Social Security 1040 Worksheet UltraTax CS will calculate the taxable portion of social security benefits received using the Social Security Worksheet located in Forms View under the SSW

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040 SOCIAL SECURITY WORKSHEET 1 Enter the

Social Security 1040 Worksheet

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG?format=500w

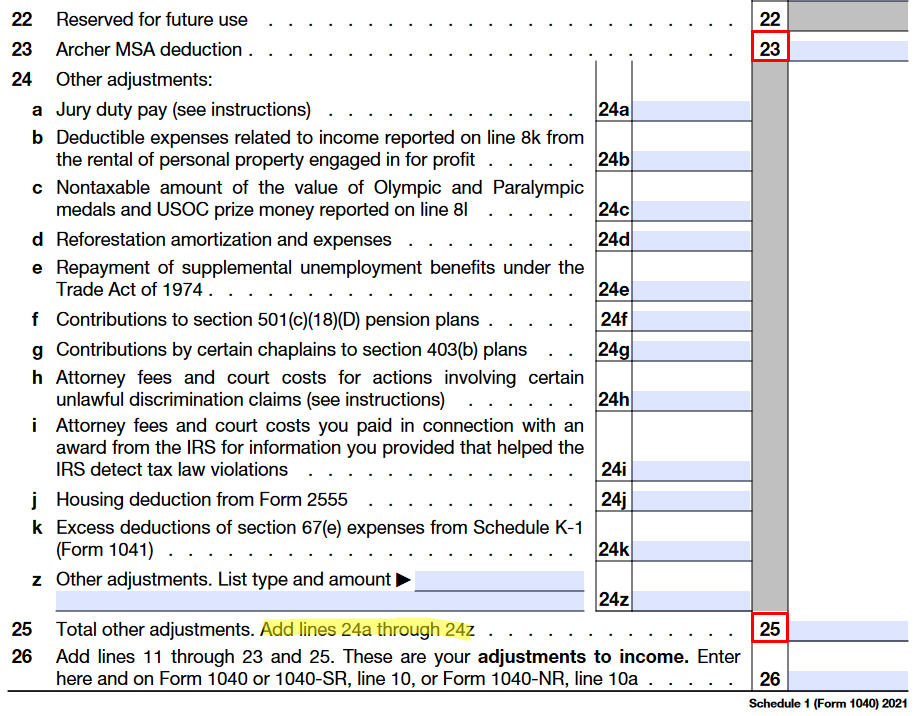

1 Enter the total amount from box 5 of ALL your Forms SSA 1099 and Forms RRB 1099 Also enter this amount on Form 1040 or

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by offering a ready-made format and layout for developing different kinds of material. Templates can be utilized for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Social Security 1040 Worksheet

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

1040 (2022) | Internal Revenue Service

Fillable Social Security Benefits Worksheet - Fill and Sign Printable Template Online

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Income – Social Security Benefits

https://www.irs.gov/pub/irs-pdf/p915.pdf

If you receive social security benefits from Canada or Germany include them on line 1 of Worksheet 1 How To Report Your Benefits If part of your benefits are

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

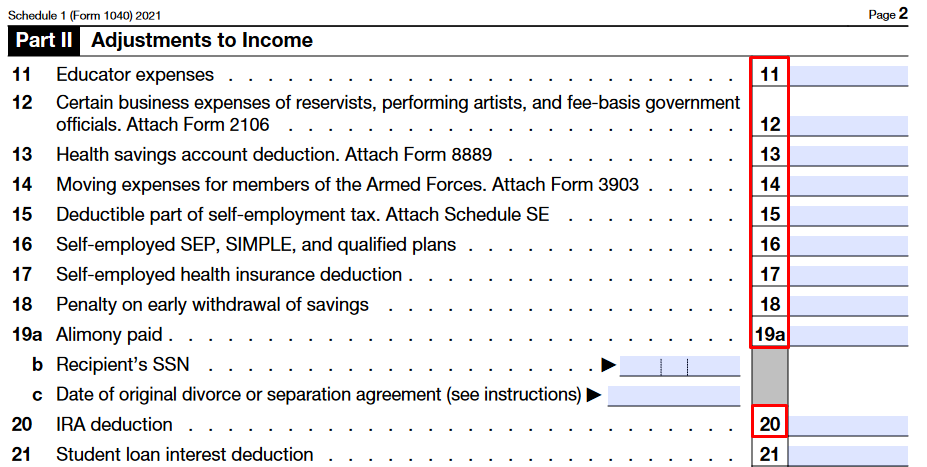

Amount of social security benefits from Federal Form 1040 or 1040 SR line MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1 Eligibility

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

Scroll down and click Form 1040 Taxable Social Security Social Security This worksheet is based on the worksheet in IRS Publication 915 Social Security and

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The worksheet provided can be used to determine the exact amount Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file

https://kb.drakesoftware.com/Site/Browse/12276/1040-Social-Security-Benefits-Worksheet

The worksheet Wks SSB 1 WK SSB in Drake15 and prior is generated in a return when you have Social Security benefits entered on screen SSA that are

1040 CT 1040NR PY or CT 1040X Column C Enter below the amounts reported on your 2020 federal Social Security Benefits Worksheet Press the Calculate Your To start change or stop federal income tax withholding from their Social Security benefits your clients can sign and submit IRS form W 4V directly to their

IRS form 1040 and tax exempt interest income as used on line 2a of IRS form 1040 and your tax filing status Tax Year 2 0 Adjusted Gross Income