Social Security Benefits Worksheet For 2022 The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late

2022 Modification Worksheet Taxable Social Security Income Worksheet Enter NOTE Use this worksheet to determine the amount if any of your Social Security Enter the Social Security benefit amount for 2022 minus the medicare premium a 7 2 If the 2022 benefit verification letter shows something other than the

Social Security Benefits Worksheet For 2022

Social Security Benefits Worksheet For 2022

Social Security Benefits Worksheet For 2022

https://www.pdffiller.com/preview/100/269/100269931.png

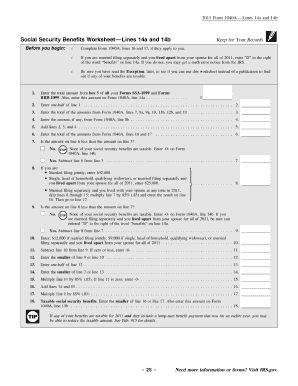

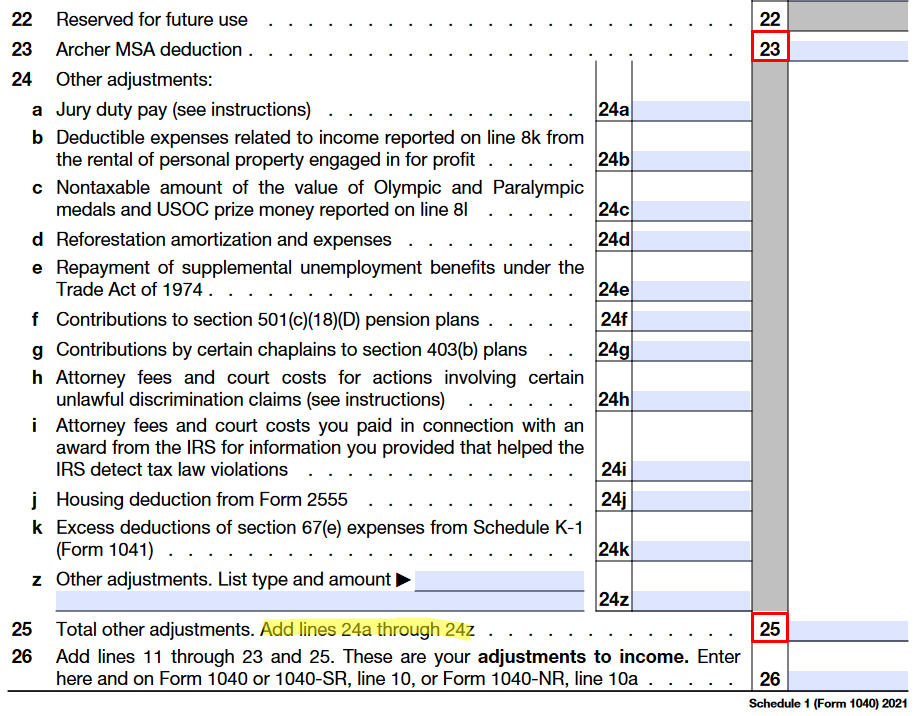

SOCIAL SECURITY WORKSHEET 1 Enter the amount from Box 5 of form s SSA 1099 2 Enter one half of line 1 amount 3 Add amounts from the federal form 1040 on

Pre-crafted templates provide a time-saving option for creating a varied series of documents and files. These pre-designed formats and layouts can be made use of for different personal and expert projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the content production procedure.

Social Security Benefits Worksheet For 2022

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

2021-2023 Form IRS Publication 915Fill Online, Printable, Fillable, Blank - pdfFiller

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

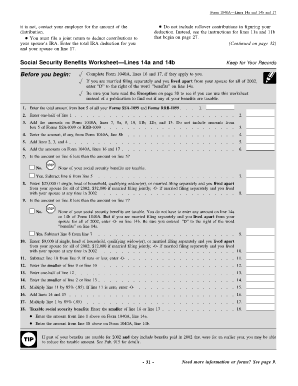

Social Security Benefits Worksheet - Lines 20a and 20b

Social Security Benefits Worksheet 2022 Pdf - Fill Out and Sign Printable PDF Template | signNow

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

https://www.irs.gov/pub/irs-pdf/n703.pdf

We developed this worksheet for you to see if your benefits may be taxable for 2022 Fill in lines A through E

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

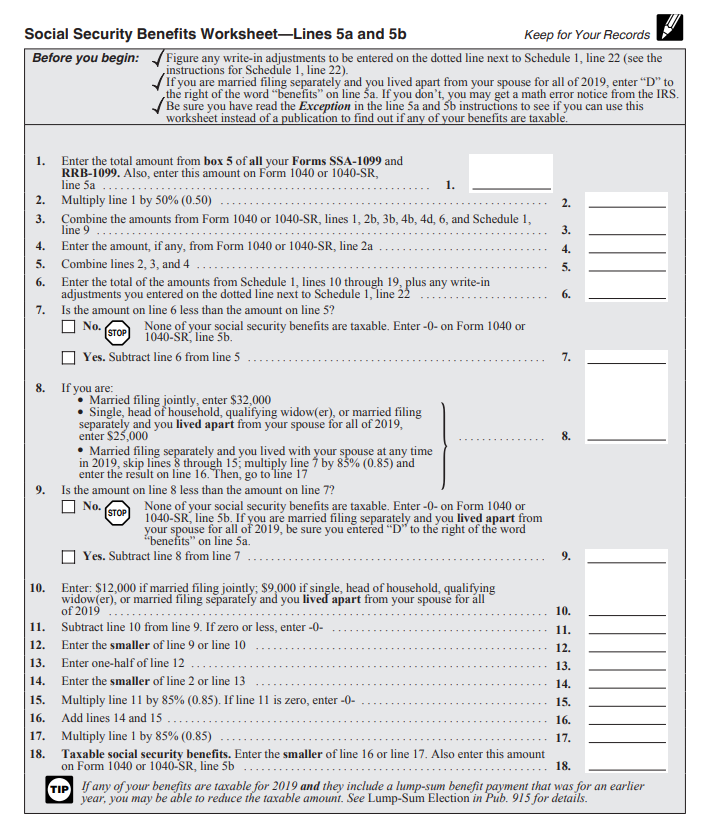

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

https://www.ssa.gov/benefits/retirement/planner/taxes.html

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://pdfliner.com/social_security_benefits_worksheet_lines_20a_and_20b

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount The file is in Adobe

How could your clients Social Security benefits be taxed Our calculator helps This taxable benefit calculator makes it Each character in the Social security worksheet for 2023 matters at such a crucial moment so completing a printed form might take a lot more effort and time

Taxable Social Security Worksheet 2023 Get a fillable Social Security Benefits Worksheet 2022 PDF template online Complete and sign it in seconds from