms

Oct 28 2020 0183 32 Here are some of the most common IRS business forms you ll see in this case Form 1040 IRS Form 1040 is used to file your individual income tax return As a sole proprietor however you ll

https://www.patriotsoftware.com/blog/accounting/llc-tax-forms

Nov 2 2022 0183 32 Here are the main tax forms for an LLC Form 1040 Form 1065 Form 1120 The LLC tax form you use depends on whether you are a single member or multi member LLC and your classification An LLC can be classified as either a disregarded entity partnership or corporation LLC tax form for a disregarded entity

Jan 18 2023 0183 32 Form 1065 is an informational tax form used to report the income gains losses deductions and credits of a partnership or LLC but no taxes are calculated or paid from this form Good accounting Jan 20 2024 0183 32 There is no federal LLC return although states may have forms for LLC taxes Instead at the federal level each LLC s tax status is assigned by default depending on the business ownership structure This determines how the LLC files and which forms are used Here are three options

Jan 1 2024 0183 32 The LLC doesn t have to pay taxes The LLC s income and expenses are reported on the individual s tax return on Form 1040 Schedule C E or F If the only member of the LLC is a corporation then the LLC s income and expenses are reported on the corporation s returns on Form 1120 or 1120S LLCs with multiple members can file as