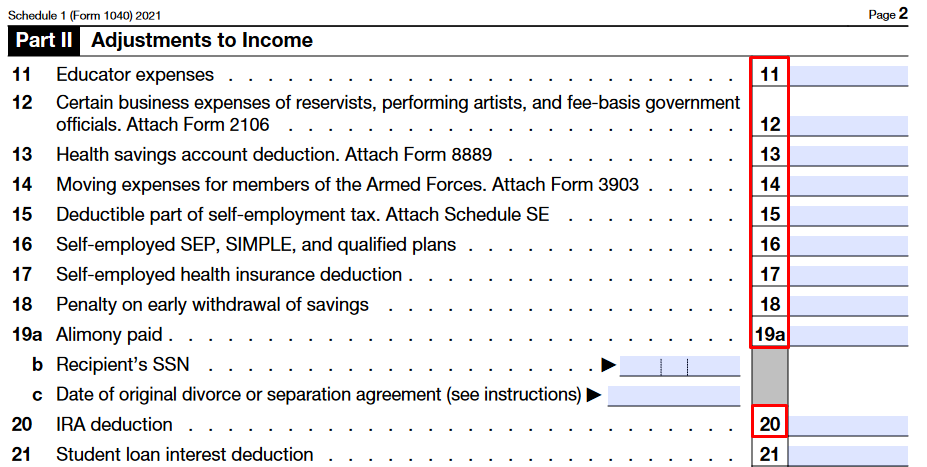

Social Security Worksheet 1040 SOCIAL SECURITY WORKSHEET 8 Enter total adjustments from federal form 1040 Schedule 1 lines 11 through 20 line 23 plus the total other adjustments

A worksheet for social security benefits is needed to reduce the number of tax payments received If you receive Social Security benefits fill out this UltraTax CS will calculate the taxable portion of social security benefits received using the Social Security Worksheet located in Forms View under the SSW

Social Security Worksheet 1040

Social Security Worksheet 1040

Social Security Worksheet 1040

https://www.unclefed.com/TaxHelpArchives/2002/1040Instrs/wrksht_socialsecurity.gif

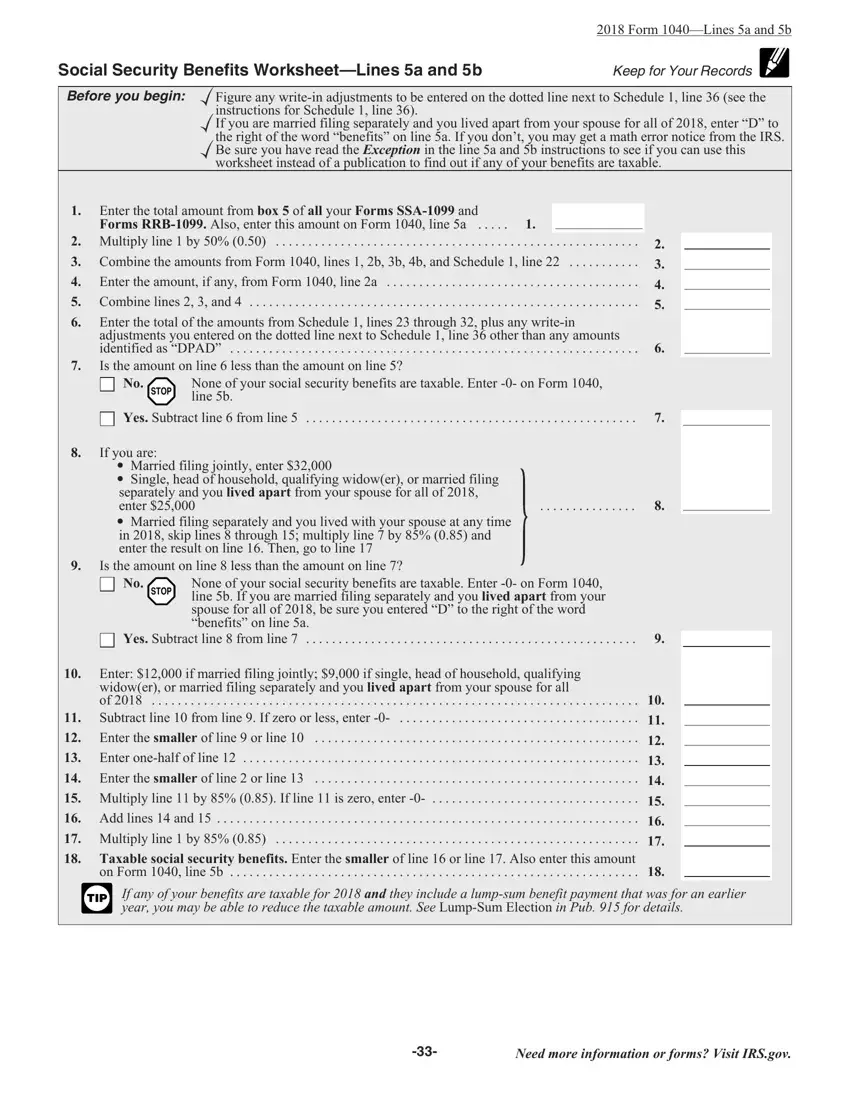

Instead include the amount from Schedule B Form 1040 or 1040 SR line 2 1 Enter the total amount from box 5 of ALL your Forms SSA 1099 and Forms RRB 1099

Templates are pre-designed files or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and design for producing various type of material. Templates can be utilized for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Social Security Worksheet 1040

Income – Social Security Benefits

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Lines 20A 20B ≡ Fill Out Printable PDF Forms Online

Social Security Benefits Worksheet

1040 (2022) | Internal Revenue Service

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

https://apps.irs.gov/app/vita/content/globalmedia/social_security_benefits_worksheet_1040i.pdf

Social Security Benefits Worksheet Lines 5a and 5b Keep for Your Records Figure any write in adjustments to be entered on the dotted on Form 1040 line 5b

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The worksheet provided can be used to determine the exact amount Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

Amount of social security benefits from Federal Form 1040 or 1040 SR line MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1 Eligibility

https://kb.drakesoftware.com/Site/Browse/12276/1040-Social-Security-Benefits-Worksheet

The worksheet Wks SSB 1 WK SSB in Drake15 and prior is generated in a return when you have Social Security benefits entered on screen SSA that are

In 1984 less than 10 percent of beneficiaries paid federal income tax on their benefits A Social Security Administration SSA microsimulation model Determine any write in adjustments to be entered on the dotted line next to line 22 Schedule 1 Form 1040 If Married Filing Separately and taxpayer

The Form 1040 ES package includes worksheets to help ensure account for This approach the amount listed on Form SSA 1099 Social Security Benefit Calculator