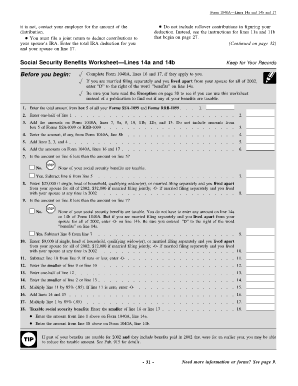

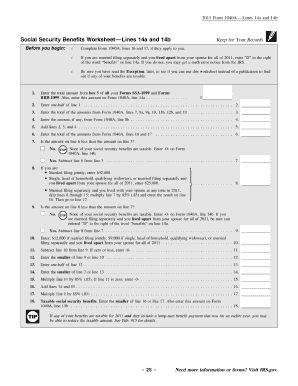

Social Security Benefits Worksheet 2022 Lines 6a And 6b To determine this amount the IRS provides tax filers with the 18 step Social Security Benefits Worksheet found in the 1040 instructions for

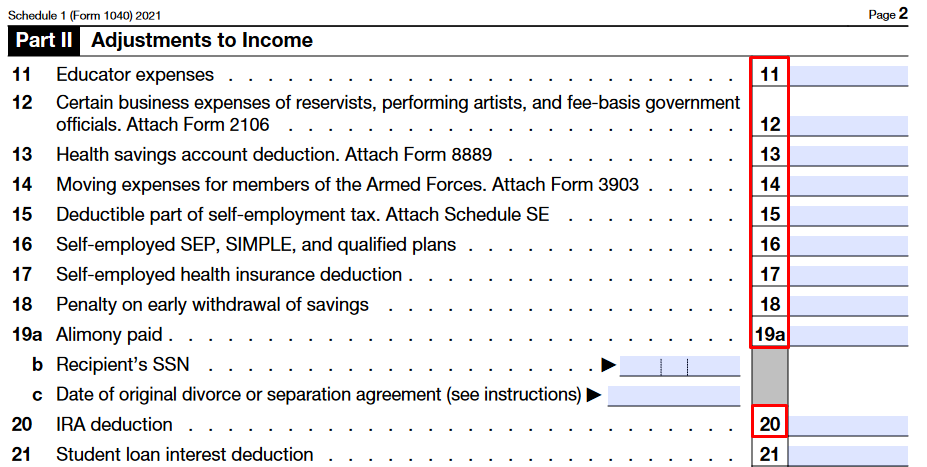

As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefits The TaxAct SOCIAL SECURITY WORKSHEET 6 Enter the amount from your federal 1040 line 2a 6 7 Add lines 2 through 6 7 8 Enter total adjustments from federal form

Social Security Benefits Worksheet 2022 Lines 6a And 6b

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG?format=500w

Line 6 of the 2020 Form 1040 is used to report your Social Security income Much like retirement income on line 4 and line 5 line 6 is

Pre-crafted templates provide a time-saving option for producing a varied variety of files and files. These pre-designed formats and layouts can be utilized for different personal and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the material creation procedure.

Social Security Benefits Worksheet 2022 Lines 6a And 6b

Fillable Social Security Benefits Worksheet - Fill and Sign Printable Template Online

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Income – Social Security Benefits

1040 (2022) | Internal Revenue Service

IRS Instruction 1040 Line 20a & 20b | pdfFiller

https://www.youtube.com/watch?v=s4A9oT8WIC8

How to complete Social Security Benefits Worksheet Lines 6a and 6b of 1040 SR This is

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://www.taxact.com/support/1373/2022/social-security-benefits-lump-sum-payments

The TaxAct program transfers the amounts from the worksheets to Form 1040 U S Individual Tax Return Lines 6a and 6b for the taxable amount of social security

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

NOTE Use this worksheet to determine the amount if any of your Social Security modification on Schedule M line 1s Yes Yes Married filing jointly or

https://pdfliner.com/social_security_benefits_worksheet_lines_20a_and_20b

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

5 Spouse B s percentage line 2 divided by line 3 6 Taxable Social Security benefits included on line 6b of federal Form 1040 or 1040 SR 6a Social security benefits b Taxable amount 6b Standard Instead enter it on line 4 of the Foreign Earned Income Tax Worksheet 24

Enter total annual Social Security SS benefit amount box 5 of any SSA 1099 and RRB 1099 Enter taxable income excluding SS benefits IRS Form 1040 lines