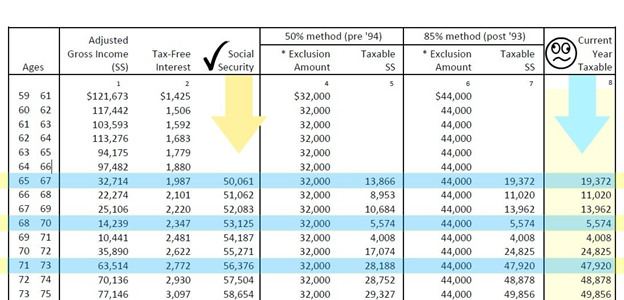

Social Security Taxable Income Worksheet Free social security taxable benefits Calculator Use this calculator to estimate how much of your Social Security benefit is subject to income taxes

This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable Note that not everyone pays taxes on benefits Social security benefits include monthly survivor and disability benefits They do not include supplemental security SSI payments which are not taxable

Social Security Taxable Income Worksheet

Social Security Taxable Income Worksheet

Social Security Taxable Income Worksheet

https://www.pdffiller.com/preview/6/963/6963800/large.png

Use this information to create an income plan Determine if Your Social Security Benefits Will Be Taxed Before you file consult your tax professional

Pre-crafted templates provide a time-saving service for creating a varied series of files and files. These pre-designed formats and layouts can be utilized for different personal and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the content development process.

Social Security Taxable Income Worksheet

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85% | Moneytree Software

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

1040 (2022) | Internal Revenue Service

Income – Social Security Benefits

https://www.irs.gov/pub/irs-pdf/n703.pdf

Internal Revenue Service Read This To See if Your Social Security Benefits May Be Taxable If your social security and or SSI supplemental security income

https://www.ssa.gov/benefits/retirement/planner/taxes.html

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

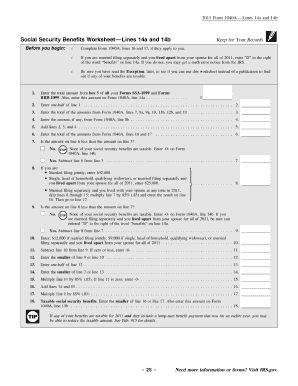

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

The TaxAct program will automatically calculate the taxable amount of your Social Security income if any To view the Social Security Benefits Worksheet

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-01/social-security-worksheet_b_3.pdf

Taxable Social Security Income Worksheet Enter your spouse s date of birth if MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1

Iowa does not tax Social Security benefits While Social Security benefits are excluded from income when computing tax some Social Security benefits are The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late

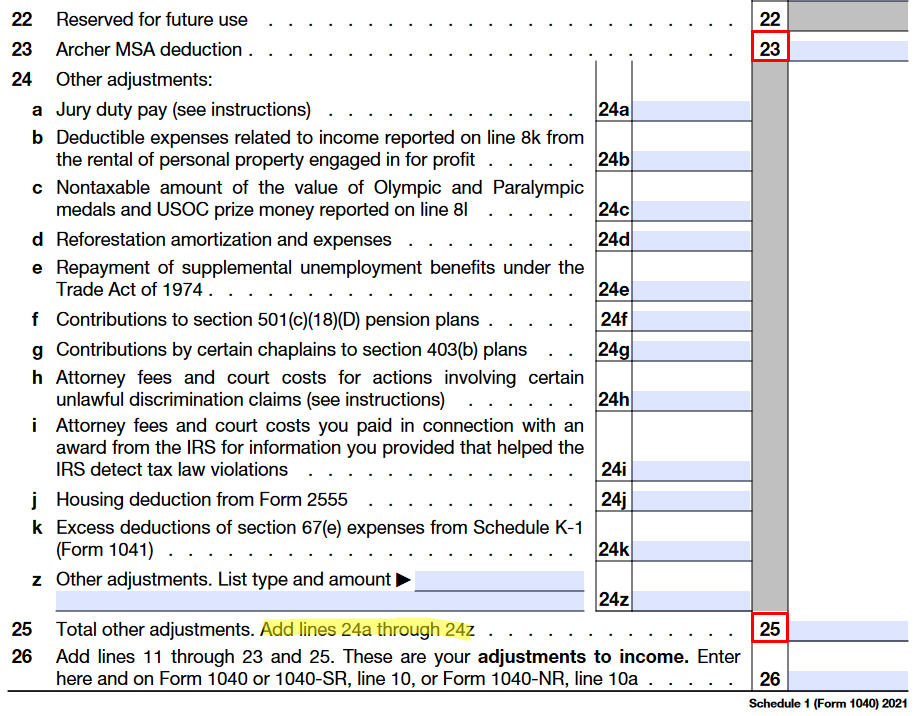

None of the benefits are taxable for 2019 3 Use the worksheet in IRS Pub 915 if any of the following apply Form 2555 Foreign Earned Income is