State And Local Income Tax Refund Worksheet 2022 Calculate and view the return Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on

The Tax Refund Worksheet calculates based on the data you enter in this section and if you do the following for all of your clients choose Setup 1040 The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line

State And Local Income Tax Refund Worksheet 2022

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/3129811d-7cec-4df6-9116-56b0ec657990.default.PNG

The authors draw upon numerous real life examples to identify and explain the fundamental principles of state and local taxation and how to

Templates are pre-designed files or files that can be used for numerous purposes. They can conserve effort and time by providing a ready-made format and layout for producing different type of content. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

State And Local Income Tax Refund Worksheet 2022

1040 (2022) | Internal Revenue Service

Fillable Online apps irs 2016 Form 1040Lines 10 Through 12 Fax Email Print - pdfFiller

ODR: 1099-G Question and Answers - Oregon Association of Tax Consultants

:max_bytes(150000):strip_icc()/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

Is Your State Tax Refund Taxable?

2022 Instructions for Schedule 8812 (2022) | Internal Revenue Service

1040 (2022) | Internal Revenue Service

https://apps.irs.gov/app/vita/content/globalmedia/state_and_local_refund_worksheet_4012.pdf

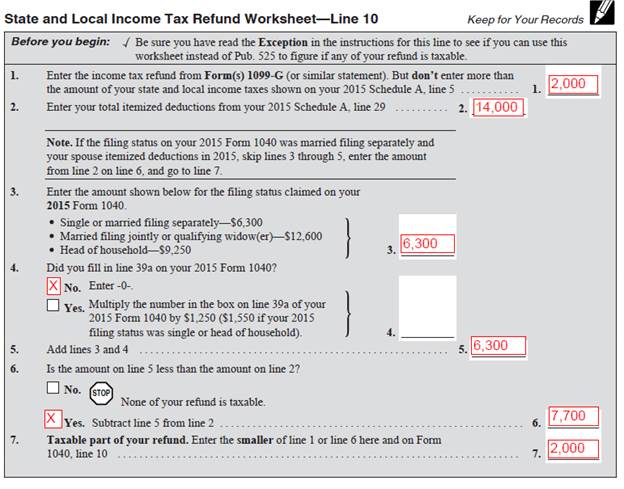

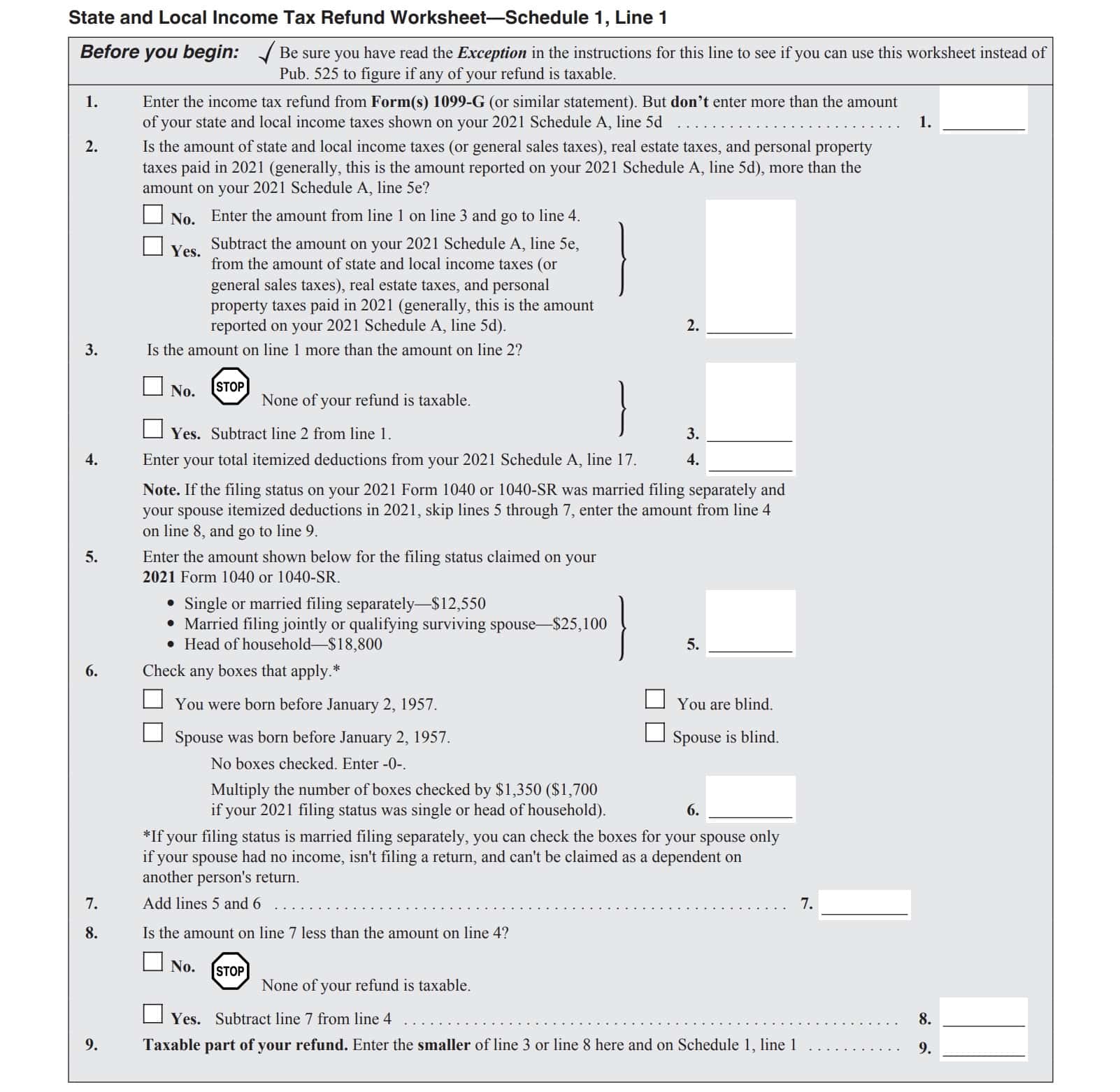

Use this worksheet to determine the portion of the taxpayer s prior year state refund that is considered taxable in the current year

https://proconnect.intuit.com/support/en-us/help-article/form-1099-g/state-local-refunds-taxable-worksheet-form-1040/L6xO7VUPl_US_en_US

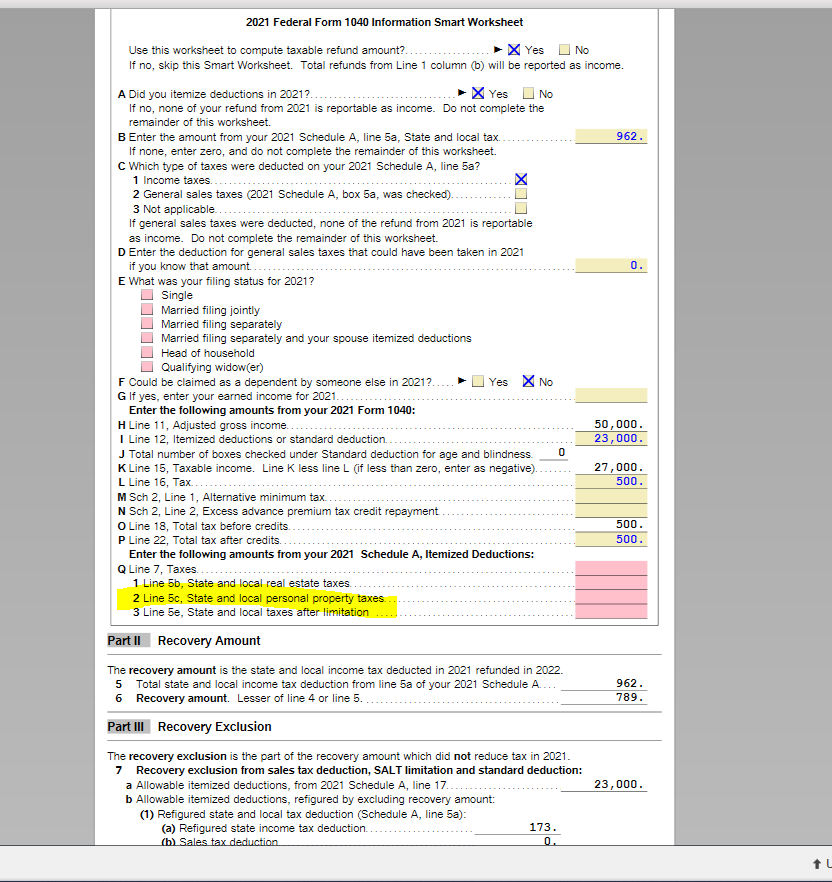

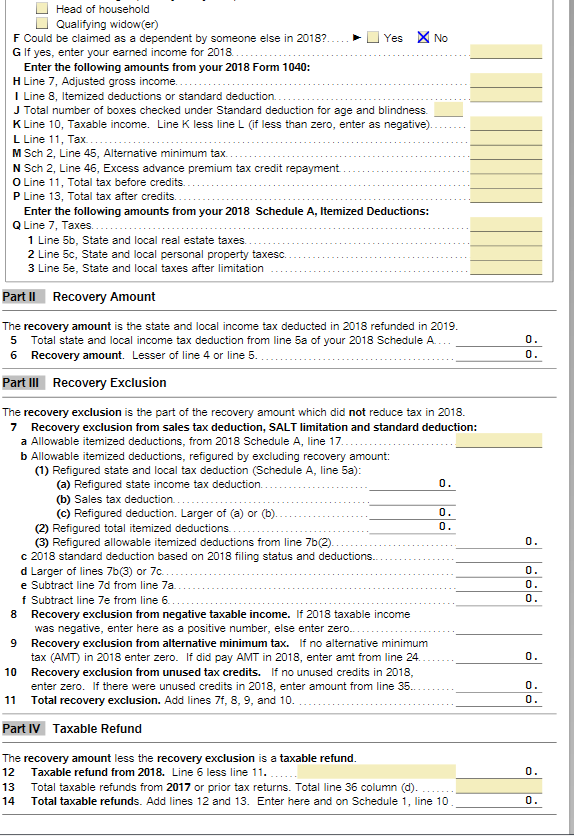

This article will help you understand how the State and Local Refunds Taxable Worksheet for Form 1040 is calculated in Intuit ProConnect

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

Can claim a refundable credit other than the earned income credit American opportunity credit or additional child tax credit

https://support.taxslayerpro.com/hc/en-us/articles/360032943513-Desktop-Form-1099-G-Box-2-State-and-Local-Refunds-

A worksheet is provided in TaxSlayer Pro to determine the amount that is included in income You can also review the State and Local Income Tax

https://support.taxslayer.com/hc/en-us/articles/360015900351-Do-I-need-to-complete-the-State-Refund-Worksheet-

Do I need to complete the State Refund Worksheet You may receive a 1099 G with information reported in Box 2 if you received a refund of state or local

In general if you receive a federal tax benefit from deducting state or local taxes in a prior taxable year and then subsequently recover Refunds received in 2022 for the return filed for 2021 State income tax refund amount State Local Income taxes General Sales taxes Check

2 Is the amount of state and local income taxes or general sales taxes real estate taxes and personal property taxes